Rolls-Royce Confirms 2025 Projections: Tariff Impact Deemed Manageable

Table of Contents

Rolls-Royce's 2025 Financial Projections: A Detailed Look

Rolls-Royce's steadfast confirmation of its 2025 projections signals a strong belief in its long-term strategy and its dominant market position. The company's projections are likely multifaceted, encompassing several crucial key performance indicators (KPIs):

- Revenue Growth: The projections almost certainly include significant increases in revenue across its diverse portfolio, including civil aerospace, defense, and power systems. This suggests strong order books and continued market demand for their advanced technologies.

- Profitability: Rolls-Royce aims for improved profit margins, a testament to their commitment to efficiency gains and shrewd cost management strategies. This is crucial in an environment of fluctuating input costs.

- Research & Development Investment: The company's continued substantial investment in research and development underscores its dedication to innovation and technological leadership. This proactive approach is vital for maintaining a competitive edge in a rapidly evolving technological landscape.

- Market Share: Maintaining or even expanding market share in key segments demonstrates continued customer loyalty and confidence in Rolls-Royce's products and services. This reflects a strong brand reputation and customer satisfaction.

The Impact of Tariffs on Rolls-Royce's Operations

The announcement highlights Rolls-Royce's impressive ability to successfully navigate the complexities of international tariffs. While tariffs undeniably increase the cost of crucial components and raw materials, the company's confident statement suggests that these impacts are effectively manageable. Their success is likely due to a combination of strategic responses:

- Supply Chain Diversification: Rolls-Royce’s global supply chain is likely highly diversified, reducing their dependence on any single supplier vulnerable to tariff impacts. This mitigates risk and ensures business continuity.

- Price Adjustments: The company may have implemented strategic price adjustments to offset increased input costs without significantly impacting overall demand. This demonstrates careful market analysis and pricing strategies.

- Operational Efficiency Improvements: Continuous improvements in operational efficiency and cost reduction are likely key to absorbing the impacts of tariffs. This speaks to an ongoing commitment to lean manufacturing and process optimization.

- Government Relations: Proactive engagement with governments and regulatory bodies allows Rolls-Royce to address tariff concerns and advocate for favorable trade policies. This highlights a sophisticated approach to navigating the complexities of international trade.

Specific Sectors and Tariff Resilience

The impact of tariffs can vary considerably across Rolls-Royce's diverse operational sectors. For instance, the civil aerospace sector might be more sensitive to global trade fluctuations than the defense sector, which often benefits from stable government contracts.

- Civil Aerospace: Within the civil aerospace sector, Rolls-Royce likely employs sophisticated risk management strategies to counteract the impact of fluctuating fuel costs and global supply chain disruptions – issues often exacerbated by tariffs. This requires a highly agile and adaptable approach.

- Defense: The defense sector, with its reliance on government contracts, offers a level of insulation from the volatility of global trade, providing crucial stability during periods of tariff uncertainty.

Investor Confidence and Market Response

Rolls-Royce's confident projection for 2025 is likely to significantly reassure investors. This resilience in the face of global economic headwinds can lead to several positive outcomes:

- Increased Share Value: The positive market sentiment and renewed investor confidence are likely to translate into higher share prices, rewarding shareholders for their belief in the company's vision.

- Stronger Credit Ratings: Maintaining financial stability despite external challenges will likely reinforce the company's creditworthiness, leading to more favorable borrowing terms.

- Attracting Investments: Successfully navigating risks like tariffs makes Rolls-Royce an attractive investment target for future projects and growth initiatives. This signifies a promising outlook for future expansion.

Conclusion

Rolls-Royce's confirmation of its 2025 projections, despite the challenges posed by international tariffs, powerfully demonstrates the robustness of its strategy, operational efficiency, and overall resilient business model. Its capacity to effectively manage the impact of tariffs provides a valuable lesson for other multinational corporations facing similar global trade complexities. For investors and industry analysts, this announcement provides a clear signal of Rolls-Royce's enduring strength and its bright future prospects. Stay informed about further developments regarding Rolls-Royce's 2025 projections and its ongoing management of the complexities of global trade. Understanding how Rolls-Royce manages tariff impacts is crucial for assessing its future performance.

Featured Posts

-

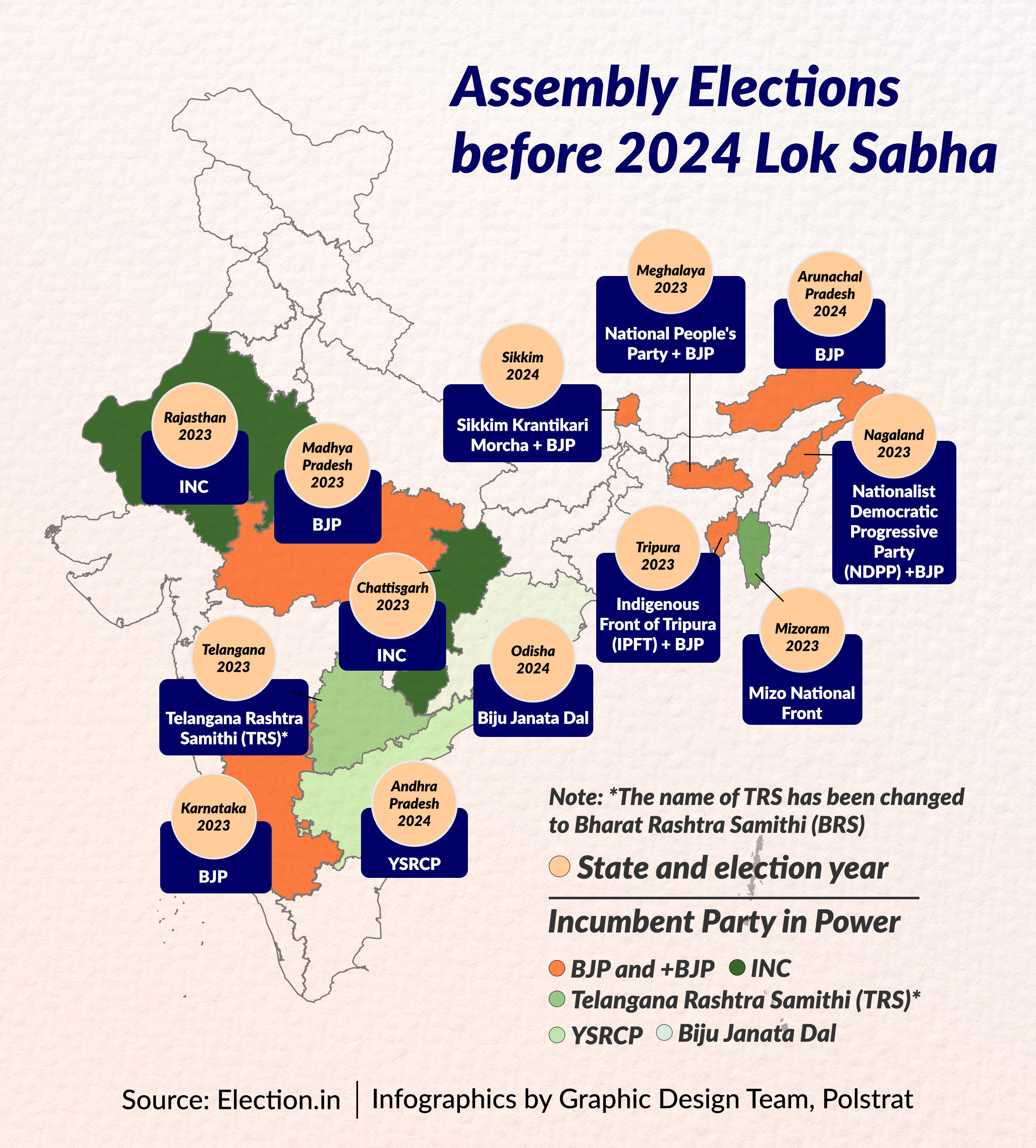

Alastthmar Fy Zl Aljbht Alwtnyt Wrqt Syasat Jdydt

May 03, 2025

Alastthmar Fy Zl Aljbht Alwtnyt Wrqt Syasat Jdydt

May 03, 2025 -

Friday School Cancellations Snow Ice And Trash Collection Delays

May 03, 2025

Friday School Cancellations Snow Ice And Trash Collection Delays

May 03, 2025 -

Class Action Lawsuit Alleges Deceptive Practices By Fortnite Maker Epic Games

May 03, 2025

Class Action Lawsuit Alleges Deceptive Practices By Fortnite Maker Epic Games

May 03, 2025 -

A Familys Grief Remembering Young Manchester United Fan Poppy

May 03, 2025

A Familys Grief Remembering Young Manchester United Fan Poppy

May 03, 2025 -

Lacrosse Hazing Incident 11 Players Avoid Kidnapping Charges In Syracuse

May 03, 2025

Lacrosse Hazing Incident 11 Players Avoid Kidnapping Charges In Syracuse

May 03, 2025

Latest Posts

-

Lee Anderson Ignites Tory Civil War Party Functioning Questioned After Lowe Attack

May 03, 2025

Lee Anderson Ignites Tory Civil War Party Functioning Questioned After Lowe Attack

May 03, 2025 -

Conservative Party Rift Deepens Lee Anderson On Dysfunction With Rupert Lowe

May 03, 2025

Conservative Party Rift Deepens Lee Anderson On Dysfunction With Rupert Lowe

May 03, 2025 -

Lee Andersons Explosive Claim Tory Civil War Erupts Over Rupert Lowe

May 03, 2025

Lee Andersons Explosive Claim Tory Civil War Erupts Over Rupert Lowe

May 03, 2025 -

Building Trust The Role Of A Robust Poll Data System In Elections

May 03, 2025

Building Trust The Role Of A Robust Poll Data System In Elections

May 03, 2025 -

A Robust Poll Data System Preventing Election Errors

May 03, 2025

A Robust Poll Data System Preventing Election Errors

May 03, 2025