Significant Changes In UBS's View On India And Hong Kong Economies

Table of Contents

Revised Growth Projections for India

UBS's revised forecast for India's GDP growth reflects a nuanced perspective on the country's economic trajectory. Previously projecting X% growth for the fiscal year, UBS has now revised this to Y%, representing a [increase/decrease] of Z%. This adjustment is a result of a complex interplay of positive and negative factors influencing the India GDP growth.

-

Positive Impacts: Strong domestic demand continues to be a key driver, fueled by a burgeoning middle class and government initiatives aimed at boosting consumption. Furthermore, continued infrastructure development and ongoing government reforms, particularly in areas like digitalization and ease of doing business, are expected to contribute to sustained economic growth in India. The technology sector, particularly in software and IT services, remains a significant contributor to overall growth.

-

Negative Impacts: Global headwinds, including a potential global slowdown and persistent inflationary pressures, pose significant challenges. Inflation in India continues to be a concern, potentially impacting consumer spending and overall economic activity. The effectiveness of the monetary policy in India in managing inflation will be crucial in determining the pace of future growth. The impact of global events, such as geopolitical instability and fluctuations in commodity prices, also plays a role in UBS's revised UBS India forecast.

-

Sector-Specific Outlook: UBS remains bullish on the technology and infrastructure sectors in India, anticipating sustained growth driven by both domestic demand and global opportunities. However, the firm has expressed some caution regarding the consumer goods sector, citing concerns about inflationary pressures and potential softening of consumer demand.

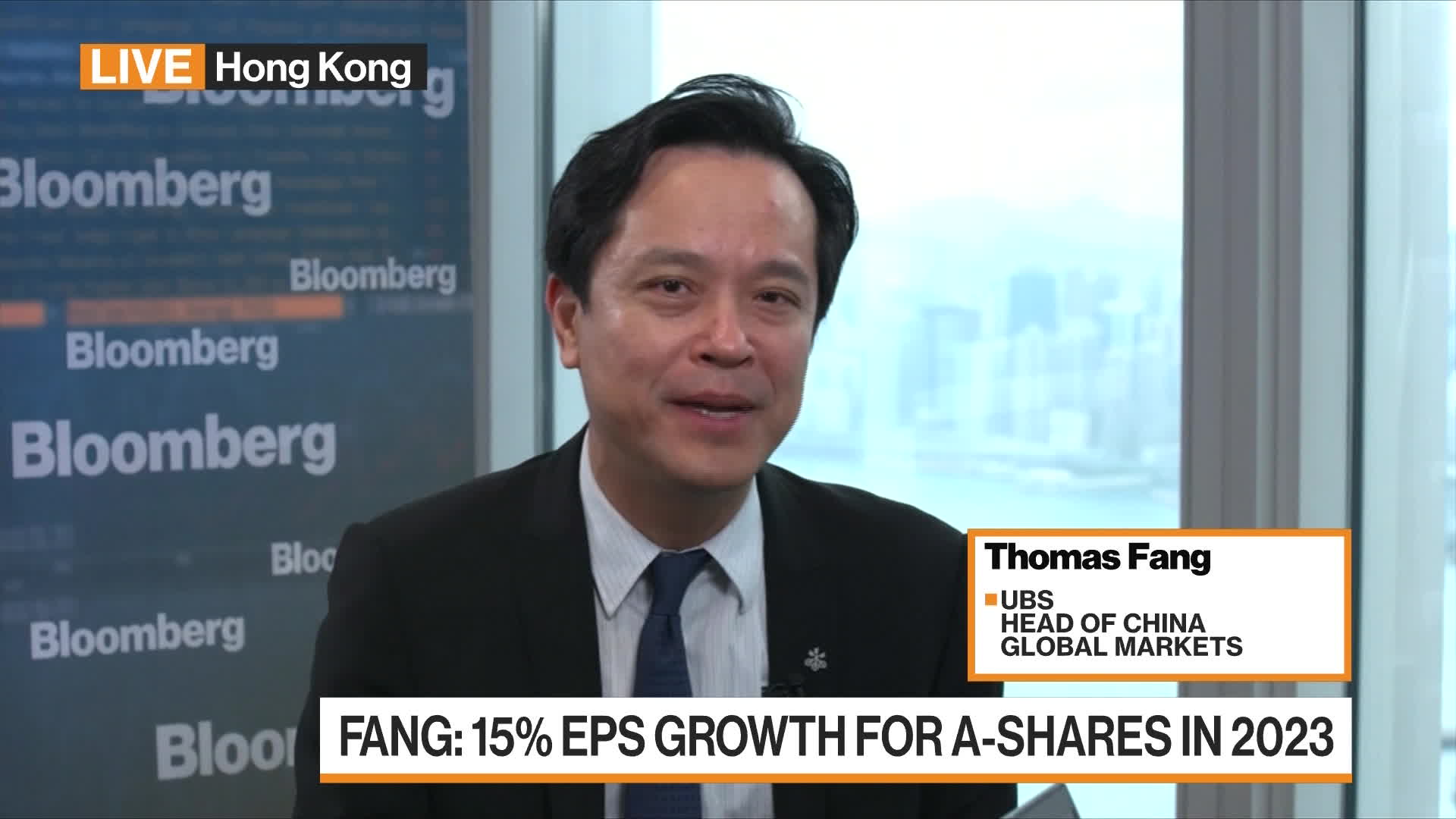

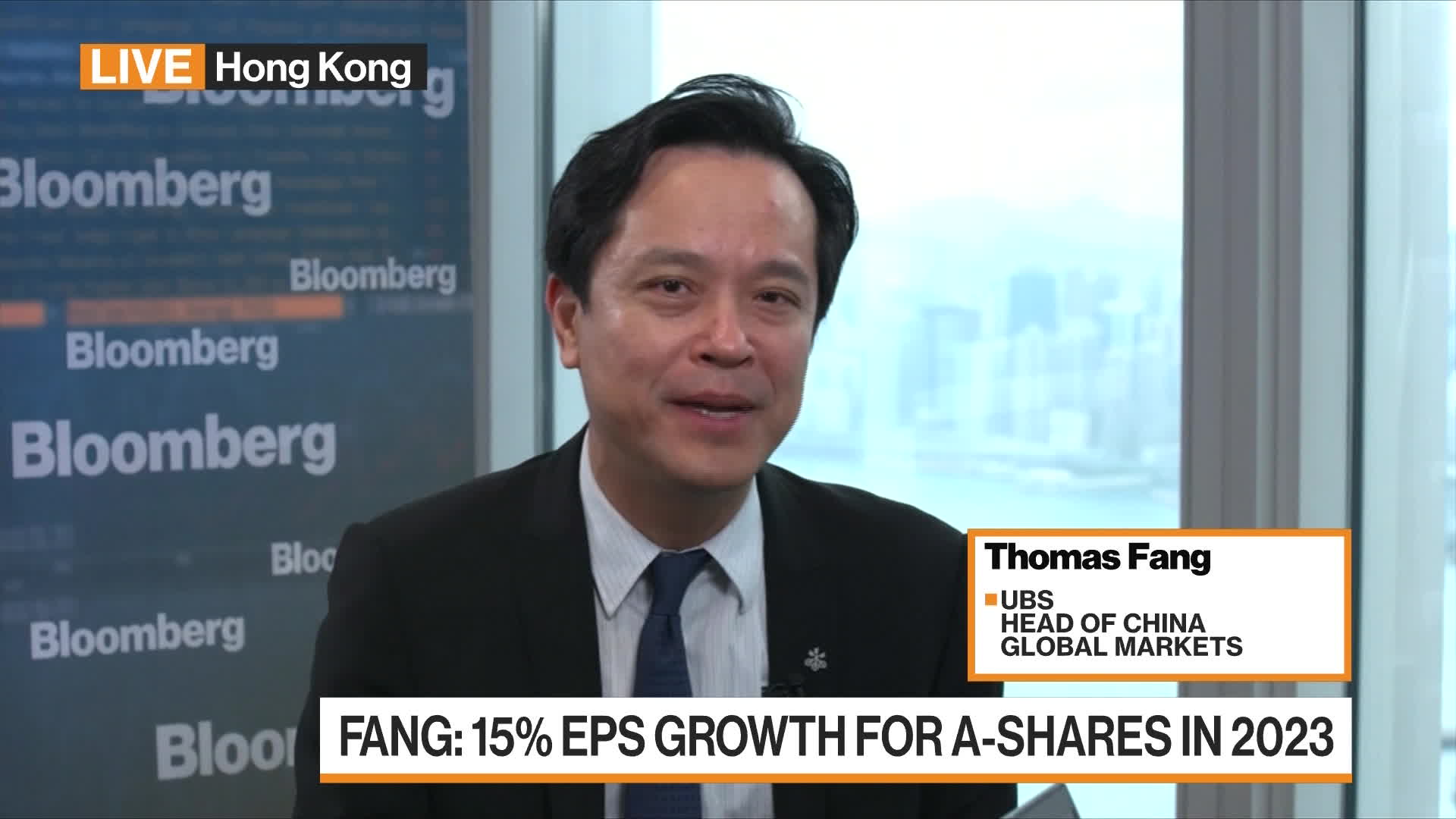

Shifting Perspectives on Hong Kong's Economy

UBS's assessment of Hong Kong's economy reflects a more cautious outlook compared to its previous projections. The firm has revised its Hong Kong GDP growth forecast downward from X% to Y%, highlighting the challenges faced by the region.

-

Factors Behind the Revision: The shifting economic landscape is largely shaped by evolving China-Hong Kong relations, geopolitical uncertainties, and internal challenges within Hong Kong. While the city benefits from its close ties to mainland China, increasing regulatory oversight and geopolitical tensions impact investor confidence and economic activity. The recovery of the tourism sector in Hong Kong remains uncertain, significantly impacting related industries. The real estate sector in Hong Kong also faces headwinds due to a combination of factors including higher interest rates and cooling measures.

-

Sector-Specific Analysis: UBS has lowered its growth projections for the finance and retail sectors in Hong Kong, reflecting concerns about reduced consumer spending and the impact of global economic slowdown. While the finance sector remains a cornerstone of the economy, its growth trajectory is expected to be less robust than previously anticipated. The UBS Hong Kong forecast indicates a slower recovery for the tourism sector, particularly in the short term.

-

Impact of China's Policies: China's economic policies and their impact on Hong Kong are central to UBS's revised outlook. The evolving regulatory environment and the integration of Hong Kong into China's broader economic framework significantly influence the trajectory of the Hong Kong economy.

Investment Implications and Strategic Recommendations

UBS's revised outlook translates into specific investment recommendations for both markets. For investment opportunities in India, UBS favors companies in the technology and infrastructure sectors, highlighting their resilience and long-term growth potential. In contrast, investment opportunities in Hong Kong are viewed with more caution, with a focus on companies exhibiting strong financial fundamentals and less susceptibility to cyclical downturns.

-

Portfolio Management Strategies: UBS's portfolio allocation strategies reflect a more cautious approach in Hong Kong, suggesting diversification away from sectors perceived as more vulnerable to geopolitical risks. For India, the emphasis is on maintaining exposure to growth sectors while carefully monitoring macroeconomic indicators. Risk assessment is crucial for both markets, given the evolving global economic landscape.

-

Specific Investment Vehicles: While UBS doesn't explicitly recommend specific stocks in this report, the overall tone suggests a shift towards defensive positioning within Hong Kong's market. For India, growth stocks within the technology and infrastructure sectors may be favored, although thorough due diligence is always advisable. Stock market trends will need to be continuously monitored for both regions.

Conclusion

UBS's recent reassessment of the Indian and Hong Kong economies reveals significant shifts in its growth projections and investment strategies. The factors driving these changes range from global macroeconomic trends to region-specific challenges and opportunities. Understanding these shifts is crucial for investors navigating these dynamic markets. To gain a deeper understanding of the latest developments and UBS's updated perspectives on the India and Hong Kong economies, visit [link to UBS website or relevant resource]. Stay informed about the evolving economic landscape to make informed investment decisions. Continue to monitor the changes in the UBS outlook on the India and Hong Kong economies for optimal portfolio management.

Featured Posts

-

Oklahoma Weather Timeline Severe Storms Hail And Strong Winds Wednesday

Apr 25, 2025

Oklahoma Weather Timeline Severe Storms Hail And Strong Winds Wednesday

Apr 25, 2025 -

Two Bundesliga Players On Arsenals Radar A Journalists Report

Apr 25, 2025

Two Bundesliga Players On Arsenals Radar A Journalists Report

Apr 25, 2025 -

Best Places To Visit In The North East This Easter

Apr 25, 2025

Best Places To Visit In The North East This Easter

Apr 25, 2025 -

Wigan And Leigh College Flower Show Students Horticultural Displays

Apr 25, 2025

Wigan And Leigh College Flower Show Students Horticultural Displays

Apr 25, 2025 -

Analyzing The Jets 2025 Nfl Draft Needs Picks And Ideal Prospects

Apr 25, 2025

Analyzing The Jets 2025 Nfl Draft Needs Picks And Ideal Prospects

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025