Should You Buy Palantir Stock Before May 5th? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Market Sentiment

Q4 2022 Earnings Recap

Palantir's Q4 2022 earnings report revealed a mixed bag. While the company exceeded revenue expectations, profitability remained a concern for some investors. Key metrics like revenue growth, while positive, fell slightly short of some analyst predictions. The company's guidance for the upcoming quarter also played a role in influencing investor sentiment. Understanding this context is crucial for analyzing the current Palantir stock price.

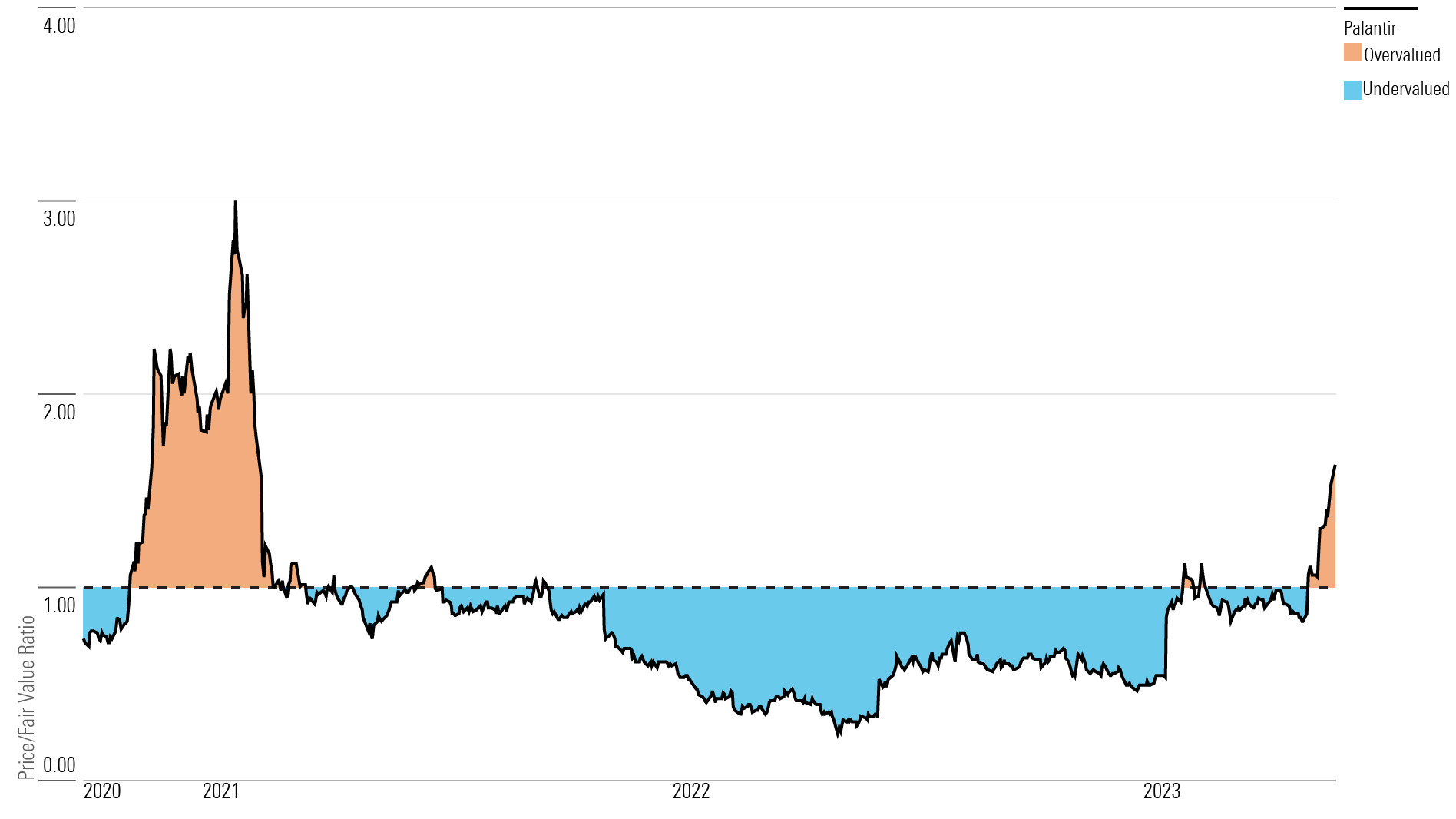

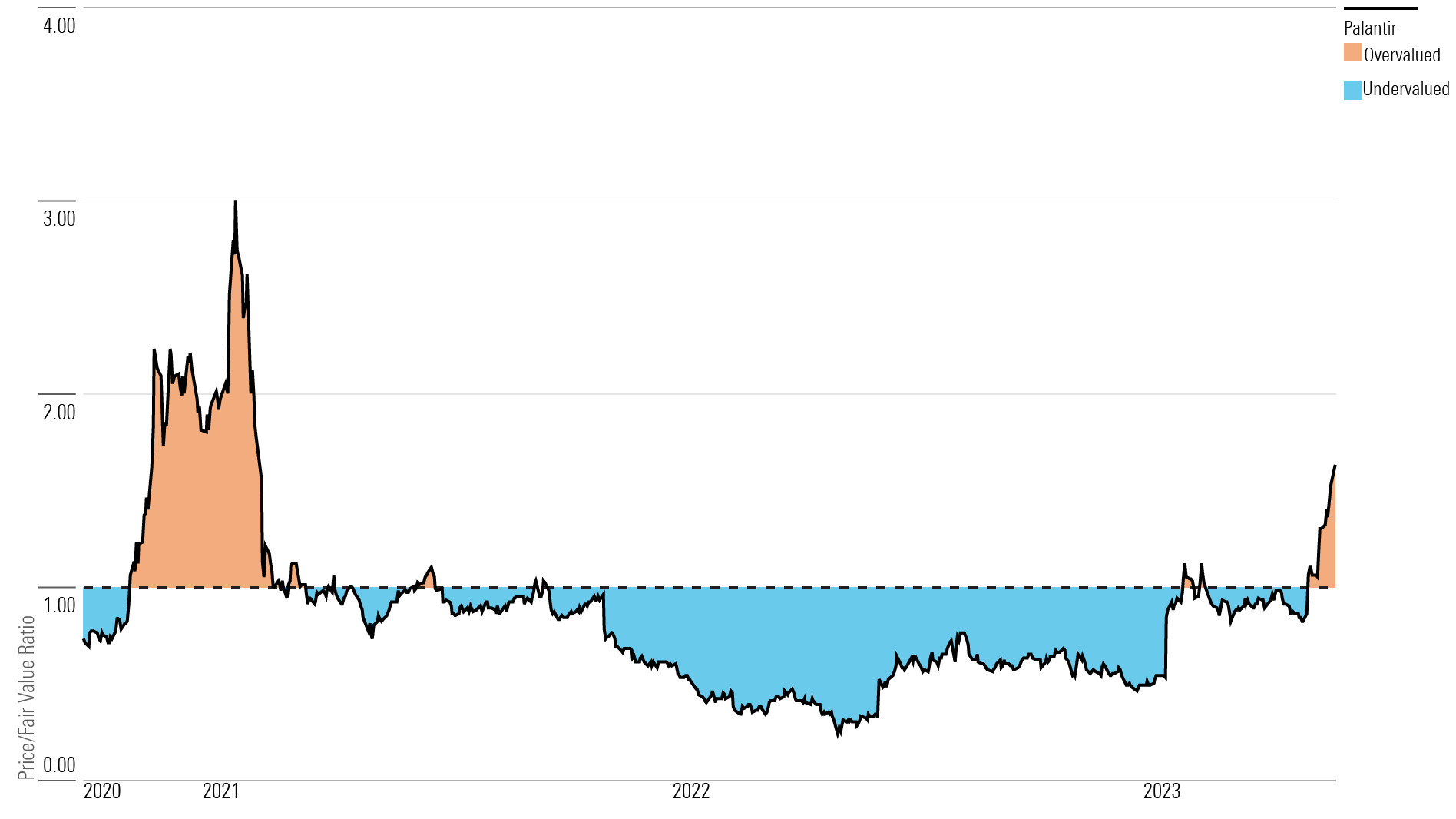

Stock Price Volatility

Palantir stock, like many tech stocks, has experienced significant price fluctuations in recent months. Factors contributing to this volatility include broader market conditions, investor sentiment shifts driven by macroeconomic factors like inflation and interest rate hikes, and news events impacting the broader technology sector and government spending. Analyzing historical price charts alongside these influencing factors provides a clearer picture of the current market sentiment surrounding Palantir stock.

- Key performance indicators (KPIs) from the last quarter: Revenue growth, operating income, net income, customer acquisition costs.

- Analyst ratings and price targets: A range of opinions from different analysts indicates differing expectations for future Palantir stock performance.

- Impact of geopolitical events on Palantir's business: Geopolitical instability can impact government contracts and overall investor confidence.

- Comparison to competitors in the big data analytics market: Analyzing Palantir's competitive position against companies like Databricks and Snowflake is essential for a comprehensive assessment.

Analyzing Palantir's Growth Prospects

Government Contracts and Revenue Streams

Government contracts represent a significant portion of Palantir's revenue. The company's success in securing and expanding these contracts is crucial for its future growth. Analyzing the pipeline of potential future government contracts and the potential for increased spending in defense and intelligence sectors is key to predicting Palantir's trajectory.

Commercial Market Expansion

Palantir is actively expanding its commercial customer base, targeting various sectors. Success in this area is vital for long-term growth and diversification away from its reliance on government contracts. Monitoring the progress of new commercial partnerships and the expansion of existing relationships will be important factors to consider when assessing Palantir stock. Successful implementations in healthcare, finance, and other sectors are positive indicators.

- Recent contract wins and their significance: New contract announcements often impact the Palantir stock price.

- Market size and growth potential for Palantir's services: The overall market for big data analytics is experiencing substantial growth, presenting significant opportunities.

- Competitive advantages of Palantir's technology: Palantir's proprietary technology gives it a competitive edge in data analysis.

- Potential risks and challenges to growth: Competition and the potential for budget cuts in the government sector represent key risks.

Key Factors to Consider Before May 5th

Earnings Expectations and Guidance

Analyst expectations for Palantir's Q1 2023 earnings report vary. Surpassing these expectations could lead to a positive stock price reaction, while falling short could trigger a decline. Closely examining the consensus earnings estimates and the company's own guidance will help predict the market’s response.

Risk Assessment

Investing in Palantir stock carries inherent risks. Market volatility, intense competition in the data analytics sector, and geopolitical uncertainty all pose potential threats. A thorough risk assessment is crucial before investing.

- Consensus earnings estimates: Review the range of estimates from various financial analysts.

- Potential upside and downside scenarios: Consider what could drive the stock price higher or lower based on the earnings report.

- Key metrics to watch in the earnings report: Focus on revenue growth, profitability, and customer acquisition costs.

- Risks associated with investing in the technology sector: The tech sector can be highly volatile, influenced by broader economic trends and technological disruptions.

Conclusion: Should You Buy Palantir Stock Before May 5th? Final Verdict and Call to Action

This pre-earnings analysis highlights the complexity of deciding whether to buy Palantir stock before May 5th. While Palantir exhibits growth potential in both government and commercial sectors, risks associated with market volatility and competition remain significant. The upcoming earnings report will be a crucial factor determining the stock's short-term trajectory. A thorough review of Palantir’s financials and a comprehensive understanding of the broader market conditions are vital.

Make an informed decision on whether to buy Palantir stock before May 5th by conducting your own thorough analysis. Remember to consult Palantir's investor relations website and other reliable financial resources to gather more information. Remember, this analysis is for informational purposes only and not financial advice. Investing in Palantir stock, like any stock, involves risk.

Featured Posts

-

Office365 Security Breach Millions In Losses Criminal Charges Filed

May 09, 2025

Office365 Security Breach Millions In Losses Criminal Charges Filed

May 09, 2025 -

Mediatheque Champollion A Dijon Degats Importants Apres Un Debut D Incendie

May 09, 2025

Mediatheque Champollion A Dijon Degats Importants Apres Un Debut D Incendie

May 09, 2025 -

Tatums All Star Game Takeaways His Honest Opinion Of Steph Curry

May 09, 2025

Tatums All Star Game Takeaways His Honest Opinion Of Steph Curry

May 09, 2025 -

Su Viec Bao Mau Danh Tre O Tien Giang Can Xu Ly Nghiem Minh Va Ngan Chan Tuong Tu

May 09, 2025

Su Viec Bao Mau Danh Tre O Tien Giang Can Xu Ly Nghiem Minh Va Ngan Chan Tuong Tu

May 09, 2025 -

Pakistan Stock Market Crash Operation Sindoor Triggers Kse 100 Plunge

May 09, 2025

Pakistan Stock Market Crash Operation Sindoor Triggers Kse 100 Plunge

May 09, 2025