Significant Acquisition: CMA CGM Invests $440 Million In Turkish Logistics

Table of Contents

CMA CGM's Strategic Rationale Behind the Turkish Investment

CMA CGM's investment reflects its proactive expansion strategy, focusing on strategically important locations and rapidly growing economies. The company's interest in emerging markets is well-documented, with this Turkish acquisition being a prime example of its commitment to global reach. Investing in Turkish logistics offers several compelling advantages:

- Strategic Geographic Location: Turkey's unique position bridging Europe and Asia makes it an ideal transit point for goods moving along crucial trade routes, offering seamless access to both Eastern and Western markets.

- Booming Turkish Economy and Trade Volumes: Turkey's steadily growing economy and increasing trade volumes present significant opportunities for logistics providers. The rising demand for efficient and reliable transportation services makes it an attractive market for investment.

- Skilled Workforce: Turkey possesses a relatively large and skilled workforce, crucial for operating and managing complex logistics operations. This readily available talent pool reduces operational challenges.

- Synergies with Existing Operations: The acquisition allows CMA CGM to leverage synergies with its existing global network, optimizing routes, streamlining operations, and enhancing overall efficiency. This integration could lead to significant cost savings and increased profitability.

While specific details of the acquired Turkish companies or assets might not be publicly available yet, the strategic nature of the investment is undeniable. This acquisition undoubtedly strengthens CMA CGM's global network, expands its market share, and reinforces its position as a major player in the global logistics arena.

Impact on the Turkish Logistics Sector

CMA CGM's substantial investment is likely to trigger a ripple effect throughout the Turkish logistics sector. We can anticipate:

- Increased Foreign Investment: This acquisition could serve as a catalyst for further foreign direct investment (FDI) in the Turkish logistics industry, attracting other international players seeking to capitalize on the country's strategic location and growth potential.

- Intensified Competition: While increased competition might lead to price pressures, it simultaneously fosters innovation and efficiency improvements within the market. This ultimately benefits consumers and strengthens the overall sector.

- Job Creation and Economic Growth: The investment will create numerous jobs, both directly within CMA CGM's operations and indirectly through related industries. This boost in employment and associated economic activity will contribute significantly to Turkey's overall economic growth.

- Infrastructure Modernization: The influx of capital could accelerate infrastructure development, including improvements in ports, railways, and road networks. This modernization will improve the efficiency and competitiveness of the Turkish logistics sector.

- Benefits for Turkish Exporters and Importers: Improved infrastructure and enhanced logistical capabilities will lead to reduced transportation costs and faster delivery times for Turkish businesses, enhancing their global competitiveness.

Global Implications of the Acquisition

The implications of this acquisition extend far beyond Turkey's borders. The impact on the global logistics landscape includes:

- Reshaped Global Supply Chains: CMA CGM's increased presence in Turkey will inevitably influence global supply chains, potentially leading to optimized routes and enhanced efficiency in the movement of goods across continents.

- Shifting Competitive Landscape: This move will intensify competition within the global shipping and logistics industry, pushing other major players to adapt and innovate to maintain their market share.

- Freight Rates and Shipping Costs: While the immediate impact on freight rates is complex and uncertain, increased capacity and efficiency resulting from the acquisition could potentially lead to more competitive pricing in the long term.

- Influence on Other Major Players: Other major logistics companies are likely to closely monitor CMA CGM's progress in Turkey, potentially inspiring similar investments in other emerging markets.

- Further Acquisitions: This acquisition might signal a trend, with CMA CGM potentially undertaking further acquisitions in strategically important emerging markets around the world.

Analyzing the $440 Million Investment

The $440 million investment is a significant commitment, representing a substantial bet on the future potential of the Turkish logistics sector. This investment is likely to be allocated across various aspects of the acquisition, including infrastructure development, technology upgrades, workforce training, and potential acquisitions of specific logistics companies. The potential return on investment (ROI) for CMA CGM will depend on factors such as market growth, operational efficiency, and competition. Compared to other significant acquisitions in the logistics sector, this investment represents a considerable commitment highlighting CMA CGM's long-term vision.

Understanding the Significance of CMA CGM's Turkish Logistics Investment

In conclusion, CMA CGM's $440 million investment in Turkish logistics represents a strategically significant move with far-reaching implications. The acquisition strengthens CMA CGM's global network, boosts Turkey's economic growth and logistics infrastructure, and reshapes the global shipping and logistics landscape. This substantial investment underscores the growing importance of emerging markets and the crucial role of strategic partnerships in navigating the complexities of the global supply chain. The long-term success of this investment will depend on various factors, but its potential to transform both the Turkish and global logistics sectors is considerable. Stay informed on significant acquisitions in the logistics sector and learn more about CMA CGM's global expansion by exploring the opportunities in Turkish logistics and the broader global shipping industry.

Featured Posts

-

Getting Professional Help With Hair And Tattoos Ariana Grandes Bold New Look

Apr 27, 2025

Getting Professional Help With Hair And Tattoos Ariana Grandes Bold New Look

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Evolution A Look At Professional Artistic Input

Apr 27, 2025

Ariana Grandes Hair And Tattoo Evolution A Look At Professional Artistic Input

Apr 27, 2025 -

World No 1 Sinners Doping Case Resolved

Apr 27, 2025

World No 1 Sinners Doping Case Resolved

Apr 27, 2025 -

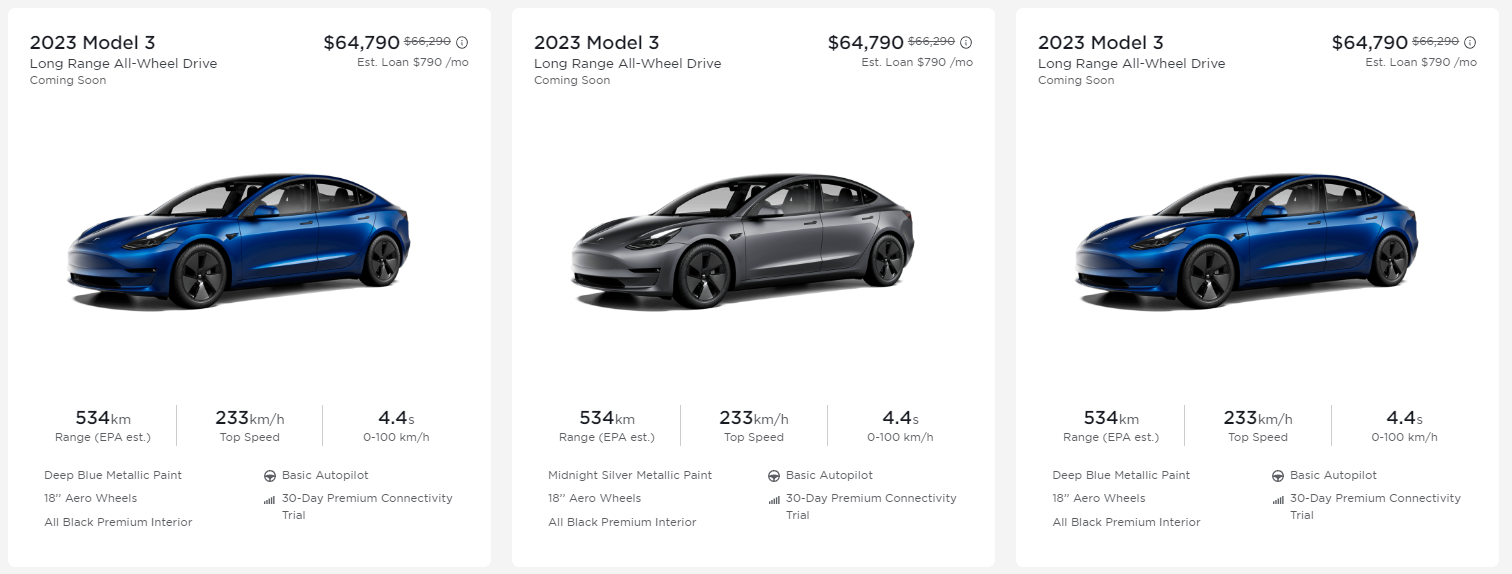

Teslas Canadian Price Adjustments And Pre Tariff Inventory Clearance

Apr 27, 2025

Teslas Canadian Price Adjustments And Pre Tariff Inventory Clearance

Apr 27, 2025 -

Ramiro Helmeyer And The Pursuit Of Barcelona Success

Apr 27, 2025

Ramiro Helmeyer And The Pursuit Of Barcelona Success

Apr 27, 2025

Latest Posts

-

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025