Sensex Soars 500+, Nifty Above 17,400: Adani Ports & Eternal's Day

Table of Contents

Adani Ports' Stellar Performance Fuels Market Rally

Adani Ports played a pivotal role in today's market surge, contributing significantly to the impressive gains in both the Sensex and Nifty. The company witnessed a substantial increase in its share price, boosting investor confidence and driving the overall market upward. This strong performance can be attributed to several key factors:

- Positive Quarterly Results: Adani Ports recently announced robust quarterly results, exceeding market expectations and showcasing strong growth in cargo handling and operational efficiency. This positive news significantly impacted investor sentiment.

- Infrastructure Developments: Ongoing infrastructure developments and expansion projects at various Adani Ports facilities are fueling expectations of continued growth and profitability. This long-term vision attracts significant investment.

- Strong Investor Sentiment: Positive market sentiment towards the port sector, coupled with Adani Ports' consistent performance, further propelled the stock's price. The company's strategic initiatives and strong management are key factors driving this sentiment.

Bullet Points:

- Adani Ports share price increased by X% today.

- Q[Quarter] results showed a Y% increase in revenue and a Z% increase in net profit.

- Analysts predict further growth in Adani Ports share price based on current market trends.

Keywords: Adani Ports share price, Adani Ports stock, Adani Ports performance, port sector growth, Adani Ports investment.

Eternal's Positive Impact on Market Sentiment

Eternal's positive performance also contributed to the overall market buoyancy. While the exact contribution might be less prominent than Adani Ports, its impact on market sentiment cannot be ignored. Eternal, a [briefly describe Eternal's business – e.g., leading pharmaceutical company], experienced a positive day, driven by [mention specific reasons – e.g., successful drug launch, positive clinical trial results, strategic partnership]. This positive news boosted investor confidence and contributed to the broader market rally.

Bullet Points:

- Eternal share price increased by A% today.

- The company announced [mention specific positive news – e.g., a new drug approval, a significant contract win].

- This positive development improved investor sentiment towards the broader market.

Keywords: Eternal share price, Eternal stock, Eternal investment, Eternal's market impact, Eternal's growth.

Broader Market Trends Contributing to the Sensex and Nifty Surge

Beyond the individual performances of Adani Ports and Eternal, several broader market trends contributed to today's impressive rally.

Bullet Points:

- Positive Global Market Sentiment: Improved global economic indicators and positive sentiment in international markets positively influenced the Indian stock market.

- Easing Inflation Concerns: Some easing of inflation concerns, both globally and domestically, boosted investor confidence.

- Strong Rupee: A relatively strong Indian Rupee against major global currencies also aided market sentiment.

- Positive Sectoral Performances: Besides ports and pharmaceuticals, other sectors also witnessed positive growth, contributing to the overall market uptrend.

Keywords: Indian stock market, BSE Sensex, NSE Nifty, market volatility, investment strategies, global market trends.

Analyzing the Sustainability of the Sensex and Nifty Gains

While today's market surge is impressive, it's crucial to analyze the sustainability of these gains. Several factors could potentially impact the market's upward trend in the coming days or weeks.

Bullet Points:

- Geopolitical Risks: Global geopolitical uncertainties could impact investor sentiment and trigger market corrections.

- Inflationary Pressures: Any resurgence of inflationary pressures could negatively affect market performance.

- Interest Rate Hikes: Further interest rate hikes by central banks could dampen investor enthusiasm.

However, the underlying strength of the Indian economy and the positive outlook for certain sectors could support continued growth. Expert opinions are divided, with some predicting a continuation of the upward trend while others caution about potential volatility.

Keywords: market analysis, stock market prediction, long-term investment, risk assessment, market outlook.

Conclusion: Sensex and Nifty's Impressive Leap – What's Next?

Today's remarkable surge, with the Sensex Soars 500+, Nifty Above 17,400, showcases the dynamism of the Indian stock market. The strong performances of Adani Ports and Eternal played a crucial role in this rally, along with broader market trends and investor sentiment. While the sustainability of these gains depends on several factors, including global economic conditions and geopolitical stability, the underlying strength of the Indian economy offers a degree of optimism. To stay informed about the dynamic Indian stock market and understand the nuances of Sensex and Nifty movements, subscribe to our newsletter for daily updates on market performance and expert analysis.

Featured Posts

-

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Transgender Women And Childbirth A Community Activists Proposal For Uterine Transplants

May 10, 2025

Transgender Women And Childbirth A Community Activists Proposal For Uterine Transplants

May 10, 2025 -

Understanding The Trump Presidency Insights Into Day 109 May 8th 2025

May 10, 2025

Understanding The Trump Presidency Insights Into Day 109 May 8th 2025

May 10, 2025 -

Nyt Strands April 9 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025 -

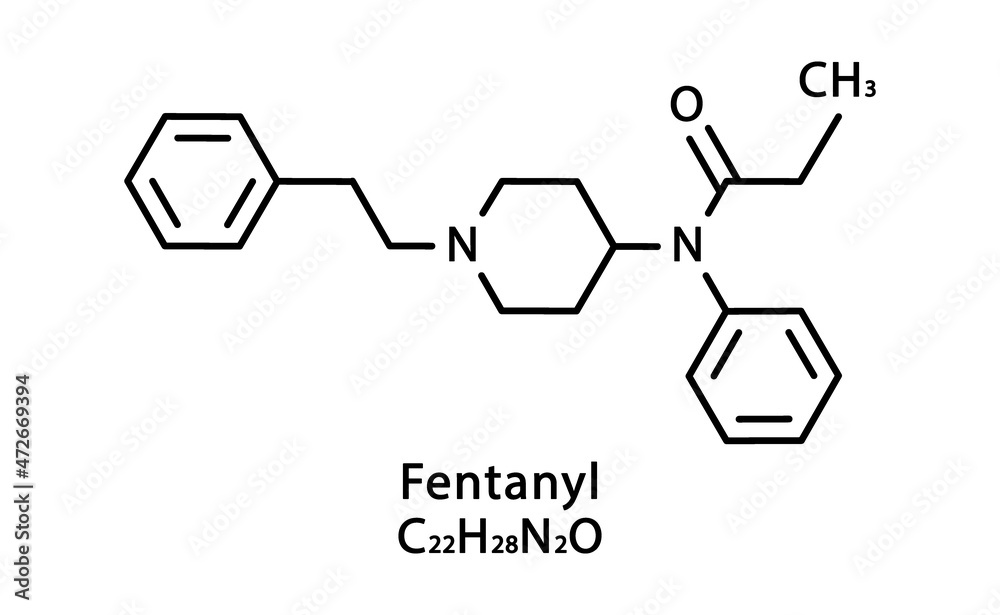

Fake Fentanyl Displayed By Attorney General Concerns And Implications

May 10, 2025

Fake Fentanyl Displayed By Attorney General Concerns And Implications

May 10, 2025