Rockwell Automation Earnings Beat Expectations: Wednesday's Stock Market Winners

Table of Contents

Rockwell Automation's Q[Quarter] Earnings Report: Key Highlights

Rockwell Automation's Q[Quarter] financial performance showcased remarkable strength across various key metrics. The company delivered an earnings per share (EPS) that significantly surpassed analyst estimates, demonstrating robust revenue growth and a healthy profit margin. This exceptional financial performance underscores the company's strong position in the industrial automation sector.

- EPS exceeded analyst estimates by [Percentage]%: This substantial beat reflects the company's ability to effectively manage costs and generate strong profits.

- Revenue growth of [Percentage]% year-over-year: This impressive growth rate indicates a healthy demand for Rockwell Automation's products and services across its key market segments.

- Strong performance in key market segments: [Specify segments, e.g., automotive, food and beverage, life sciences]. Highlighting specific segment performance demonstrates the breadth of Rockwell Automation's success.

- Positive outlook for future quarters: The company's confident guidance for upcoming quarters further reinforces the positive momentum. Mention specific forecasts if available.

Factors Contributing to Rockwell Automation's Success

Several factors contributed to Rockwell Automation's outstanding Q[Quarter] performance. A combination of strategic initiatives, market demand, and effective internal management fueled this impressive growth.

- Successful new product launches: The introduction of innovative products catering to evolving industry needs played a crucial role. Mention specific product launches if possible and their impact.

- Increased demand in specific industries: Strong demand in sectors like [mention specific industries and explain why] boosted sales and revenue. This highlights the company's ability to capitalize on market trends.

- Effective cost-cutting measures: Efficient cost management strategies contributed to improved profitability, demonstrating fiscal responsibility. Provide details on cost-cutting measures if available.

- Strategic acquisitions or partnerships: Mention any recent acquisitions or partnerships that contributed to revenue growth or expanded market reach. This showcases Rockwell Automation's strategic growth plan. Highlight the synergistic benefits.

Impact on Rockwell Automation Stock and Investor Sentiment

The market reacted positively to Rockwell Automation's earnings beat, with the stock price experiencing a significant surge. Investor confidence soared, reflected in increased trading volume and positive analyst sentiment.

- Stock price surge of [Percentage]% following the earnings release: This dramatic increase demonstrates investor confidence in the company's future prospects.

- Increased trading volume: The higher trading volume indicates heightened investor interest and activity.

- Summary of analyst comments and ratings: Many analysts upgraded their ratings and increased price targets, signaling a bullish outlook. Mention specific analyst upgrades and target price changes. Highlight any buy ratings received.

Rockwell Automation's Future Outlook and Investment Implications

Rockwell Automation's positive outlook for future quarters, coupled with its long-term growth strategy, presents compelling investment opportunities. The company's commitment to innovation and strategic expansion positions it for continued success.

- Long-term growth strategy: Highlight the company's plans for future expansion, including R&D investments, market penetration, and potential acquisitions.

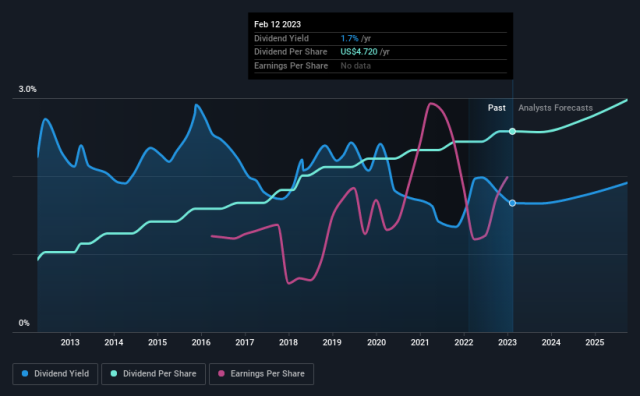

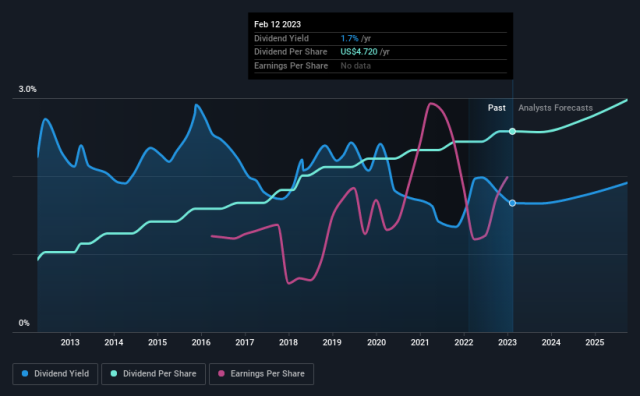

- Investment strategy considerations: Discuss the potential risks and rewards for investors considering Rockwell Automation. Analyze the return on investment (ROI) potential and dividend yield, if applicable.

- Future prospects: Based on the current financial performance and strategic plans, project the future potential of Rockwell Automation.

Conclusion: Rockwell Automation's Strong Earnings Signal Positive Momentum

Rockwell Automation's Q[Quarter] earnings report exceeded expectations across the board, leading to a significant increase in its stock price and a boost in investor sentiment. The company's strong financial performance, driven by innovation, strategic initiatives, and favorable market conditions, signals positive momentum for the future. The impressive financial highlights, coupled with a positive outlook, make Rockwell Automation a compelling investment opportunity for those seeking exposure to the industrial automation sector. Invest in Rockwell Automation, conduct your own thorough research on Rockwell Automation stock analysis, and consider adding Rockwell Automation to your portfolio. Learn more about Rockwell Automation earnings and explore the investment possibilities.

Featured Posts

-

Severance And Game Of Thrones Gwendoline Christie On Embracing New Challenges

May 17, 2025

Severance And Game Of Thrones Gwendoline Christie On Embracing New Challenges

May 17, 2025 -

New Doctor Who Trailer The Fifteenth Doctor Meets His Companion Battles Killer Cartoons

May 17, 2025

New Doctor Who Trailer The Fifteenth Doctor Meets His Companion Battles Killer Cartoons

May 17, 2025 -

Top 10 Tv Shows Cancelled Before Their Time

May 17, 2025

Top 10 Tv Shows Cancelled Before Their Time

May 17, 2025 -

Tesla Berlin Prosvjed I Poruka O Globalnoj Prijetnji

May 17, 2025

Tesla Berlin Prosvjed I Poruka O Globalnoj Prijetnji

May 17, 2025 -

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection Guide

May 17, 2025

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection Guide

May 17, 2025

Latest Posts

-

Ngam Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Moi Nhat

May 17, 2025

Ngam Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Moi Nhat

May 17, 2025 -

Thu Thiem Kham Pha Phoi Canh Cong Vien Dien Anh Ven Song

May 17, 2025

Thu Thiem Kham Pha Phoi Canh Cong Vien Dien Anh Ven Song

May 17, 2025 -

Nominalizari Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 In Frunte

May 17, 2025

Nominalizari Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 In Frunte

May 17, 2025 -

Cong Vien Dien Anh Thu Thiem Phoi Canh Ven Song Sai Gon

May 17, 2025

Cong Vien Dien Anh Thu Thiem Phoi Canh Ven Song Sai Gon

May 17, 2025 -

Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Conduc Nominalizarile Vezi Lista Completa

May 17, 2025

Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Conduc Nominalizarile Vezi Lista Completa

May 17, 2025