Shareholder Lawsuit Expedited After Judge Rejects Paramount-Skydance Merger Block

Table of Contents

The Judge's Ruling and its Impact on the Shareholder Lawsuit

The judge's decision to block the Paramount-Skydance merger stemmed from concerns regarding the fairness and transparency of the deal's terms. Specific details regarding the judge's reasoning remain under seal, but reports suggest concerns about potential undervaluation of Skydance's assets and insufficient disclosure to shareholders played significant roles. This ruling directly cleared the path for an expedited shareholder lawsuit, as it effectively validated the plaintiffs' claims of potential harm and breach of fiduciary duty.

The legal arguments presented by both sides highlighted contrasting interpretations of shareholder rights and corporate governance.

- Key arguments presented by the plaintiffs (shareholders): The shareholders argued that the merger terms were unfairly biased in favor of Paramount, leading to an undervaluation of their investment in Skydance. They claimed a lack of transparency in the negotiations and a breach of the fiduciary duty owed to them by the company's board of directors.

- Key arguments presented by the defendants (Paramount/Skydance): Paramount and Skydance defended the merger terms, arguing they were fair and negotiated in good faith. They contended that the deal offered significant long-term benefits to shareholders and that all necessary disclosures were made.

- Specific legal precedents cited in the case: Both sides likely cited precedents related to corporate governance, shareholder rights, and the legal standards for approving mergers and acquisitions. Cases involving similar allegations of undervaluation and breach of fiduciary duty would have been central to their arguments.

Analysis of the Expedited Shareholder Lawsuit

The expedited nature of this shareholder lawsuit stems from the judge's ruling, which provided immediate legal standing for the plaintiffs' claims. This accelerates the typical legal timeline significantly, potentially leading to a faster resolution.

- Timeline of the lawsuit's progression: The expedited timeline could see discovery, depositions, and potential trial occur far sooner than in a standard lawsuit.

- Potential outcomes of the expedited lawsuit: Potential outcomes range from a settlement negotiated between the parties to a full trial and judicial ruling. If the shareholders prevail, it could result in financial compensation, renegotiation of the merger terms, or even the blocking of future similar transactions.

- Key legal strategies employed by both sides: Given the expedited nature, we can expect both sides to employ aggressive legal strategies, focusing on efficient evidence gathering and concise legal arguments to expedite the process.

Implications for Future Mergers and Acquisitions

This case carries significant implications for future mergers and acquisitions (M&A) activity, particularly within the entertainment industry.

- Increased scrutiny for future merger proposals: The ruling will likely lead to increased scrutiny of future merger proposals by both regulators and shareholders. Companies may face stricter requirements regarding transparency and fairness in merger negotiations.

- Potential shifts in legal strategies for M&A deals: Law firms advising on M&A deals will likely need to adjust their strategies to account for the increased risk of shareholder lawsuits and the potential for expedited proceedings.

- Increased importance of due diligence: Companies involved in M&A will need to conduct more thorough due diligence, ensuring the valuations are fair and transparent, and that all relevant disclosures are made to shareholders. This will include a more robust review of potential legal challenges and preemptive strategies.

Expert Opinions on the Shareholder Lawsuit and its Outcome

Several legal experts specializing in corporate law and shareholder rights have commented on the case. While opinions differ on the ultimate outcome, the consensus is that this case represents a significant challenge to the conventional approach to M&A in the entertainment sector.

- Quotes from legal experts on the strength of the shareholder case: [Insert quotes from relevant legal experts here, focusing on their assessment of the plaintiffs' chances of success].

- Predictions regarding the potential financial damages: [Insert predictions from legal experts about the potential financial settlements involved, highlighting the range of possible outcomes].

- Analysis of the legal precedent this case may set: [Discuss the potential for this case to set a new precedent for future shareholder lawsuits and influence how M&A deals are structured and negotiated going forward].

Conclusion: Understanding the Ramifications of the Expedited Shareholder Lawsuit

The expedited shareholder lawsuit following the rejection of the Paramount-Skydance merger marks a significant development in corporate law and M&A practices. The judge's ruling has dramatically accelerated the legal proceedings and highlights the growing importance of shareholder rights and transparency in large-scale corporate transactions. The outcome of this case will undoubtedly influence future merger negotiations and could significantly reshape the landscape of the entertainment industry's M&A activity. This case underscores the need for careful due diligence and a robust approach to shareholder relations in any significant business merger. Stay updated on this pivotal shareholder lawsuit and its impact on the entertainment industry by following our future coverage.

Featured Posts

-

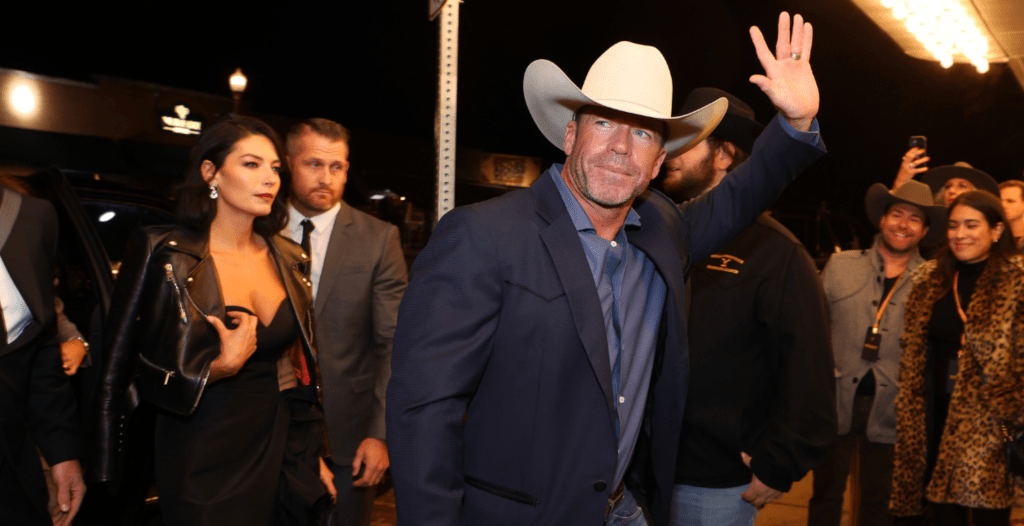

Is Taylor Sheridan Retiring Soon The Future Of Yellowstone

May 27, 2025

Is Taylor Sheridan Retiring Soon The Future Of Yellowstone

May 27, 2025 -

Hulus Alien Earth Fan Theories Point To Alien Vs Predator

May 27, 2025

Hulus Alien Earth Fan Theories Point To Alien Vs Predator

May 27, 2025 -

Nora Fatehi And Jason Derulos Snake Tops Uk British Asian Music Charts

May 27, 2025

Nora Fatehi And Jason Derulos Snake Tops Uk British Asian Music Charts

May 27, 2025 -

E Bay Faces Legal Action Over Banned Chemicals Section 230 At Issue

May 27, 2025

E Bay Faces Legal Action Over Banned Chemicals Section 230 At Issue

May 27, 2025 -

Voennaya Pomosch Ukraine Ot Germanii Ukreplenie Pvo Reb I Sistem Svyazi

May 27, 2025

Voennaya Pomosch Ukraine Ot Germanii Ukreplenie Pvo Reb I Sistem Svyazi

May 27, 2025

Latest Posts

-

Andre Agassi Revine In Actiune Debutul In Pickleball

May 30, 2025

Andre Agassi Revine In Actiune Debutul In Pickleball

May 30, 2025 -

El Legado Del Ex Numero 3 La Historia Detras De La Frase A Marcelo Rios

May 30, 2025

El Legado Del Ex Numero 3 La Historia Detras De La Frase A Marcelo Rios

May 30, 2025 -

Marcelo Rios Y La Frase Del Ex Numero 3 Un Analisis Profundo

May 30, 2025

Marcelo Rios Y La Frase Del Ex Numero 3 Un Analisis Profundo

May 30, 2025 -

La Inspiracion De Marcelo Rios Revelando La Poderosa Frase Del Ex Numero 3

May 30, 2025

La Inspiracion De Marcelo Rios Revelando La Poderosa Frase Del Ex Numero 3

May 30, 2025 -

Ex Numero 3 Del Mundo La Motivacion Tras La Frase A Marcelo Rios

May 30, 2025

Ex Numero 3 Del Mundo La Motivacion Tras La Frase A Marcelo Rios

May 30, 2025