Shein's London IPO: The US Tariff Hurdle

Table of Contents

Shein's Business Model and its Vulnerability to US Tariffs

Shein's ultra-fast fashion business model relies heavily on low manufacturing costs and incredibly high sales volume. This strategy, while successful in achieving significant market share, makes it particularly vulnerable to US tariffs. Shein's dependence on the US market, combined with its predominantly Chinese manufacturing base, creates a direct exposure to the existing tariffs on textile and apparel imports.

- High volume, low-margin sales strategy: Shein thrives on selling vast quantities of clothing at low prices, making profit margins slim.

- Significant dependence on Chinese manufacturing: The vast majority of Shein's garments are produced in China, leveraging lower labor and production costs.

- Large percentage of sales destined for the US market: The US is a crucial market for Shein, representing a substantial portion of its overall revenue.

- Current US tariffs on textile and apparel imports: These tariffs, implemented as part of trade disputes, increase the cost of goods sold (COGS) for Shein, impacting its already tight profit margins.

These increased costs, directly attributable to US tariffs, reduce Shein's competitiveness in the US market, forcing it to either absorb the increased costs or raise prices, potentially impacting sales volume. The Shein trade war, in effect, is being fought on the front lines of global trade.

The London IPO as a Strategic Move

Shein's choice of the London Stock Exchange over other major exchanges like New York or Hong Kong is a strategic decision with several potential advantages.

- Access to a large pool of international investors: London offers access to a diverse and substantial investor base, potentially securing greater funding for expansion.

- Potentially less stringent regulatory requirements than the US: The regulatory environment in London may be more accommodating to fast-fashion companies than in the US, simplifying the IPO process.

- Strategic positioning for European and global expansion: A London listing strengthens Shein's position for further growth within Europe and other global markets.

- Potential for avoiding some US regulatory scrutiny: Listing in London might offer Shein some distance from potential US regulatory investigations or scrutiny.

However, a London listing also has potential drawbacks. The US market remains crucial, and a London IPO might not fully alleviate the pressure of US tariffs. The Shein US Tariffs remain a significant obstacle, regardless of where the IPO takes place.

Potential Strategies to Mitigate Tariff Impacts

To lessen the impact of US tariffs, Shein could employ several strategies:

- Diversifying manufacturing locations: Shifting production to countries like Vietnam or Bangladesh could reduce reliance on China and potentially lower tariffs.

- Negotiating with the US government for tariff reductions: Shein could lobby for tariff reductions or exemptions, a complex but potentially impactful strategy.

- Adjusting pricing strategies: Absorbing some tariff costs or strategically raising prices on certain products could be considered, although this risks impacting sales.

- Focusing on higher-margin product lines: Shifting towards higher-value items could offset the impact of tariffs on lower-margin products.

- Investing in technology to streamline supply chains and reduce costs: Technological advancements can lead to greater efficiency and cost reduction throughout the supply chain.

The feasibility and effectiveness of each strategy depend on various factors, including geopolitical conditions and the overall competitiveness of the global fast-fashion market.

The Impact of Geopolitical Factors

The ongoing trade tensions between China and the US significantly influence Shein's IPO plans. These tensions create uncertainty in the global market, potentially affecting investor confidence and the overall success of the Shein London IPO. Negative sentiment surrounding the Sino-US relationship could impact the valuation of Shein and make securing the desired funding more challenging.

Conclusion

Shein's pursuit of a London IPO presents a complex challenge, with US tariffs creating significant headwinds. The US market remains vital for Shein's continued success, making the tariff issue a critical factor. The potential mitigation strategies outlined above—diversification, negotiation, pricing adjustments, and technological investments—are crucial for navigating this hurdle. The success of Shein's London IPO hinges on its ability to effectively address the US tariff challenge. Further analysis of Shein's strategic response to these tariffs will be crucial in understanding the long-term implications for this fast-fashion giant. Stay tuned for updates on Shein's IPO and its ongoing battle with US trade policies.

Featured Posts

-

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025 -

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025 -

Early Kentucky Derby 2025 Odds And Analysis Who Are The Favorites

May 05, 2025

Early Kentucky Derby 2025 Odds And Analysis Who Are The Favorites

May 05, 2025 -

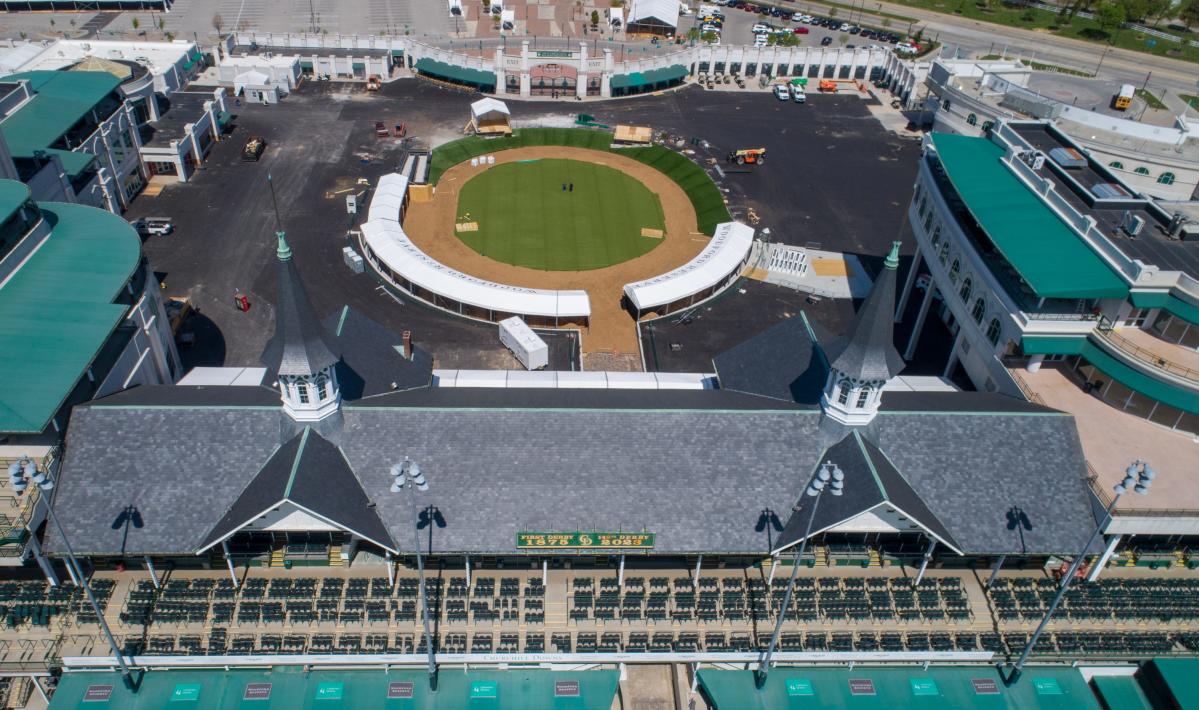

Renovation Race Against Time Churchill Downs Prepares For Kentucky Derby

May 05, 2025

Renovation Race Against Time Churchill Downs Prepares For Kentucky Derby

May 05, 2025 -

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 05, 2025

Ufc 314 Volkanovski Lopes Main Event And Full Fight Card Preview

May 05, 2025

Latest Posts

-

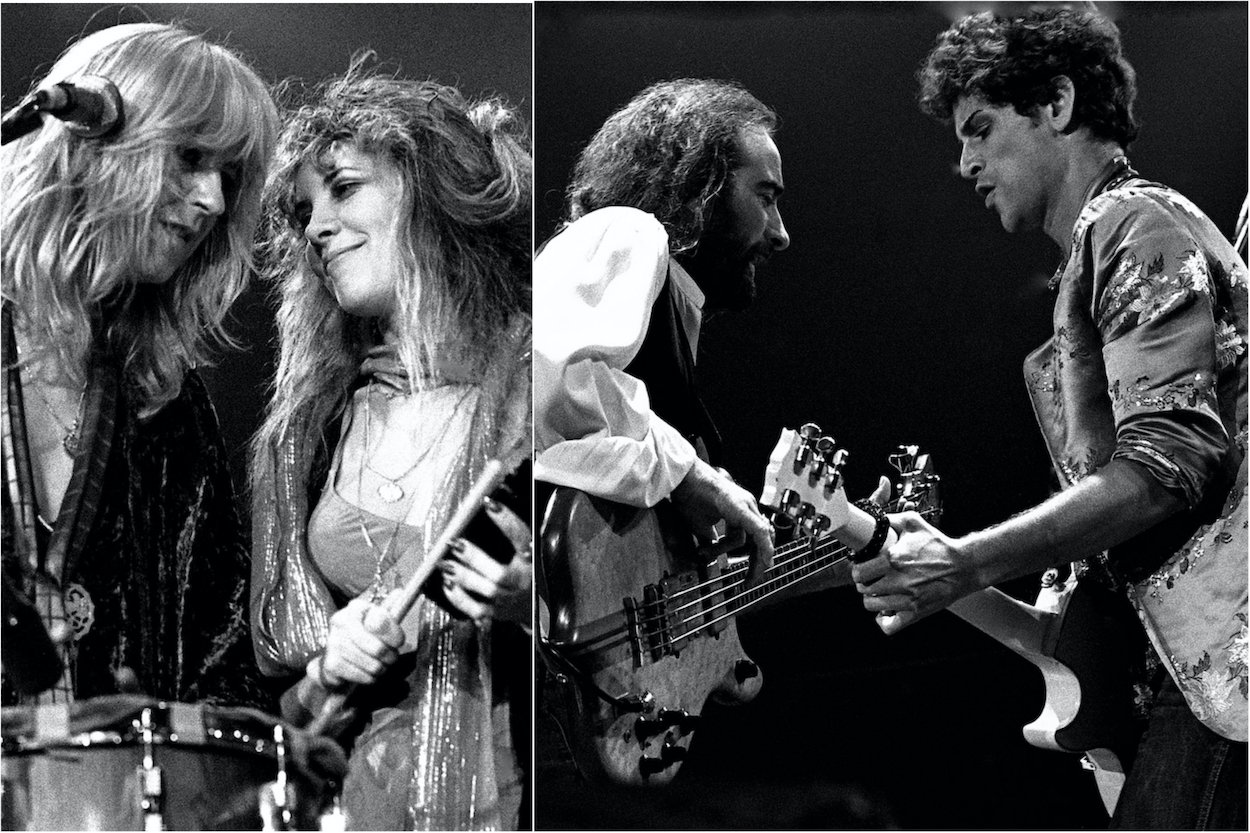

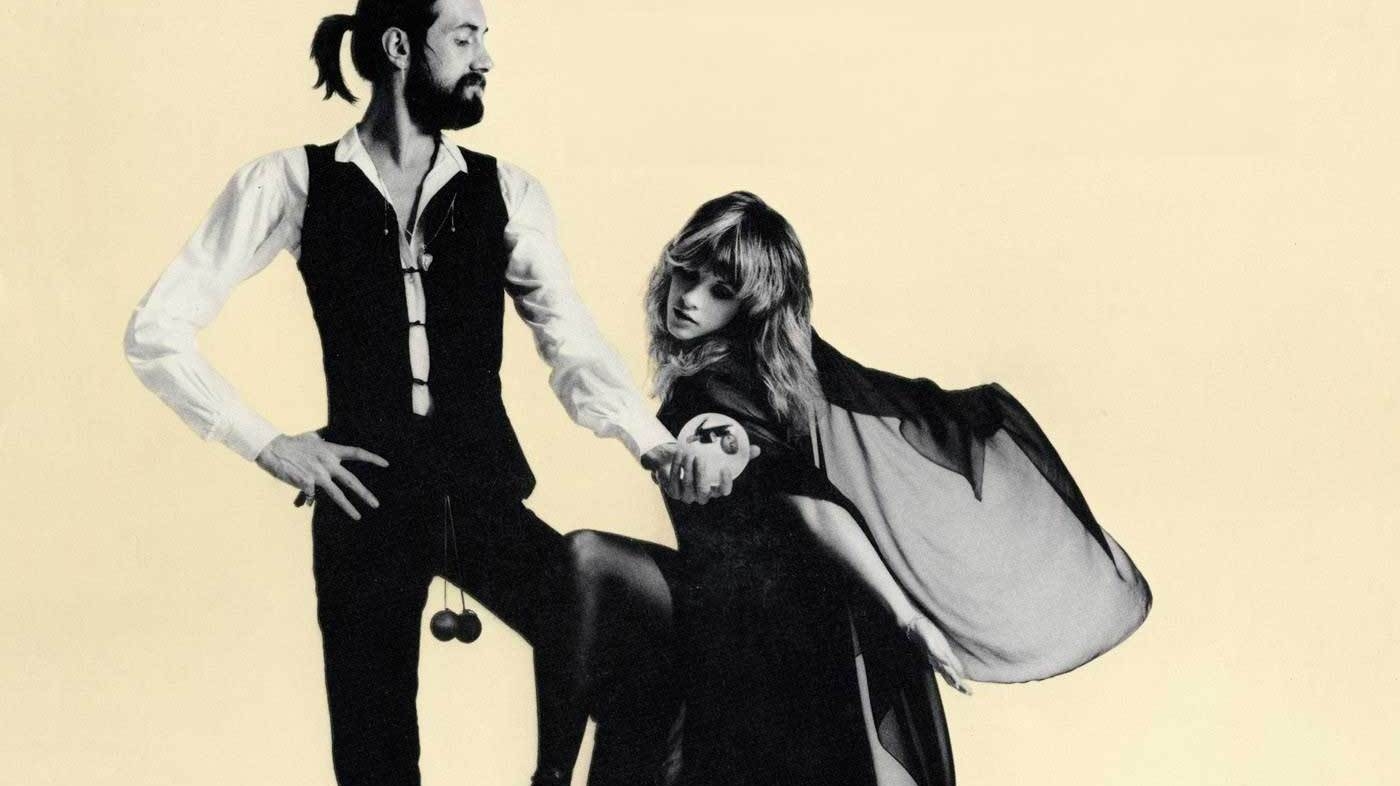

The Lasting Legacy Of Fleetwood Mac Pioneering The Supergroup Concept

May 05, 2025

The Lasting Legacy Of Fleetwood Mac Pioneering The Supergroup Concept

May 05, 2025 -

Fleetwood Macs Rumours The Genesis Of The Modern Supergroup

May 05, 2025

Fleetwood Macs Rumours The Genesis Of The Modern Supergroup

May 05, 2025 -

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025 -

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025 -

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025