Should You Invest In D-Wave Quantum Inc. (QBTS)? A Quantum Computing Stock Analysis

Table of Contents

Understanding D-Wave Quantum Inc. (QBTS) and its Business Model

D-Wave's approach to quantum computing differs from many competitors. Instead of gate-based quantum computing, which uses qubits to perform computations sequentially, D-Wave utilizes quantum annealing. This specialized approach excels at solving optimization problems, making it particularly attractive to specific industries.

Their target market includes companies facing complex optimization challenges across various sectors. This includes logistics and supply chain optimization, financial modeling, materials science, and drug discovery. D-Wave's solutions offer the potential for significant improvements in efficiency and cost savings within these industries.

Key partnerships and collaborations are crucial to D-Wave's success. They work with leading organizations in various sectors, leveraging their expertise to develop and deploy quantum-enhanced solutions.

- D-Wave's Advantageous system: This is their flagship quantum computer, boasting a high number of qubits and improved performance compared to previous generations. Applications range from machine learning to solving complex scientific problems.

- Software and cloud access: D-Wave offers user-friendly software and cloud access to their quantum computers, lowering the barrier to entry for potential clients and fostering widespread adoption.

- Revenue streams and growth trajectory: Revenue is generated primarily through cloud access subscriptions and consulting services, with potential for significant growth as quantum computing adoption increases. Analyzing their financial reports reveals a company focused on expanding its market reach and technological advancements.

- Competitive landscape: The quantum computing sector is highly competitive, with players like IBM, Google, and IonQ pursuing different quantum computing approaches. D-Wave differentiates itself through its focus on quantum annealing and its established customer base.

Analyzing QBTS Stock Performance and Valuation

Analyzing QBTS stock performance requires examining its historical price movements. While the stock market is inherently volatile, particularly for companies in emerging technologies, reviewing historical charts and graphs can offer insights into past performance and potential future trends.

Key financial metrics such as revenue growth, earnings, and debt levels are critical indicators of the company's financial health. Comparing these metrics to industry averages and competitors provides a clearer picture of QBTS's financial standing. Understanding the company's valuation relative to its competitors, considering factors like market capitalization and price-to-earnings ratio, is also essential.

- Stock performance charts and graphs: Visual representations of QBTS's stock price over time can highlight significant trends and volatility.

- Risks and challenges impacting QBTS stock: Factors such as technological hurdles, intense competition, and market uncertainty can significantly influence stock prices.

- Stock volatility analysis: Understanding the factors that contribute to QBTS stock price fluctuations is crucial for informed investment decisions.

- QBTS valuation compared to competitors: Benchmarking QBTS against other quantum computing companies helps determine whether its valuation is justified based on its performance and future prospects.

Assessing the Risks and Rewards of Investing in QBTS

Investing in QBTS, like any investment in a nascent technology, carries inherent risks.

- Technological hurdles: The field of quantum computing is still in its early stages, and significant technological challenges remain. Unforeseen technical difficulties could hinder D-Wave's progress.

- Market competition: The intense competition from established tech giants and emerging quantum computing startups poses a significant threat to D-Wave's market share.

- Financial uncertainty: As a relatively young company, D-Wave's financial performance may be unpredictable, particularly in the short-term.

However, the potential rewards are substantial.

- Early-stage investment: Investing in QBTS presents the opportunity to capitalize on the early growth of a potentially disruptive technology.

- High-return potential: The successful commercialization of quantum computing could lead to significant returns for early investors. The potential for exponential growth in this sector is a key driver for investors.

Comparing QBTS to Other Quantum Computing Investments

Several other companies are making strides in the quantum computing space. Publicly traded companies like IonQ and Rigetti Computing offer alternative investment opportunities within the sector. Comparing QBTS's strengths and weaknesses against these competitors helps create a diversified portfolio strategy.

- Comparison table of key metrics: A comparative analysis of key financial and operational metrics across different quantum computing stocks facilitates a more informed investment decision.

- Market capitalization and investment potential: Understanding the market capitalization and growth potential of each company helps determine which offers the most attractive investment opportunity.

- Long-term vs. short-term investment strategies: Different investors have varying time horizons, and this comparison will help determine which company aligns best with individual investment strategies.

Conclusion

Investing in D-Wave Quantum Inc. (QBTS) presents both exciting opportunities and significant risks. While the potential for high returns in the quantum computing sector is undeniable, the technological challenges, competitive landscape, and inherent volatility of the stock market should be carefully considered. Our analysis highlights the importance of thorough due diligence, including a comprehensive understanding of D-Wave's business model, financial performance, and competitive positioning.

While this analysis provides valuable insights, it is crucial to conduct your own thorough research before considering a D-Wave Quantum Inc. (QBTS) investment. Consult with a qualified financial advisor to assess your risk tolerance and determine if investing in QBTS aligns with your overall investment strategy. Remember, this analysis is for informational purposes only and does not constitute financial advice. Make informed decisions about your D-Wave Quantum Inc. (QBTS) investment.

Featured Posts

-

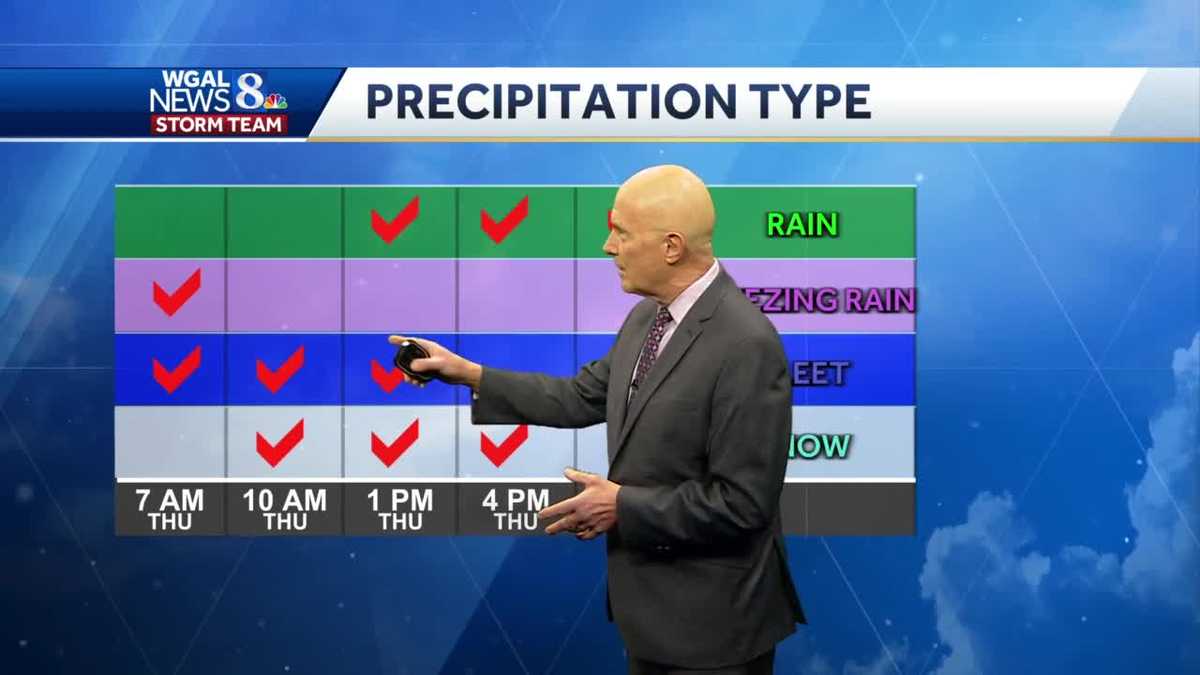

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 20, 2025

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 20, 2025 -

Oil Firms To Repay 1 231 Billion Representatives Action Plan Unveiled

May 20, 2025

Oil Firms To Repay 1 231 Billion Representatives Action Plan Unveiled

May 20, 2025 -

No Murder In Sight Deconstructing Agatha Christies Towards Zero Episode 1

May 20, 2025

No Murder In Sight Deconstructing Agatha Christies Towards Zero Episode 1

May 20, 2025 -

How Effective Middle Management Drives Company Performance And Employee Engagement

May 20, 2025

How Effective Middle Management Drives Company Performance And Employee Engagement

May 20, 2025 -

Best Deals On Hugo Boss Perfumes Amazon Spring Sale 2025

May 20, 2025

Best Deals On Hugo Boss Perfumes Amazon Spring Sale 2025

May 20, 2025