SEC's XRP ETF Nod: Impact On Bitcoin And The Crypto Market

Table of Contents

Potential Market Impacts of an XRP ETF

An XRP ETF approval would undeniably trigger significant changes within the cryptocurrency market. The consequences extend far beyond XRP's own price trajectory, potentially reshaping the entire landscape.

Increased Institutional Investment

The accessibility provided by an ETF is a major draw for institutional investors who are often hesitant to navigate the complexities of direct cryptocurrency trading. An XRP ETF could act as a gateway, bringing significant capital inflows into the XRP market. This influx of institutional money could substantially drive up XRP's price. This surge, however, could also impact Bitcoin's dominance, potentially challenging its position as the leading cryptocurrency. Increased liquidity would also be a key outcome, making XRP trading smoother and more efficient.

- Increased trading volume: Expect a significant surge in XRP trading activity on exchanges.

- Price volatility: While potentially positive for long-term growth, short-term price fluctuations are likely.

- New exchange listings: More exchanges would likely list XRP, further enhancing its accessibility.

Price Volatility and Market Sentiment

The news of an XRP ETF approval would undoubtedly trigger significant short-term price volatility for both XRP and Bitcoin. The magnitude and direction of these fluctuations will depend on several factors, including the overall market sentiment at the time of the announcement. A positive announcement is highly likely to boost investor confidence, potentially triggering a broader market rally. Conversely, a negative reaction could lead to a market correction.

- Short-term price fluctuations: Expect dramatic price swings immediately following the SEC’s decision.

- Long-term price trends: The long-term impact will depend on factors like adoption rates and market stability.

- Investor confidence: A positive decision will likely boost confidence in the crypto market as a whole.

Regulatory Precedent and Implications for Bitcoin ETFs

Perhaps the most significant long-term impact of an SEC's XRP ETF nod lies in its potential to influence the regulatory landscape surrounding Bitcoin ETFs. A positive decision on XRP could set a crucial precedent, paving the way for a smoother approval process for Bitcoin ETFs. This would significantly reduce regulatory uncertainty and increase market stability. Conversely, a negative decision could create further delays and uncertainty for other cryptocurrencies seeking ETF approval.

- Potential approval timeline for Bitcoin ETFs: A positive XRP ETF decision could expedite Bitcoin ETF approvals.

- Impact on regulatory uncertainty: Clarity from the SEC could reduce uncertainty and encourage further institutional investment.

- Overall market stability: A clear regulatory framework could lead to greater market stability and maturity.

Bitcoin's Position Amidst the XRP ETF Buzz

Bitcoin's dominance in the cryptocurrency market is undeniable. However, the potential approval of an XRP ETF introduces a new variable into the equation.

Bitcoin's Market Dominance

The arrival of an XRP ETF might challenge Bitcoin's long-held market dominance. While it's unlikely to completely displace Bitcoin, increased XRP adoption could potentially cannibalize some of Bitcoin's market share, especially among institutional investors seeking diversified portfolios. Conversely, a synergistic effect is also possible, with the increased overall market capitalization lifting all boats.

- Market capitalization comparisons: Direct comparisons of market caps will be key to understanding the shift in dominance.

- Trading volume comparisons: Trading volume will indicate the relative popularity and adoption of each asset.

- Investor preference shifts: Analyzing investor behavior post-ETF approval will be crucial.

Bitcoin's Price Correlation with XRP

Historically, Bitcoin and XRP have shown some degree of price correlation. However, the launch of an XRP ETF could significantly alter this relationship. While some correlation might persist, the increased institutional investment and independent market dynamics surrounding XRP could lead to a decoupling of prices.

- Correlation coefficient analysis: Statistical analysis can measure the extent of price correlation before and after the ETF launch.

- Price movements after the announcement: Tracking immediate price changes will show the impact of the news.

- Potential decoupling: The ETF's impact could potentially lead to independent price movements for both assets.

Wider Crypto Market Effects of the XRP ETF Decision

The SEC's decision will not be confined to just XRP and Bitcoin; its repercussions will resonate throughout the entire crypto market.

Altcoin Market Dynamics

The impact on other altcoins is a crucial area of consideration. A successful XRP ETF could trigger a wave of increased interest in altcoins, potentially boosting their prices. Alternatively, the focus might shift entirely towards XRP, potentially leaving other altcoins lagging behind. Increased competition and the potential for price increases in related altcoins are both significant possibilities.

- Increased competition: Other altcoins will need to compete for investor attention and capital.

- Potential for price increases in related altcoins: Positive sentiment could boost the entire altcoin market.

- Overall market diversification: The effect on market diversification will depend on investor behavior.

Impact on Decentralized Finance (DeFi)

The implications for Decentralized Finance (DeFi) are also worth noting. Increased adoption and liquidity of XRP could significantly impact DeFi protocols and applications using XRP. This could lead to increased transaction volumes on XRP-based DeFi platforms and potentially stimulate the development of new DeFi products tailored to XRP's expanding ecosystem.

- Increased transaction volume on XRP-based DeFi platforms: Higher liquidity will facilitate greater transaction activity.

- Potential for new DeFi products: Developers might create new DeFi products leveraging XRP's enhanced liquidity.

- Enhanced liquidity for DeFi users: More efficient and cost-effective transactions within the DeFi space.

Conclusion: Navigating the SEC's XRP ETF Nod and its Impact

The potential approval of an XRP ETF represents a pivotal moment for the cryptocurrency market. Its ripple effects will undoubtedly impact Bitcoin's dominance, reshape the altcoin landscape, and influence the trajectory of DeFi. Understanding these potential impacts is crucial for informed decision-making. The SEC's XRP ETF nod is more than just an approval; it's a catalyst for change, potentially ushering in a new era of regulatory clarity and institutional adoption within the cryptocurrency space. Stay updated on the evolving landscape of SEC regulations and the impact on your XRP and Bitcoin investments. Continue to monitor news and analysis concerning the SEC's XRP ETF nod for informed decision-making.

Featured Posts

-

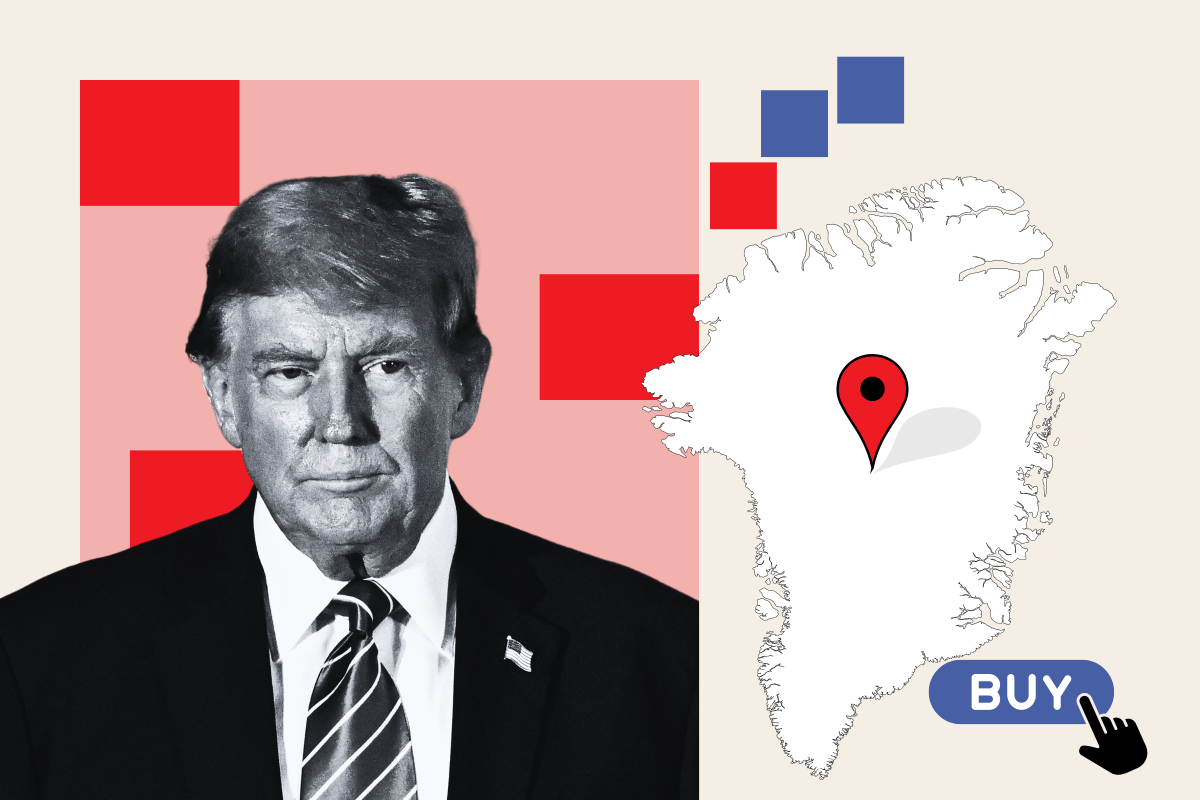

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025

Trumps Greenland Concerns Is China A Real Threat

May 08, 2025 -

Jayson Tatum Bone Bruise Will He Play Game 2

May 08, 2025

Jayson Tatum Bone Bruise Will He Play Game 2

May 08, 2025 -

La Gesta Historica Del Real Betis Balompie

May 08, 2025

La Gesta Historica Del Real Betis Balompie

May 08, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television

May 08, 2025

Hollywood Shutdown Double Strike Cripples Film And Television

May 08, 2025 -

Analyzing Sonys Ps 5 Pro Announcement Features And Implications

May 08, 2025

Analyzing Sonys Ps 5 Pro Announcement Features And Implications

May 08, 2025