Rockwell Automation Earnings Surprise: Stock Soars With Other Market Leaders

Table of Contents

Rockwell Automation's Q[Quarter] Earnings Beat Expectations

Revenue Growth Analysis

Rockwell Automation's Q[Quarter] revenue significantly outperformed predictions, showcasing strong growth compared to both the previous quarter and the same quarter last year. The company reported a [Insert Specific Revenue Figure] in revenue, representing a [Insert Percentage]% increase year-over-year and a [Insert Percentage]% increase quarter-over-quarter. This impressive growth can be attributed to several key factors:

- Breakdown of Revenue by Segment: [Insert detailed breakdown of revenue by segment, e.g., Industrial Automation segment saw a X% increase driven by strong demand for robotics and control systems; Software and Services contributed Y% to overall revenue growth due to increased adoption of digital solutions].

- Comparison to Analyst Predictions: Analysts had predicted a revenue figure of [Insert Analyst Prediction], significantly lower than the actual results. This substantial beat underscores the strength of Rockwell Automation's performance.

- Key Factors Contributing to Revenue Growth: Besides strong market demand, key factors contributing to revenue growth include the successful launch of new products like [mention specific product examples], strategic partnerships, and effective expansion into new markets.

Profitability and Margins

Rockwell Automation's profitability also exceeded expectations. The company reported a gross margin of [Insert Gross Margin Percentage]% and an operating margin of [Insert Operating Margin Percentage]%.

- Significant Changes in Margins: [Explain any noteworthy changes in margins compared to previous quarters, and highlight if the changes are positive or negative and what caused them, for example: "The increase in gross margin reflects the company's focus on cost optimization and pricing strategies."]

- Impact of Cost-Cutting Measures or Increased Efficiency: [Explain the impact of any cost-cutting measures, improved efficiency, supply chain optimization or other relevant factors on margins and profitability. For example: "Efficient supply chain management and successful cost-reduction initiatives contributed significantly to the improved operating margin."]

- Comparison to Previous Quarters and Competitor Performance: Compared to the previous quarter's [Insert Previous Quarter Margin]%, and the same quarter last year's [Insert Last Year's Margin]%, this represents a substantial improvement. [Compare to competitor performance, using data from competitors where possible.]

Stock Market Reaction and Investor Sentiment

Immediate Stock Price Surge

Following the earnings release, Rockwell Automation's stock price experienced a dramatic surge. The stock price increased by [Insert Percentage]% on [Insert Date], reaching a new high of [Insert Stock Price].

- Percentage Increase in Stock Price: This significant increase showcases investor confidence in the company's future prospects.

- Trading Volume and Volatility: Trading volume also increased significantly, indicating high investor interest and activity. [Mention trading volume figures if available].

- Relevant Charts or Graphs: [Include relevant charts or graphs illustrating the stock price movement if possible.]

Analyst Upgrades and Future Outlook

The positive earnings report prompted several analyst upgrades and positive revisions to future earnings projections.

- Price Target Changes: [Mention specific price target changes by analysts, including the names of reputable analyst firms.]

- Consensus Among Analysts Regarding Future Growth: The general consensus among analysts is that Rockwell Automation is well-positioned for continued growth, driven by strong industry trends and the company's strategic initiatives.

- Potential Risks or Uncertainties: While the outlook is positive, analysts have also noted potential risks such as [mention potential risks like global economic slowdown, supply chain disruptions, or competition].

Comparison to Other Industrial Automation Leaders

Peer Performance

Rockwell Automation's Q[Quarter] performance stands out against its main competitors in the industrial automation sector, including Siemens and Schneider Electric. While precise competitor data may require further research and may vary depending on reporting dates, [briefly compare performance against key competitors, focusing on relative strengths. For example: "While precise figures for competitors are still emerging, early indicators suggest Rockwell Automation's growth outpaced several key rivals."].

- Brief Discussion of the Earnings Performance of Key Competitors: [Briefly discuss the earnings performance of major competitors, emphasizing areas where Rockwell Automation outperformed or lagged behind.]

- Relative Strength of Rockwell Automation Compared to Its Peers: Rockwell Automation's strong revenue growth and improved margins highlight its relative strength within the competitive landscape.

- Market Share Implications: [Discuss potential implications for market share based on the performance comparison. For example: "This strong performance could indicate a potential increase in Rockwell Automation’s market share."]

Industry Trends and Growth Factors

Rockwell Automation's success is partly attributable to broader positive trends within the industrial automation sector.

- Trends like Automation Adoption, Digital Transformation, and Industry 4.0: The increasing adoption of automation technologies across various industries, coupled with the ongoing digital transformation, is driving demand for Rockwell Automation's products and services.

- Impact of These Trends on the Industrial Automation Sector: These trends are creating significant growth opportunities for companies like Rockwell Automation that offer innovative solutions for Industry 4.0 initiatives.

- Outlook for Continued Growth in the Industry: The outlook for the industrial automation sector remains positive, suggesting continued growth opportunities for Rockwell Automation in the coming quarters.

Conclusion

Rockwell Automation's Q[Quarter] earnings report delivered a significant "earnings surprise," resulting in a remarkable "stock soar" and showcasing the company's robust financial health. The impressive revenue growth, improved profitability, and positive investor sentiment firmly place Rockwell Automation among the leaders in the industrial automation sector. Its performance outpaces many competitors, capitalizing on major industry trends.

Stay informed on future Rockwell Automation earnings announcements and the continued impact of its success on the broader industrial automation market. Analyze the company's performance and consider its potential for long-term growth. Keep a close eye on Rockwell Automation stock and its earnings reports for continued insights into this dynamic sector.

Featured Posts

-

Cassidy Hutchinsons Memoir A First Hand Account Of The January 6th Attack

May 17, 2025

Cassidy Hutchinsons Memoir A First Hand Account Of The January 6th Attack

May 17, 2025 -

Gambling On California Wildfires A Troubling Trend

May 17, 2025

Gambling On California Wildfires A Troubling Trend

May 17, 2025 -

Tvs Jupiter Cng Petrol R1 Km

May 17, 2025

Tvs Jupiter Cng Petrol R1 Km

May 17, 2025 -

Rossiya Trete Mesto Po Investitsiyam V Uzbekistane

May 17, 2025

Rossiya Trete Mesto Po Investitsiyam V Uzbekistane

May 17, 2025 -

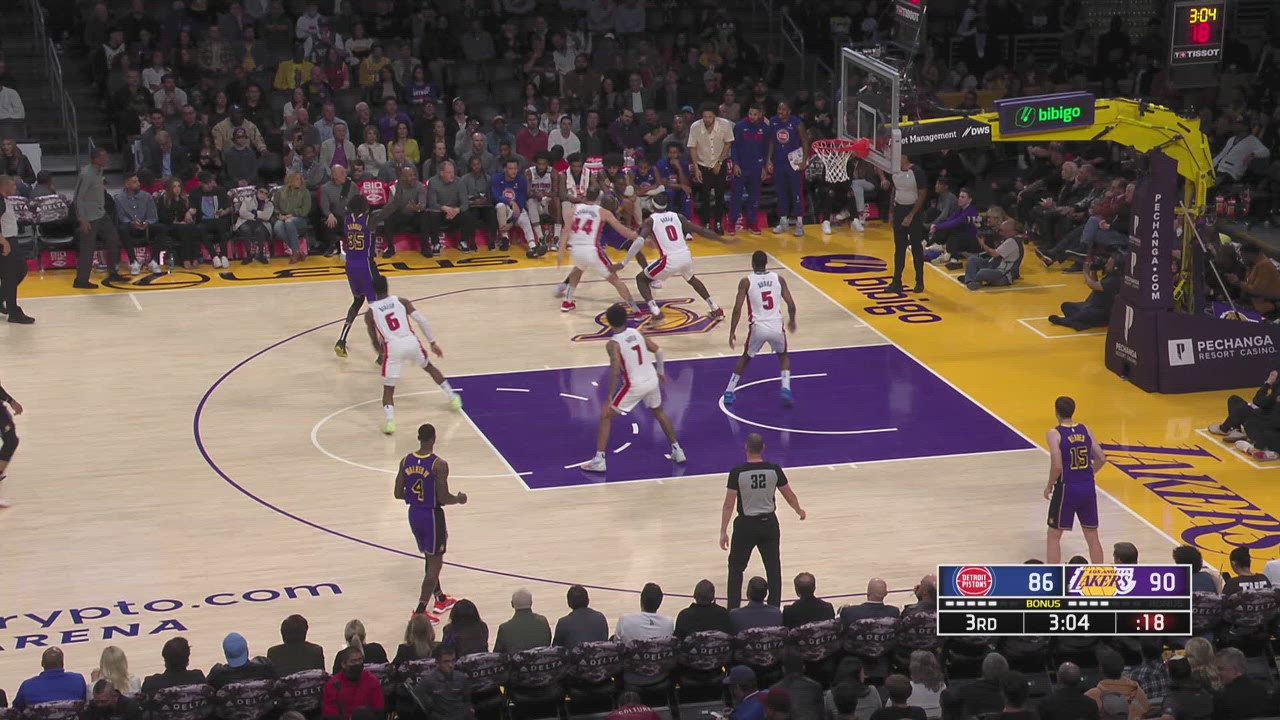

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025

Missed Foul Call Fuels Pistons Anger After Game 4 Defeat

May 17, 2025

Latest Posts

-

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Options Compared

May 17, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Options Compared

May 17, 2025 -

Andor Season 1 Where To Stream All Episodes Hulu And You Tube

May 17, 2025

Andor Season 1 Where To Stream All Episodes Hulu And You Tube

May 17, 2025 -

Andor Season 1 Episodes 1 3 Where To Watch Online Hulu And You Tube

May 17, 2025

Andor Season 1 Episodes 1 3 Where To Watch Online Hulu And You Tube

May 17, 2025 -

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Strong Indicators

May 17, 2025

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Strong Indicators

May 17, 2025 -

Three Reasons A Princess Leia Cameo In The New Star Wars Show Is Highly Likely

May 17, 2025

Three Reasons A Princess Leia Cameo In The New Star Wars Show Is Highly Likely

May 17, 2025