Should You Buy XRP Now? A 400% Price Increase In 3 Months Analyzed

Table of Contents

The Recent XRP Price Surge: A Deep Dive

Factors Contributing to the 400% Increase

Several intertwined factors contributed to XRP's impressive 400% price surge. Understanding these factors is crucial to assessing the sustainability of this growth.

- Increased Institutional Adoption: A growing number of institutional investors are exploring XRP's potential for cross-border payments, driving demand and price appreciation. Several large financial institutions have hinted at incorporating XRP into their payment systems.

- Positive Ripple Lawsuit Developments: While the SEC lawsuit against Ripple remains ongoing, recent court decisions and expert opinions have injected optimism into the market, fueling speculation about a positive outcome.

- Growing Interest in Cross-Border Payments and Blockchain Technology: The increasing global demand for faster, cheaper, and more transparent cross-border payment solutions has boosted XRP's appeal as a potential solution.

- Speculative Trading and Market Sentiment: The positive news surrounding Ripple and the potential for further price increases have attracted speculative traders, further escalating XRP's price. This created a positive feedback loop, driving the price upward.

- Specific News Events: Examples include [insert specific news events or announcements that positively impacted XRP's price here, linking to credible sources]. This could include partnerships, regulatory developments in other jurisdictions, or significant on-chain activity.

Analyzing the Volatility of XRP

Investing in XRP, or any cryptocurrency, involves significant risk. XRP's price is notoriously volatile, experiencing dramatic swings in short periods.

- Inherent Risks: Cryptocurrencies are highly speculative assets, and their prices are susceptible to market manipulation, regulatory changes, and unexpected technological developments.

- Price Fluctuations: The chart below illustrates the significant price volatility of XRP over the past year. [Insert a chart or graph showing XRP's price volatility].

- Risk Management: Employing effective risk management strategies is paramount. This includes diversification of your investment portfolio, setting stop-loss orders to limit potential losses, and only investing what you can afford to lose.

Ripple's Ongoing Legal Battle and its Impact on XRP

Current Status of the SEC Lawsuit

The SEC lawsuit against Ripple Labs is a critical factor influencing XRP's price. The lawsuit alleges that Ripple sold XRP as an unregistered security.

- Key Aspects: The case hinges on the classification of XRP as a security or a commodity. A ruling in favor of the SEC could significantly impact XRP's price, potentially leading to delisting from major exchanges. Conversely, a favorable ruling for Ripple could propel XRP's price even higher.

- Potential Outcomes: The potential outcomes range from a complete victory for either party to a negotiated settlement. Expert legal analysis provides varying predictions, highlighting the uncertainty surrounding the case. [Include links to relevant legal analysis].

Potential Future Regulatory Scenarios and Their Effects on XRP

Regulatory clarity is crucial for XRP's long-term stability. Different regulatory outcomes will have a significant impact on its price.

- Regulatory Outcomes: Potential scenarios include XRP being classified as a security, a commodity, or something in between. Each scenario will have vastly different implications for trading and adoption.

- Impact on Trading and Adoption: Regulatory certainty could lead to increased institutional adoption and a more stable price. Conversely, unclear regulations could deter investors and hinder widespread adoption.

Technical Analysis and Future Price Predictions (Use with Caution!)

Chart Patterns and Technical Indicators

Technical analysis can provide insights into potential price trends, but it's not a foolproof method.

- Technical Indicators: Indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can be used to identify potential support and resistance levels. However, these indicators are not predictive and should be interpreted cautiously.

- Chart Patterns: Analyzing chart patterns such as head and shoulders or triangles can offer clues about potential price movements. However, interpreting these patterns is subjective, and their accuracy is limited.

Expert Opinions and Market Sentiment

Expert opinions on XRP's future price vary widely, highlighting the inherent uncertainty.

- Analyst Predictions: Various analysts offer diverse price predictions, ranging from significantly higher to significantly lower prices. [Include links to credible analyst reports, emphasizing the speculative nature of these predictions].

- Market Sentiment: The overall market sentiment towards XRP is currently [describe current market sentiment – bullish, bearish, neutral]. However, sentiment can change rapidly, affecting the price.

Alternatives to XRP: Diversifying Your Cryptocurrency Portfolio

Exploring Other Cryptocurrencies

Diversification is key to mitigating risk in the volatile cryptocurrency market.

- Similar Cryptocurrencies: Consider exploring other cryptocurrencies with similar use cases or potential, such as [mention other relevant cryptocurrencies]. This helps reduce reliance on a single asset.

Understanding the Crypto Market Landscape

The cryptocurrency market is dynamic and risky.

- Risks and Rewards: Investing in cryptocurrencies offers the potential for high returns but also carries significant risks.

- Thorough Research: Before investing in any cryptocurrency, conduct thorough research, understanding the underlying technology, the project's team, and the market's overall conditions.

Conclusion: Should You Buy XRP Now? A Final Verdict

XRP's recent 400% price surge, driven by institutional adoption, positive lawsuit developments, and growing interest in blockchain technology, is undeniable. However, the ongoing SEC lawsuit, inherent price volatility, and the speculative nature of the cryptocurrency market present significant risks. While the potential for high returns exists, so does the potential for substantial losses. Technical analysis provides some insights, but price predictions remain inherently uncertain. Diversification is crucial to mitigate risk. Before making any decisions about buying XRP, remember to conduct your own due diligence and carefully consider your risk tolerance. Learn more about XRP investment strategies and research the market thoroughly. Remember that this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Italy Vs France Duponts 11 Point Masterclass Decides The Match

May 01, 2025

Italy Vs France Duponts 11 Point Masterclass Decides The Match

May 01, 2025 -

Prince Williams Scottish Homelessness Initiative A Warm Embrace With Gail Porter

May 01, 2025

Prince Williams Scottish Homelessness Initiative A Warm Embrace With Gail Porter

May 01, 2025 -

Enexis En Kampen In Juridisch Conflict Aansluiting Op Het Stroomnet

May 01, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Op Het Stroomnet

May 01, 2025 -

Medias Interpretatie Van Zware Auto Een Geen Stijl Analyse

May 01, 2025

Medias Interpretatie Van Zware Auto Een Geen Stijl Analyse

May 01, 2025 -

Miss Pacific Islands 2025 A Samoan Win

May 01, 2025

Miss Pacific Islands 2025 A Samoan Win

May 01, 2025

Latest Posts

-

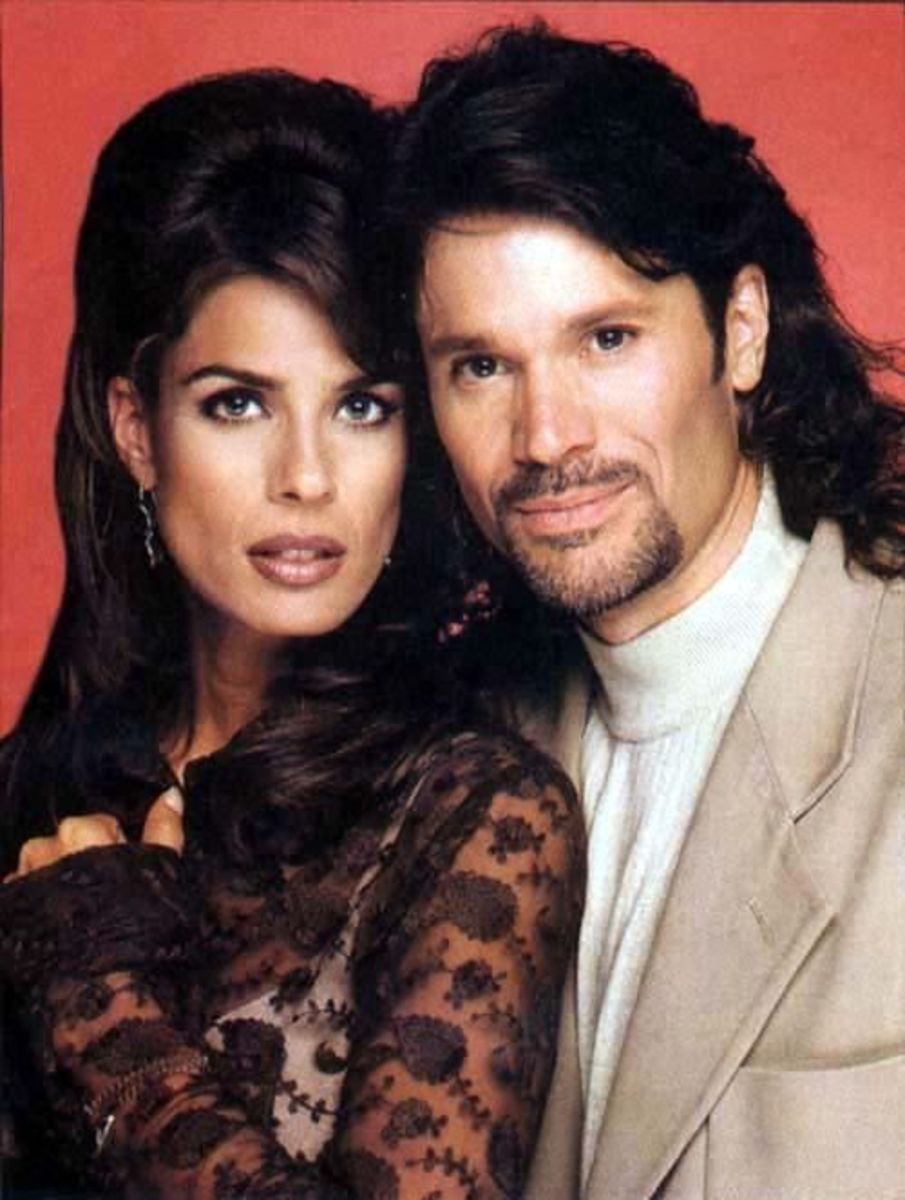

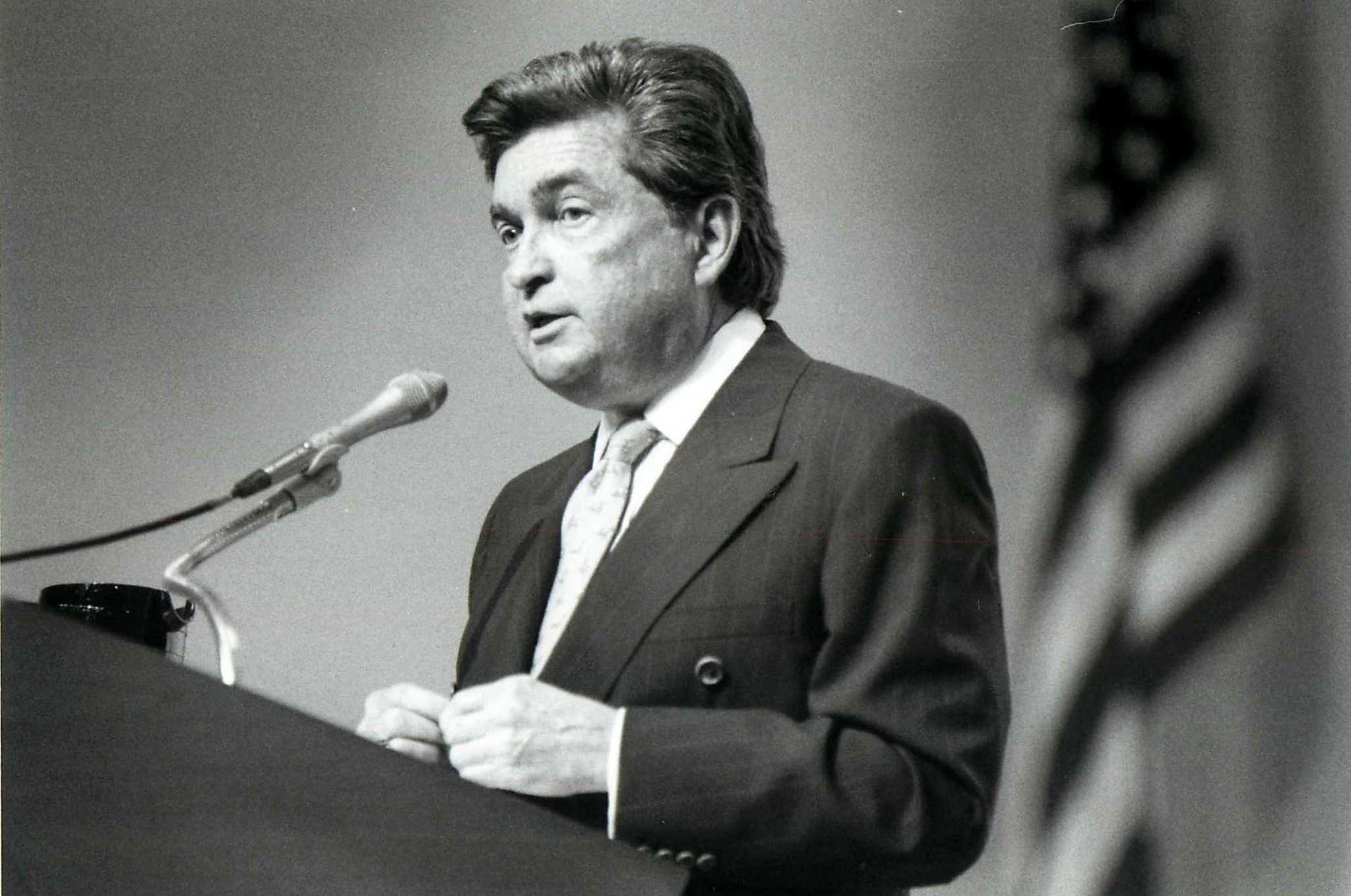

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025 -

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025 -

Dallas Icon Passes Away At The Age Of 100

May 01, 2025

Dallas Icon Passes Away At The Age Of 100

May 01, 2025 -

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025