Shopify Stock Market Reaction: Nasdaq 100 Addition

Table of Contents

Immediate Market Reaction to Nasdaq 100 Inclusion

Short-Term Stock Price Volatility

The announcement of Shopify's inclusion in the Nasdaq 100 resulted in immediate, albeit relatively contained, price fluctuations. While the exact percentage change varied depending on the specific timeframe, initial reports indicated a moderate increase in Shopify's stock price. Trading volume also experienced a noticeable surge, reflecting heightened investor interest and activity.

- Investor Sentiment: The overall market sentiment at the time of the announcement played a significant role. Positive investor sentiment generally amplified the positive reaction to the Nasdaq 100 inclusion. Conversely, negative broader market trends could have dampened the impact.

- Buying and Selling Pressure: The inclusion likely triggered increased buying pressure as investors sought to add Shopify to their portfolios, particularly those tracking the Nasdaq 100 index. However, some profit-taking might have created countervailing selling pressure.

- Concurrent Market Events: It's crucial to acknowledge any other significant news or events impacting the broader market around the time of the announcement. These external factors could have influenced the overall market reaction to Shopify's inclusion.

Analyst Reactions and Predictions

Following the announcement, financial analysts offered a range of opinions and predictions regarding Shopify's future stock performance. While the consensus appeared positive, reflecting the overall bullish sentiment towards the company, the specific price targets varied considerably.

- Price Targets: Individual analysts provided diverse price targets for Shopify stock, reflecting different assumptions about the company's future growth and the broader market conditions. These price targets offered a range of potential outcomes for investors.

- Bullish vs. Cautious Opinions: Some analysts maintained a bullish outlook, citing Shopify's strong market position and growth potential within the e-commerce sector. Others expressed more cautious views, highlighting potential challenges or uncertainties related to the competitive landscape or macroeconomic factors.

Factors Influencing Shopify's Stock Price

E-commerce Market Growth and Shopify's Position

Shopify’s stock price is intrinsically linked to the performance of the e-commerce market. Shopify enjoys a significant market share within this rapidly expanding sector, benefiting from increasing online retail adoption.

- Market Share and Competition: Shopify's competitive positioning within the e-commerce platform market is a key factor affecting its stock. Analysis of its market share compared to competitors helps investors assess its growth potential.

- Industry Trends: The broader trends within the e-commerce industry, such as mobile commerce, omnichannel strategies, and the adoption of new technologies, significantly influence Shopify's prospects.

Company Performance and Financial Results

Shopify's financial performance, as reflected in its quarterly and annual reports, directly impacts investor confidence and its stock price.

- Revenue Growth and Profitability: Consistent revenue growth and improving profitability are crucial indicators of Shopify's financial health and its ability to deliver returns to shareholders. Investors closely scrutinize these metrics.

- Key Performance Indicators (KPIs): Other key metrics, such as customer acquisition costs, merchant retention rates, and average revenue per user (ARPU), provide valuable insights into the company's operational efficiency and overall performance. These directly correlate with the stock’s performance.

Macroeconomic Factors and Market Sentiment

Broader economic conditions and overall market sentiment significantly impact Shopify's stock price, regardless of its internal performance.

- Interest Rates and Inflation: Changes in interest rates and inflation can affect investor risk appetite and the overall valuation of growth stocks like Shopify.

- Investor Confidence: Overall investor confidence, often driven by geopolitical events or economic news, significantly influences the stock market's performance, including Shopify's stock.

Long-Term Implications and Investment Opportunities

Nasdaq 100 Inclusion and Investor Appeal

Inclusion in the Nasdaq 100 index substantially boosts Shopify's visibility and appeal to a wider range of investors.

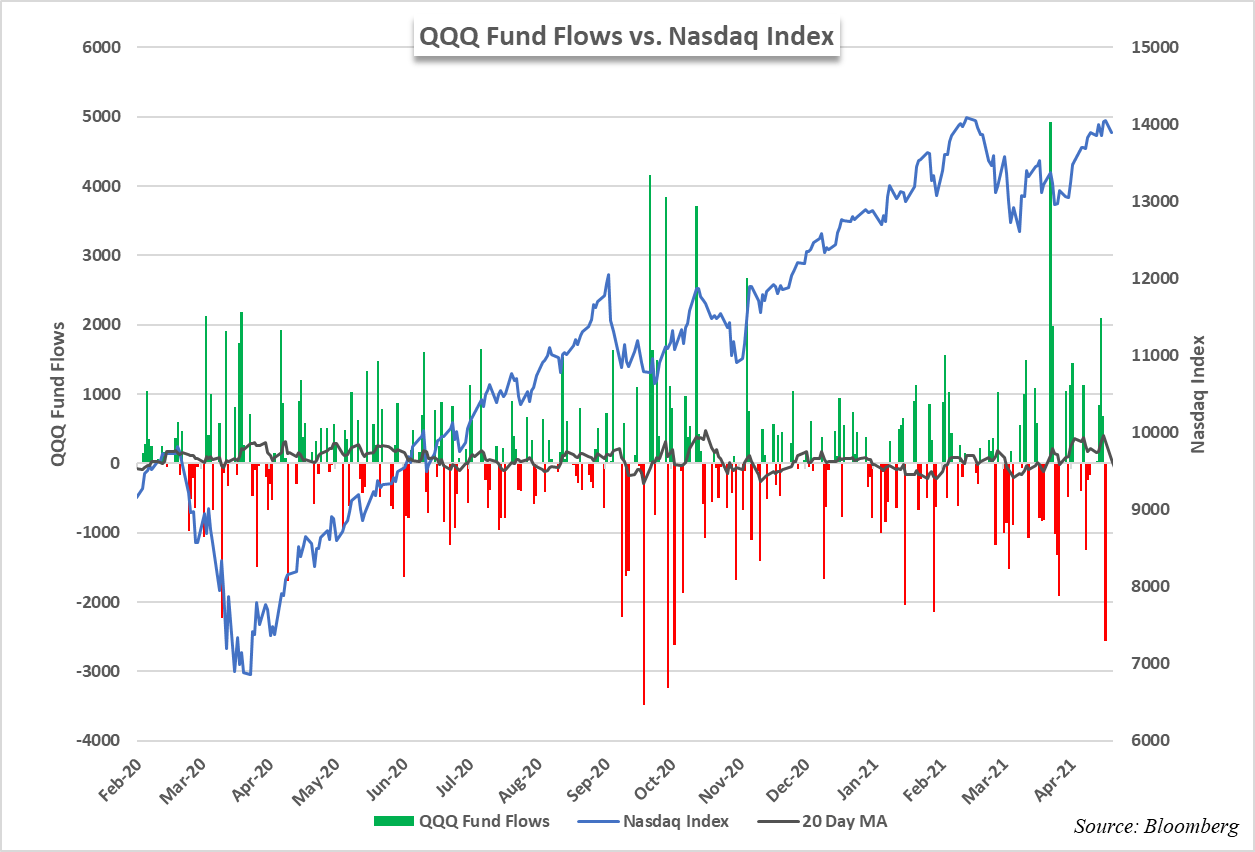

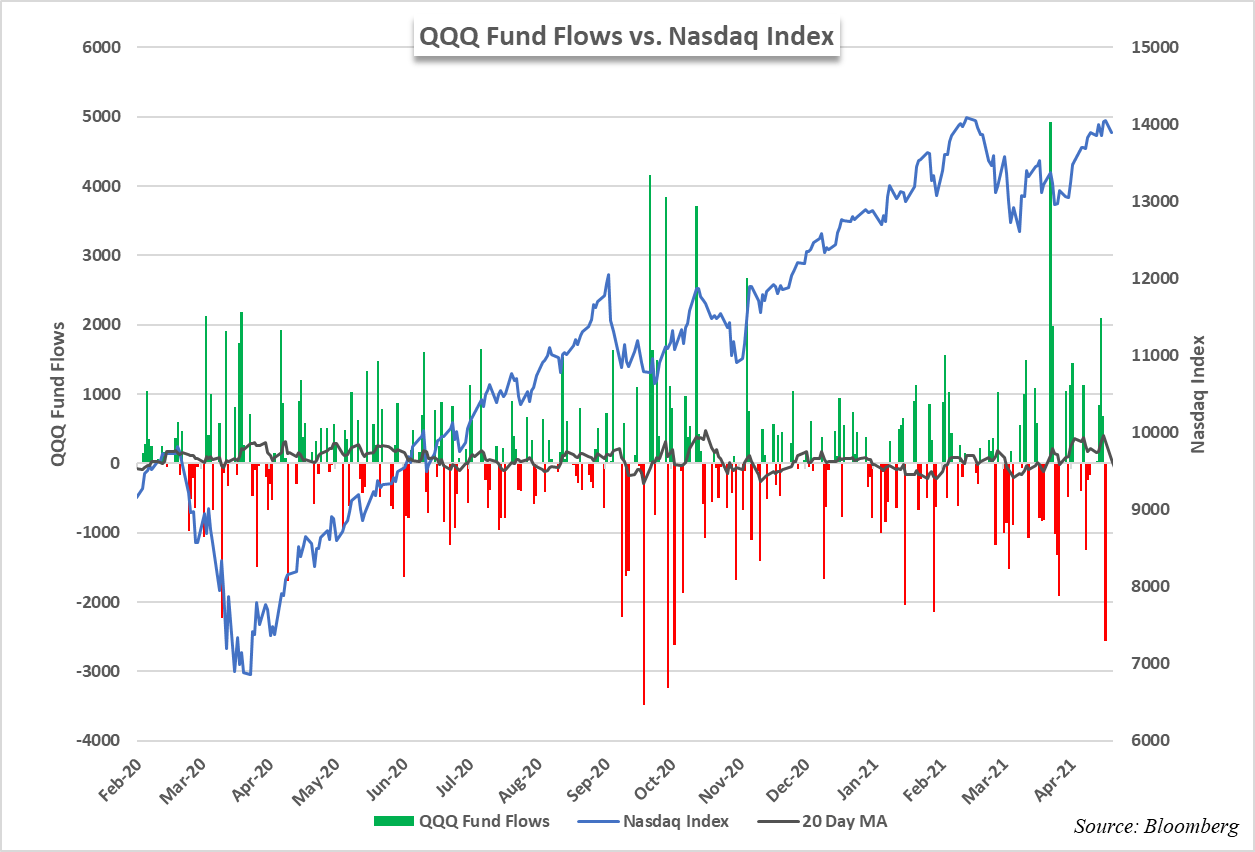

- Index Funds and ETFs: Many index funds and exchange-traded funds (ETFs) tracking the Nasdaq 100 will now include Shopify, leading to passive investment inflows.

- Increased Trading Volume and Liquidity: Inclusion improves trading volume and liquidity for Shopify stock, making it more attractive to both institutional and individual investors.

Growth Potential and Future Projections

Shopify's long-term growth potential remains strong, given its ongoing innovation and expansion into new markets.

- New Features and Product Development: Shopify's continuous investment in new features and product development helps it maintain a competitive edge and expand its market reach.

- Future Revenue Streams and Growth Potential: Shopify's strategic expansion into areas such as payments and logistics provides significant opportunities for future revenue growth and potential diversification.

Conclusion

The inclusion of Shopify in the Nasdaq 100 index has resulted in a complex market reaction, influenced by both short-term volatility and long-term growth potential. While short-term price fluctuations are to be expected, the long-term outlook for Shopify remains positive given its strong position in the e-commerce market and ongoing innovation. Its increased visibility and accessibility through index funds should further fuel its growth.

Call to Action: Stay informed about the ongoing Shopify stock market reaction and its performance within the Nasdaq 100. Continue to research Shopify's financial reports, industry trends, and its competitive positioning to make informed investment decisions regarding Shopify stock and its future performance within the NASDAQ.

Featured Posts

-

Staten Islands Best Nonna Restaurants Authentic Italian Cuisine

May 14, 2025

Staten Islands Best Nonna Restaurants Authentic Italian Cuisine

May 14, 2025 -

Nuit Des Musees 2025 Cinema A La Fondation Seydoux Pathe

May 14, 2025

Nuit Des Musees 2025 Cinema A La Fondation Seydoux Pathe

May 14, 2025 -

The 1987 Horror Snow White Did It Predict Disneys Remake Choices

May 14, 2025

The 1987 Horror Snow White Did It Predict Disneys Remake Choices

May 14, 2025 -

Selin Dion Biografiya Khvoroba Osobiste Zhittya Ostannya Informatsiya

May 14, 2025

Selin Dion Biografiya Khvoroba Osobiste Zhittya Ostannya Informatsiya

May 14, 2025 -

Gewinnzahlen Eurojackpot Ziehung Vom 14 Maerz 2025 Freitag

May 14, 2025

Gewinnzahlen Eurojackpot Ziehung Vom 14 Maerz 2025 Freitag

May 14, 2025