Rising Gold Prices: A Reaction To Trump's EU Trade Threats

Table of Contents

Understanding the Safe Haven Appeal of Gold

Gold's value as a safe haven asset stems from its inherent characteristics and historical performance. Throughout history, it has served as a reliable hedge against inflation and political instability. Unlike stocks or bonds, gold possesses unique qualities that make it an attractive investment during times of uncertainty:

- Inherent Value and Lack of Counterparty Risk: Gold's value is intrinsic; it doesn't rely on the performance of a company or government. This lack of counterparty risk makes it a stable investment option.

- Limited Supply and High Demand: Gold's scarcity contributes to its value. While mining increases supply, the rate is relatively slow compared to demand, especially during times of economic turmoil.

- Historical Use in Times of Crisis: Numerous historical events demonstrate gold's role as a safe haven. During periods of war, economic depression, or political upheaval, investors flock to gold as a store of value.

- Central Bank Gold Holdings: Central banks worldwide hold significant gold reserves, reflecting the metal's enduring value and role in global financial systems. This further underpins its stability and trustworthiness.

Trump's Trade Policies and Market Volatility

Donald Trump's trade policies, characterized by aggressive tariffs and threats of trade wars, have significantly impacted global markets. His administration's imposition of tariffs on various goods, particularly the threats against the EU, has introduced significant uncertainty and volatility.

- Specific Examples of Trump's Trade Actions Against the EU: The imposition of tariffs on steel and aluminum, alongside threats of further tariffs on automobiles and other goods, created considerable market anxiety.

- Impact on Specific Sectors: The automotive and agricultural sectors, heavily reliant on transatlantic trade, have been particularly vulnerable to these trade actions, leading to job losses and economic slowdown in affected areas.

- Market Reactions to These Announcements: Stock markets worldwide have reacted negatively to announcements of new trade tariffs, reflecting investor concerns about the potential for broader economic disruption.

- Increased Investor Anxiety: The unpredictability of Trump's trade policies has heightened investor anxiety, driving a search for safe haven assets like gold.

The Direct Correlation Between Trade Threats and Gold Prices

The rise in gold prices strongly correlates with the timing of Trump's escalating trade threats against the EU. While other factors influence gold prices, the timing suggests a clear link between increased trade uncertainty and increased gold demand. (Insert chart or graph here illustrating the correlation between Trump's trade announcements and gold price movements.)

- Specific Price Increases and Dates Correlated to Trade News: Note specific dates when gold prices spiked following major trade announcements, illustrating the direct impact of news on investor behavior.

- Analysis of Investor Sentiment Data: Data showing increased investor demand for gold during periods of heightened trade uncertainty further supports this correlation.

- Addressing Alternative Explanations: While other factors may influence gold prices, a comprehensive analysis would show that the timing and magnitude of the price increases strongly suggest the trade tensions as a primary driver.

Implications for Investors and the Global Economy

The rising price of gold carries significant implications for both investors and the global economy. The outcome of the trade disputes will influence the future trajectory of gold prices.

- Impact on Inflation: Rising gold prices can be an indicator of inflation, as investors seek a hedge against the erosion of purchasing power.

- Impact on Currency Exchange Rates: Trade wars and associated uncertainty can impact currency exchange rates, influencing gold's value in different currencies.

- Investment Strategies for Navigating This Uncertainty: Diversification of investment portfolios and employing risk management strategies are crucial for investors navigating this period of heightened market volatility.

Conclusion: Navigating the Future of Gold Prices in the Face of Trade Uncertainty

This analysis demonstrates a strong link between Trump's trade threats against the EU and the surge in gold prices. Gold's role as a safe haven asset during periods of economic and political uncertainty has been clearly reinforced. To make informed investment decisions, staying abreast of both gold prices and Trump's ongoing trade policies is essential. Further research into gold price prediction models and safe haven investment strategies is recommended. The ongoing need to monitor gold price fluctuations in relation to global trade tensions cannot be overstated. Understanding these dynamics is key to navigating the complex landscape of precious metal investments.

Featured Posts

-

Your Monday Night Viewing Guide 10 Top Tv And Streaming Choices

May 26, 2025

Your Monday Night Viewing Guide 10 Top Tv And Streaming Choices

May 26, 2025 -

Laurent Baffie Thierry Ardisson Mea Culpa Et Accusations De Comportements Machistes

May 26, 2025

Laurent Baffie Thierry Ardisson Mea Culpa Et Accusations De Comportements Machistes

May 26, 2025 -

Hasil Latihan Bebas Moto Gp Inggris 2025 Fp 1 Jadwal And Jam Tayang Trans7

May 26, 2025

Hasil Latihan Bebas Moto Gp Inggris 2025 Fp 1 Jadwal And Jam Tayang Trans7

May 26, 2025 -

Armando Iannucci Has His Satirical Edge Dulled

May 26, 2025

Armando Iannucci Has His Satirical Edge Dulled

May 26, 2025 -

Remembering The Idf Soldiers Held Captive In Gaza

May 26, 2025

Remembering The Idf Soldiers Held Captive In Gaza

May 26, 2025

Latest Posts

-

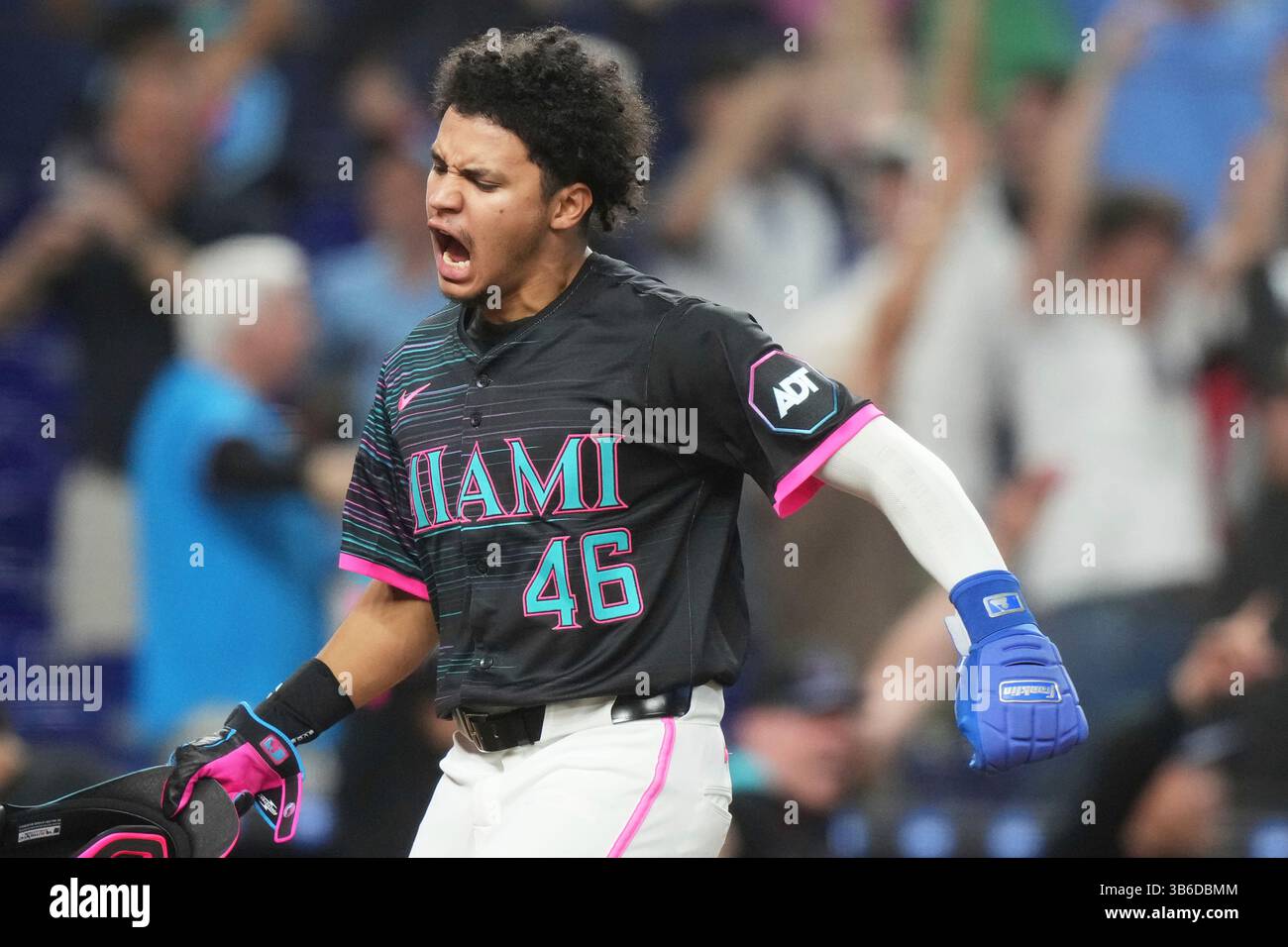

Stowers Stays Hot Grand Slam Highlights Marlins Win

May 28, 2025

Stowers Stays Hot Grand Slam Highlights Marlins Win

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Marlins Secure Victory

May 28, 2025

Kyle Stowers Walk Off Grand Slam Marlins Secure Victory

May 28, 2025 -

Another Win For Angels Four In A Row

May 28, 2025

Another Win For Angels Four In A Row

May 28, 2025 -

Angels Four Game Winning Run

May 28, 2025

Angels Four Game Winning Run

May 28, 2025 -

Angels Secure Fourth Straight Win Against A

May 28, 2025

Angels Secure Fourth Straight Win Against A

May 28, 2025