Saudi PIF Imposes One-Year Ban On PwC Advisory Services

Table of Contents

The Details of the PIF's Ban on PwC Advisory Services

The PIF's ban represents a complete suspension of all advisory services provided by PwC within Saudi Arabia. While the exact scope of services affected remains partially undisclosed, it’s understood to encompass a wide range of advisory functions, potentially impacting projects related to the Kingdom's Vision 2030 initiatives. The geographical scope is currently limited to Saudi Arabia, though the repercussions could have international implications for PwC's operations.

- Specific reasons cited by the PIF for the ban: While the PIF hasn't publicly detailed the specific reasons for the ban, speculation points towards potential breaches of contract, regulatory violations, or conflicts of interest within their past engagements. Further clarity is expected in upcoming official statements.

- Timeline of events leading up to the ban: Information regarding the precise timeline leading to this decision is limited. It is likely that a thorough internal investigation preceded the ban, following suspected irregularities in one or more advisory projects undertaken by PwC for the PIF.

- The duration of the ban and potential for extension or early termination: The ban is currently set for one year. However, the possibility of an extension or early termination depends on PwC’s response, any subsequent investigations, and the overall satisfaction of the PIF with the remedial actions taken.

Financial Implications and Penalties

The financial implications for PwC are substantial. The loss of revenue from PIF contracts, a significant client, will undoubtedly impact their bottom line. Beyond direct financial losses, the reputational damage caused by this ban could negatively affect future business opportunities, not just within Saudi Arabia but also globally.

- Estimated financial losses for PwC: Precise figures are unavailable at this time, but the loss of revenue is expected to be significant, potentially running into millions, if not billions, of dollars depending on the number and size of affected projects.

- Any fines or other financial penalties levied: While specific financial penalties haven't been publicly disclosed, the PIF's actions suggest the possibility of additional sanctions beyond the one-year ban, perhaps involving financial penalties or restrictions on future bids.

- Potential impact on PwC’s future bids for PIF contracts: Given the severity of the ban, PwC's ability to secure future contracts with the PIF will likely be significantly hampered, at least in the short to medium term. Regaining the PIF's trust will require substantial effort and demonstrable improvements in their compliance and risk management systems.

Wider Implications for the Saudi Arabian Financial Sector

The PIF's decision carries substantial implications for the broader Saudi Arabian financial landscape. It signals a tightening of regulatory oversight within the Kingdom and increased scrutiny of accounting and advisory firms.

- Impact on investor confidence in Saudi Arabia: While the Saudi Arabian economy is robust, the ban could create some uncertainty among international investors, prompting a reassessment of the regulatory environment.

- Increased regulatory scrutiny of other accounting and advisory firms operating in the Kingdom: Other firms operating in Saudi Arabia are likely to face increased scrutiny from regulatory bodies in the wake of this decision. This might lead to enhanced compliance measures and improved risk management practices across the sector.

- Potential changes to the regulatory framework for auditing and advisory services in Saudi Arabia: The ban may spur reviews and potential reforms of the regulatory framework for auditing and advisory services to strengthen oversight and minimize the risk of future occurrences.

- Implications for foreign investment in Saudi Arabia: While the long-term impact on foreign investment remains to be seen, the situation highlights the importance of strong regulatory compliance for businesses seeking to operate in Saudi Arabia.

PwC's Response and Future Actions

PwC has issued a statement acknowledging the ban and expressing their commitment to cooperating fully with the PIF. Specific details about their plans for moving forward remain limited.

- PwC’s official statement regarding the ban: PwC’s official statement emphasizes their commitment to upholding the highest ethical standards and regulatory compliance, expressing regret over the situation and outlining their intent to work constructively with the PIF to address concerns.

- Any planned appeals or legal actions: While there have been no public announcements of legal action, PwC may explore all available avenues to resolve the situation and potentially mitigate the impact of the ban.

- Steps PwC might take to regain PIF's trust: PwC will need to demonstrate a significant commitment to improving internal compliance and risk management processes, potentially including independent reviews and enhanced training programs.

- Potential restructuring or changes in the firm's approach to compliance and risk management: The ban is likely to prompt significant internal changes within PwC, including enhanced training, stricter internal controls, and potentially a restructuring of their compliance and risk management departments.

Conclusion

The Saudi Public Investment Fund's unprecedented one-year ban on PwC advisory services represents a significant development in the Saudi Arabian financial landscape. The reasons behind the ban, while not fully disclosed, point to potential breaches of contract or regulatory violations, highlighting the growing importance of stringent compliance and robust risk management practices. The financial implications for PwC are substantial, encompassing not only direct revenue loss but also reputational damage. The broader consequences for the Saudi Arabian financial sector include increased regulatory scrutiny, potential changes in the regulatory framework, and a possible impact on investor confidence. This situation underscores the need for continuous vigilance and adaptation within the rapidly evolving regulatory environment of Saudi Arabia. To stay informed on further developments concerning the Saudi PIF and its impact on the global financial landscape, keep checking back for updates on this evolving situation and the ongoing ramifications of the Saudi PIF and PwC ban.

Featured Posts

-

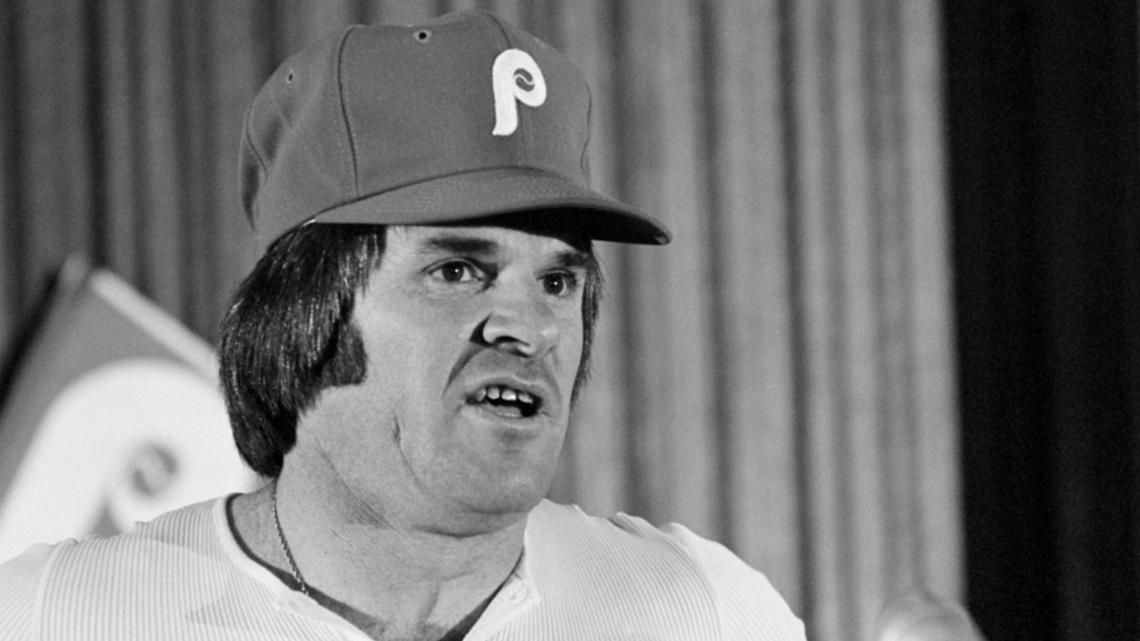

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025 -

Pw Cs Retreat From Sub Saharan Africa Reasons And Consequences

Apr 29, 2025

Pw Cs Retreat From Sub Saharan Africa Reasons And Consequences

Apr 29, 2025 -

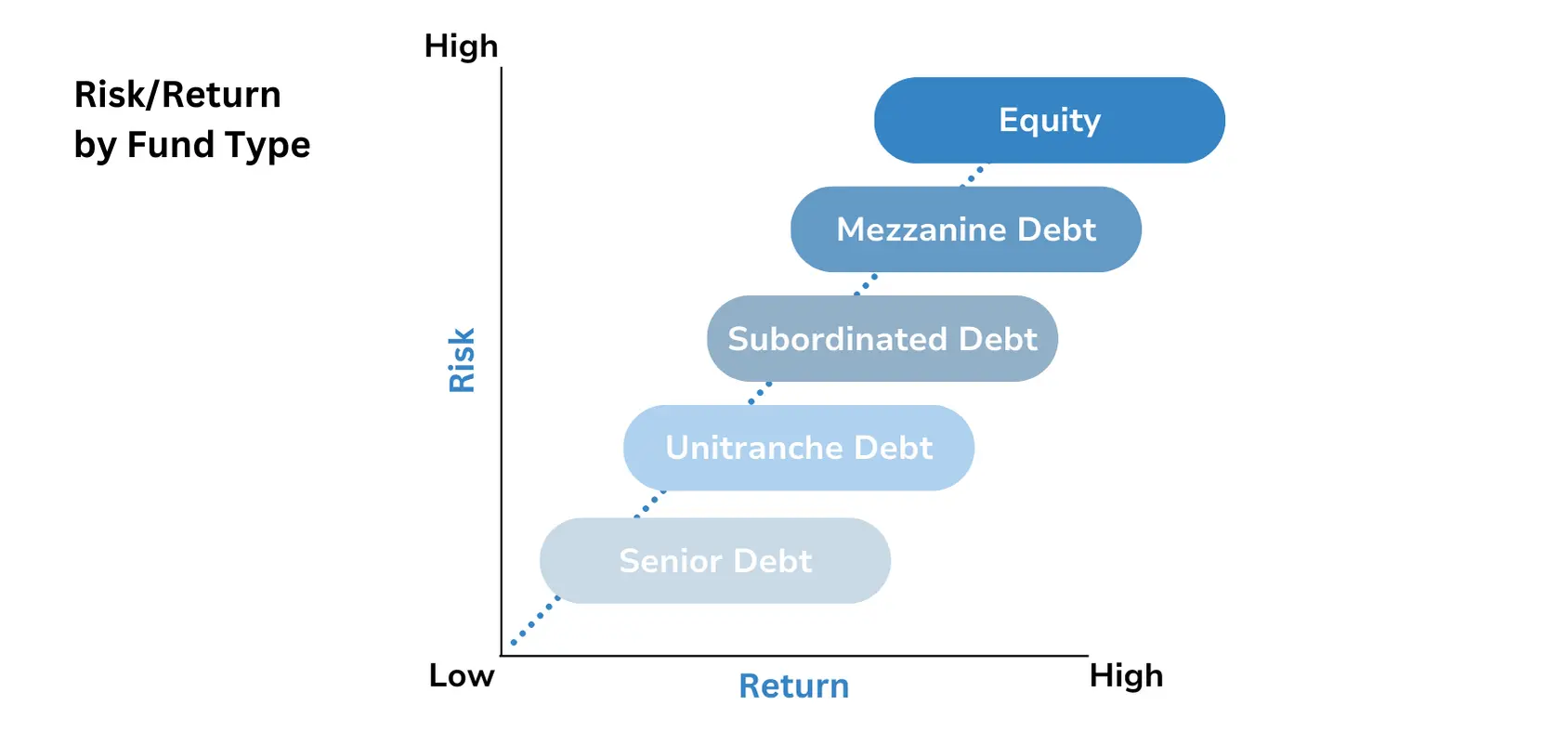

5 Key Actions To Secure A Role In The Private Credit Boom

Apr 29, 2025

5 Key Actions To Secure A Role In The Private Credit Boom

Apr 29, 2025 -

Relocating To Spain Different Paths For Two Americans

Apr 29, 2025

Relocating To Spain Different Paths For Two Americans

Apr 29, 2025

Latest Posts

-

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025 -

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025 -

Where To Watch Ru Pauls Drag Race Season 17 Episode 6 For Free Without Cable

Apr 30, 2025

Where To Watch Ru Pauls Drag Race Season 17 Episode 6 For Free Without Cable

Apr 30, 2025 -

How To Stream Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025

How To Stream Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025 -

A Day In The Life Amanda Owens 9 Children And Their Rural Family Life

Apr 30, 2025

A Day In The Life Amanda Owens 9 Children And Their Rural Family Life

Apr 30, 2025