Should You Buy Palantir Stock? Analyzing The Pre-May 5th Outlook

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's recent performance is crucial for any Palantir stock analysis. We need to look beyond the headlines and examine the underlying financial health of the company.

Revenue Growth and Profitability

Palantir's revenue growth has been a key factor driving investor interest. Let's examine the numbers:

- Q4 2022: [Insert actual Q4 2022 revenue figures and growth percentage compared to Q4 2021]. This demonstrates [positive or negative, explain the significance].

- Full Year 2022: [Insert actual full-year 2022 revenue and growth percentage compared to 2021]. This represents [positive or negative, explain the significance in relation to Palantir's overall financial performance].

- Operating Margins: [Insert data on operating margins, explaining trends and comparison to industry benchmarks]. Improving margins are a positive sign of Palantir's increasing profitability and efficiency.

- Net Income: [Insert data on net income, explaining trends and comparison to previous periods]. This is a crucial metric reflecting the company's overall financial health and success in turning revenue into profit.

These figures, when viewed alongside industry benchmarks, give a clearer picture of Palantir's financial performance and its potential for future profitability. Understanding Palantir revenue trends is essential for evaluating the Palantir stock investment potential.

Government vs. Commercial Contracts

Palantir's revenue stream is split between government and commercial contracts. Understanding this balance is crucial for a comprehensive Palantir stock analysis.

- Government Contracts: These provide a stable, albeit potentially less rapidly growing, revenue source. [Discuss the size and stability of government contracts, and potential risks associated with government budget cuts or changes in policy].

- Commercial Contracts: This sector presents higher growth potential but also carries greater risk. [Discuss the growth rate, potential for expansion, and competition within the commercial market. Mention key commercial clients and their significance].

The diversification of Palantir's client base is a key factor in mitigating risk. Analyzing the balance between Palantir government contracts and Palantir commercial clients offers crucial insight into the company's long-term financial sustainability.

Key Partnerships and Strategic Initiatives

Strategic partnerships and innovative initiatives can significantly impact Palantir's future trajectory. Here are some key examples:

- [Partnership 1]: [Brief description, highlighting its potential impact on Palantir's growth and market position. Include a link to a relevant news article if available].

- [Partnership 2]: [Brief description, highlighting its potential impact on Palantir's growth and market position. Include a link to a relevant news article if available].

- [New Initiative 1]: [Brief description of any new product or service, explaining its potential market impact].

These developments demonstrate Palantir's commitment to innovation and expansion, significantly contributing to its Palantir stock valuation and overall growth potential.

Market Analysis and Valuation of Palantir Stock

Understanding the market dynamics and Palantir's valuation is crucial for any Palantir stock investment decision.

Stock Price Trends and Volatility

Analyzing Palantir's stock price trends reveals significant information about investor sentiment and market expectations.

- [Insert a chart or graph illustrating recent stock price movements]. [Analyze the chart, highlighting significant highs and lows, and explaining the events that caused major fluctuations].

- [Mention any recent news events or analyst reports that impacted the Palantir stock price].

This analysis of Palantir stock price reveals its volatility and the impact of external factors on investor confidence.

Competitor Analysis

Palantir operates in a competitive landscape. Understanding its key competitors is crucial for a comprehensive Palantir stock analysis.

- [List key competitors, such as [Competitor A], [Competitor B], etc.].

- [Compare Palantir's strengths and weaknesses against its key competitors, focusing on factors like technology, market share, and customer base].

Assessing Palantir's competitive advantage and market share is critical for understanding its long-term growth prospects.

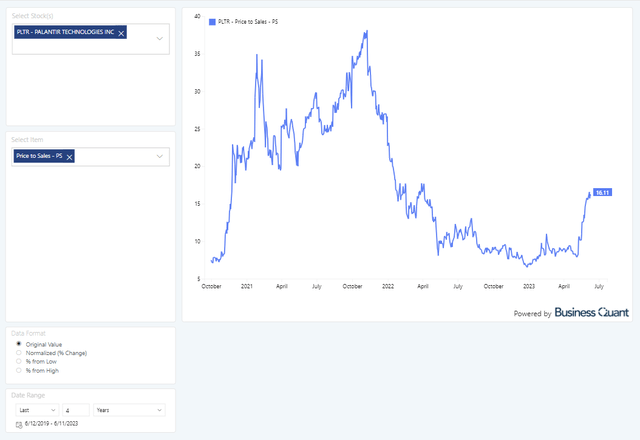

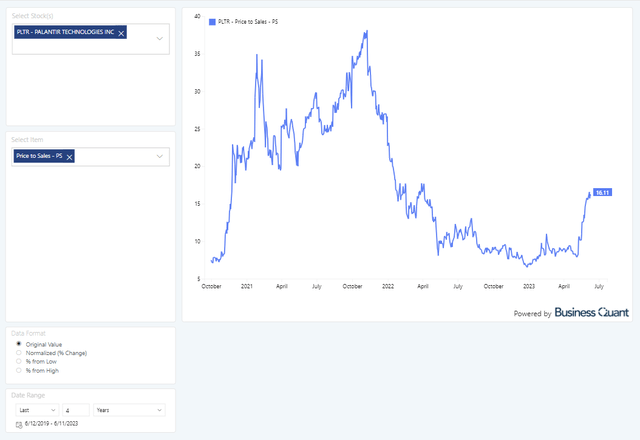

Valuation Metrics (P/E Ratio, etc.)

Analyzing Palantir's valuation using key metrics like the Price-to-Earnings (P/E) ratio provides valuable insights.

- [Provide Palantir's current P/E ratio and compare it to industry averages and similar companies]. [Explain the significance of this comparison].

- [Mention other relevant valuation metrics, such as PEG ratio, Price-to-Sales ratio, etc., explaining their implications for investors].

Risks and Opportunities Associated with Investing in Palantir Stock

Every investment carries risks and opportunities. Understanding these factors is vital before investing in Palantir stock.

Potential Risks

Investing in Palantir stock involves several inherent risks:

- Market Volatility: The tech sector is known for its volatility. [Explain how this affects Palantir stock].

- Competition: The competitive landscape is intense. [Explain how this could impact Palantir's growth and profitability].

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. [Explain the risks associated with this dependence].

Potential Growth Opportunities

Despite the risks, Palantir has significant growth potential:

- Expansion into New Markets: Palantir can expand into new sectors and geographical regions. [Explain the potential for growth in these areas].

- Development of Innovative Technologies: Palantir's continued investment in R&D could lead to groundbreaking technologies. [Explain the potential impact of these technologies].

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

Our pre-May 5th analysis of Palantir reveals a company with significant growth potential but also inherent risks. The strong revenue growth and innovative initiatives are positive signs, but market volatility and competition remain considerable concerns. Based on our analysis, [State your recommendation: Buy, Sell, Hold, or Further Research Needed] This recommendation is primarily based on [Mention the key factors that informed your recommendation, referencing specific points from the analysis].

Ultimately, the decision of whether or not to buy Palantir stock rests with you. This analysis serves as a starting point for your own research. We encourage you to conduct further due diligence and consider your personal risk tolerance before making any investment decisions. Learn more about Palantir stock and start your Palantir stock research today!

Featured Posts

-

Transgender Individuals And The Legacy Of Trumps Executive Orders We Want To Hear From You

May 10, 2025

Transgender Individuals And The Legacy Of Trumps Executive Orders We Want To Hear From You

May 10, 2025 -

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 10, 2025

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 10, 2025 -

Nyt Strands Crossword April 6 2025 Complete Guide To Solving

May 10, 2025

Nyt Strands Crossword April 6 2025 Complete Guide To Solving

May 10, 2025 -

Nyt Strands Game 357 Complete Hints And Solutions For February 23

May 10, 2025

Nyt Strands Game 357 Complete Hints And Solutions For February 23

May 10, 2025 -

Unprovoked Racist Killing A Familys Devastating Loss

May 10, 2025

Unprovoked Racist Killing A Familys Devastating Loss

May 10, 2025