Shein's IPO Plans In London Face Setback Due To US Tariffs

Table of Contents

The Impact of US Tariffs on Shein's IPO Prospects

The US has imposed significant tariffs on clothing imports from China, Shein's primary manufacturing base. These tariffs, designed to protect domestic industries, directly impact Shein's profitability and investor confidence. The increased cost of production significantly eats into profit margins, forcing Shein to either absorb these costs or raise prices, potentially impacting consumer demand.

-

Increased production costs directly reduce profit margins. Each percentage point increase in tariff translates to a direct reduction in Shein's already slim profit margins, making the company less attractive to potential investors looking for strong returns.

-

Higher prices may lead to decreased consumer demand. Passing the increased costs onto consumers through higher prices risks alienating the price-sensitive customer base that Shein has cultivated. This could lead to decreased sales and further damage the company's financial outlook.

-

Negative investor sentiment due to reduced profitability. Investors are acutely aware of the tariff situation and the uncertainty it creates. This uncertainty, coupled with reduced profitability, can severely dampen investor enthusiasm, making it harder for Shein to secure the necessary funding for its planned Shein IPO.

-

Uncertainty surrounding future tariff changes adds risk. The ever-changing nature of US trade policy adds another layer of risk. The possibility of further tariff increases or unexpected changes in policy creates instability and makes accurate financial forecasting incredibly difficult for Shein.

Alternative Strategies Shein Might Consider

Faced with these challenges, Shein needs to explore several strategies to mitigate the impact of US tariffs and improve its prospects for a successful Shein IPO.

-

Shifting production to countries with lower tariffs (e.g., Vietnam, Bangladesh). Diversifying its manufacturing base to countries with more favorable trade relationships with the US could significantly reduce the impact of tariffs. This, however, requires significant investment and logistical restructuring.

-

Investing in automation to reduce labor costs. Automation can help to offset increased production costs by reducing reliance on manual labor. This strategy requires substantial upfront investment but offers long-term cost savings.

-

Lobbying efforts to influence US trade policy. Shein could engage in lobbying efforts to advocate for a reduction or removal of tariffs on its products. This is a long-term strategy with an uncertain outcome.

-

Adjusting pricing strategies to balance profitability and competitiveness. Shein could explore more nuanced pricing strategies, potentially offering discounts in certain markets or focusing on higher-margin products to maintain profitability.

The London Stock Exchange's Appeal and Potential Alternatives

Shein initially chose the London Stock Exchange for its IPO, likely attracted by access to European markets and a relatively favorable regulatory environment compared to other major exchanges. London also offers a potential route to tapping into a large pool of international investors.

-

Access to European markets and investors. The UK is a gateway to the European Union, providing access to a vast consumer market and a large base of investors interested in global fashion brands.

-

Regulatory environment in London. London’s well-established regulatory framework provides a degree of stability and transparency, making it an attractive location for IPOs.

-

Potential for higher valuation on certain exchanges. While London offers many benefits, other exchanges like New York or Hong Kong might potentially offer a higher valuation depending on investor sentiment and market conditions. Shein needs to carefully weigh these factors when making a final decision.

-

Impact of geopolitical factors on IPO decisions. Geopolitical factors play a significant role. Brexit and its implications for trade with the EU, as well as ongoing tensions between the US and China, add considerable complexity to Shein’s IPO decision.

Shein's Public Image and Ethical Concerns

Shein's business practices have attracted scrutiny regarding fast fashion, labor conditions, and environmental impact. These ethical concerns are increasingly important to investors, influencing their decisions and impacting the potential valuation of the Shein IPO. Negative publicity and the ongoing debate surrounding these issues can deter potential investors. Addressing these concerns transparently is crucial for Shein's long-term success and investor confidence.

-

Negative media coverage can deter investors. Negative press surrounding labor practices and environmental concerns can impact investor confidence and make it more challenging to secure the necessary funding.

-

ESG (Environmental, Social, and Governance) concerns are increasingly important for investors. Many investors now prioritize ESG factors in their investment decisions, making it crucial for Shein to demonstrate a commitment to sustainability and ethical practices.

-

Addressing ethical concerns is crucial for long-term success. Addressing these concerns not only helps attract ethically conscious investors but also improves the company's long-term reputation and sustainability.

Conclusion

Shein's planned London IPO faces significant headwinds due to US tariffs. The increased costs and the uncertainty they create significantly impact Shein's profitability and attractiveness to investors. While alternative strategies exist, the challenges are substantial, requiring a multifaceted approach. Shein's response to these challenges will be crucial in determining the success of its IPO and its future growth. Staying informed about the developments regarding the Shein IPO and its future plans is essential for understanding the future of this fast-fashion giant.

Featured Posts

-

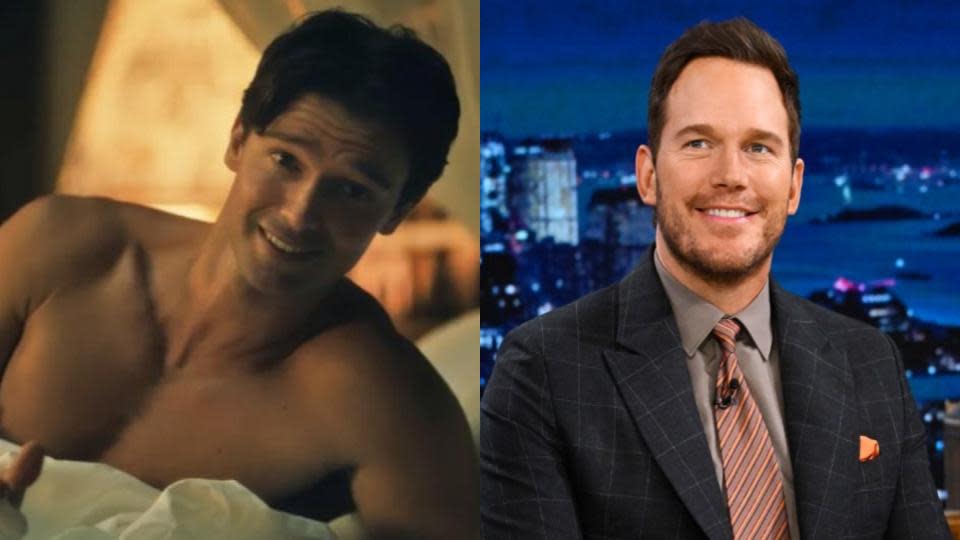

Pratt On Schwarzeneggers Full Frontal A Surprising Endorsement

May 06, 2025

Pratt On Schwarzeneggers Full Frontal A Surprising Endorsement

May 06, 2025 -

Chris Pratt Reacts To Patrick Schwarzenegger In White Lotus

May 06, 2025

Chris Pratt Reacts To Patrick Schwarzenegger In White Lotus

May 06, 2025 -

Celtics Vs Heat Game On February 10th Where To Watch

May 06, 2025

Celtics Vs Heat Game On February 10th Where To Watch

May 06, 2025 -

Halle Bailey Turns 25 See Photos From Her Birthday Celebration

May 06, 2025

Halle Bailey Turns 25 See Photos From Her Birthday Celebration

May 06, 2025 -

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025

Latest Posts

-

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025 -

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025 -

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025 -

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son

May 06, 2025