Should You Buy Palantir Stock Before May 5th? A Prudent Investor's Guide

Table of Contents

Palantir's Recent Performance and Future Outlook

Analyzing Q4 2023 Earnings and Revenue Growth

Palantir's recent financial performance provides crucial insight into its current trajectory and potential for future growth. Analyzing Q4 2023 earnings reveals key performance indicators (KPIs) such as revenue growth, profitability, and earnings per share (EPS). Significant increases in these metrics signal positive momentum, while stagnation or decline warrants closer examination. For example, a strong revenue growth percentage exceeding industry averages indicates a healthy demand for Palantir's data analytics and AI-powered platforms.

The sources of this growth are equally important. A strong reliance on government contracts indicates stability, but diversification into the commercial sector shows broader market acceptance and potential for exponential growth. Comparing Palantir's performance to competitors like Databricks and Snowflake allows investors to gauge its competitive position and market share.

- Revenue growth percentage: (Insert actual Q4 2023 data if available, otherwise use estimates and cite sources)

- EPS figures: (Insert actual Q4 2023 data if available, otherwise use estimates and cite sources)

- Key contract wins: (List significant contract wins in Q4 2023 or the recent past)

- Market share analysis: (Provide an analysis of Palantir's market share compared to its competitors)

Assessing Palantir's Long-Term Growth Potential

Beyond the immediate quarterly results, assessing Palantir's long-term growth potential requires a deeper dive into its strategic initiatives and market opportunities. The company's expansion into new markets, particularly in the commercial sector, and its advancements in artificial intelligence (AI) and machine learning (ML) technologies will significantly influence its future success. The growing demand for sophisticated data analytics and AI solutions across various industries presents a considerable market opportunity.

However, potential risks and challenges exist. Intense competition from established players and emerging startups, as well as regulatory hurdles and geopolitical uncertainties, could impact Palantir's growth trajectory. A comprehensive risk assessment is crucial before investing in Palantir stock.

- Expansion into new markets: (Detail Palantir's expansion plans and their potential impact)

- Technological advancements: (Highlight key technological developments and their competitive advantages)

- Competitive landscape analysis: (Analyze the competitive landscape and Palantir's competitive strengths and weaknesses)

- Potential regulatory risks: (Discuss potential regulatory challenges and their potential impact)

Evaluating Palantir's Valuation and Stock Price

Understanding Palantir's Current Market Capitalization

Palantir's current stock price and market capitalization are essential factors in determining its valuation. Analyzing the Price-to-Earnings (P/E) ratio, along with other key valuation metrics like Price-to-Sales (P/S) and Price-to-Book (P/B), allows for a comparison to industry peers and historical trends. A high P/E ratio may suggest high growth expectations, but it also reflects higher risk. Understanding these metrics is crucial for determining whether the Palantir stock price is fairly valued or overvalued.

- Current stock price: (Insert current Palantir stock price)

- Market capitalization: (Insert Palantir's current market capitalization)

- P/E ratio: (Insert Palantir's current P/E ratio and compare it to industry averages)

- Comparison to competitors' valuations: (Compare Palantir's valuation to its main competitors)

Predicting Future Stock Price Movement

Predicting future stock price movements is inherently difficult, but analyzing potential catalysts and risks can offer valuable insights. New product launches, strategic partnerships, and positive regulatory developments could trigger significant price increases. Conversely, economic downturns, increased competition, or geopolitical instability could negatively impact the stock price. Consulting analyst predictions and price targets can provide additional perspective, but it's crucial to understand that these are not guarantees.

- Potential catalysts for growth: (Identify potential positive events that could boost the stock price)

- Risks to consider: (List potential negative events that could negatively impact the stock price)

- Analyst predictions and price targets: (Summarize analyst predictions and price targets, citing sources)

Considering the Risks and Rewards of Investing in Palantir Stock

Understanding the Volatility of Palantir Stock

Investing in a growth stock like Palantir carries inherent risks, primarily its volatility. Palantir's stock price has historically experienced significant fluctuations, reflecting the inherent uncertainty associated with high-growth companies. Understanding your risk tolerance is paramount before investing. A balanced investment portfolio, diversified across various asset classes, can mitigate the risk associated with Palantir stock price swings.

- Historical stock price volatility: (Illustrate the historical volatility of Palantir stock with charts or data)

- Risk tolerance assessment: (Emphasize the importance of assessing one's individual risk tolerance)

- Importance of diversification: (Stress the benefits of diversifying an investment portfolio)

Weighing the Potential Rewards Against the Risks

The decision of whether or not to buy Palantir stock hinges on weighing the potential rewards against the associated risks. While Palantir's long-term growth potential is substantial, the short-term volatility could lead to significant losses. A prudent investor will carefully assess their individual risk tolerance and investment goals before committing to this investment.

- Potential long-term returns: (Summarize the potential for long-term returns based on the analysis above)

- Potential short-term losses: (Highlight the potential for short-term losses due to stock price volatility)

- Overall risk-reward profile: (Provide a balanced summary of the overall risk-reward profile of Palantir stock)

Conclusion

This guide offers a prudent investor's perspective on whether to buy Palantir stock before May 5th. While Palantir presents significant long-term growth potential fueled by its innovative data analytics and AI capabilities, it's crucial to acknowledge the inherent risks and volatility associated with this investment. Before making any decision regarding Palantir stock, conduct your own thorough due diligence, analyze the company's financials, and consider your own risk tolerance and investment timeframe. Remember to diversify your portfolio and only invest what you can afford to lose. Consult with a qualified financial advisor if needed. Should you buy Palantir stock? The final decision rests solely on your individual circumstances and investment goals.

Featured Posts

-

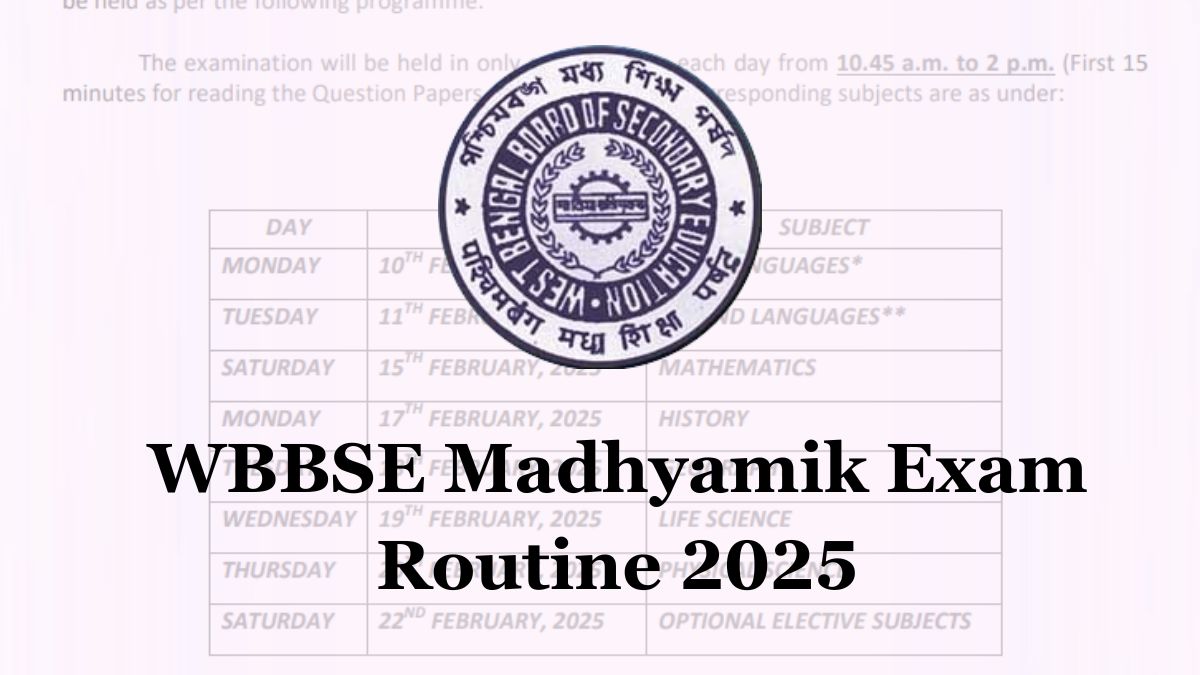

West Bengal Board Madhyamik Merit List 2025

May 10, 2025

West Bengal Board Madhyamik Merit List 2025

May 10, 2025 -

Wynne Evans Bbc Meeting Postponed A Cosy Day Out With Girlfriend Liz

May 10, 2025

Wynne Evans Bbc Meeting Postponed A Cosy Day Out With Girlfriend Liz

May 10, 2025 -

Bof A Reassures Investors Why Stretched Valuations Arent A Threat

May 10, 2025

Bof A Reassures Investors Why Stretched Valuations Arent A Threat

May 10, 2025 -

High Potential Still A Psych Spiritual Powerhouse 11 Years Later

May 10, 2025

High Potential Still A Psych Spiritual Powerhouse 11 Years Later

May 10, 2025 -

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025