Rising Sea Levels, Falling Credit Scores: The Link Between Climate And Mortgages

Table of Contents

How Rising Sea Levels Impact Property Values and Mortgage Lending

Increased flood risk due to rising sea levels significantly diminishes property values in coastal areas. This devaluation stems from several factors. The higher the risk of flooding, the more challenging it becomes to secure adequate insurance, leading to:

- Skyrocketing insurance premiums: Insurers are increasingly reluctant to cover properties in high-risk zones, or they charge exorbitant premiums that make homeownership unsustainable.

- Reduced buyer interest: Potential buyers are understandably hesitant to invest in properties facing imminent flood threats, creating a depressed market and reducing demand.

- Lower appraisals: Appraisers reflect the increased risk in their valuations, leading to lower assessments that directly impact the amount a bank is willing to lend.

- Stringent lending practices: Banks are becoming more cautious, implementing stricter lending criteria and potentially refusing mortgages altogether for properties in vulnerable areas. This echoes historical redlining practices, but now the discriminatory factor is climate risk, disproportionately affecting certain communities.

This devaluation isn't hypothetical. Areas like Miami, Florida, and parts of the Netherlands are already experiencing significant drops in property values due to rising sea levels and increased flood risk. The impact of climate change on property values is no longer a distant concern; it's a present reality impacting mortgage lending decisions.

The Impact of Climate-Related Disasters on Credit Scores

Climate-related disasters like floods, hurricanes, and wildfires have devastating consequences, extending far beyond the immediate property damage. The financial fallout can severely impact credit scores:

- Missed mortgage payments: Displacement or property damage can make it impossible for homeowners to meet their mortgage obligations, leading to late payments or defaults.

- Increased debt: Repair costs after a disaster, or relocation expenses if a home is uninhabitable, can quickly accumulate significant debt.

- Negative credit reports: Missed payments and debt accumulation are dutifully recorded on credit reports, negatively impacting credit scores.

- Future lending difficulties: A damaged credit history makes it extremely challenging to obtain future loans, further compounding financial hardship.

While insurance claims can help mitigate some financial losses, the process itself can be lengthy and complex, potentially exacerbating existing credit issues. Fortunately, resources like FEMA and various non-profit organizations offer assistance to individuals struggling to recover from climate-related disasters.

The Growing Awareness of Climate Risk in Mortgage Underwriting

The mortgage industry is slowly but surely incorporating climate risk into its underwriting processes. Lenders are increasingly:

- Scrutinizing high-risk properties: Detailed assessments of flood risk and climate vulnerability are becoming standard practice.

- Utilizing advanced models: Flood maps and sophisticated climate risk models are used to evaluate loan applications more accurately.

- Implementing stricter lending terms: Higher interest rates or stricter lending criteria are being applied to properties in vulnerable areas.

- Developing innovative insurance products: New insurance products are emerging to address the increased risk associated with climate change.

Government initiatives and regulations are also playing a crucial role, pushing for greater transparency and accountability in assessing climate risk. Technological advancements are further improving the ability of lenders to assess and manage climate-related risks, making the process more data-driven and accurate.

Protecting Your Credit Score in a Changing Climate

Homeowners in high-risk areas need to be proactive in protecting their homes and credit scores. Consider these steps:

- Secure flood insurance: This is crucial, even if your home isn't in a designated flood zone.

- Implement mitigation measures: Elevate your home, install flood barriers, or take other steps to reduce your vulnerability.

- Monitor your credit report: Regularly check your credit report for any inaccuracies or negative marks.

- Build a strong financial safety net: Create an emergency fund to cover unexpected expenses.

- Understand your lender's policies: Be fully aware of your lender's policies on climate risk.

Resources for obtaining flood insurance and financial assistance are available through FEMA, the National Flood Insurance Program, and various non-profit organizations. Proactive financial planning is essential to navigate the challenges posed by climate change.

Conclusion: Navigating Rising Sea Levels and Protecting Your Mortgage

The connection between rising sea levels, climate change, and the impact on mortgages and credit scores is undeniable. Understanding the increased risks associated with climate change is crucial for responsible financial planning. Proactive measures, such as obtaining flood insurance and understanding your lender's policies on climate risk are essential. By understanding rising sea levels and their impact on your mortgage, you can mitigate the effects of rising sea levels on your credit score and protect your financial future. Don't wait; take action today to protect your mortgage in the face of rising sea levels.

Featured Posts

-

Appeal Launched Against Sentence For Racial Hatred Tweet

May 21, 2025

Appeal Launched Against Sentence For Racial Hatred Tweet

May 21, 2025 -

Remont Pivdennogo Mostu Pidryadniki Protses Ta Vartist

May 21, 2025

Remont Pivdennogo Mostu Pidryadniki Protses Ta Vartist

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025 -

Benjamin Kaellman Maalinteko Ja Tulevaisuus Huuhkajissa

May 21, 2025

Benjamin Kaellman Maalinteko Ja Tulevaisuus Huuhkajissa

May 21, 2025 -

Antiques Roadshow Appraisal Leads To Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Antiques Roadshow Appraisal Leads To Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Latest Posts

-

Wwe Raw Results May 19 2025 Winners And Grades

May 21, 2025

Wwe Raw Results May 19 2025 Winners And Grades

May 21, 2025 -

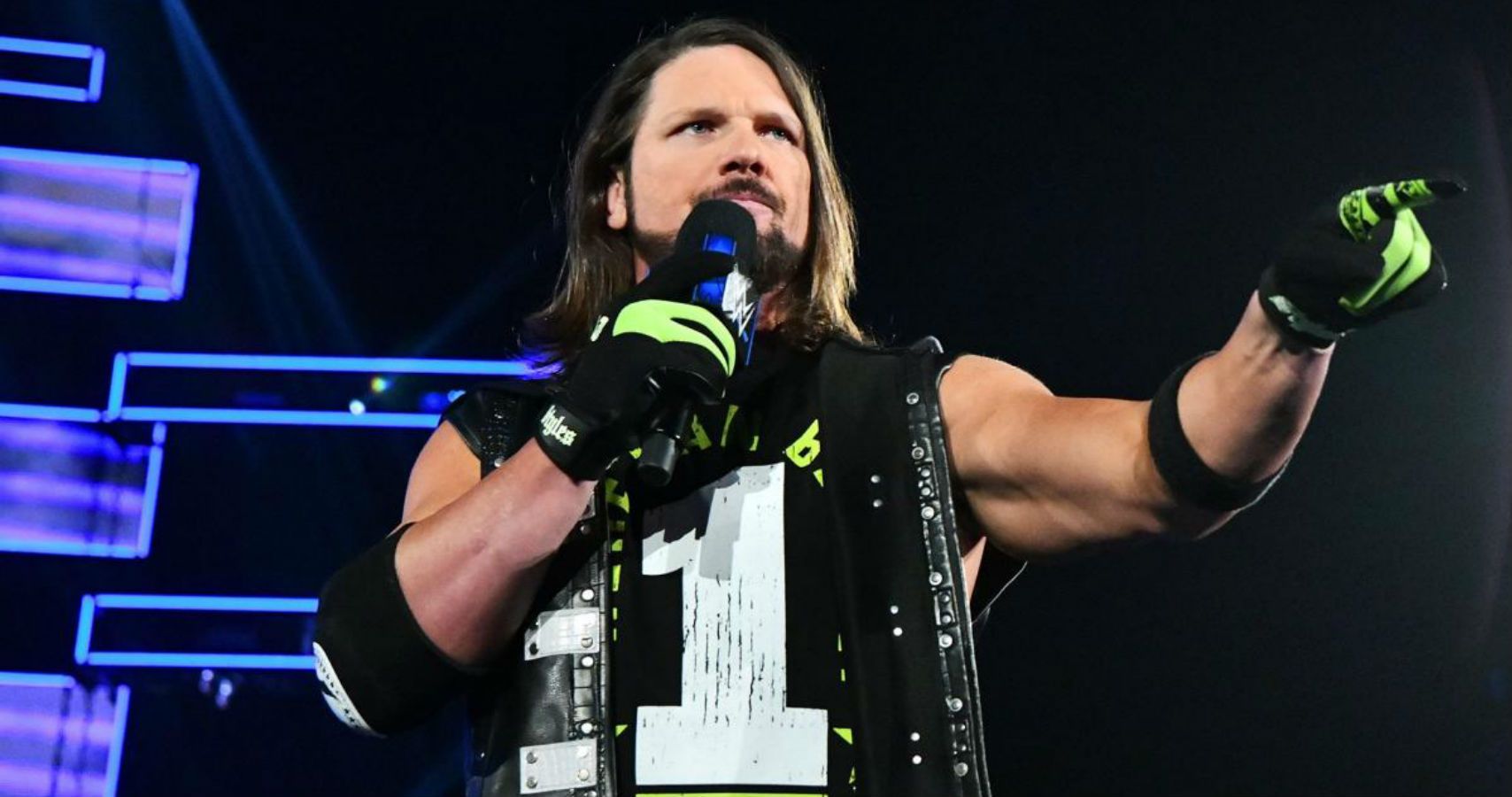

Backstage News The Current State Of Aj Styles Wwe Contract

May 21, 2025

Backstage News The Current State Of Aj Styles Wwe Contract

May 21, 2025 -

Wwes Aj Styles Contract Status And Future Plans

May 21, 2025

Wwes Aj Styles Contract Status And Future Plans

May 21, 2025 -

Wwe Raw Match Ends With Zoey Stark Injury

May 21, 2025

Wwe Raw Match Ends With Zoey Stark Injury

May 21, 2025 -

Mm Karsinnat 2024 Huuhkajien Uuden Valmennuksen Haasteet

May 21, 2025

Mm Karsinnat 2024 Huuhkajien Uuden Valmennuksen Haasteet

May 21, 2025