Significant Drop In Amsterdam Stock Exchange: AEX Index Down Over 4%

Table of Contents

Causes of the AEX Index Decline

The substantial fall in the AEX Index is a multifaceted issue, stemming from a confluence of global and domestic factors.

Global Market Factors

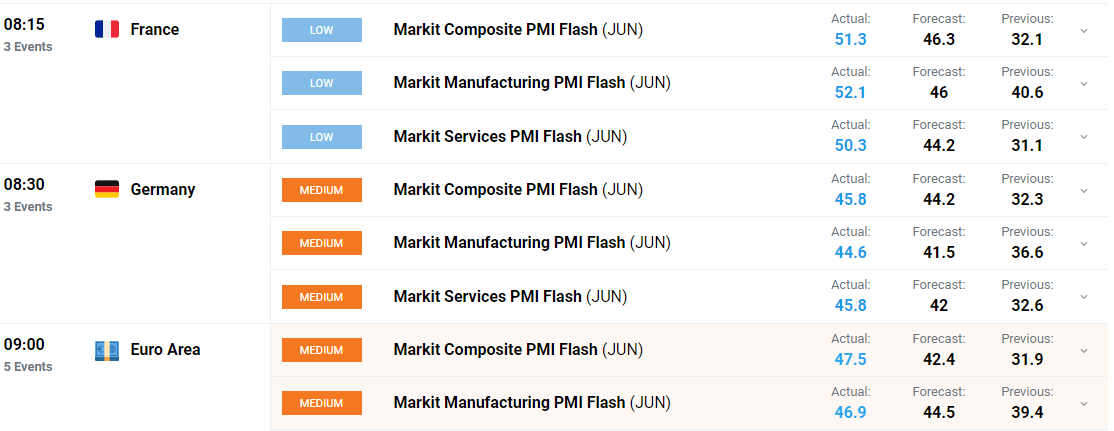

Global economic uncertainty is a primary driver behind the AEX Index's decline. Rising inflation rates across major economies, coupled with aggressive interest rate hikes by central banks like the Federal Reserve and the European Central Bank (ECB), are dampening economic growth and impacting investor sentiment. The ongoing war in Ukraine and the resulting energy crisis further exacerbate this instability.

- Inflation: Eurozone inflation remains stubbornly high, exceeding the ECB's target, leading to concerns about sustained price increases.

- Interest Rate Hikes: Increased interest rates increase borrowing costs for businesses, potentially slowing investment and economic growth. The ECB's recent interest rate increases are directly impacting the AEX.

- Geopolitical Uncertainty: The war in Ukraine continues to create significant geopolitical uncertainty, impacting energy supplies and global trade.

- Correlation with other indices: The AEX Index's decline mirrors similar trends observed in other major global indices such as the Dow Jones and the FTSE 100, indicating a broader market downturn.

Sector-Specific Impacts

The decline wasn't uniform across all sectors. Certain sectors within the AEX were hit harder than others.

- Energy Sector: The energy sector, heavily reliant on global commodity prices, experienced a significant drop due to fluctuating oil and gas prices influenced by the war in Ukraine and supply chain disruptions. Companies like Shell and Uniper saw substantial decreases in their share prices.

- Technology Sector: The technology sector, sensitive to interest rate changes, also witnessed substantial losses, reflecting concerns about future growth prospects in a higher interest rate environment.

- Financial Sector: Banks and other financial institutions also experienced notable declines, reflecting concerns about potential loan defaults and reduced profitability in a slowing economy.

Investor Sentiment and Market Volatility

Negative investor sentiment and panic selling significantly amplified the AEX Index's decline. News headlines highlighting global economic woes and concerns about potential recession contributed to a sell-off.

- Trading Volume: A surge in trading volume indicated heightened market activity driven by investors reacting to the negative news.

- Volatility Indices: Volatility indices (comparable to the VIX in the US) likely spiked, reflecting the increased uncertainty and risk aversion in the market.

- Media Influence: Negative media coverage surrounding global economic uncertainty and the war in Ukraine fueled fear and uncertainty, prompting investors to liquidate their holdings.

Consequences of the AEX Index Drop

The sharp drop in the AEX Index has far-reaching consequences for the Dutch economy and its investors.

Impact on the Dutch Economy

The AEX Index decline could trigger a ripple effect throughout the Dutch economy.

- GDP Growth: Reduced investor confidence and slower business activity may negatively impact GDP growth in the short term.

- Consumer Confidence: The stock market downturn could erode consumer confidence, leading to decreased spending and slower economic recovery.

- Business Investment: Businesses may postpone or reduce investment plans due to uncertainty and tighter credit conditions.

Implications for Investors

The AEX Index's plunge resulted in substantial losses for many investors.

- Portfolio Losses: Investors holding AEX-listed stocks experienced significant portfolio losses.

- Risk Management: The event underscores the importance of diversified investment strategies and robust risk management techniques.

- Long-Term Strategies: Long-term investors should maintain a disciplined approach, avoiding impulsive reactions based on short-term market fluctuations.

Potential Recovery and Future Outlook

Predicting the future trajectory of the AEX Index is challenging, but analyzing current conditions offers some insights.

Short-Term Predictions

A short-term recovery depends on several factors.

- Easing Geopolitical Tensions: A de-escalation of the war in Ukraine could improve investor sentiment.

- Inflation Control: Successful measures to curb inflation could boost investor confidence.

- Government Intervention: Government stimulus packages aimed at supporting the economy could trigger a rebound.

Long-Term Prospects

The long-term outlook for the AEX Index depends on fundamental economic factors.

- Economic Fundamentals: The strength of the Dutch economy, including its export performance and domestic consumption, will significantly influence the AEX's long-term trajectory.

- Structural Changes: Structural reforms and investments in innovation could support long-term economic growth and positively impact the AEX.

- Global Economic Recovery: A global economic recovery would provide a favorable environment for the AEX Index's growth.

Conclusion

The over 4% drop in the AEX Index represents a significant event with far-reaching consequences for the Dutch economy and investors. The decline is attributed to a combination of global market factors, sector-specific impacts, and negative investor sentiment. The potential consequences include slower economic growth, decreased consumer confidence, and substantial losses for investors. While the short-term outlook remains uncertain, a long-term recovery depends on addressing underlying economic challenges and fostering a positive investment climate. Stay updated on the AEX Index and navigate market fluctuations wisely by monitoring reputable financial news sources and seeking professional financial advice for managing your investment portfolios during periods of market volatility. Understanding AEX Index performance is crucial for effective investment strategies in the Dutch financial markets.

Featured Posts

-

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 25, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 25, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 25, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 25, 2025 -

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Artist Lineup

May 25, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Artist Lineup

May 25, 2025 -

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 25, 2025

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 25, 2025 -

Dow Joness Measured Rise Positive Pmi Data Provides Support

May 25, 2025

Dow Joness Measured Rise Positive Pmi Data Provides Support

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025