Should You Invest In Palantir Before Its May 5th Earnings?

Table of Contents

Palantir's Recent Performance and Financial Health

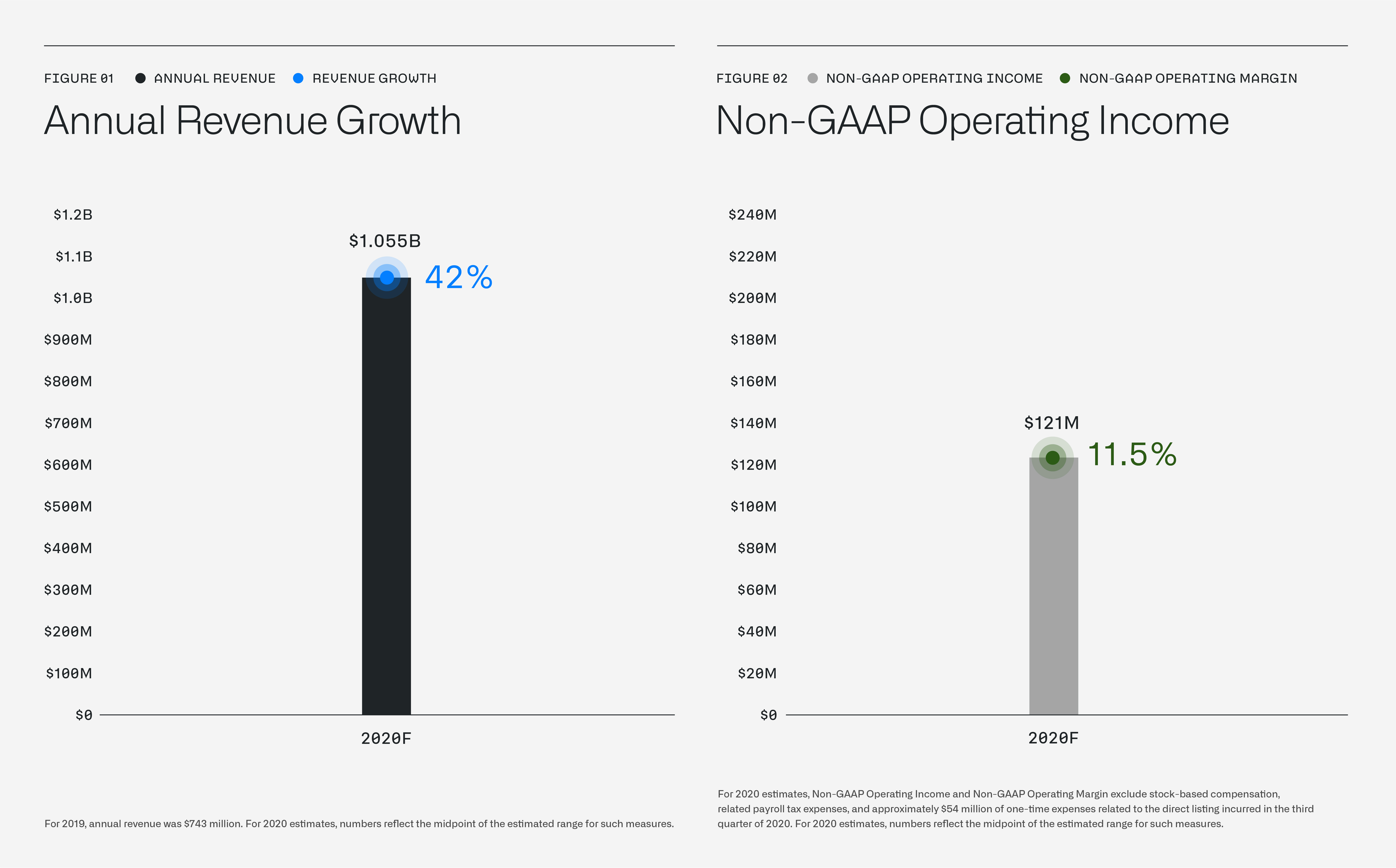

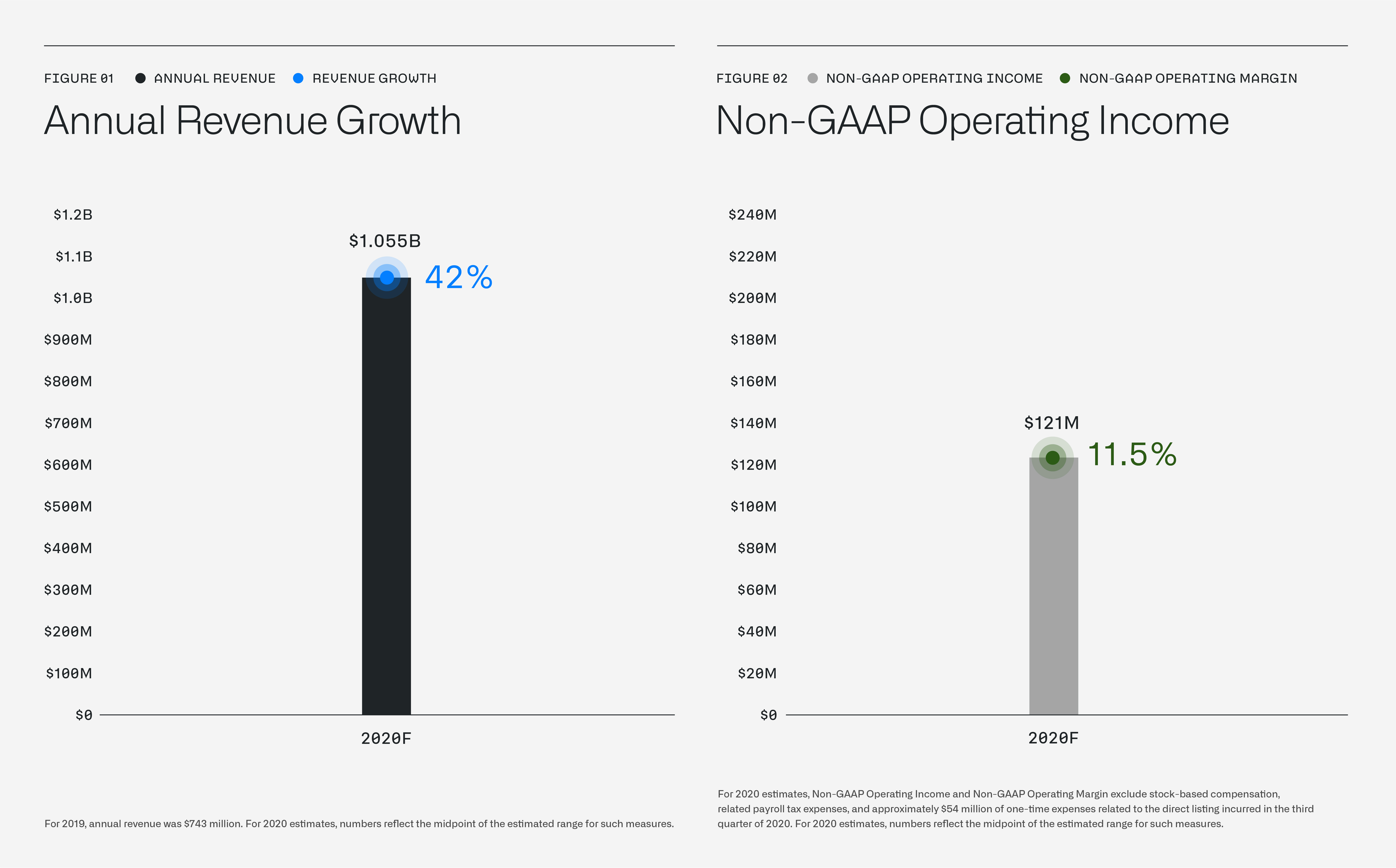

Analyzing Palantir's recent financial performance is crucial before considering a Palantir investment. Key metrics to examine include revenue growth, profitability, cash flow, and debt levels. Understanding these aspects provides a clearer picture of the company's financial health and stability.

-

Revenue Growth: Examine Palantir's revenue growth in recent quarters. A consistent increase signifies strong demand for its data analytics platforms. Pay close attention to the breakdown of revenue between government contracts and commercial contracts. A diversified revenue stream reduces reliance on any single sector and makes the Palantir investment less risky.

-

Profitability and Margins: Palantir's profitability, measured by metrics like operating margin and net income, indicates its ability to generate profits from its operations. Improving margins suggest increasing efficiency and a healthier financial outlook for a Palantir investment.

-

Cash Flow and Debt: Strong positive cash flow demonstrates Palantir's ability to generate cash from its operations. This is vital for sustaining growth, investing in research and development, and managing debt. Low debt levels suggest a financially stable company, mitigating risks associated with a Palantir investment.

-

Competitor Comparison: Comparing Palantir's performance against its competitors in the data analytics sector, such as AWS, Google Cloud, and Microsoft Azure, helps assess its relative strength and market position. This comparative analysis contributes to a more informed decision about a Palantir investment.

Assessing Palantir's Future Growth Potential

Palantir's future growth potential hinges on several factors, including strategic partnerships, technological innovation, and the overall market for data analytics. Understanding these aspects is critical when evaluating a potential Palantir investment.

-

Strategic Partnerships and Collaborations: Palantir's strategic partnerships with other technology companies and its collaborations with government agencies can significantly impact its future growth. These partnerships can expand its reach, enhance its technology, and open up new market opportunities, making a Palantir investment more attractive.

-

Artificial Intelligence (AI) Impact: The increasing adoption of artificial intelligence (AI) presents both opportunities and challenges for Palantir. Its ability to leverage AI in its data analytics platforms will be crucial for maintaining a competitive edge and driving future growth. This should be a significant factor in your Palantir investment strategy.

-

Data Analytics Market Growth: The data analytics market is experiencing rapid growth, driven by the increasing volume of data generated worldwide. Palantir's ability to capitalize on this growth will be a major determinant of its future success and the success of a Palantir investment.

-

Product Innovation and Pipeline: Palantir's commitment to product innovation and its pipeline of new offerings are key indicators of its long-term growth potential. Innovative products and services can attract new customers and enhance its competitive position. This aspect is critical when considering a long-term Palantir investment.

Understanding the Risks Associated with Investing in Palantir

Investing in Palantir involves inherent risks, including stock price volatility, competitive pressures, and geopolitical factors. A thorough risk assessment is essential before making any investment decisions.

-

Stock Price Volatility: Palantir's stock price has historically been volatile, meaning it can experience significant price swings. This volatility presents both opportunities and risks for investors. Understanding this volatility is crucial before making a Palantir investment.

-

Competitive Landscape: The data analytics sector is highly competitive. Palantir faces competition from established technology giants and emerging startups. The ability to maintain a competitive edge is crucial for long-term success.

-

Geopolitical and Regulatory Factors: Geopolitical events and regulatory changes can significantly impact Palantir's business, particularly its government contracts. This risk must be considered when evaluating a Palantir investment.

-

Revenue Concentration: A significant portion of Palantir's revenue comes from government contracts. This concentration makes the company vulnerable to changes in government spending and policy. This risk factor should be weighed carefully before deciding on a Palantir investment.

Analyzing Analyst Predictions and Price Targets

Analyzing analyst predictions and price targets can provide additional insight, but should not be the sole basis for investment decisions.

-

Analyst Consensus: Understanding the consensus among financial analysts regarding Palantir's stock performance and future prospects can inform your investment strategy.

-

Price Target Range: The range of price targets set by different analysts reflects the diversity of opinions and expectations regarding Palantir's future stock price.

-

Factors Influencing Predictions: It is important to understand the factors that contribute to the variation in analyst predictions. This understanding allows you to assess the credibility and relevance of each prediction in your Palantir investment decision.

Conclusion

Investing in Palantir before its May 5th earnings announcement requires a careful consideration of its recent financial performance, future growth prospects, and inherent risks. While Palantir operates in a rapidly growing market with significant potential, the company's stock price is known for its volatility. Analyzing analyst predictions can provide further insight, but ultimately, the decision rests on your own risk tolerance and investment strategy.

Before making any investment decisions regarding Palantir stock before its May 5th earnings, conduct thorough due diligence and consider consulting a financial advisor. Learn more about Palantir investment strategies by researching the company’s financial reports and market analysis. Remember, investing in Palantir stock involves risk.

Featured Posts

-

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 09, 2025

Solve The Nyt Spelling Bee April 4 2025 Hints And Strategies

May 09, 2025 -

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025

Star Stylist Elizabeth Stewart And Lilysilks Spring Collaboration A Luxurious New Collection

May 09, 2025 -

Tomas Hertls Second Hat Trick Golden Knights Defeat Red Wings

May 09, 2025

Tomas Hertls Second Hat Trick Golden Knights Defeat Red Wings

May 09, 2025 -

23 Year Old Woman Believes She Is Madeleine Mc Cann New Dna Test Results

May 09, 2025

23 Year Old Woman Believes She Is Madeleine Mc Cann New Dna Test Results

May 09, 2025 -

Inter Milan Eyeing De Ligt Loan Deal On The Cards From Man Utd

May 09, 2025

Inter Milan Eyeing De Ligt Loan Deal On The Cards From Man Utd

May 09, 2025