S&P 500 Soars 3%+ On US-China Trade War Tariff Deal

Table of Contents

Details of the US-China Trade Deal and its Impact

The recently reached US-China trade agreement marks a significant step towards de-escalating the protracted trade war. While details remain complex, the "phase one" deal focuses primarily on tariff reductions and increased Chinese purchases of US goods. This trade agreement signifies a commitment to reducing existing tariffs on billions of dollars worth of goods. Specific tariffs removed or reduced include those on agricultural products, consumer goods, and some manufactured items. However, important points of contention remain, including concerns about intellectual property rights and technology transfer, hinting at the need for further negotiations in the future. Keywords: trade agreement, tariff reduction, phase one deal, trade negotiations, US-China trade relations.

- Specific examples of tariff reductions: Tariffs on soybeans were significantly lowered, benefiting American farmers. Import duties on certain electronics were also reduced, impacting consumer prices.

- Quantifiable data on the volume of trade affected: The deal is estimated to affect hundreds of billions of dollars in bilateral trade, potentially boosting global economic activity.

- Commitments regarding intellectual property rights and technology transfer: China has made commitments to strengthen intellectual property protection and refrain from forced technology transfer, although enforcement remains a key concern.

Market Reaction and Investor Sentiment

The immediate reaction to the news was overwhelmingly positive. The S&P 500 soared, along with other major indices like the Dow Jones Industrial Average and the Nasdaq Composite. This dramatic market surge reflects a palpable shift in investor sentiment, moving from widespread uncertainty to cautious optimism. The technology sector, particularly sensitive to trade tensions, saw significant gains. Similarly, the manufacturing sector, heavily impacted by tariffs, experienced a boost in investor confidence. Keywords: investor confidence, market volatility, stock prices, market capitalization, sector performance.

- Specific examples of stock price increases: Tech giants like Apple and Microsoft saw their stock prices rise substantially following the announcement.

- Data on trading volume increase: Trading volume spiked significantly on the day of the announcement, indicating heightened investor activity.

- Analysis of investor sentiment: Analyst reports and news articles reflected a general feeling of relief and optimism, although many cautioned against premature celebrations.

Long-Term Implications for the S&P 500 and the Global Economy

While the immediate impact is positive, the long-term implications of this US-China trade deal are complex and require careful consideration. The deal could potentially boost economic growth in both the US and China by reducing trade barriers and fostering greater economic certainty. This could also have positive ripple effects on global supply chains, making international trade more efficient. Keywords: economic growth, global trade, supply chain, economic outlook, long-term investment. However, risks remain. The success of the agreement hinges on effective implementation and continued cooperation between both nations.

- Predictions for future economic growth: Many economists predict modest improvements in global economic growth due to reduced trade uncertainty.

- Discussion of potential ripple effects on other economies: The deal could positively impact economies closely linked to US-China trade, while others might experience less direct benefit.

- Potential downsides or unforeseen consequences: The agreement's long-term effectiveness depends on China's adherence to its commitments, and unforeseen challenges might emerge.

Navigating the Future After the S&P 500's Surge

The US-China trade deal's impact on the S&P 500's performance is undeniable; the market responded with a significant surge reflecting a renewed sense of confidence. However, investors must remain vigilant and continue monitoring the evolving US-China trade relationship for potential shifts. The long-term trajectory of the S&P 500 and the global economy will depend on successful implementation of the agreement and ongoing progress in trade negotiations. Staying informed about S&P 500 movements and US-China trade developments is crucial for effective investment strategies. To deepen your understanding of trade agreements and market analysis, explore reputable financial news sources and economic research publications. Keywords: S&P 500 outlook, investment strategy, market trends, US-China relations, economic analysis.

Featured Posts

-

Nba Tankathon Miami Heat Fans New Off Season Obsession

May 13, 2025

Nba Tankathon Miami Heat Fans New Off Season Obsession

May 13, 2025 -

Islanders Claim Top Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025

Islanders Claim Top Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025 -

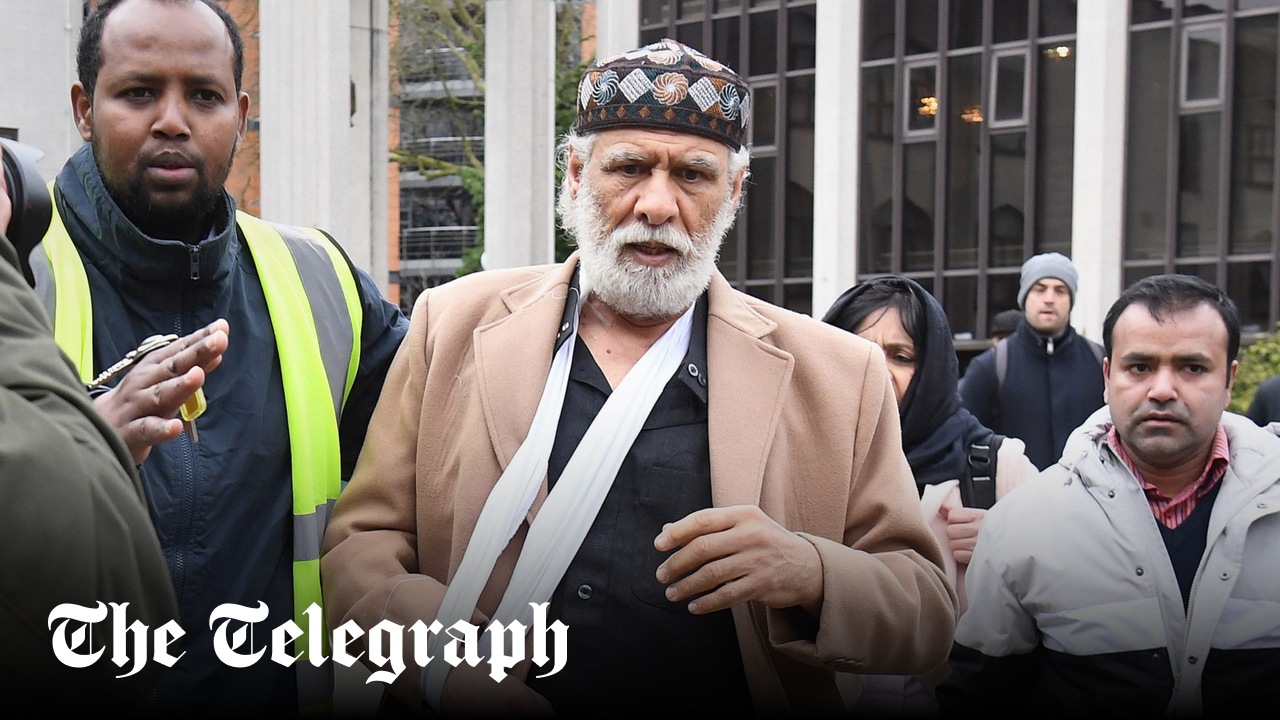

Muslim Mega City Mosque Responds To Police Investigation Criticism

May 13, 2025

Muslim Mega City Mosque Responds To Police Investigation Criticism

May 13, 2025 -

Salman Khan Box Office Performance 4 7 Budget Return

May 13, 2025

Salman Khan Box Office Performance 4 7 Budget Return

May 13, 2025 -

Manila Heatwave Schools Closed Bangkok Post Reports

May 13, 2025

Manila Heatwave Schools Closed Bangkok Post Reports

May 13, 2025