Sensex LIVE: Sharp Gains Today, Nifty Reclaims 23,800 - Sector-Wise Analysis

Table of Contents

Sensex and Nifty's Sharp Rise: Key Drivers

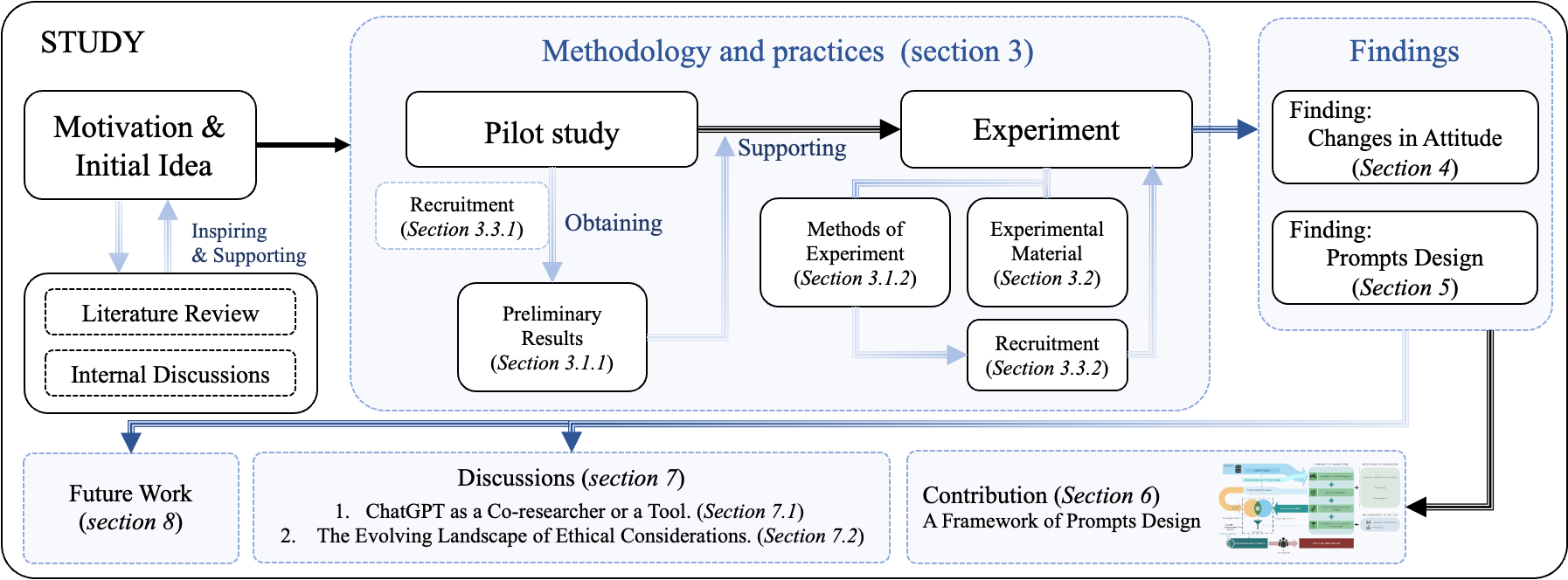

Today's sharp rise in the Sensex and Nifty can be attributed to a confluence of factors, both domestic and global. Positive global market sentiment played a crucial role, mirroring gains in major international markets like the US. Furthermore, encouraging domestic economic data, including a potentially improved GDP growth forecast, fueled investor confidence. Specific company performances also contributed significantly to the indices' overall gains. Let's break down the key drivers:

- Global Market Sentiment: Positive cues from the US markets, indicating continued strength in the global economy, had a ripple effect on the Indian stock market, boosting investor optimism.

- Domestic Economic Data: Improved forecasts for India's GDP growth instilled confidence among investors, signaling a healthy trajectory for the economy.

- Strong Corporate Earnings: Several prominent companies reported better-than-expected quarterly results, further bolstering market sentiment. This positive corporate performance injected significant momentum into the indices.

- Government Policies: Recent government announcements and supportive policies also played a role in strengthening investor confidence and driving market growth.

Sector-Wise Performance Analysis: Winners and Losers

Analyzing the performance of individual sectors provides a more granular understanding of the market's overall movement. Let's delve into the performance of key sectors:

Banking Sector's Robust Growth

The banking sector witnessed robust growth today, driven by positive investor sentiment and expectations of improved credit growth. Stocks like HDFC Bank and ICICI Bank saw substantial gains, reflecting the sector's overall strength. This positive performance is a strong indicator of the health of the Indian financial system.

IT Sector's Mixed Performance

The IT sector displayed a mixed performance today. While some IT giants experienced gains, others lagged behind, reflecting varying degrees of investor confidence in individual companies within the sector. This mixed performance highlights the sector-specific nuances that impact the overall market. Infosys and TCS saw moderate gains, while some smaller IT firms showed less significant movement.

Pharma Sector's Steady Performance

The Pharma sector demonstrated steady performance today, with moderate gains across most stocks. This stability reflects the sector's inherent resilience and its less volatile nature compared to other sectors. Consistent performance by companies like Sun Pharma and Cipla contributed to the sector's overall stability.

Auto Sector’s Positive Momentum

The Auto sector exhibited positive momentum today, driven by strong sales figures and a positive outlook for the coming quarters. Leading automobile manufacturers experienced significant gains, indicating robust consumer demand and industry growth. Maruti Suzuki and Tata Motors were amongst the notable gainers.

FMCG Sector's Moderate Gains

The FMCG sector recorded moderate gains today, driven by steady consumer demand and consistent company performance. While not as dramatic as some other sectors, this steady growth reflects the sector's resilience and its position as a defensive investment option. Hindustan Unilever and Nestle India showed moderate positive growth.

Technical Analysis: Charts and Indicators

A technical analysis of today's market reveals a positive trend. Key indicators like the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) suggest bullish momentum. Support levels for both the Sensex and Nifty held firm, indicating strong underlying support for the market's recent rise. While the short-term outlook appears positive, it's crucial to monitor these indicators closely for any potential shifts in market sentiment. Resistance levels should also be closely observed to understand the potential for further gains.

Expert Opinions and Market Outlook

(This section would include quotes from market analysts and experts, offering their insights into the day's market movement and future predictions. This would add depth and authority to the analysis.)

Conclusion: Sensex LIVE: Navigating the Market's Upswing

Today's sharp gains in the Sensex and Nifty, driven by a combination of global and domestic factors, highlight the importance of continuous market monitoring and sector-wise analysis. The robust performance of sectors like banking and auto, coupled with the steady performance of others, paints a largely positive picture for the Indian stock market. However, the mixed performance within certain sectors underscores the need for careful, sector-specific analysis. Stay tuned to our Sensex LIVE updates for continuous analysis and informed investment decisions. Sign up for our email alerts or follow us on social media for the latest market insights and updates!

Featured Posts

-

Trump Eyes Jeanine Pirro For Dc Prosecutor A Fox News Connection

May 10, 2025

Trump Eyes Jeanine Pirro For Dc Prosecutor A Fox News Connection

May 10, 2025 -

Figmas Ai Update Redefining Design And Content Workflow

May 10, 2025

Figmas Ai Update Redefining Design And Content Workflow

May 10, 2025 -

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

Dijon Proces Pour Violences Conjugales Contre Le Boxeur Bilel Latreche En Aout

May 10, 2025

Dijon Proces Pour Violences Conjugales Contre Le Boxeur Bilel Latreche En Aout

May 10, 2025 -

Post Liberation Day Financial Repercussions Of Trumps Trade Policies

May 10, 2025

Post Liberation Day Financial Repercussions Of Trumps Trade Policies

May 10, 2025