Risk Assessment And Mitigation In Financing A 270MWh BESS Project In Belgium

Table of Contents

Regulatory and Policy Risks in the Belgian BESS Market

Navigating the regulatory environment is paramount for any large-scale BESS project in Belgium. Several key areas present significant risk:

Permitting and Licensing Challenges

Obtaining the necessary permits and licenses for a 270MWh BESS project in Belgium can be complex and time-consuming. This involves interactions with multiple regulatory bodies, including, but not limited to, the Flemish Environment Agency (VMM), the Walloon Environment Agency (SPW), and potentially the federal government depending on the project location. Delays in the permitting process can lead to substantial cost overruns and project delays.

- Complex Application Process: Each agency has its own specific requirements and procedures, requiring meticulous preparation and submission of comprehensive documentation.

- Environmental Impact Assessments: Thorough environmental impact assessments are mandatory, potentially leading to revisions and delays.

- Public Consultations: Public consultations may be required, adding to the timeline and requiring engagement with local communities.

Grid Connection and Transmission Issues

Connecting a 270MWh BESS project to the Belgian electricity grid presents significant challenges. The grid's capacity limitations and potential bottlenecks need careful consideration. Securing a grid connection agreement with Elia, the Belgian transmission system operator, is crucial and involves a rigorous process.

- Grid Capacity Constraints: Ensuring sufficient grid capacity to accommodate the influx of energy from the BESS system is vital.

- Network Upgrades: Upgrades to the existing grid infrastructure may be required, adding to the project's cost and complexity.

- Connection Timelines: Negotiating and securing the grid connection agreement can take considerable time.

Government Incentives and Subsidies

The Belgian government offers various incentives and subsidies to promote renewable energy projects, including BESS. However, these incentives can be subject to change, creating uncertainty. Understanding the eligibility criteria and application processes for these incentives is crucial for project feasibility.

- Tax Breaks: Potential tax benefits, such as accelerated depreciation, can significantly impact the project's financial viability.

- Direct Subsidies: Government grants and subsidies can reduce the overall cost of the project.

- Policy Changes: Changes in government policy regarding BESS incentives can impact the project's profitability and require adaptation of the financial model.

Financial and Economic Risks in BESS Project Financing

The financial aspects of a 270MWh BESS project require careful planning and risk mitigation. The significant investment and dependence on fluctuating energy markets present substantial challenges.

Capital Expenditure (CAPEX) and Operating Expenditure (OPEX)

A 270MWh BESS project involves substantial upfront capital expenditure (CAPEX) for battery procurement, installation, and grid connection infrastructure. Ongoing operational expenditure (OPEX), including maintenance, insurance, and grid fees, needs careful budgeting.

- High Initial Investment: CAPEX represents a significant financial commitment.

- Ongoing Operational Costs: OPEX includes battery monitoring, maintenance, and replacement, as well as grid connection fees.

- Cost Optimization: Exploring different battery technologies and optimizing the system design can help in minimizing CAPEX and OPEX.

Revenue Streams and Market Volatility

BESS projects can generate revenue through various mechanisms such as frequency regulation, peak shaving, and arbitrage. However, electricity price volatility and market fluctuations can significantly affect project profitability.

- Revenue Diversification: Diversifying revenue streams reduces reliance on any single market segment.

- Price Volatility: Hedging strategies are crucial to mitigate risks associated with fluctuating electricity prices.

- Market Forecasting: Accurate market forecasting is essential for robust financial modelling and risk assessment.

Financing Options and Lender Requirements

Securing financing for a large-scale BESS project requires a strong project development plan and financial model. Various financing options exist, including debt financing, equity financing, and project finance. Lenders will conduct thorough due diligence before committing funds.

- Debt Financing: Traditional bank loans and bonds.

- Equity Financing: Investment from private equity firms or venture capitalists.

- Project Finance: Financing structured around the project's cash flows.

- Lender Requirements: Lenders will require comprehensive financial projections, risk assessments, and detailed technical specifications.

Technological and Operational Risks in BESS Projects

Technological and operational risks are inherent in BESS projects. Addressing these risks proactively is crucial for project success.

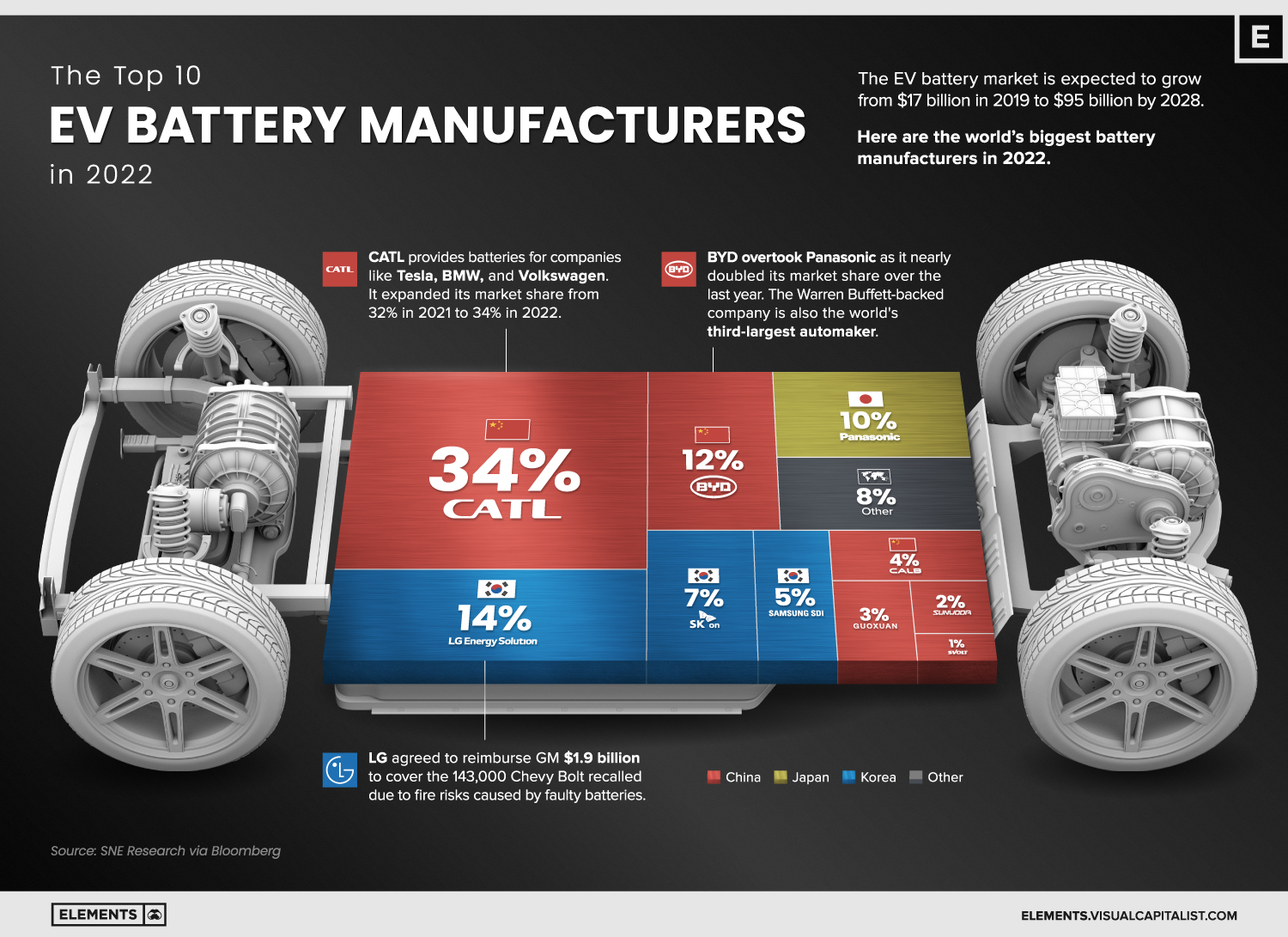

Battery Technology and Degradation

Battery technology continues to evolve, but degradation remains a concern. Understanding the lifespan and performance characteristics of different battery chemistries is crucial for assessing long-term project viability.

- Battery Degradation: Battery capacity and performance decline over time.

- Battery Lifespan: The expected lifespan of the battery system impacts the project's overall economic viability.

- Technology Selection: Choosing the appropriate battery chemistry and considering the potential need for future battery replacements.

System Integration and Reliability

Seamless system integration and reliable operation are essential. Technical failures can have significant consequences, disrupting energy supply and incurring repair costs.

- System Integration: Ensuring the smooth integration of the BESS system with other grid components.

- Redundancy: Incorporating redundant components to ensure reliable operation even in case of failures.

- Monitoring and Maintenance: Implementing robust monitoring and maintenance procedures to identify and address potential problems early.

Cybersecurity Risks

Cybersecurity threats represent a growing concern for BESS systems. Protecting the system from unauthorized access and cyberattacks is crucial.

- Data Encryption: Implementing strong encryption to protect sensitive data.

- Access Control: Restricting access to the system to authorized personnel only.

- Compliance: Adhering to relevant cybersecurity standards and regulations.

Conclusion: Mitigating Risks for Successful BESS Project Financing in Belgium

Financing a 270MWh BESS project in Belgium involves navigating a complex interplay of regulatory, financial, and technological risks. Comprehensive Risk Assessment and Mitigation in Financing a 270MWh BESS Project in Belgium is paramount. By proactively identifying and mitigating these risks through careful planning, robust financial models, and technologically sound system design, developers can unlock the significant potential of BESS for Belgium's energy transition. Successfully deploying large-scale BESS projects contributes to enhancing grid stability, integrating renewable energy, and advancing Belgium's sustainability goals. Successfully navigating the complexities of Risk Assessment and Mitigation in Financing a 270MWh BESS Project in Belgium requires careful planning and proactive risk management. Contact us today to learn how we can help you assess and mitigate risks for your energy storage project.

Featured Posts

-

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025 -

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025

Obsessive F1 Ceo Stefano Domenicalis Impact On Formula Ones Global Growth

May 04, 2025 -

The High Price Of Offshore Wind A Shift In Industry Sentiment

May 04, 2025

The High Price Of Offshore Wind A Shift In Industry Sentiment

May 04, 2025 -

Chinas Ev Revolution Preparing For Global Competition The Us Response

May 04, 2025

Chinas Ev Revolution Preparing For Global Competition The Us Response

May 04, 2025 -

Declaration De Macron Sur La Militarisation Potentielle De L Aide Humanitaire A Gaza

May 04, 2025

Declaration De Macron Sur La Militarisation Potentielle De L Aide Humanitaire A Gaza

May 04, 2025

Latest Posts

-

From Repetitive Documents To Profound Podcasts The Power Of Ai

May 04, 2025

From Repetitive Documents To Profound Podcasts The Power Of Ai

May 04, 2025 -

Ai Driven Podcast Creation From Scatological Data To Engaging Content

May 04, 2025

Ai Driven Podcast Creation From Scatological Data To Engaging Content

May 04, 2025 -

Will The Opposition Break The Paps Hold On Power In Singapore

May 04, 2025

Will The Opposition Break The Paps Hold On Power In Singapore

May 04, 2025 -

Turning Poop Into Profit An Ai Powered Podcast Revolution

May 04, 2025

Turning Poop Into Profit An Ai Powered Podcast Revolution

May 04, 2025 -

Singapore Election Assessing The Oppositions Chances

May 04, 2025

Singapore Election Assessing The Oppositions Chances

May 04, 2025