'Sell America' Sentiment Returns Amid Rising 30-Year Treasury Yields

Table of Contents

Rising 30-Year Treasury Yields: A Flight to Safety or a Sign of Economic Weakness?

The dramatic increase in 30-year Treasury yields is a key catalyst for the resurfacing "Sell America" sentiment. Several factors contribute to this rise:

- Inflation Concerns: Persistent inflation continues to pressure the Federal Reserve to maintain a hawkish monetary policy, impacting long-term interest rates.

- Federal Reserve Policy: The Fed's actions, including interest rate hikes and quantitative tightening, directly influence Treasury yields and investor expectations.

- Global Economic Uncertainty: Geopolitical instability and economic slowdown in other major economies are driving investors towards the perceived safety of US Treasuries, increasing demand and pushing up yields.

- Increased Demand for Safe-Haven Assets: In times of uncertainty, investors often flock to safe-haven assets like US Treasuries, leading to higher yields.

This rise in the Treasury yield curve, particularly the long-term rates reflected in 30-year yields, presents a complex picture. Is it a flight to safety, suggesting underlying confidence in the US economy despite global turmoil? Or does it signal a deeper concern about the US economy's long-term prospects? The answer, likely, lies somewhere in between.

The "Sell America" Sentiment: What Does it Mean for Investors?

"Sell America" sentiment represents a bearish outlook on US assets, encompassing stocks, bonds, and real estate. Historically, this sentiment has manifested during periods of economic uncertainty or when investors seek better returns elsewhere. Currently, this sentiment translates to:

- Capital flight from US markets: Investors are potentially shifting their investments away from US assets towards other markets perceived as having better prospects.

- Potential for currency depreciation: A weakening US dollar could result from reduced demand for US assets.

- Impact on US corporate earnings: Higher interest rates and reduced investment could negatively impact corporate profitability.

These factors could result in increased market volatility and have significant short-term and long-term impacts on investor portfolios. Careful consideration of investment strategy is crucial in this environment.

Specific Sectors Feeling the "Sell America" Pressure

Certain sectors are particularly vulnerable to this "Sell America" pressure:

- Technology sector: Growth stocks, especially in the tech sector, are highly sensitive to interest rate hikes and shifts in investor sentiment.

- Growth stocks: Companies with high valuations and future-oriented business models are more susceptible to corrections during periods of risk aversion.

- Export-oriented industries: A stronger dollar (potentially counterintuitive to the currency depreciation mentioned above, but possible depending on other global factors) can hurt the competitiveness of US exports.

These sectors are facing challenges due to their reliance on sustained growth and investor confidence.

Global Economic Factors Exacerbating the "Sell America" Trend

Several global economic factors are compounding the "Sell America" trend:

- Geopolitical risks: Ongoing geopolitical tensions create uncertainty and influence investment decisions.

- Global inflation: Global inflationary pressures contribute to investor concerns about the US economic outlook.

- Supply chain disruptions: Ongoing supply chain issues continue to create economic instability.

- Emerging market instability: Challenges in emerging markets can trigger capital flows towards safer havens, impacting the US market.

The interplay between these global factors and domestic concerns amplifies the "Sell America" sentiment, creating a challenging environment for investors.

Potential Counter-Trends and Mitigation Strategies

While the "Sell America" sentiment is prevalent, it's important to consider potential counter-arguments: The US economy remains relatively strong compared to many others; innovation and technological leadership could still attract investment; and value stocks may offer opportunities.

Investors can adopt several mitigation strategies:

- Diversification: Diversifying investments across asset classes and geographies reduces exposure to the "Sell America" risk.

- Hedging strategies: Implementing hedging strategies can help protect portfolios against market downturns.

- Alternative investments: Exploring alternative investments, such as real estate or commodities, can offer diversification benefits.

- Focus on value stocks: Value stocks, with lower valuations and potentially higher dividend yields, may be less sensitive to shifts in market sentiment.

The current environment, while challenging, also presents opportunities for astute investors.

Conclusion: Navigating the "Sell America" Sentiment and Rising Yields

The resurgence of "Sell America" sentiment, closely tied to rising 30-year Treasury yields, reflects a complex interplay of domestic and global factors. The implications for investors are significant, impacting various asset classes and requiring a careful evaluation of investment strategies. While the trajectory of this trend remains uncertain, understanding the underlying drivers is crucial. To navigate this challenging market effectively, carefully evaluate your investment strategy in light of the current "Sell America" sentiment and rising 30-year Treasury yields. Consider seeking professional financial advice to tailor your approach to your specific risk tolerance and investment goals. Don't let the "Sell America" sentiment dictate your decisions without a thorough understanding of the market dynamics and your own financial situation.

Featured Posts

-

Factory Jobs And The Trump Legacy A Look At Reshoring Efforts

May 20, 2025

Factory Jobs And The Trump Legacy A Look At Reshoring Efforts

May 20, 2025 -

Hl Ymkn Lldhkae Alastnaey Ktabt Rwayat Aghatha Krysty

May 20, 2025

Hl Ymkn Lldhkae Alastnaey Ktabt Rwayat Aghatha Krysty

May 20, 2025 -

Understanding The Lyrics And Meaning Behind Suki Waterhouses On This Love

May 20, 2025

Understanding The Lyrics And Meaning Behind Suki Waterhouses On This Love

May 20, 2025 -

Is Amorims New Signing The Key To Man Utds Success

May 20, 2025

Is Amorims New Signing The Key To Man Utds Success

May 20, 2025 -

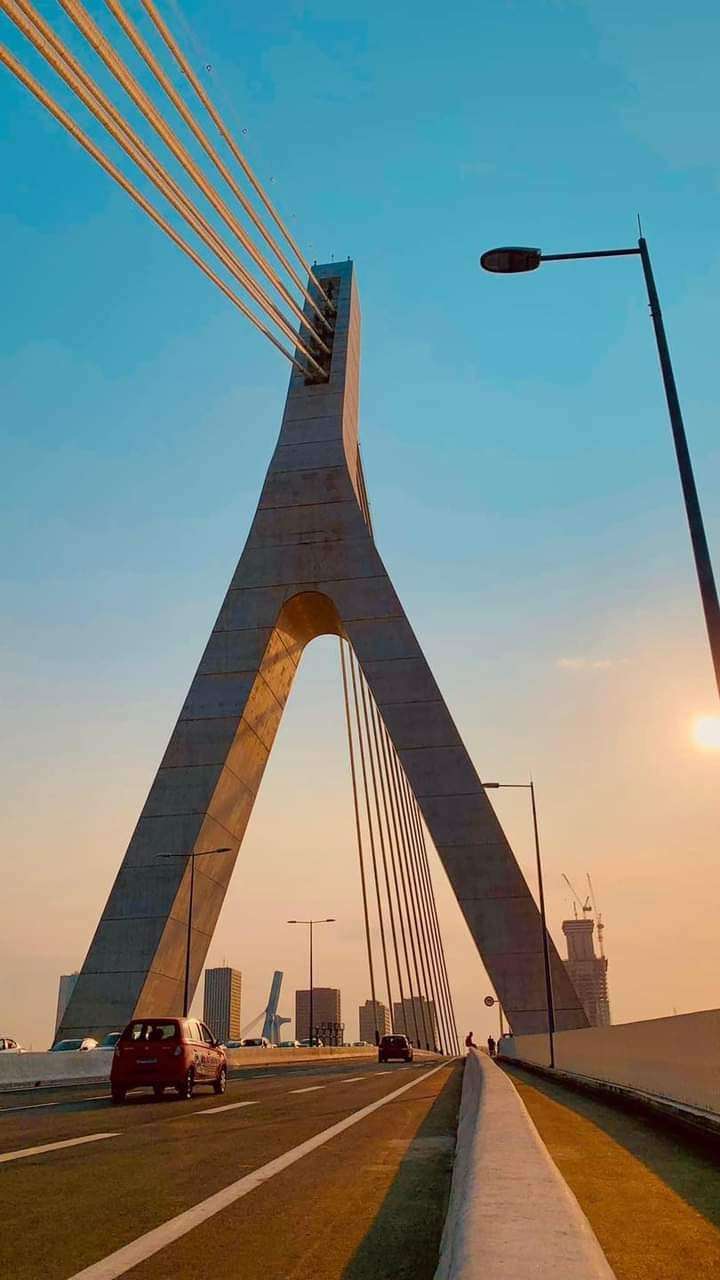

Projet Du 4eme Pont D Abidjan Tout Savoir Sur Le Delai Le Cout Et Les Depenses

May 20, 2025

Projet Du 4eme Pont D Abidjan Tout Savoir Sur Le Delai Le Cout Et Les Depenses

May 20, 2025