Rs 400 Investment: JM Financial's Baazar Style Retail Offering

Table of Contents

Understanding JM Financial's Baazar-Style Retail Offering

What is a Baazar-Style Retail Investment?

JM Financial's baazar-style retail investment model offers fractional ownership in a diverse portfolio of assets. Unlike traditional investments requiring large sums, this approach allows you to participate in various market segments with a minimal investment. Think of it like visiting a bustling marketplace (bazaar) and picking and choosing small portions of various goods—except instead of spices and textiles, you’re investing in diverse assets. This approach offers diversification, mitigating the risk associated with putting all your eggs in one basket.

- Fractional Ownership: You own a small portion of a larger asset, making it accessible even with a limited budget.

- Diversification Benefits: Your investment is spread across multiple assets, reducing the impact of any single asset's underperformance.

- Comparison to Traditional Stock Market Investments: This model simplifies stock market participation, eliminating the need for extensive market knowledge or large initial capital.

- Ease of Entry and Exit: Investing and withdrawing your investment is designed to be straightforward and user-friendly.

The Rs 400 Investment: Breaking Down the Cost and Benefits

Minimum Investment Amount and its Implications

The most remarkable feature of this offering is the unbelievably low barrier to entry: just Rs 400. This makes investing accessible to a vast population, including first-time investors and those with limited disposable income. This small investment acts as a stepping stone, enabling you to learn about the markets and build your investment portfolio over time.

- Stepping Stone to Larger Investments: Rs 400 can be the first step toward more significant investments in the future.

- Cost Comparison: Consider other investment avenues; few offer such an accessible entry point.

- Potential Return on Investment (ROI): While no investment guarantees returns, this model presents a potential for high returns relative to the initial investment. Realistic expectations, however, are crucial. Past performance is not indicative of future results.

- Transaction Fees: It's essential to understand any associated transaction fees or charges before investing. Check the JM Financial website for complete details.

Risk Assessment and Due Diligence

It's vital to remember that all investments carry inherent risks. Market volatility can impact the value of your investment, leading to both gains and losses. Thorough research and understanding of the investment are crucial before committing your funds.

- Market Volatility: Be prepared for fluctuations in the market; your investment value may go up or down.

- Research and Understanding: Before investing, understand the underlying assets and the potential risks involved.

- Financial Advisor Consultation: If needed, seek advice from a qualified financial advisor to make informed investment decisions.

How to Invest Rs 400 in JM Financial's Offering

Step-by-Step Investment Guide

Investing your Rs 400 is a simple process:

- Account Creation: Visit the JM Financial website and create an online account.

- Investment Process: Select the baazar-style retail investment option and specify the amount (Rs 400 or more).

- Verification and Confirmation: Verify your details and confirm your investment.

- Accessing Investment Information: Access your investment information and statements through your online account.

JM Financial's Baazar-Style Retail Offering: A Comparison with Other Investment Options

Alternatives and their Advantages/Disadvantages

Compared to other small investment options in India, such as mutual funds and fixed deposits, JM Financial's baazar-style retail offering presents unique advantages. While mutual funds might require higher minimum investments, and fixed deposits offer lower potential returns, this option offers the potential for higher returns with a very low barrier to entry and ease of use.

- Return Comparison: While potential returns are higher compared to fixed deposits, they are also subject to market fluctuations, unlike fixed deposits.

- Risk Level Comparison: Risk levels are higher than fixed deposits, but diversification mitigates this risk compared to individual stock market investments.

- Accessibility and Ease of Use Comparison: The accessibility and ease of use surpass many other investment options.

Conclusion

JM Financial's baazar-style retail offering presents a revolutionary opportunity for investors in India. The ability to start investing with just Rs 400 is transformative, opening doors to financial growth for a wider audience. The potential for high returns, coupled with the ease of investment and the inherent benefits of diversification, makes it a compelling option. However, remember that all investments carry risks, and understanding these risks before investing is paramount. Start your investment journey today with a Rs 400 investment and explore the potential of small investment opportunities with JM Financial. Visit the [JM Financial Website Link Here] to learn more and begin your investment journey today.

Featured Posts

-

Ledra Pal Carsamba Dijital Veri Tabani Ile Isguecue Piyasasi Rehberi

May 15, 2025

Ledra Pal Carsamba Dijital Veri Tabani Ile Isguecue Piyasasi Rehberi

May 15, 2025 -

Potochinja Detski Festival Ispolnet So Khumanost

May 15, 2025

Potochinja Detski Festival Ispolnet So Khumanost

May 15, 2025 -

San Diego Padres Reach 10 Wins First Victory Over Oakland Athletics

May 15, 2025

San Diego Padres Reach 10 Wins First Victory Over Oakland Athletics

May 15, 2025 -

Mlb Dfs Lineup Advice May 8th Sleeper Picks And One Batter To Avoid

May 15, 2025

Mlb Dfs Lineup Advice May 8th Sleeper Picks And One Batter To Avoid

May 15, 2025 -

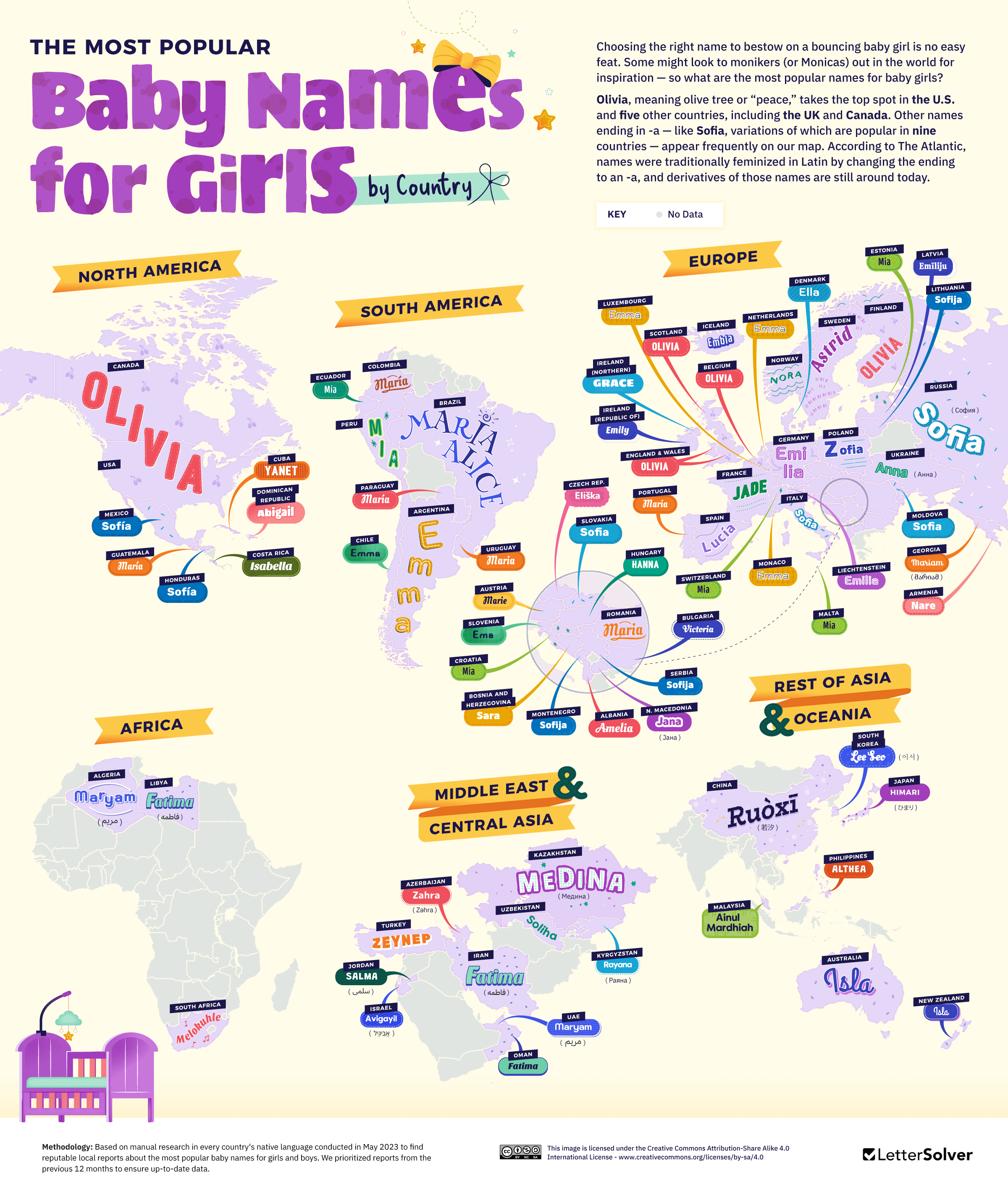

2024s Most Popular Baby Names Classic And Contemporary

May 15, 2025

2024s Most Popular Baby Names Classic And Contemporary

May 15, 2025