Sabadell's Approach To Unicaja Investors: A Deal In The Making?

Table of Contents

Analyzing Sabadell's Offer to Unicaja Shareholders

H3: The Proposed Terms and Conditions:

Sabadell's offer to Unicaja shareholders is central to the merger's success. The details of the offer, including the crucial exchange ratio, will directly impact shareholder decisions. Key elements include:

- Exchange Ratio: The proposed number of Sabadell shares offered for each Unicaja share is paramount. A favorable ratio is crucial for attracting Unicaja shareholders. A higher ratio generally indicates greater value for Unicaja shareholders.

- Financial Incentives: Sabadell may offer additional financial incentives beyond the exchange ratio, such as cash payments or warrants, to sweeten the deal and enhance shareholder value.

- Premium Offered: A significant aspect of the offer is the premium offered to Unicaja shareholders compared to the prevailing market price of their shares. This premium incentivizes acceptance.

Understanding these financial aspects is key to evaluating the overall attractiveness of the deal for Unicaja investors. Successful negotiation hinges on maximizing shareholder value and presenting a compelling financial case.

H3: Communication Strategy and Investor Relations:

Effective communication is crucial for Sabadell to gain the trust and support of Unicaja investors. Their investor relations strategy will play a pivotal role in the merger's success. Key aspects of their communication include:

- Investor Presentations: Sabadell likely held or will hold dedicated investor presentations detailing the merger rationale, financial projections, and the benefits for Unicaja shareholders.

- Conferences and Webinars: These events provide platforms to directly address investor concerns, answer questions, and build confidence.

- Transparency and Due Diligence: Providing clear, concise, and readily accessible information is crucial for building trust and encouraging due diligence. Openness and transparency are essential for fostering positive investor sentiment.

Regulatory Hurdles and Antitrust Concerns

H3: Navigating Regulatory Approvals:

Securing regulatory approvals is a significant hurdle in any merger, especially one of this scale within the Spanish banking sector. Key regulatory bodies involved include:

- European Commission: The European Commission will scrutinize the merger to assess its impact on competition within the EU banking market.

- Bank of Spain (Banco de España): The Bank of Spain will evaluate the merger's financial stability implications for the Spanish banking system.

- Timeline for Approvals: The regulatory approval process can be lengthy and complex, potentially impacting the merger's overall timeline.

Successfully navigating these regulatory hurdles requires meticulous preparation, addressing potential concerns proactively, and demonstrating compliance with all applicable regulations.

H3: Addressing Antitrust Concerns:

Antitrust concerns arise when a merger creates a dominant player with excessive market share, potentially stifling competition. Sabadell must address these issues effectively:

- Market Share Overlaps: A detailed analysis of market share overlaps between Sabadell and Unicaja is critical, identifying potential areas of concern.

- Remedies: Sabadell may need to propose remedies, such as divesting certain assets or business lines, to address antitrust concerns and gain regulatory approval. These remedies aim to maintain competition within specific market segments.

- Competition Policy: A thorough understanding of competition policy and its implications for the merger is essential for a successful outcome.

Market Reaction and Investor Sentiment

H3: Stock Market Performance:

The stock market's reaction to the proposed merger offers insights into investor sentiment. Key aspects to observe include:

- Share Price Fluctuations: Monitoring the stock prices of both Sabadell and Unicaja following the announcement provides a real-time indicator of investor confidence.

- Market Volatility: Significant fluctuations could signal uncertainty or concerns about the merger's success.

- Investor Confidence: Positive market reactions generally suggest increasing investor confidence in the merger's prospects.

H3: Analyst Opinions and Predictions:

Financial analysts play a crucial role in shaping market perception. Their opinions and predictions hold significant weight:

- Analyst Ratings: Following analyst ratings and recommendations for both banks can reveal the broader market outlook.

- Financial Forecasts: Analysts' financial forecasts for the merged entity offer insights into potential future performance.

- Merger Success Predictions: Analysts' assessment of the likelihood of a successful merger guides investor decisions.

Conclusion: The Future of Sabadell and Unicaja – A Successful Merger?

Sabadell's approach to Unicaja investors involves a multifaceted strategy encompassing a competitive financial offer, a transparent communication plan, navigating regulatory and antitrust hurdles, and successfully managing market perception. The likelihood of a successful merger hinges on the effective execution of each of these elements. While challenges remain, a positive market reaction and supportive analyst opinions suggest a favorable outcome. However, continued monitoring of regulatory developments and investor sentiment remains crucial. To stay updated on developments concerning Sabadell's approach to Unicaja investors and the ongoing Sabadell-Unicaja merger, subscribe to our newsletter or follow reputable financial news sources. Keeping abreast of these developments is vital for understanding the evolving landscape of the Spanish banking sector and the implications of this significant merger.

Featured Posts

-

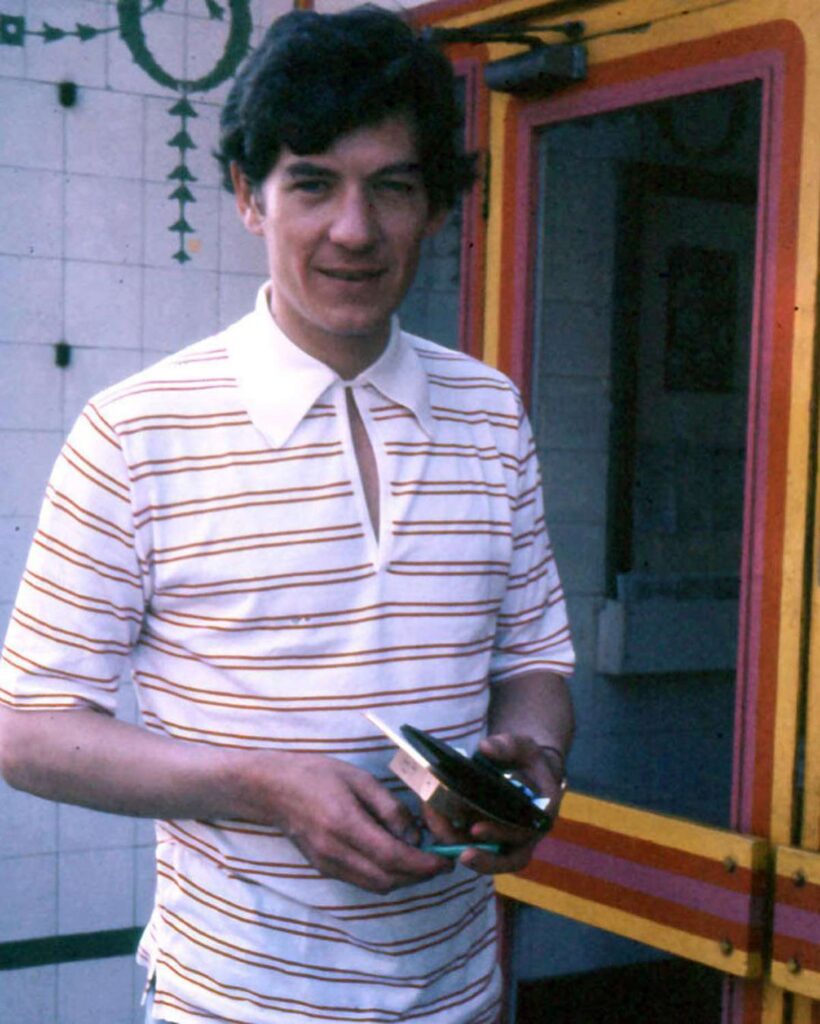

Ian Mc Kellen Young Actors Shouldnt Stay In The Closet

May 13, 2025

Ian Mc Kellen Young Actors Shouldnt Stay In The Closet

May 13, 2025 -

Big Issues Childrens Competition The Winner Is

May 13, 2025

Big Issues Childrens Competition The Winner Is

May 13, 2025 -

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025 -

Celebrating Eva Longorias 50th A Collection Of Her Best Photos

May 13, 2025

Celebrating Eva Longorias 50th A Collection Of Her Best Photos

May 13, 2025 -

Japans Cherry Blossoms A Springwatch Perspective

May 13, 2025

Japans Cherry Blossoms A Springwatch Perspective

May 13, 2025