Secure No Credit Check Loans With Guaranteed Approval From Direct Lenders

Table of Contents

Understanding No Credit Check Loans and Their Implications

"No credit check loans" are short-term loans that don't require a traditional credit check. Unlike traditional loans from banks or credit unions that heavily weigh your credit score, these loans focus on other factors like your income and employment history. This makes them accessible to individuals with bad credit or no credit history. However, this accessibility comes with a price.

-

Higher Interest Rates: Because the lender assumes a higher risk, no credit check loans typically come with significantly higher interest rates than traditional loans. This means you'll pay more in interest over the life of the loan.

-

Shorter Repayment Terms: These loans often have shorter repayment periods, meaning you'll need to make larger monthly payments. Failing to meet these payments can lead to serious financial consequences.

-

Potential for Debt Traps: If not managed carefully, these loans can easily become debt traps. The high interest rates and short repayment terms can make it difficult to repay the loan on time, leading to a cycle of borrowing and repaying, accumulating more debt.

-

Importance of Comparing Offers: It’s crucial to compare offers from multiple lenders to find the best terms and interest rates before committing to a loan.

-

Bullet Points:

- Higher interest rates compared to traditional loans.

- Shorter repayment terms (often a few weeks or months).

- Potential for debt traps if not managed carefully.

- Importance of comparing offers from multiple lenders to secure the best deal.

Finding Reputable Direct Lenders for Guaranteed Approval Loans

Choosing the right lender is crucial when seeking no credit check loans. Beware of scams; many predatory lenders target those with bad credit. To avoid falling victim to fraudulent schemes, follow these guidelines:

-

Verify Lender's Licensing and Registration: Check if the lender is licensed and registered in your state or country. This helps ensure they operate legally and adhere to regulations.

-

Read Online Reviews and Testimonials: Look for online reviews and testimonials from previous borrowers to gauge the lender's reputation and customer service. Pay attention to both positive and negative feedback.

-

Look for Secure Website Encryption (HTTPS): Ensure the lender's website uses HTTPS encryption to protect your personal information during the application process.

-

Avoid Lenders Demanding Upfront Fees: Legitimate lenders will not ask for upfront fees before approving your loan. This is a significant red flag.

-

Compare Interest Rates and Terms: Carefully compare interest rates, fees, and repayment terms from different lenders before making a decision.

-

Bullet Points:

- Verify lender's licensing and registration.

- Read online reviews and testimonials.

- Look for secure website encryption (HTTPS).

- Avoid lenders demanding upfront fees.

- Compare interest rates and terms from multiple direct lenders.

The Application Process for Secure No Credit Check Loans

The application process for no credit check loans is generally straightforward and often completed online.

-

Online Application Process: Most direct lenders offer online application forms, making it convenient to apply from anywhere with internet access.

-

Required Documentation Checklist: You'll typically need to provide proof of income (pay stubs, bank statements), identification (driver's license, passport), and sometimes proof of address.

-

Loan Approval Timeline: The approval process can be quick, sometimes within hours or a few days, but this varies among lenders.

-

Understanding Loan Terms and Conditions: Carefully read and understand the loan agreement before signing. Pay close attention to the interest rate, fees, and repayment schedule.

-

Bullet Points:

- Online application process, usually quick and easy.

- Required documentation: proof of income, identification, and sometimes proof of address.

- Loan approval timeline varies by lender.

- Thoroughly understand loan terms and conditions before signing.

Managing Your No Credit Check Loan Responsibly

Even with guaranteed approval, responsible borrowing is key. Failing to manage your loan can lead to serious financial consequences.

-

Create a Realistic Repayment Budget: Develop a realistic budget that includes your loan repayment.

-

Track Expenses and Income: Monitor your spending and income to ensure you can afford your loan payments.

-

Set Up Automatic Payments: Set up automatic payments to avoid late payments and additional fees.

-

Seek Help from Credit Counseling Agencies if Needed: If you're struggling to make payments, seek assistance from a credit counseling agency.

-

Bullet Points:

- Create a realistic repayment budget.

- Track expenses and income carefully.

- Set up automatic payments to avoid late fees.

- Seek help from credit counseling agencies if you struggle to make payments.

Conclusion: Securing Your Financial Future with Responsible No Credit Check Loans

No credit check loans offer a solution for immediate financial needs, particularly for those with bad credit. However, it's crucial to understand the higher interest rates and the importance of responsible borrowing. Choosing a reputable direct lender and carefully managing your loan are essential to avoid falling into a debt trap. Remember, while "guaranteed approval" is attractive, it’s not a free pass. Thorough research and responsible financial planning are paramount.

Start your search for a secure no credit check loan today! Find a reputable direct lender and take control of your finances. Remember to compare offers and choose wisely. Don't let bad credit hold you back; take charge of your financial future with a responsible approach to no credit check loans.

Featured Posts

-

Bert Natters Concentratiekamproman Groots Dodelijk Vermoeiend En Indrukwekkend Portret Van De Nazitijd

May 28, 2025

Bert Natters Concentratiekamproman Groots Dodelijk Vermoeiend En Indrukwekkend Portret Van De Nazitijd

May 28, 2025 -

Hailee Steinfelds Red Carpet Look Sinner Photo Call In Mexico

May 28, 2025

Hailee Steinfelds Red Carpet Look Sinner Photo Call In Mexico

May 28, 2025 -

Rome Champ Continued Success Not Complacency

May 28, 2025

Rome Champ Continued Success Not Complacency

May 28, 2025 -

Semarang Diprediksi Hujan Siang Ini Bagaimana Cuaca Besok 22 April

May 28, 2025

Semarang Diprediksi Hujan Siang Ini Bagaimana Cuaca Besok 22 April

May 28, 2025 -

Nba 2 K25 Final Update Player Ratings Surge Before Playoffs

May 28, 2025

Nba 2 K25 Final Update Player Ratings Surge Before Playoffs

May 28, 2025

Latest Posts

-

La Bestia Sudamericana De Agassi El Recuerdo De Rios

May 30, 2025

La Bestia Sudamericana De Agassi El Recuerdo De Rios

May 30, 2025 -

Ruuds Knee Injury Hinders French Open 2025 Performance Borges Wins

May 30, 2025

Ruuds Knee Injury Hinders French Open 2025 Performance Borges Wins

May 30, 2025 -

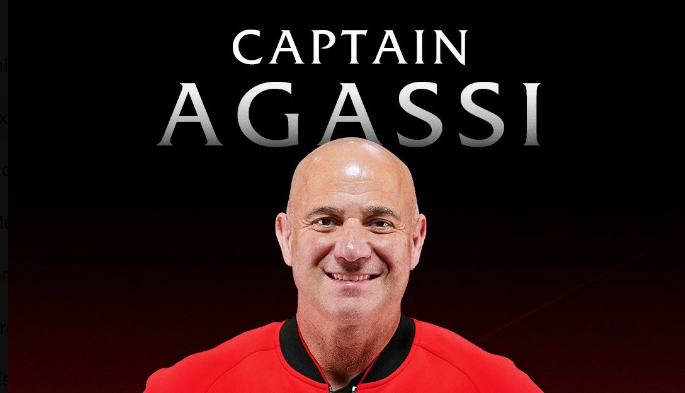

Agassi Joins The Pickleball Pro Circuit His Inaugural Tournament

May 30, 2025

Agassi Joins The Pickleball Pro Circuit His Inaugural Tournament

May 30, 2025 -

Andre Agassi And Ira Khan An Unforeseen Revelation

May 30, 2025

Andre Agassi And Ira Khan An Unforeseen Revelation

May 30, 2025 -

Agassi Y Rios La Rivalidad Tenistica Sudamericana

May 30, 2025

Agassi Y Rios La Rivalidad Tenistica Sudamericana

May 30, 2025