S&P 500 Risk Management: Protecting Your Investments During Market Uncertainty

Table of Contents

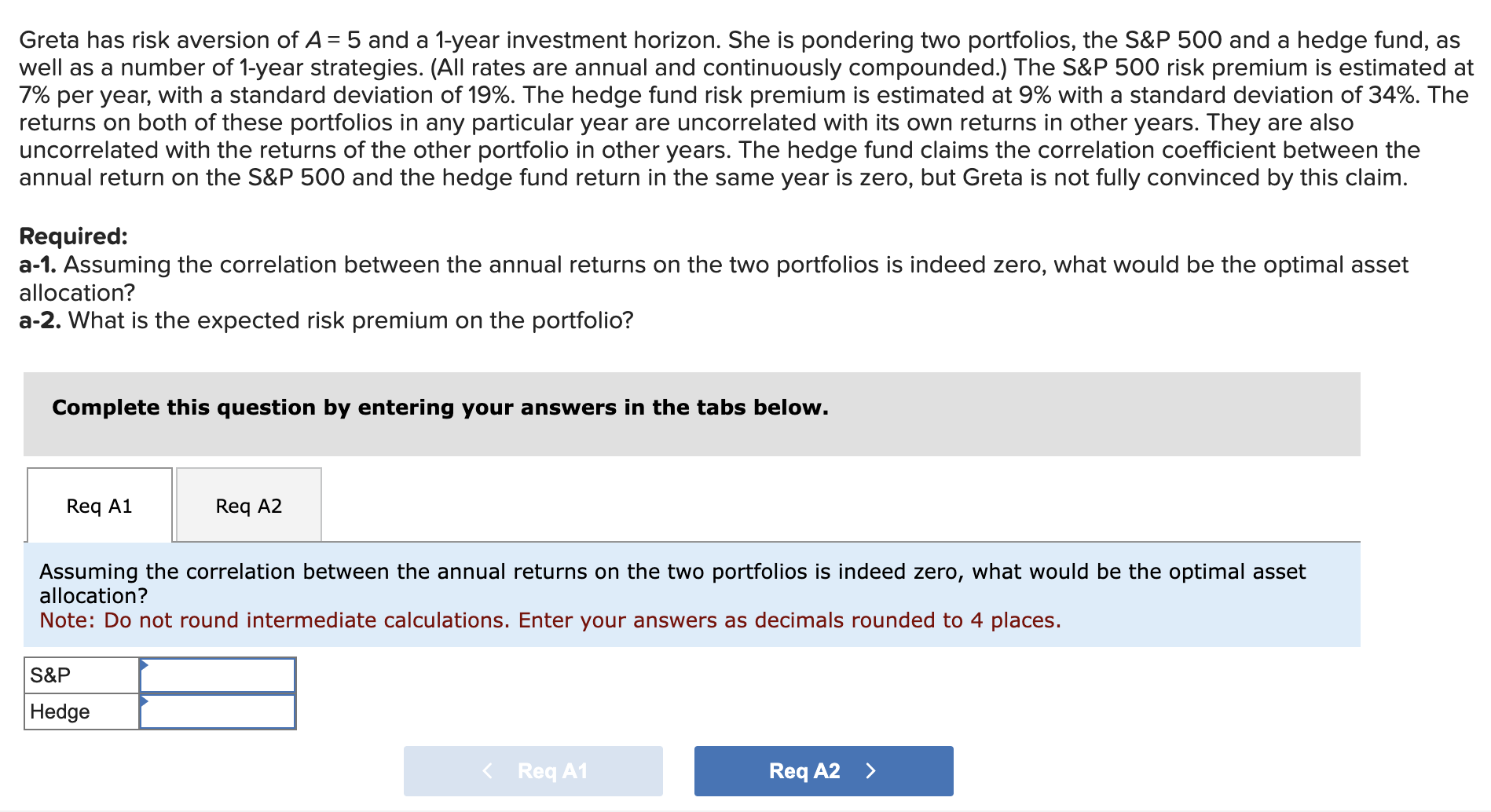

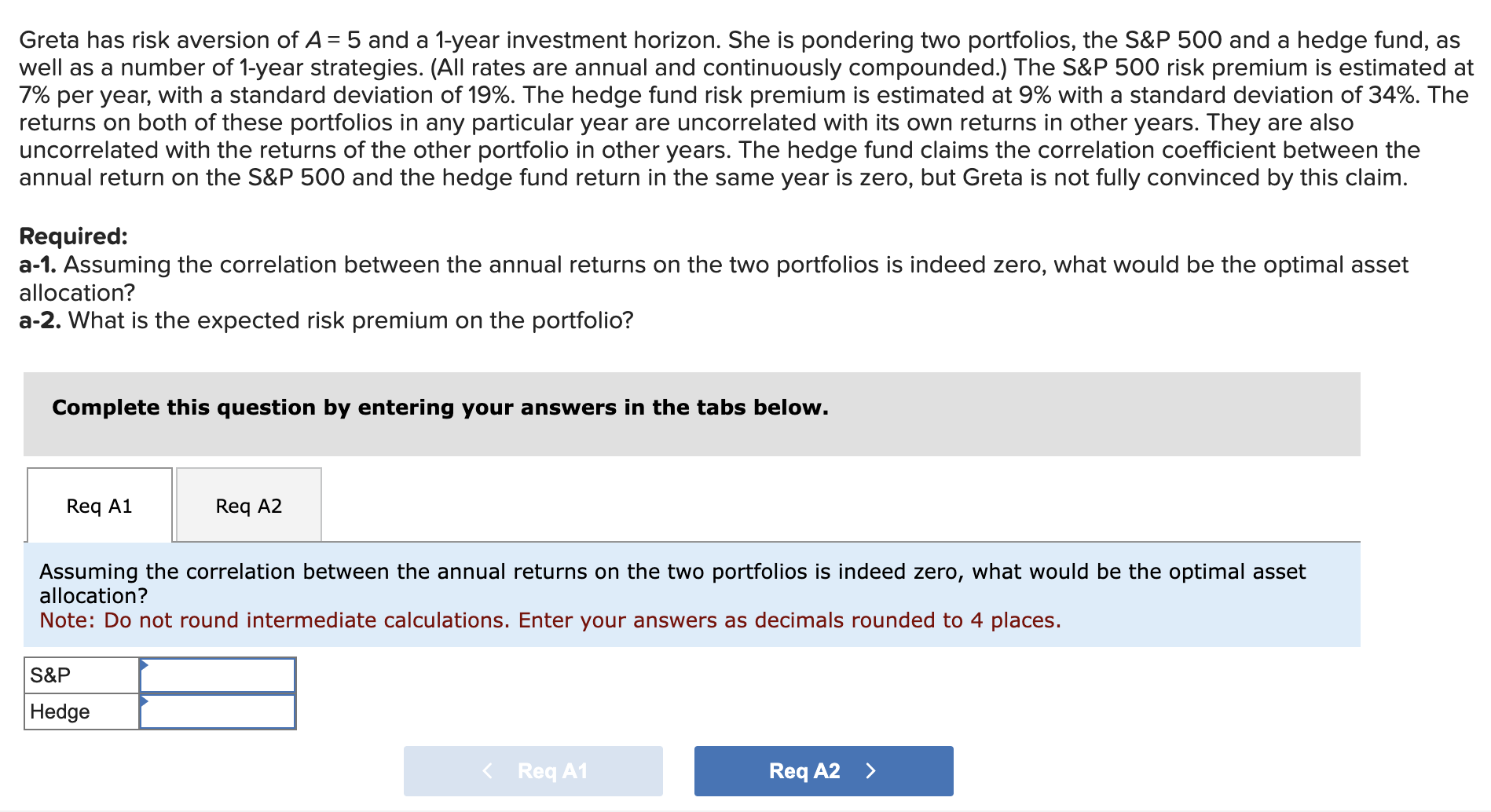

Understanding S&P 500 Volatility and its Impact on Investments

Historical Volatility Analysis

The S&P 500's historical performance reveals periods of significant volatility. Understanding these fluctuations is crucial for effective S&P 500 risk management.

- The Dot-com Bubble (2000-2002): The bursting of the tech bubble led to a significant decline in the S&P 500, wiping out billions in investor wealth. This highlighted the risks associated with over-investment in specific sectors.

- The 2008 Financial Crisis: The global financial crisis triggered a sharp downturn, demonstrating the interconnectedness of global markets and the impact of systemic risk on S&P 500 volatility.

- The COVID-19 Pandemic (2020): The pandemic caused unprecedented market uncertainty, leading to a rapid and substantial drop in the S&P 500 before a strong recovery. This underscored the unpredictable nature of market fluctuations and the need for robust S&P 500 risk management plans.

Analyzing historical S&P 500 performance helps identify patterns and potential triggers for future volatility. Studying past market downturns and their impact on investments is crucial for informed decision-making.

Identifying Key Risk Factors

Several factors contribute to S&P 500 risk and market uncertainty. Understanding these risks is essential for effective investment risk management.

- Inflation: High inflation erodes purchasing power and can negatively impact corporate profits, leading to lower stock prices.

- Interest Rate Hikes: Increased interest rates make borrowing more expensive for businesses, potentially slowing economic growth and impacting stock valuations.

- Geopolitical Instability: International conflicts and political uncertainty can significantly influence market sentiment and create market fluctuations.

- Sector-Specific Risks: Overexposure to a single sector (e.g., technology) can amplify losses if that sector experiences a downturn.

- Unexpected Economic Events: Unforeseen economic events, like recessions or pandemics, can trigger sharp market corrections.

Identifying these S&P 500 risk factors allows investors to proactively adjust their portfolios and implement appropriate risk mitigation techniques.

Diversification Strategies for S&P 500 Investments

Asset Allocation

Diversification is a cornerstone of S&P 500 risk management. Asset allocation strategies involve spreading investments across different asset classes to reduce overall portfolio risk.

- Stocks: Offer higher growth potential but also carry higher risk. Diversifying across different stock sectors mitigates sector-specific risks.

- Bonds: Provide stability and income, acting as a buffer against stock market volatility.

- Real Estate: Offers diversification benefits and potential for long-term growth.

- Alternative Investments: (e.g., commodities, private equity) can further enhance diversification and reduce dependence on traditional asset classes.

A well-diversified portfolio minimizes the impact of S&P 500 volatility on your overall investment performance. Portfolio diversification is a crucial component of effective S&P 500 diversification.

Sector Diversification

While diversification across asset classes is important, diversifying within the S&P 500 itself is equally crucial. Overexposure to a single sector can magnify losses during market downturns. Sector diversification involves spreading investments across different sectors (e.g., technology, healthcare, consumer staples) to reduce S&P 500 sector exposure.

- Risks of Sector Concentration: Investing heavily in a single sector can lead to significant losses if that sector underperforms.

- Strategies for Broader Diversification: Utilize index funds or ETFs that track the entire S&P 500 or broader market indices to achieve sector diversification and reduce overall sector risk.

Practical Risk Management Techniques for the S&P 500

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a risk mitigation strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the impact of market timing on your overall investment returns.

- Implementing DCA: Invest a set amount each month or quarter, regardless of the current market price.

- Advantages: Reduces the risk of investing a large sum at a market peak.

- Disadvantages: May not result in the highest possible returns if the market consistently rises.

S&P 500 DCA is a simple yet effective risk mitigation technique for long-term investors. This dollar-cost averaging strategy helps smooth out the volatility inherent in the stock market.

Stop-Loss Orders

Stop-loss orders are market orders that automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Setting Stop-Loss Orders: Determine a price point below your purchase price at which you're willing to sell.

- Drawbacks: May trigger a sale prematurely if there's a temporary market dip, potentially missing out on future gains.

- Effective Use: Best used in conjunction with other risk management tools as part of a comprehensive S&P 500 risk management strategy.

Hedging Strategies

Hedging involves using financial instruments (e.g., options, inverse ETFs) to offset potential losses in your S&P 500 investments. This is a more sophisticated approach requiring a deeper understanding of derivatives markets.

- Options: Can be used to protect against downside risk while maintaining the potential for upside gains.

- Inverse ETFs: Invest inversely to the S&P 500, providing a hedge against market declines.

Remember, hedging strategies carry their own risks and should be implemented carefully. Consult with a financial advisor before employing complex risk hedging strategies for S&P 500 hedging.

Conclusion

Effective S&P 500 risk management requires a multi-faceted approach. Understanding S&P 500 volatility, diversifying investments across asset classes and sectors, and implementing risk mitigation techniques like dollar-cost averaging and stop-loss orders are crucial. While hedging can offer additional protection, it’s vital to understand the associated complexities.

Take control of your S&P 500 investments with effective risk management strategies today! Learn more about proactive S&P 500 risk management and protect your portfolio. Consider consulting with a financial advisor to develop a personalized S&P 500 risk management plan tailored to your individual investment goals and risk tolerance.

Featured Posts

-

China Life Reports Higher Profits Amidst Strong Investment Returns

Apr 30, 2025

China Life Reports Higher Profits Amidst Strong Investment Returns

Apr 30, 2025 -

Communique De Presse Amf Valneva 24 Mars 2025 Points Importants Du Document Cp 2025 E1027271

Apr 30, 2025

Communique De Presse Amf Valneva 24 Mars 2025 Points Importants Du Document Cp 2025 E1027271

Apr 30, 2025 -

Valneva Analyse Du Document Amf Cp 2025 E1027271 24 Mars 2025

Apr 30, 2025

Valneva Analyse Du Document Amf Cp 2025 E1027271 24 Mars 2025

Apr 30, 2025 -

Queen Mary 2 Norovirus Outbreak Live Updates And Passenger Impact

Apr 30, 2025

Queen Mary 2 Norovirus Outbreak Live Updates And Passenger Impact

Apr 30, 2025 -

Months Long Toxic Chemical Exposure The Ohio Train Derailment Aftermath

Apr 30, 2025

Months Long Toxic Chemical Exposure The Ohio Train Derailment Aftermath

Apr 30, 2025

Latest Posts

-

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Lan Toa Yeu Thuong Cong Dong

Apr 30, 2025

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Lan Toa Yeu Thuong Cong Dong

Apr 30, 2025 -

Flaminia Dalla Quinta Alla Seconda Posizione Un Importante Rimonta

Apr 30, 2025

Flaminia Dalla Quinta Alla Seconda Posizione Un Importante Rimonta

Apr 30, 2025 -

Stuttgart Atff Gelecegin Yildizlarini Kesfediyoruz

Apr 30, 2025

Stuttgart Atff Gelecegin Yildizlarini Kesfediyoruz

Apr 30, 2025 -

Tien Linh Huyen Thoai San Co Tam Guong Sang Cua Tinh Than Thien Nguyen Binh Duong

Apr 30, 2025

Tien Linh Huyen Thoai San Co Tam Guong Sang Cua Tinh Than Thien Nguyen Binh Duong

Apr 30, 2025 -

La Flaminia Sale Al Secondo Posto Analisi Della Risalita

Apr 30, 2025

La Flaminia Sale Al Secondo Posto Analisi Della Risalita

Apr 30, 2025