Securing Your Place In The Sun: Practical Tips For International Property Investment

Table of Contents

Due Diligence: Researching Your Chosen Location and Property

Before taking the plunge into international property investment, thorough due diligence is paramount. This involves meticulous research into both the chosen location and the specific property itself.

Understanding Local Market Conditions

Analyzing the local market is crucial for making informed decisions. Consider these key aspects:

- Property price trends: Research historical and current property prices in your target area. Are prices rising, falling, or stabilizing? Reliable real estate portals and government statistics provide valuable data.

- Rental yields: If you plan to generate rental income, investigate the average rental yields for similar properties in the area. High rental yields can offset costs and boost your return on investment.

- Capital appreciation potential: Assess the long-term growth potential of the property market. Factors like infrastructure development, tourism growth, and economic stability significantly impact property values.

- Reliable data sources: Utilize reputable sources for your research, including government statistics agencies, established real estate portals (like Zillow, Rightmove, etc., depending on the country), and local real estate agents with proven track records.

Investigating Legal and Regulatory Frameworks

Understanding the legal and regulatory landscape is non-negotiable in international property investment. Key considerations include:

- Property ownership laws: Familiarize yourself with the laws governing property ownership in the target country. Some countries have stricter regulations than others for foreign buyers.

- Tax implications: Research the tax implications for foreign investors, including capital gains tax, property taxes, and inheritance tax. Seek professional tax advice to minimize your tax liability.

- Legal counsel: Consulting with lawyers specializing in international property law is crucial. They can guide you through the legal complexities and ensure your investment is legally sound.

- Building codes and permits: Understand local building codes and the process for obtaining necessary permits for renovations or construction.

Financing Your International Property Investment

Securing the necessary financing is a key step in your international property investment journey.

Securing a Mortgage for Overseas Property

Obtaining a mortgage for overseas property can be more challenging than securing a domestic mortgage.

- Mortgage options: Research mortgage options available to foreign buyers. Some lenders specialize in international property mortgages, while others may require a larger down payment.

- Interest rates and terms: Compare interest rates and loan terms offered by different lenders. Consider the implications of fluctuating exchange rates.

- Mortgage application requirements: Understand the documentation required for mortgage applications, which may differ significantly from domestic requirements.

- Currency exchange risks: Be aware of currency exchange rate fluctuations and their potential impact on your mortgage repayments and overall investment.

Managing Your Finances Effectively

Effective financial management is crucial for successful international property investment.

- Realistic budget: Develop a detailed budget encompassing the purchase price, legal fees, taxes, ongoing maintenance expenses, and potential rental income.

- Financing options: Explore various financing options, such as cash purchases, mortgages, or joint ventures. Each option has its own advantages and disadvantages.

- Currency fluctuation: Consider the implications of currency fluctuations on your investment. Hedging strategies might be necessary to mitigate risks.

- Professional financial advice: Seek professional financial advice tailored to international property investments. A financial advisor can help you navigate the complexities and make informed decisions.

Working with Professionals: Agents, Lawyers, and Other Experts

Leveraging the expertise of professionals is essential for a smooth and successful international property investment.

Selecting a Reputable Real Estate Agent

Choosing the right real estate agent can make a significant difference.

- Agent specialization: Look for agents specializing in international property transactions and familiar with the local market.

- Credential verification: Verify their credentials, experience, and licensing. Check online reviews and testimonials.

- Clear communication: Establish clear communication regarding your needs and expectations.

The Importance of Legal Counsel

Legal counsel is invaluable throughout the entire process.

- International property law expertise: Engage lawyers experienced in international property law in both your home country and the target country.

- Ongoing legal advice: Seek their advice from due diligence to closing and beyond.

- Contract review: Ensure all contracts and agreements are thoroughly reviewed and understood before signing.

- Legal protection: Proper legal documentation safeguards your investment and protects your rights.

Managing Your International Property Investment

Once you've acquired your property, ongoing management is key.

Property Maintenance and Management

Maintaining your international property requires planning and potentially outsourcing.

- Maintenance planning: Plan for regular maintenance and repairs.

- Property management companies: Consider hiring a reputable property management company, especially if you're a long-distance owner.

- Local regulations: Understand local regulations concerning property maintenance and upkeep.

- Ongoing expenses: Factor in ongoing expenses such as insurance, property taxes, and utilities.

Protecting Your Investment

Protecting your investment involves proactive measures.

- Insurance coverage: Obtain adequate insurance coverage to protect against unforeseen events.

- Legal updates: Stay informed about changes in local laws and regulations.

- Market monitoring: Monitor the market to anticipate potential changes affecting your property's value.

- Portfolio diversification: Consider diversifying your investment portfolio to minimize risk.

Securing Your Dream with International Property Investment

Successful international property investment hinges on thorough research, meticulous due diligence, securing appropriate financing, and working with experienced professionals. Remember the key takeaways: research the local market conditions and legal framework, secure suitable financing, and engage reputable real estate agents and legal counsel. Effective management, including regular maintenance and appropriate insurance, is vital for protecting your investment. Start your journey towards successful international property investment today! Research your desired location, seek professional advice, and take the first step towards owning your dream property abroad. Don't hesitate to explore further resources and expert opinions to ensure a smooth and rewarding international property investment experience.

Featured Posts

-

The Future Of Buy Canadian Insights From Loblaws Ceo

May 03, 2025

The Future Of Buy Canadian Insights From Loblaws Ceo

May 03, 2025 -

Fortnites Backward Music A Source Of Player Frustration

May 03, 2025

Fortnites Backward Music A Source Of Player Frustration

May 03, 2025 -

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025 -

Graeme Souness Aston Villa Transfer Message On Marcus Rashford

May 03, 2025

Graeme Souness Aston Villa Transfer Message On Marcus Rashford

May 03, 2025 -

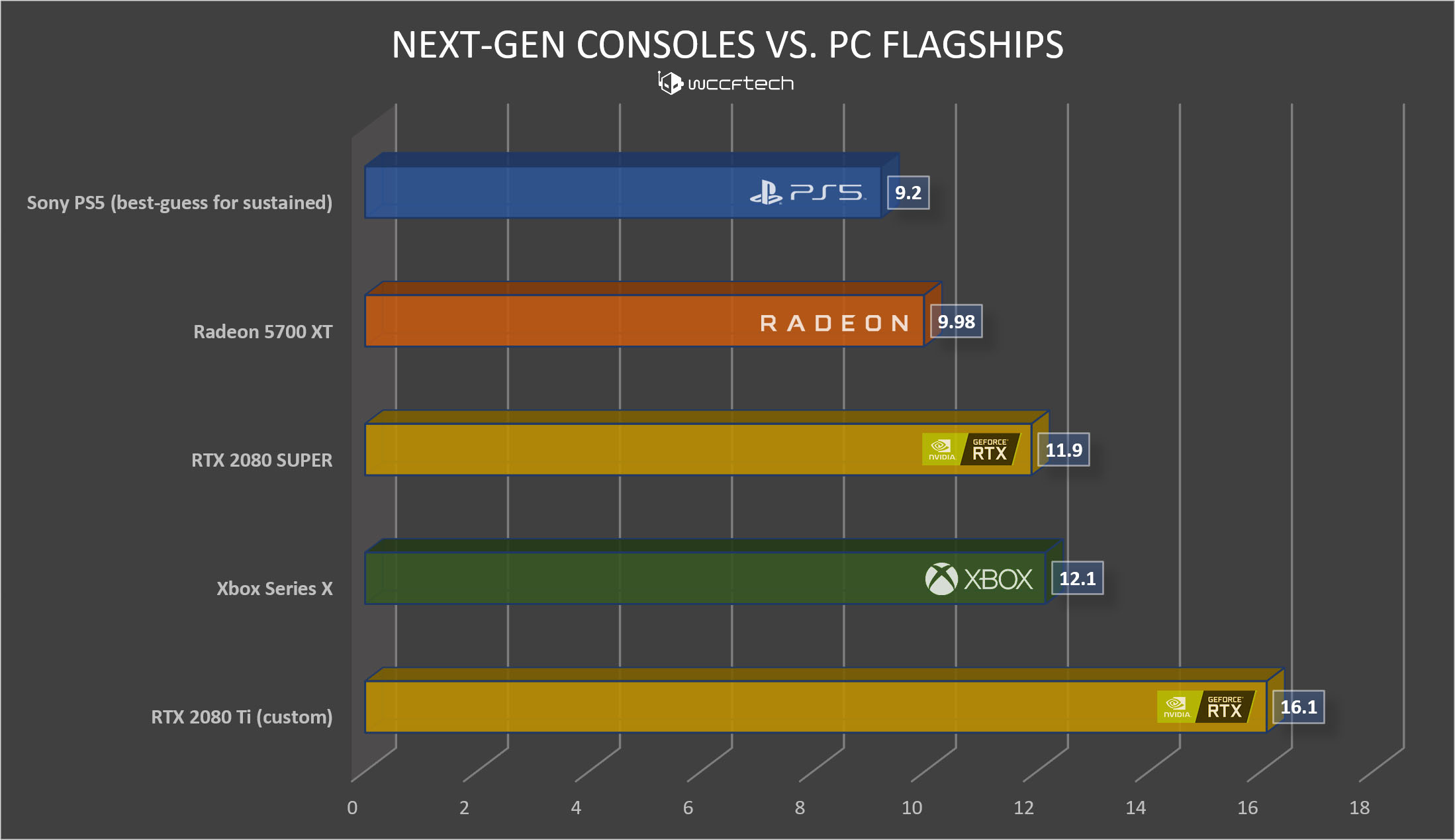

Analyzing Us Sales Figures Ps 5 Vs Xbox Series X S Market Share

May 03, 2025

Analyzing Us Sales Figures Ps 5 Vs Xbox Series X S Market Share

May 03, 2025

Latest Posts

-

Fixing Fortnite Matchmaking Error 1 Expert Solutions And Tips

May 03, 2025

Fixing Fortnite Matchmaking Error 1 Expert Solutions And Tips

May 03, 2025 -

Fortnite Game Mode Removals A Sign Of Shifting Priorities

May 03, 2025

Fortnite Game Mode Removals A Sign Of Shifting Priorities

May 03, 2025 -

The Impact Of Fortnite Game Mode Shutdowns On Player Engagement

May 03, 2025

The Impact Of Fortnite Game Mode Shutdowns On Player Engagement

May 03, 2025 -

Fortnite Server Downtime Checking Server Status And Update 34 21 Details

May 03, 2025

Fortnite Server Downtime Checking Server Status And Update 34 21 Details

May 03, 2025 -

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025