SEC Acknowledges Grayscale XRP ETF Filing: Impact On XRP And Bitcoin Prices

Table of Contents

Understanding the Grayscale XRP ETF Filing and its Implications

Grayscale Investments, a prominent digital currency asset manager, filed an application with the SEC for an XRP ETF. This isn't just another filing; it represents a significant move towards legitimizing XRP and potentially opening the floodgates for institutional participation in the XRP market. The SEC's acknowledgment, while not an approval, is a positive sign, indicating that the application is under active review and hasn't been summarily rejected. This signals a degree of receptiveness from the regulatory body towards XRP, a stark contrast to previous responses concerning certain cryptocurrencies.

The potential benefits of an approved XRP ETF are substantial:

- Increased liquidity: An ETF would drastically increase the ease with which investors can buy and sell XRP, reducing volatility and attracting larger capital inflows.

- Enhanced accessibility: Investing in XRP would become simpler and more accessible to a wider range of investors, including those who may be unfamiliar with cryptocurrency exchanges.

- Institutional investment: The availability of an XRP ETF would attract substantial investment from institutional investors, like hedge funds and pension funds, who often prefer regulated investment vehicles.

Key Potential Benefits of an XRP ETF:

- Increased trading volume for XRP, driving price discovery.

- A potential price surge due to higher demand and increased investor confidence.

- Increased legitimacy and mainstream adoption of XRP, bolstering its position in the market.

- Enhanced price discovery mechanism, leading to a more efficient and transparent market.

Potential Impact on XRP Price

The SEC's acknowledgment could significantly influence XRP's price. While predicting the market is notoriously difficult, several scenarios are possible:

- Positive Price Movements: Approval of the ETF would likely lead to a substantial increase in XRP's price, driven by increased demand and institutional investment.

- Negative Price Movements: A rejection of the application could lead to a temporary price drop, although the market may already have partially priced in this risk.

- Price Stagnation: If the SEC remains indecisive for an extended period, the price might experience relative stagnation, awaiting further clarity.

However, factors beyond the ETF filing will also play a role, including:

- Market sentiment: Overall investor confidence in the cryptocurrency market will influence XRP's price.

- Overall crypto market trends: The performance of Bitcoin and other major cryptocurrencies will impact XRP's price.

- Ripple's ongoing legal battle: The outcome of Ripple's legal battle with the SEC will significantly affect XRP's price and overall perception.

Potential XRP Price Scenarios:

- Short-term price volatility is highly likely in response to news and updates regarding the ETF application.

- Long-term price appreciation is possible if the ETF is approved and successfully launched.

- Correlation with Bitcoin price is expected, meaning movements in Bitcoin's price could influence XRP.

- Market speculation will play a significant role in price fluctuations, driven by news and investor sentiment.

Ripple Effects on Bitcoin and the Broader Crypto Market

The XRP ETF filing's impact extends beyond XRP itself. The interconnectedness of the cryptocurrency market means that positive sentiment towards XRP could spill over into other assets, including Bitcoin.

- Positive correlation between XRP and Bitcoin price: A rise in XRP's price might boost confidence in the broader cryptocurrency market, positively impacting Bitcoin's price.

- Increased investor interest in the crypto market: The successful launch of an XRP ETF could attract new investors to the cryptocurrency space.

- Potential for altcoin season: The increased interest could trigger an "altcoin season," where altcoins (cryptocurrencies other than Bitcoin) experience significant price gains.

- Impact on overall market capitalization: A successful XRP ETF could increase the overall market capitalization of the cryptocurrency market.

Regulatory Landscape and Future Outlook for XRP ETFs

The regulatory landscape for cryptocurrencies is constantly evolving. The SEC's history with crypto ETF applications has been mixed, with approvals being few and far between. The likelihood of approval and the timeline remain uncertain, dependent on various factors including the SEC’s ongoing evaluation and potential legal challenges. Different regulatory outcomes would have significantly different impacts on investor confidence and future ETF launches.

Key Considerations:

- SEC's ongoing scrutiny of crypto assets and their regulatory frameworks is a key factor.

- Potential legal challenges could arise, delaying or preventing approval.

- Impact of regulatory clarity on investor confidence is crucial for market stability.

- Future prospects for other crypto ETFs will be significantly influenced by the outcome of Grayscale’s XRP ETF application.

Conclusion: The SEC Acknowledgment and the Future of XRP and Bitcoin

The SEC's acknowledgment of Grayscale's XRP ETF filing is a significant development, with the potential to significantly impact XRP and Bitcoin prices. While uncertainty remains, the possibility of increased liquidity, accessibility, and institutional investment highlights the transformative potential of this event for the cryptocurrency market. The interconnected nature of cryptocurrencies suggests positive ripple effects across the board, impacting investor confidence and overall market sentiment. The outcome will significantly shape the regulatory landscape and future prospects for XRP ETFs and cryptocurrency investments as a whole. Stay tuned for updates on the Grayscale XRP ETF and its potential impact on the future of XRP and Bitcoin. Continue to monitor news and developments regarding SEC actions on cryptocurrencies and the potential for future XRP ETF approvals. Keep informed about the evolving regulatory landscape for informed cryptocurrency investment decisions.

Featured Posts

-

7 Surprisingly Great Movies On Paramount

May 08, 2025

7 Surprisingly Great Movies On Paramount

May 08, 2025 -

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025 -

The Future Of Xrp Etf Potential Sec Decisions And Market Predictions

May 08, 2025

The Future Of Xrp Etf Potential Sec Decisions And Market Predictions

May 08, 2025 -

Is Stephen Kings The Long Walk Adaptation Actually Happening A Trailer Review

May 08, 2025

Is Stephen Kings The Long Walk Adaptation Actually Happening A Trailer Review

May 08, 2025 -

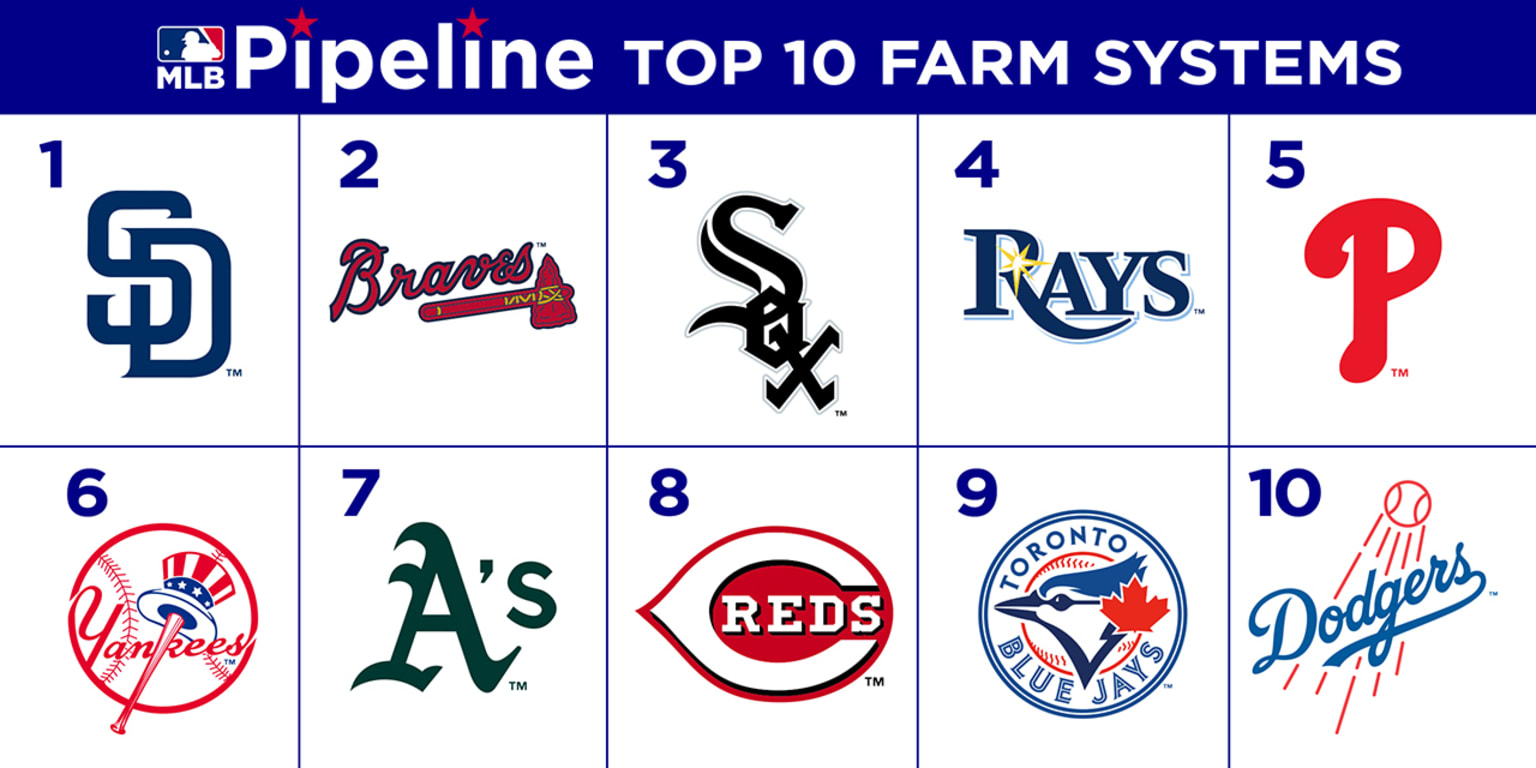

Angels Farm System A Brutal Mlb Insider Ranking

May 08, 2025

Angels Farm System A Brutal Mlb Insider Ranking

May 08, 2025