Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Analyzing Current Market Sentiment Towards Palantir PLTR

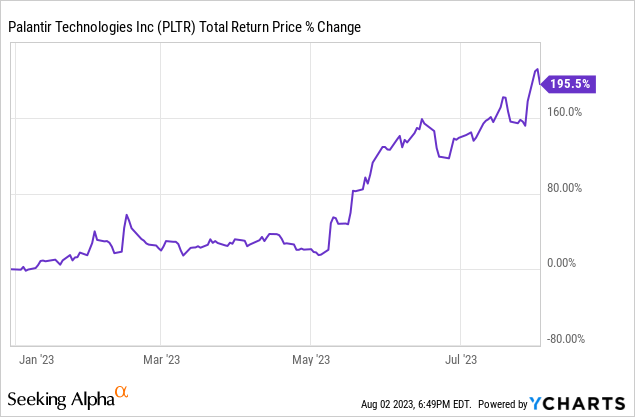

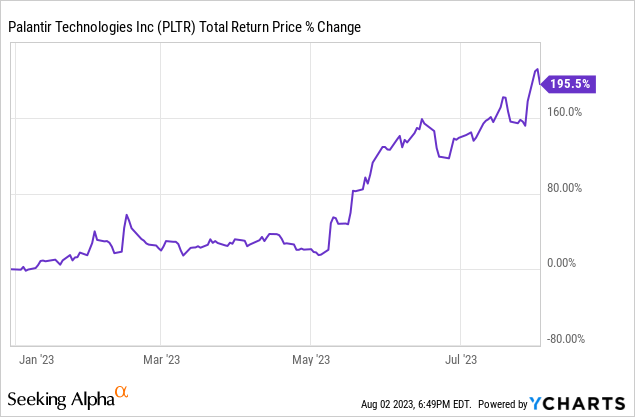

H3: Recent Stock Performance and Volatility: Palantir stock price has experienced significant volatility in recent months. While it has shown periods of growth, it's also seen sharp drops, reflecting the inherent risk in investing in this growth-oriented company.

- Price Point Example: In the last quarter, PLTR saw a high of [Insert recent high price] and a low of [Insert recent low price], representing a [Percentage]% fluctuation. (Remember to replace the bracketed information with actual data.)

- Factors Contributing to Volatility: News regarding large contract wins or losses, overall market trends, and changes in analyst ratings all contribute to the volatility of the Palantir stock price. Geopolitical events and broader macroeconomic factors can also impact investor sentiment towards PLTR.

H3: Wall Street Analyst Ratings and Price Targets: Analyst opinions on Palantir are mixed. While some maintain a bullish outlook, citing the company's potential for growth in the government and commercial sectors, others express caution, citing concerns about profitability and competition.

- Analyst Ratings Example: Analyst A (Firm A) has a "Buy" rating with a price target of [Price]. Analyst B (Firm B) holds a "Hold" rating, while Analyst C (Firm C) has a "Sell" rating with a price target of [Price]. (Remember to replace the bracketed information with actual data from reputable sources).

- Divergence in Opinions: This divergence reflects the uncertainty surrounding Palantir's future performance. Some analysts emphasize the potential for significant revenue growth from expanding its commercial business, while others focus on the company's reliance on government contracts and the challenges of competing in a crowded market.

Key Factors Influencing Palantir's Stock Price Before May 5th

H3: Upcoming Earnings Report and Expectations: The May 5th earnings report is crucial for Palantir. Investors will scrutinize key metrics:

- Expected Revenue Growth: Analysts are predicting revenue growth in the range of [Percentage] to [Percentage] for the quarter. (Remember to replace with actual data from reliable sources.)

- Profitability: A key focus will be on Palantir's progress towards profitability. Any deviation from expectations regarding profit margins could significantly impact the stock price.

- Guidance: The company's forward guidance will be particularly important. Positive guidance for the coming quarters could boost investor confidence, while cautious or negative guidance might trigger a sell-off.

H3: Government Contracts and Commercial Growth: Palantir's revenue stream is diverse. Its success depends on both:

- Government Contracts: Securing large government contracts remains vital for Palantir's revenue. Any significant new contract wins or losses could dramatically shift investor sentiment.

- Commercial Growth: Expansion into the commercial sector is critical for long-term sustainability. Progress in this area will be a key indicator of Palantir's growth potential.

H3: Competition and Market Share: Palantir faces stiff competition in the big data and analytics market.

- Key Competitors: Competitors include established players like [List key competitors, e.g., IBM, Microsoft, etc.].

- Competitive Advantages: Palantir’s proprietary technology and strong relationships with government agencies provide competitive advantages. However, maintaining market share requires continuous innovation and adaptation.

Potential Risks and Rewards of Investing in Palantir Stock Before May 5th

H3: Risks Associated with Palantir Investment: Investing in Palantir carries inherent risks:

- High Volatility: The stock price is highly volatile, making it unsuitable for risk-averse investors.

- Government Contract Dependence: Reliance on government contracts exposes Palantir to potential disruptions from shifts in government priorities or budget cuts.

- Intense Competition: The competitive landscape is challenging, and Palantir needs to continuously innovate to maintain its market position.

H3: Potential Rewards and Long-Term Growth Prospects: Despite the risks, potential rewards exist:

- Significant Growth Potential: Palantir operates in a rapidly growing market with high demand for its services. A successful expansion into the commercial sector could unlock significant growth opportunities.

- First-Mover Advantage: Palantir’s early entry into the big data analytics market gives it a first-mover advantage.

- Technological Innovation: Continuous investment in R&D keeps Palantir at the forefront of technological advancements.

Conclusion

The decision of whether to buy Palantir stock before May 5th is complex. Wall Street shows a surprising lack of consensus, reflecting the uncertainty surrounding the upcoming earnings report and the company’s long-term prospects. While Palantir boasts significant growth potential and technological advantages, investors must weigh these against substantial risks including volatility, dependence on government contracts, and intense competition. Remember to thoroughly research Palantir's financials and consider your risk tolerance before making any investment in Palantir stock. Consult with a financial advisor before making any investment decisions. Carefully analyze all available information before buying Palantir stock.

Featured Posts

-

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025 -

Sensex And Nifty Rally 5 Key Factors Driving Todays Market Surge

May 09, 2025

Sensex And Nifty Rally 5 Key Factors Driving Todays Market Surge

May 09, 2025 -

Anchorage Arts A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts A Standing Ovation For Local Coverage

May 09, 2025 -

Njwm Krt Alqdm W Eadt Altdkhyn Hqayq Warqam

May 09, 2025

Njwm Krt Alqdm W Eadt Altdkhyn Hqayq Warqam

May 09, 2025 -

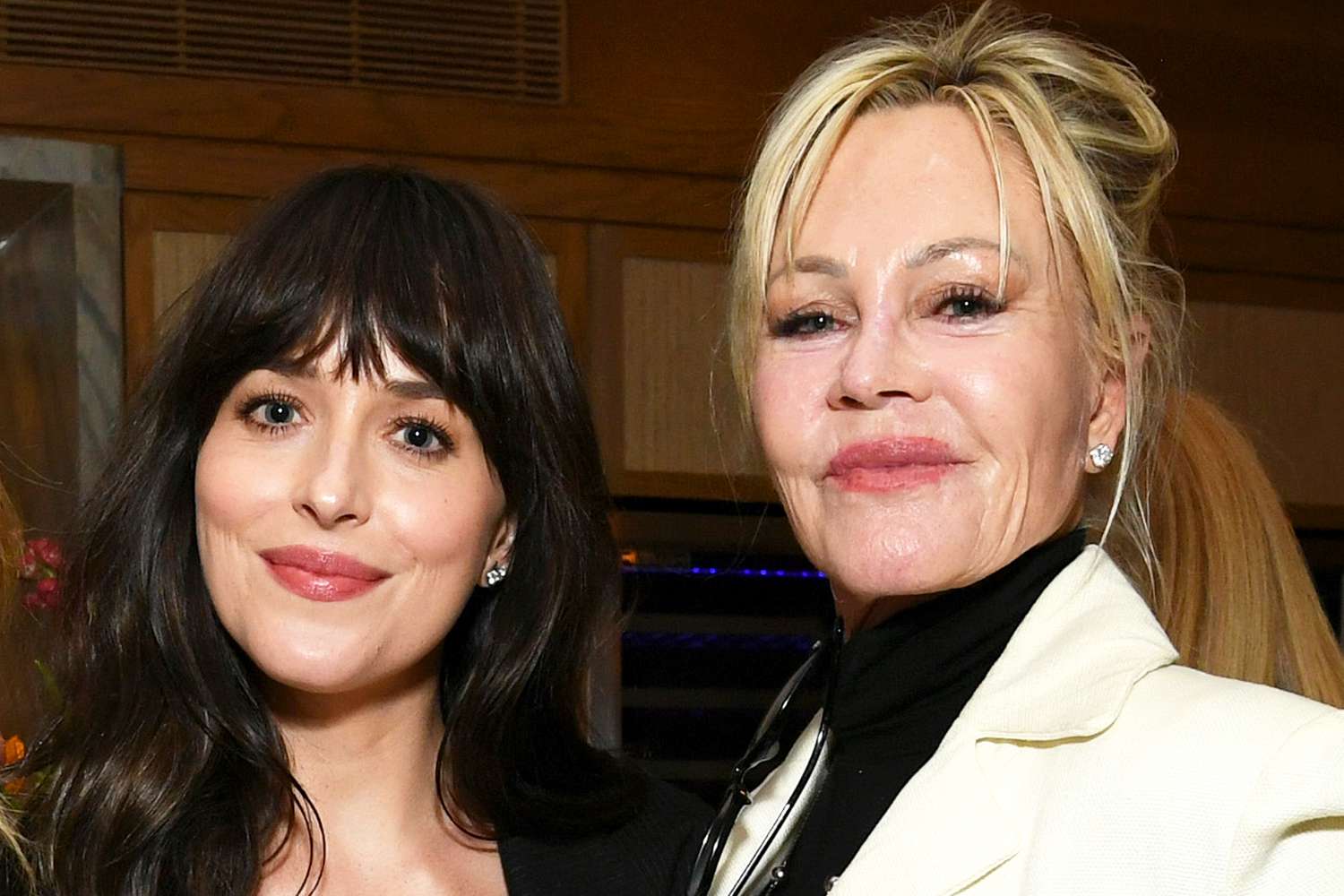

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Event

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Event

May 09, 2025