Rosenberg Critiques Bank Of Canada's Cautious Approach

Table of Contents

Rosenberg's Core Argument: The Bank of Canada is Behind the Curve

Rosenberg contends that the Bank of Canada's gradual interest rate hikes are too little, too late to effectively curb inflation. He believes the central bank's measured approach risks allowing inflation to become entrenched, leading to more severe economic consequences down the line.

- Persistent Inflation Prediction: Rosenberg predicts that inflation will remain stubbornly high for longer than the Bank of Canada anticipates, potentially leading to a wage-price spiral. He points to persistent supply chain disruptions and robust consumer demand as contributing factors.

- Criticism of the Bank's Actions: Rosenberg criticizes the Bank's timing and magnitude of rate hikes. He argues that the increases have been too slow and incremental, failing to adequately address the accelerating inflationary pressures. He may cite specific instances where he believes the Bank should have acted more decisively. (Note: Specific examples and data points would need to be inserted here based on Rosenberg's actual statements.)

- Supporting Data (Placeholder): [Insert specific data points from Rosenberg's analysis, such as inflation projections, GDP growth forecasts, or commentary on specific economic indicators, to strengthen his argument. For example: "Rosenberg points to the recent CPI figures showing inflation at X%, significantly higher than the Bank of Canada's target of Y%, as evidence of their inadequate response."]

The Risks of a "Cautious Approach": Potential Economic Consequences

Rosenberg highlights several potential negative economic consequences stemming from what he views as the Bank of Canada's inaction. He warns that the current strategy could trigger a more severe economic downturn than necessary.

- Entrenched Inflation: A delayed and insufficient response to inflation could allow it to become embedded in the economy, making it far more difficult to control in the future. This could lead to further instability and uncertainty.

- Deeper Recession: By waiting too long to act decisively, Rosenberg argues that the Bank of Canada risks triggering a deeper and more prolonged recession. A more aggressive approach now, while painful in the short term, might ultimately prevent a more severe downturn later.

- Impact on Consumers and Businesses: High inflation erodes purchasing power, impacting Canadian consumers' disposable income. Businesses face rising input costs, potentially leading to reduced investment and job losses.

- Canadian Dollar Impact: The Bank of Canada's monetary policy decisions significantly influence the value of the Canadian dollar. A perceived lack of decisiveness could lead to a weakening of the Canadian dollar, impacting trade and investment flows.

Rosenberg's Alternative Proposal: A More Aggressive Monetary Policy?

Rosenberg advocates for a more aggressive monetary policy to combat inflation effectively. This might involve:

- Larger, Faster Rate Hikes: He likely suggests significantly larger and more frequent interest rate increases than what the Bank of Canada has implemented.

- Other Policy Recommendations (Placeholder): [This section requires specifics from Rosenberg's proposals. He might advocate for additional measures beyond interest rate adjustments, such as quantitative tightening or other unconventional monetary policies.]

- Potential Benefits: Rosenberg would argue that a more aggressive approach, while having short-term negative effects, would ultimately lead to a quicker return to price stability and a more sustainable economic recovery.

Counterarguments and Rebuttals to Rosenberg's Critique

The Bank of Canada likely defends its cautious approach with the following counterarguments:

- Recessionary Risks: The Bank might emphasize the risk of triggering a sharp recession by raising interest rates too quickly or aggressively. A sudden economic contraction could have severe social and economic consequences.

- Monetary Policy Lags: Monetary policy changes don't have an immediate impact on the economy. There's a significant lag between policy adjustments and their effects on inflation and economic activity. The Bank might argue that its current strategy reflects this lag.

- Other Economic Factors: The Bank's decision-making considers numerous factors beyond inflation, such as global economic conditions, supply chain issues, and geopolitical events. These external factors can influence the effectiveness of monetary policy.

The Implications for the Canadian Economy and Investors

Both Rosenberg's critique and the Bank of Canada's current approach have significant implications for the Canadian economy and investors:

- Investment Strategies: Investors must carefully consider the potential outcomes of both scenarios when making investment decisions. A more aggressive monetary policy could lead to higher yields on fixed-income securities but potentially lower equity valuations.

- Consumer Behavior: Higher interest rates could lead to decreased consumer spending and investment, impacting economic growth.

- Long-Term Implications for Economic Growth: The effectiveness of the Bank of Canada's response to inflation will have long-term consequences for Canada's economic growth trajectory. A failure to control inflation could lead to lower long-term growth potential.

Conclusion

David Rosenberg's critique of the Bank of Canada's cautious monetary policy highlights a significant debate about the appropriate response to persistent inflation. His argument for a more aggressive approach centers on the risk of allowing inflation to become entrenched, potentially leading to a deeper recession. However, the Bank of Canada counters with concerns about triggering a sharp economic downturn and the inherent lags in monetary policy. The ultimate consequences for the Canadian economy and investors will depend on which approach proves more effective in navigating this complex economic environment. Stay updated on the latest developments in Rosenberg's analysis of the Bank of Canada's monetary policy and its implications for your financial decisions. Understanding the implications of the Bank of Canada's cautious approach is crucial for informed investment strategies.

Featured Posts

-

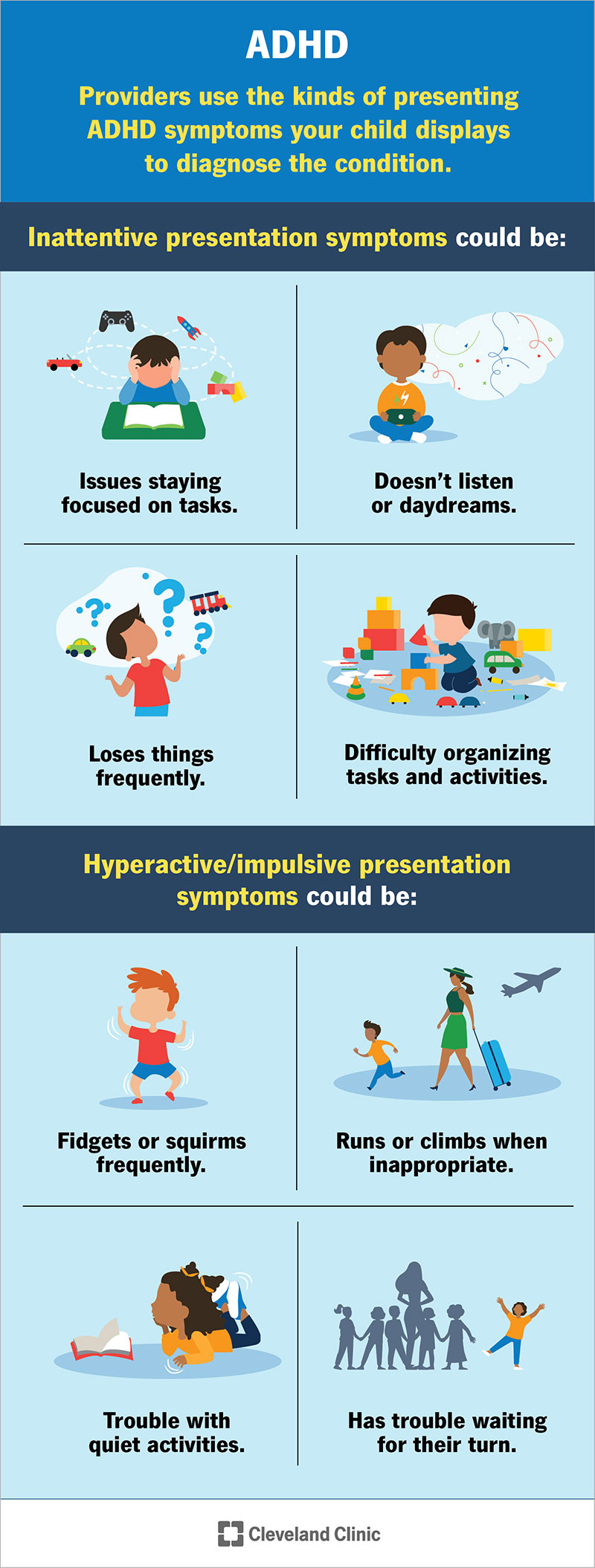

Exploring The Impact Of Group Support On Adhd

Apr 29, 2025

Exploring The Impact Of Group Support On Adhd

Apr 29, 2025 -

The Pete Rose Pardon Debate Examining Trumps Potential Action

Apr 29, 2025

The Pete Rose Pardon Debate Examining Trumps Potential Action

Apr 29, 2025 -

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

Apr 29, 2025

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

Apr 29, 2025 -

Jeff Goldblums Oscar Photo Check Goes Viral The Internet Reacts

Apr 29, 2025

Jeff Goldblums Oscar Photo Check Goes Viral The Internet Reacts

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

Latest Posts

-

Adhd Symptom Management Exploring Natural And Holistic Approaches

Apr 29, 2025

Adhd Symptom Management Exploring Natural And Holistic Approaches

Apr 29, 2025 -

Finding Natural Relief Effective Strategies For Managing Adhd Symptoms

Apr 29, 2025

Finding Natural Relief Effective Strategies For Managing Adhd Symptoms

Apr 29, 2025 -

Adult Adhd A Guide To Diagnosis And Next Steps

Apr 29, 2025

Adult Adhd A Guide To Diagnosis And Next Steps

Apr 29, 2025 -

Manage Adhd Naturally Holistic Approaches To Symptom Relief

Apr 29, 2025

Manage Adhd Naturally Holistic Approaches To Symptom Relief

Apr 29, 2025 -

Natural Ways To Manage Adhd Symptoms Effective Strategies For Adults And Children

Apr 29, 2025

Natural Ways To Manage Adhd Symptoms Effective Strategies For Adults And Children

Apr 29, 2025