Settlement Reached In Farage-NatWest De-banking Controversy

Table of Contents

The Core of the Farage-NatWest Dispute

The dispute began when NatWest, one of the UK's largest banks, closed Nigel Farage's personal and business accounts. Farage alleged that the decision was politically motivated, a claim vehemently denied by NatWest. The bank cited concerns about compliance with anti-money laundering regulations, though Farage argued that this justification was a pretext for silencing a prominent political figure. This sparked a heated debate about the balance between preventing financial crime and protecting the financial freedom of individuals, particularly those involved in political activities. The potential legal implications were substantial, representing a significant challenge to the established power dynamics between financial institutions and their clients.

- Timeline of events: The account closures occurred in 2022, leading to immediate public outcry and the eventual launch of legal proceedings.

- Key arguments: Farage argued political bias, while NatWest maintained compliance as its primary motivation. The case explored the interpretation of anti-money laundering regulations and their potential for misuse.

- Public reaction: The controversy ignited intense debate about freedom of speech, political donations, and the role of banks in maintaining a healthy democracy. Media coverage was extensive, further fueling the public interest.

Details of the Settlement

The terms of the settlement between Farage and NatWest remain partially confidential, reflecting the inclusion of confidentiality clauses within the agreement. While the exact financial details haven't been publicly disclosed, reports suggest that NatWest agreed to compensate Farage for the inconvenience and reputational damage caused by the de-banking. Both parties have issued statements acknowledging the settlement, though neither has elaborated significantly on the specifics. The settlement brings a definitive end to the litigation, preventing a potentially protracted and expensive court battle.

- Key aspects: The settlement involved a financial compensation package and a mutual agreement to avoid further public statements on the matter.

- Confidentiality clauses: Significant portions of the settlement are confidential, limiting public access to the full details of the agreement.

- Impact on future action: The settlement closes this specific case, but the underlying issues related to de-banking and political donations remain open for debate and further legal challenges.

Implications for Financial Freedom and Political Donations

This case raises serious concerns about the potential for de-banking to be used to stifle political dissent or to unfairly target individuals based on their political views. It highlights the need for greater transparency and accountability in the banking sector, ensuring that decisions to close accounts are not influenced by political considerations. The controversy has also reignited the discussion about the regulatory environment surrounding political donations and the role of banks in facilitating these activities.

- Potential for similar cases: The outcome could encourage similar lawsuits from individuals who believe they have been unfairly de-banked.

- Calls for greater transparency: This case emphasizes the necessity for greater clarity and oversight in banking practices related to account closures.

- Debate on the balance: The ongoing debate centers on striking the right balance between preventing financial crime and upholding the right of individuals to access financial services.

Future of Banking Practices and Regulatory Oversight

The Farage-NatWest settlement is likely to trigger a review of banking regulations and practices. Regulatory bodies will face increased pressure to ensure that banks adhere to fair and transparent processes when dealing with customers, and to clearly define circumstances under which de-banking is justifiable. The future relationship between banks and high-profile individuals, particularly those involved in politics, is likely to be scrutinized more closely.

- Potential legislative changes: The government may consider legislative changes to clarify the rules surrounding de-banking and ensure a clearer process for redress.

- Increased scrutiny: Banks will face more intense scrutiny of their decision-making processes when it comes to account closures.

- Due process and fair treatment: The importance of due process and fair treatment in financial services will be a key focus for regulators moving forward.

Conclusion

The settlement reached in the Farage-NatWest de-banking controversy marks a significant moment in the ongoing debate about financial freedom and banking regulation. While the specifics of the agreement remain partially confidential, the case highlights the critical need for greater transparency, accountability, and clarity surrounding banking practices and the potential for abuse of power. The impact on future regulations and the relationship between banks and their clients, particularly those in the public eye, remains to be seen.

Stay updated on the evolving landscape of de-banking controversies and learn more about protecting your financial freedom. Understanding your rights in the face of potential de-banking is crucial in today's financial climate.

Featured Posts

-

Rsalt Thdhyryt L Slah Mn Jw 24 Twqf En Almkhatrt

May 03, 2025

Rsalt Thdhyryt L Slah Mn Jw 24 Twqf En Almkhatrt

May 03, 2025 -

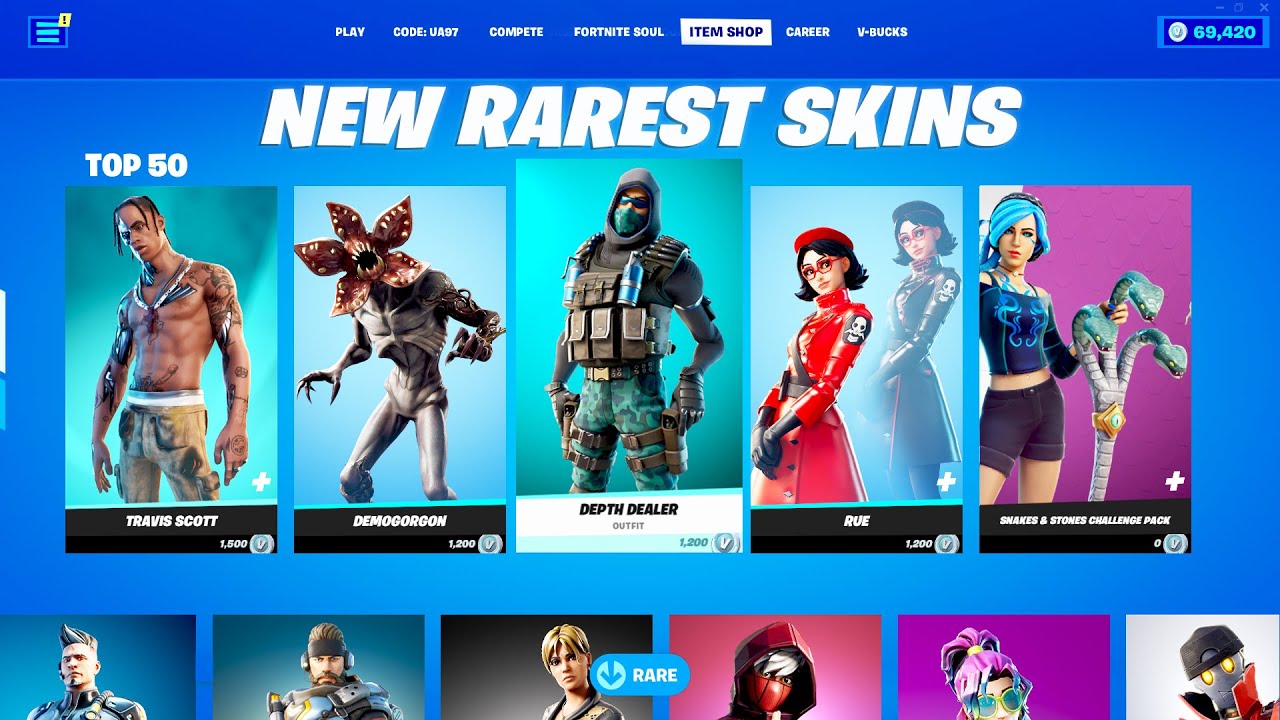

Fortnite Highly Requested Skins Re Released After 1000 Days

May 03, 2025

Fortnite Highly Requested Skins Re Released After 1000 Days

May 03, 2025 -

Fortnite Item Shop Rare Skins Possibly Removed Permanently

May 03, 2025

Fortnite Item Shop Rare Skins Possibly Removed Permanently

May 03, 2025 -

Une Rencontre Poignante Macron Et Les Victimes De L Armee Israelienne

May 03, 2025

Une Rencontre Poignante Macron Et Les Victimes De L Armee Israelienne

May 03, 2025 -

Reform Party Leadership Why Farage Should Make Way For Lowe

May 03, 2025

Reform Party Leadership Why Farage Should Make Way For Lowe

May 03, 2025

Latest Posts

-

Fixing Fortnite Matchmaking Error 1 Expert Solutions And Tips

May 03, 2025

Fixing Fortnite Matchmaking Error 1 Expert Solutions And Tips

May 03, 2025 -

Fortnite Game Mode Removals A Sign Of Shifting Priorities

May 03, 2025

Fortnite Game Mode Removals A Sign Of Shifting Priorities

May 03, 2025 -

The Impact Of Fortnite Game Mode Shutdowns On Player Engagement

May 03, 2025

The Impact Of Fortnite Game Mode Shutdowns On Player Engagement

May 03, 2025 -

Fortnite Server Downtime Checking Server Status And Update 34 21 Details

May 03, 2025

Fortnite Server Downtime Checking Server Status And Update 34 21 Details

May 03, 2025 -

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025

Fortnites V34 30 Update Sabrina Carpenter Collaboration And New Content

May 03, 2025