Sensex, Nifty 50 Flat Amidst Bajaj Twins Losses And Geopolitical Tensions

Table of Contents

Bajaj Twins' Impact on Market Sentiment

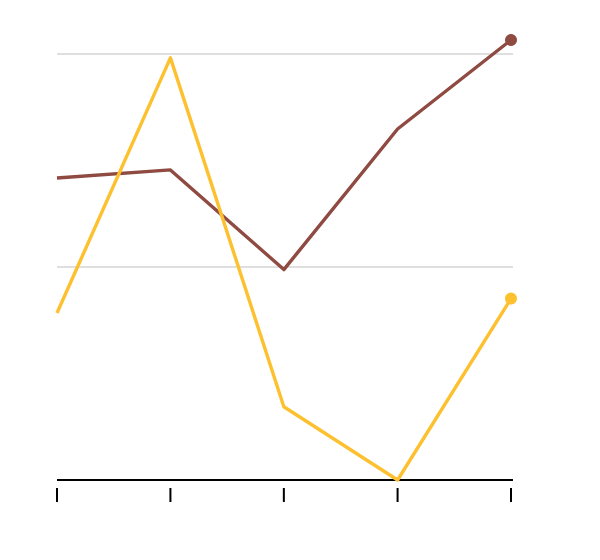

The decline in shares of Bajaj Auto and its financial services arm, Bajaj Finance, played a significant role in today's muted market performance. These two companies, often referred to as the "Bajaj twins," are major players in the Indian auto and financial sectors, making their performance highly influential on the overall market.

Decline in Bajaj Auto and Bajaj Finance Share Prices

Both Bajaj Auto and Bajaj Finance experienced a notable drop in their share prices. Bajaj Auto saw a [Insert Percentage]% decline, closing at [Insert Closing Price], while Bajaj Finance witnessed a [Insert Percentage]% decrease, ending the day at [Insert Closing Price]. Trading volumes for both stocks were significantly higher than average, indicating heightened investor activity and uncertainty. The reasons behind this decline are multifaceted and likely include a combination of factors such as:

- Quarterly Results: Disappointing quarterly earnings reports could have triggered selling pressure.

- Market Speculation: Negative market speculation and rumors may have contributed to the sell-off.

- Industry Trends: Slowdown in the auto sector or changes in the financial services landscape might have influenced investor perception.

These factors, individually or collectively, likely contributed to the significant losses observed in the Bajaj twins' share prices, creating ripples throughout the market.

Ripple Effect Across Related Sectors

The losses in Bajaj Auto and Bajaj Finance weren't isolated events. Their decline sent shockwaves through related sectors. The auto ancillary sector, for instance, experienced a noticeable dip as investors reacted to the negative sentiment stemming from Bajaj Auto's performance. Similarly, the broader financial services sector felt the impact, with some companies experiencing correlated declines. The extent of this ripple effect varied depending on the degree of correlation with the Bajaj twins.

- Auto Ancillary Sector: Companies supplying parts to Bajaj Auto likely experienced decreased investor confidence.

- Financial Services Sector: Companies competing with Bajaj Finance might have seen some indirect negative pressure.

Understanding these interconnected relationships within the Indian stock market is crucial for assessing the overall impact of Bajaj twins' performance.

Investor Reactions and Sentiment

The decline in Bajaj Auto and Bajaj Finance shares significantly impacted investor sentiment. The substantial drop in share prices triggered a wave of selling, contributing to the overall flat performance of the Sensex and Nifty 50. Investor confidence took a hit, as evidenced by the increased trading volume and the cautious approach adopted by many market participants. Analyst comments pointed towards a period of uncertainty and caution, urging investors to exercise vigilance. This negative sentiment overshadowed other potentially positive market influences, keeping the indices subdued.

Geopolitical Tensions and Global Market Uncertainty

Beyond the domestic challenges presented by the Bajaj twins' losses, broader geopolitical tensions played a considerable role in the Sensex and Nifty 50's flat performance. Global uncertainty often translates directly into market instability.

Ongoing Global Conflicts and their Economic Ramifications

The ongoing conflict in Ukraine, coupled with the persistent US-China trade tensions and other geopolitical uncertainties, continues to create ripples across global markets. These events directly impact investor confidence and capital flows. Global market volatility increased as a result of these tensions, impacting investor sentiment globally. News headlines reflected the uncertainty, further fueling anxieties.

- Ukraine Conflict: The ongoing war affects global energy prices and supply chains.

- US-China Relations: Trade disputes and technological competition continue to add to the uncertainty.

Impact on Indian Economy and Stock Market

Geopolitical tensions have a direct and indirect impact on the Indian economy. Increased global uncertainty can lead to decreased foreign investment, impacting the rupee exchange rate and potentially leading to inflationary pressures. These economic consequences directly translate into fluctuations in the Sensex and Nifty 50, as investors react to perceived risks.

- Foreign Investment: Uncertainty often leads to a decrease in foreign portfolio investment.

- Inflation: Global instability can increase inflationary pressures within the Indian economy.

Safe Haven Assets and Investor Behavior

In times of geopolitical uncertainty, investors often shift their focus towards safe-haven assets, such as gold and government bonds. This "flight to safety" reduces investment in riskier assets like stocks, resulting in decreased trading activity and dampened market performance in indices like the Sensex and Nifty 50. The price of gold, often a key indicator of risk aversion, saw a slight increase, further supporting this observation.

Conclusion: Navigating the Sensex and Nifty 50 in Uncertain Times

The relatively flat performance of the Sensex and Nifty 50 today can be attributed to a confluence of factors, primarily the significant losses in Bajaj Auto and Bajaj Finance shares, and the persistent impact of global geopolitical uncertainties. These factors combined to create a climate of market hesitancy and risk aversion, impacting investor sentiment and trading activity. The interplay between domestic market events and global geopolitical risks underscores the complex dynamics of the Indian stock market. Understanding these interconnected factors is crucial for navigating the complexities of investing in the Sensex and Nifty 50. Stay updated on the latest Sensex and Nifty 50 news and analysis to make informed investment decisions in these volatile times. Understanding the interplay of factors affecting the Sensex and Nifty 50 is crucial for successful investing.

Featured Posts

-

Disneys Improved Profit Outlook Attributed To Theme Parks And Streaming Success

May 09, 2025

Disneys Improved Profit Outlook Attributed To Theme Parks And Streaming Success

May 09, 2025 -

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 09, 2025 -

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 09, 2025

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 09, 2025 -

Former Becker Sentencing Judge Heads Nottingham Inquiry

May 09, 2025

Former Becker Sentencing Judge Heads Nottingham Inquiry

May 09, 2025 -

Social Media Blocked Turkish Mayors Account Suspended Amidst Protests

May 09, 2025

Social Media Blocked Turkish Mayors Account Suspended Amidst Protests

May 09, 2025