Rising Retail Sales Figures Could Halt Bank Of Canada's Rate Cutting Strategy

Table of Contents

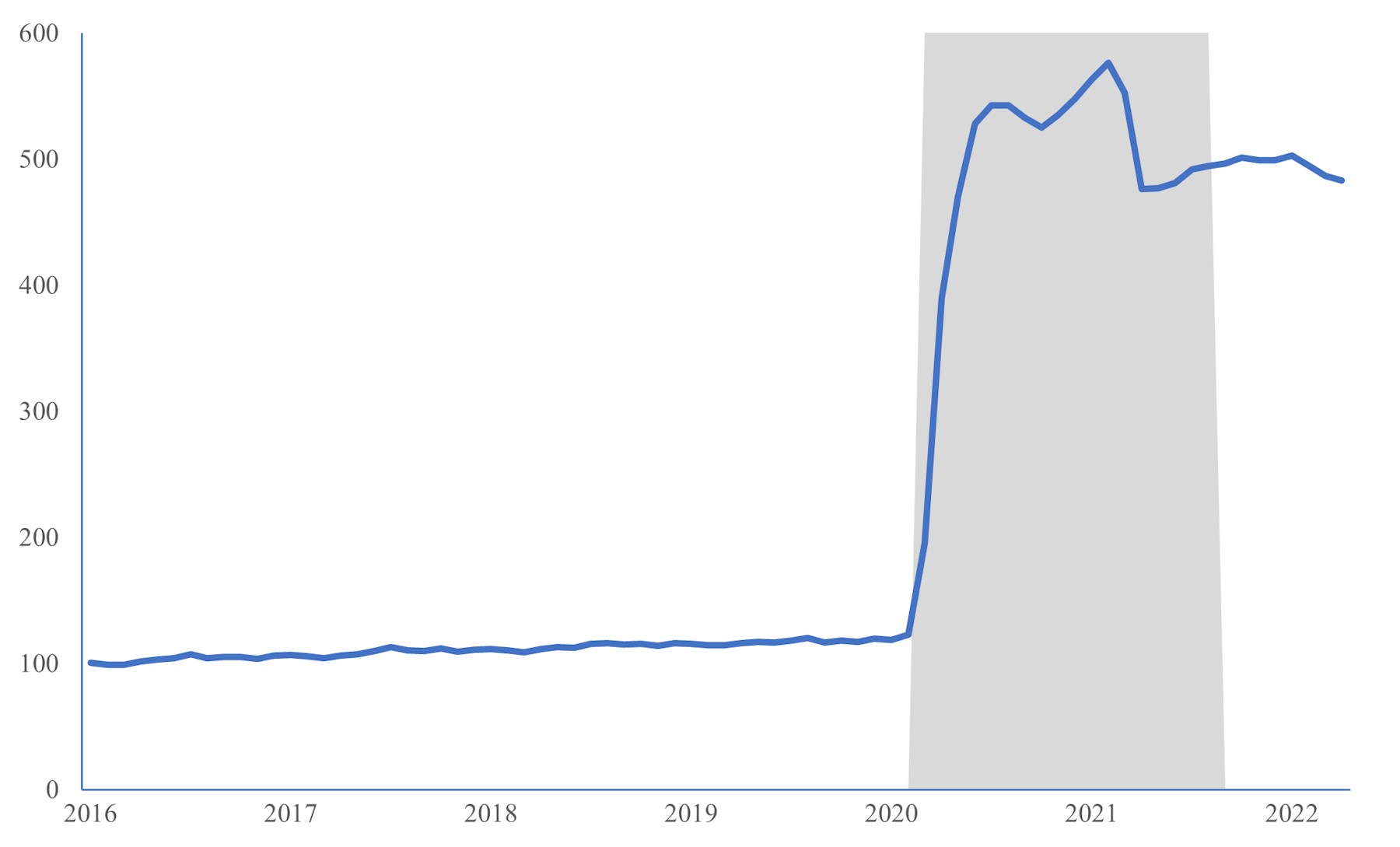

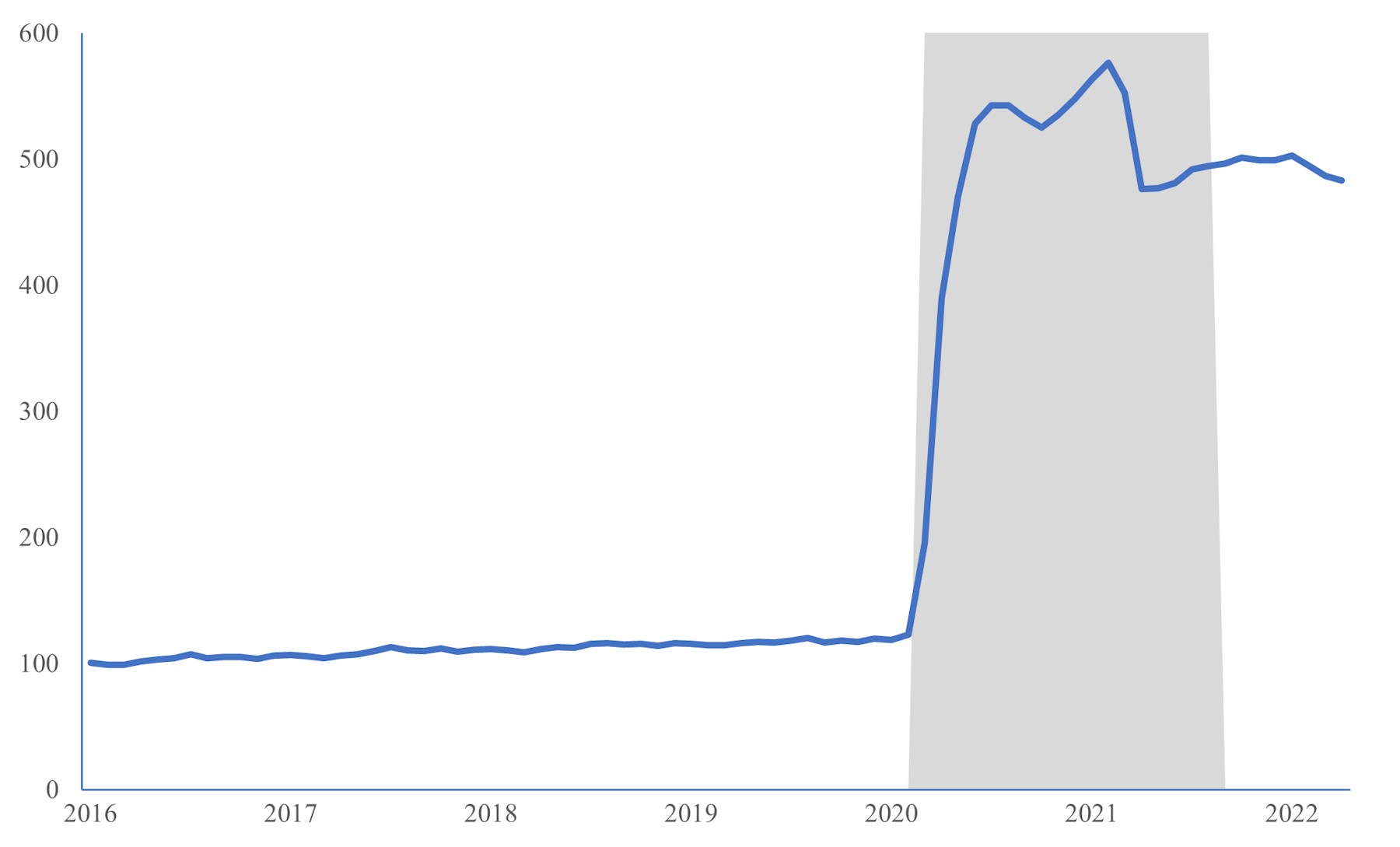

Robust Retail Sales Indicate a Stronger-Than-Expected Economy

The impressive growth in retail sales points towards a healthier Canadian economy than many had predicted. This strength stems from several key factors:

Consumer Spending Power Remains High

- Increased Consumer Confidence: Surveys indicate a rise in consumer confidence, fueled by positive job market conditions and a sense of economic stability.

- Job Growth and Wage Increases: The Canadian labor market has shown resilience, with steady job creation and modest wage growth contributing to increased disposable income. Statistics Canada reported an unemployment rate of 5.2% in July 2024, down from 5.5% in June. Average hourly earnings increased by 4.3% year-over-year.

- Government Stimulus Measures: While the impact of past government stimulus packages is waning, residual effects continue to support consumer spending.

Analysis: The combination of higher employment, wage growth, and increased consumer confidence directly translates into robust consumer spending, driving the significant increase in retail sales. This signifies a strong foundation for economic growth, potentially impacting the Bank of Canada's approach to interest rate adjustments.

Inflationary Pressures Could Resurface

- Increased Demand Leading to Higher Prices: Strong consumer demand puts upward pressure on prices across various sectors, potentially reigniting inflationary concerns.

- Supply Chain Bottlenecks: While easing, lingering supply chain issues in certain sectors can exacerbate price increases.

- Energy Prices: Fluctuations in global energy markets could also contribute to inflationary pressure.

Data Points: The annual inflation rate in July 2024 was reported at 2.8%, slightly above the Bank of Canada's 2% target. Specific sectors showing price increases include automotive sales and restaurants.

Analysis: The Bank of Canada closely monitors inflation. While current inflation is near the target, robust retail sales and the potential for increased inflationary pressures could force a reassessment of the rate-cutting strategy.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada has been actively managing monetary policy in response to evolving economic conditions.

Recent Interest Rate Cuts and Their Rationale

- Slowing Economic Growth: Concerns about slowing global economic growth prompted the Bank of Canada to reduce interest rates earlier this year.

- Global Uncertainties: Geopolitical risks and global economic volatility played a significant role in their decision-making.

Data Points: The Bank of Canada reduced its benchmark interest rate by 0.25% in March and April 2024, bringing the target overnight rate to 4.5%.

Analysis: The aim of these rate cuts was to stimulate economic activity and mitigate the impact of global headwinds.

Potential Impact of Rising Retail Sales on Future Decisions

- Pause in Rate Cuts: The strong retail sales figures might lead the Bank of Canada to pause its rate-cutting cycle, opting for a period of observation.

- Reversal of Rate Cuts: If inflationary pressures intensify, a reversal of the rate cuts, leading to an increase in interest rates, is a possibility.

Analysis: The robust retail sales data presents a significant challenge to the Bank of Canada's initial projections. The central bank will need to carefully weigh the risks of fueling inflation against the risks of stifling economic growth.

Alternative Economic Indicators and Their Influence

While retail sales provide a strong signal, the Bank of Canada considers a broader range of economic indicators.

Analyzing Other Key Economic Data Points

- Employment Numbers: Sustained job growth indicates a healthy economy, supporting the retail sales data.

- Housing Market Data: The housing market's performance is another crucial indicator of economic health.

- Manufacturing Output: Manufacturing sector activity provides insights into industrial production and overall economic strength.

Data Points: These data points require further analysis and will be reviewed in upcoming reports by the Bank of Canada.

Analysis: A comprehensive evaluation of all these indicators is critical to forming a holistic view of the Canadian economy.

The Importance of a Holistic Economic Assessment

The Bank of Canada's monetary policy decisions are based on a complex interplay of various economic factors. Predicting economic trends with absolute certainty is impossible, and the central bank must adapt its strategy in response to new information.

Rising Retail Sales Figures Could Halt Bank of Canada's Rate Cutting Strategy – A Summary and Call to Action

Strong retail sales in Canada suggest a more resilient economy than previously forecast, potentially altering the Bank of Canada's planned interest rate cuts. The central bank faces a critical decision: balancing the risk of inflation with the need to stimulate economic growth. This situation has significant implications for consumers and businesses alike.

Stay updated on the evolving situation regarding rising retail sales and the Bank of Canada's rate-cutting strategy by following the Bank of Canada's website for official statements and releases.

Featured Posts

-

Borsa Italiana Analisi Del Mercato Dopo I Conti Di Italgas

May 25, 2025

Borsa Italiana Analisi Del Mercato Dopo I Conti Di Italgas

May 25, 2025 -

Boosting Bangladesh Europe Ties Collaboration For Economic Growth

May 25, 2025

Boosting Bangladesh Europe Ties Collaboration For Economic Growth

May 25, 2025 -

Aex Aandelen Profiteren Van Trump Uitstel Markt Analyse

May 25, 2025

Aex Aandelen Profiteren Van Trump Uitstel Markt Analyse

May 25, 2025 -

The Prince Of Monaco And The Allegations Of Financial Misconduct

May 25, 2025

The Prince Of Monaco And The Allegations Of Financial Misconduct

May 25, 2025 -

Natural Disaster Betting A Look At The Los Angeles Wildfires And Societal Implications

May 25, 2025

Natural Disaster Betting A Look At The Los Angeles Wildfires And Societal Implications

May 25, 2025

Latest Posts

-

Atletico Madrid Barcelona Maci Canli Skor Fanatik Ten Dakika Dakika Detaylar

May 25, 2025

Atletico Madrid Barcelona Maci Canli Skor Fanatik Ten Dakika Dakika Detaylar

May 25, 2025 -

Barcelona Atletico Madrid Maci Canli Yayin Anlik Sonuclar Ve Goller

May 25, 2025

Barcelona Atletico Madrid Maci Canli Yayin Anlik Sonuclar Ve Goller

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Canli Anlatim

May 25, 2025

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Canli Anlatim

May 25, 2025 -

3 Mac Sonra Zafer Atletico Madrid In Doenuesue

May 25, 2025

3 Mac Sonra Zafer Atletico Madrid In Doenuesue

May 25, 2025 -

Atletico Madrid Uec Maclik Kara Seri Sonlandi

May 25, 2025

Atletico Madrid Uec Maclik Kara Seri Sonlandi

May 25, 2025