SEC's Potential Commodity Classification Of XRP: Ripple Settlement Fallout

Table of Contents

The Ripple-SEC Settlement: A Summary

The protracted legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) concluded with a settlement in 2023. The SEC alleged that Ripple had sold XRP as an unregistered security, violating federal securities laws. This lawsuit created significant uncertainty for XRP investors and the broader cryptocurrency market.

-

Summary of the SEC's allegations against Ripple: The SEC argued that Ripple's distribution and sale of XRP constituted an unregistered securities offering, due to the expectation of profit based on Ripple's efforts. They focused on programmatic sales and sales to institutional investors.

-

Key points of the settlement agreement: The settlement did not involve an admission of guilt by Ripple. The terms included a significant financial penalty for Ripple, but it allowed Ripple to continue its operations. Importantly, the settlement lacked a clear definition of XRP’s legal status.

-

The lack of explicit admission of guilt by Ripple: This aspect of the settlement is crucial. While Ripple paid a substantial fine, it avoided a formal admission that XRP is a security, leaving the door open for future legal interpretations.

-

Immediate market reactions to the settlement news: The market reacted with a mix of relief and uncertainty. XRP's price initially surged following the settlement announcement but its future remains subject to ongoing legal and regulatory developments.

XRP as a Commodity: Implications for Trading and Investment

The distinction between securities and commodities is critical. Securities are subject to stringent regulations designed to protect investors, while commodities are generally subject to less stringent rules. If XRP is classified as a commodity, the regulatory landscape surrounding it will change significantly.

-

How commodity classification affects XRP trading regulations: Commodity classification could potentially simplify XRP trading regulations, making it easier for exchanges to list and trade XRP.

-

Potential impact on investor protections: Investor protections might be less robust under a commodity classification compared to a securities classification.

-

Changes to tax implications for XRP holders: The tax implications for XRP holders could shift depending on its classification as a commodity versus a security. This could affect capital gains taxes and reporting requirements.

-

The effect on exchange listings and trading volumes: A commodity classification might lead to increased exchange listings and potentially higher trading volumes for XRP.

-

Increased clarity vs. continued uncertainty for investors: While a commodity classification provides some clarity, the lack of explicit definition in the Ripple settlement leaves lingering uncertainty for investors.

The Broader Impact on the Cryptocurrency Market

The Ripple-SEC settlement has far-reaching consequences beyond XRP itself. Its impact resonates throughout the cryptocurrency ecosystem.

-

Potential for other crypto projects facing similar legal challenges: The settlement sets a precedent that could influence legal challenges faced by other cryptocurrency projects.

-

The influence on future SEC enforcement actions: The SEC's approach in this case could shape its future enforcement actions against other cryptocurrencies.

-

The effect on investor confidence in the crypto market: The uncertainty surrounding XRP's legal status and the overall regulatory landscape has impacted investor confidence in the broader cryptocurrency market.

-

The impact on the development and innovation within the crypto space: Regulatory uncertainty can hinder innovation and development in the cryptocurrency industry.

-

The role of legal precedent in shaping future cryptocurrency regulation: The Ripple case sets a significant legal precedent, influencing the regulatory landscape and shaping future legal battles in the crypto space.

Regulatory Clarity and the Path Forward

The ongoing need for clear regulatory frameworks for cryptocurrencies cannot be overstated. The Ripple-SEC case highlights the urgent need for greater regulatory certainty.

-

The importance of regulatory certainty for market stability: Clear and consistent regulations are essential for fostering market stability and investor confidence.

-

The role of international cooperation in regulating crypto assets: Given the global nature of cryptocurrencies, international cooperation is crucial for effective regulation.

-

Potential future legal challenges and their impact: The crypto space is constantly evolving, and further legal challenges are expected to emerge.

-

The ongoing debate surrounding the Howey Test and its applicability to cryptocurrencies: The Howey Test, a key legal standard for determining whether an investment is a security, remains a subject of debate in the context of cryptocurrencies.

Conclusion

The Ripple-SEC settlement and the potential commodity classification of XRP mark a significant turning point in the cryptocurrency regulatory landscape. While the settlement brings a degree of clarity, uncertainty still remains regarding the long-term implications for XRP and the broader crypto market. The future of crypto regulation hinges on the ability of lawmakers and regulators to develop clear, consistent, and effective frameworks.

Call to Action: Stay informed about the ongoing developments surrounding XRP and the evolving regulatory environment for cryptocurrencies. Understanding the potential implications of XRP's commodity classification is crucial for making informed decisions regarding your investments in the digital asset space. Further research into the SEC's position on XRP and similar cryptocurrencies is highly recommended.

Featured Posts

-

Malek F Aangehouden Na Neersteekpartij In Van Mesdagkliniek Groningen

May 01, 2025

Malek F Aangehouden Na Neersteekpartij In Van Mesdagkliniek Groningen

May 01, 2025 -

W

May 01, 2025

W

May 01, 2025 -

Love Lifts Arizona Over Texas Tech In Big 12 Semifinals

May 01, 2025

Love Lifts Arizona Over Texas Tech In Big 12 Semifinals

May 01, 2025 -

April 4th Pasifika Sipoti Overview

May 01, 2025

April 4th Pasifika Sipoti Overview

May 01, 2025 -

Kashmir Rail Link Pm Modi To Inaugurate First Train

May 01, 2025

Kashmir Rail Link Pm Modi To Inaugurate First Train

May 01, 2025

Latest Posts

-

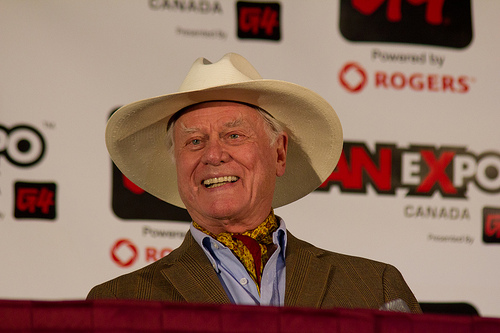

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025 -

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025 -

Remembering A Dallas Legend Passing At 100

May 01, 2025

Remembering A Dallas Legend Passing At 100

May 01, 2025 -

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025 -

Longtime Dallas Star Dies At 100

May 01, 2025

Longtime Dallas Star Dies At 100

May 01, 2025