Significant Saudi Rule Change Reshapes The ABS Market Landscape

Table of Contents

Key Regulatory Changes in the Saudi ABS Market

The Saudi Arabian Monetary Authority (SAMA), the kingdom's central bank, has recently implemented significant changes to the regulations governing the securitization of assets and the issuance of ABS. These amendments aim to modernize the Saudi ABS market, making it more attractive to both domestic and international investors. The changes are designed to stimulate growth and increase the efficiency of the capital markets.

- Specific details about the amended regulations: The new regulations include updated guidelines on eligible assets, improved transparency requirements, and streamlined processes for issuance. These changes aim to reduce the complexities associated with securitization, making it a more accessible funding option for businesses.

- Mention the regulatory body responsible for the changes: SAMA is the driving force behind these changes, reflecting its commitment to developing a sophisticated and robust financial sector within Saudi Arabia.

- Highlight any relaxed requirements for issuers: The new framework features less stringent requirements for issuers, lowering the barriers to entry and making securitization a more viable option for a broader range of companies.

- Note any increased transparency requirements: Increased transparency is a key element of the reforms. This includes clearer disclosure requirements for both issuers and investors, enhancing market confidence and investor protection. This focus on transparency aims to attract greater foreign investment into the Saudi ABS market.

Keyword integration: Saudi Arabia ABS regulations, Saudi securitization rules, new ABS framework Saudi Arabia

Impact on Investors in the Saudi ABS Market

The regulatory overhaul presents numerous opportunities for investors in the Saudi ABS market. The changes are anticipated to lead to a more liquid and efficient market, offering potentially higher returns and enhanced diversification benefits.

- Expected increase in ABS issuance volume: With easier access to the market for issuers, the volume of ABS issuance is expected to increase significantly, providing a wider range of investment options.

- Potential for higher yields due to increased competition: Increased competition among issuers could lead to higher yields for investors seeking attractive returns within the Saudi ABS market.

- Enhanced liquidity in the Saudi ABS market: The reforms are projected to significantly enhance liquidity within the Saudi ABS market, making it easier for investors to buy and sell securities.

- Greater diversification opportunities for investment portfolios: The expanded range of ABS offerings provides investors with increased opportunities to diversify their portfolios and manage risk effectively.

Keyword integration: Saudi ABS investment opportunities, returns on Saudi ABS, Saudi ABS market liquidity

Implications for Issuers in the Saudi ABS Market

The revised regulatory framework provides several benefits for companies issuing ABS in Saudi Arabia. The changes aim to lower costs and streamline the issuance process, making it a more attractive funding source.

- Lower barriers to entry for securitization: The simplified regulations reduce the hurdles for businesses seeking to access funding through securitization, broadening access to capital.

- Potential for reduced funding costs for companies: Increased competition and improved market efficiency could lead to lower funding costs for companies issuing ABS.

- Streamlined processes for issuing ABS: The revised framework simplifies the issuance process, reducing administrative burden and accelerating time to market.

- Increased access to a wider pool of investors: The enhanced transparency and improved market efficiency are likely to attract a wider pool of both domestic and international investors.

Keyword integration: Saudi ABS issuance, cost of Saudi ABS, Saudi ABS market access

Specific Asset Classes Affected

The regulatory changes are expected to significantly impact several asset classes within the Saudi ABS market.

- Detailed analysis of the impact on specific asset classes: The impact will be particularly notable for asset classes like auto loans, mortgages, and credit card receivables. These are expected to see a surge in securitization activity.

- Projection of growth in specific segments: The Saudi auto loan ABS market, for example, is poised for significant growth, driven by the increased affordability and accessibility of vehicles within the Kingdom. Similarly, the Saudi mortgage-backed securities market is expected to expand significantly.

- Potential risks and challenges associated with each asset class: While the potential for growth is substantial, issuers and investors need to carefully assess the specific risks and challenges associated with each asset class, including potential default rates and market fluctuations.

Keyword integration: Saudi auto loan ABS, Saudi mortgage-backed securities, Saudi credit card ABS

Challenges and Potential Risks in the Reshaped Saudi ABS Market

While the regulatory changes offer significant opportunities, it's crucial to acknowledge potential challenges and risks.

- Potential increase in competition amongst issuers: The lower barriers to entry could lead to increased competition, potentially impacting pricing and profitability.

- Need for robust risk management frameworks: Issuers and investors will need robust risk management frameworks to navigate the evolving market and mitigate potential losses.

- Importance of investor due diligence: Thorough due diligence is essential for investors to assess the creditworthiness of issuers and the underlying assets.

- Potential systemic risks: As with any rapidly expanding market, the potential for systemic risks exists and requires careful monitoring and management.

Keyword integration: Saudi ABS market risks, challenges in Saudi ABS market, Saudi ABS default risk

Conclusion

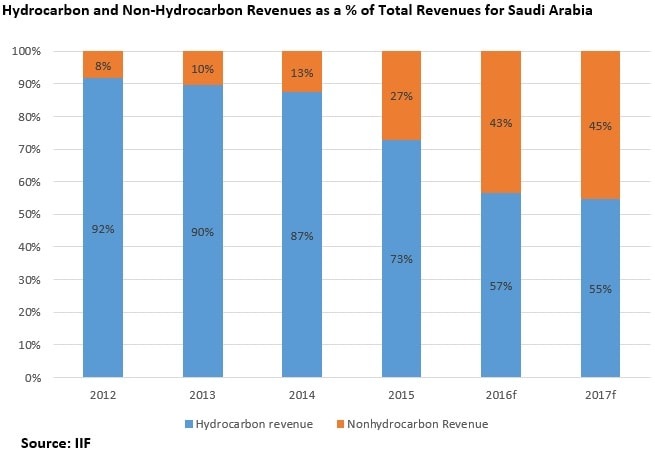

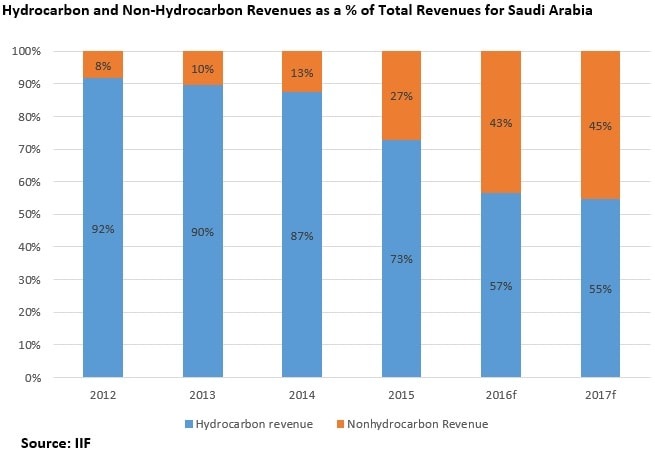

The significant regulatory changes in Saudi Arabia have created a new dynamic in the Saudi ABS market, presenting both exciting opportunities and potential challenges. The revised framework promises to boost liquidity, attract foreign investment, and open up new avenues for both investors and issuers. The growth of the Saudi ABS market is expected to contribute significantly to the diversification of the Saudi economy and the development of its financial sector.

Call to Action: Understanding the nuances of this reshaped Saudi ABS market is crucial for investors and businesses alike. Stay informed about the latest developments in the Saudi ABS market and leverage these changes to optimize your investment strategy or funding plans. Learn more about the opportunities within the evolving Saudi ABS market today!

Featured Posts

-

Fortnite Server Status Update 34 40 Causes Extended Downtime

May 03, 2025

Fortnite Server Status Update 34 40 Causes Extended Downtime

May 03, 2025 -

Fortnite Cowboy Bebop Skins And More Free Giveaway Details

May 03, 2025

Fortnite Cowboy Bebop Skins And More Free Giveaway Details

May 03, 2025 -

5 Dos And Don Ts Succeeding In The Private Credit Hiring Boom

May 03, 2025

5 Dos And Don Ts Succeeding In The Private Credit Hiring Boom

May 03, 2025 -

What The Florida And Wisconsin Turnouts Reveal About The Political Climate

May 03, 2025

What The Florida And Wisconsin Turnouts Reveal About The Political Climate

May 03, 2025 -

Itfaqyat Jdydt Ltezyz Alteawn Altjary Byn Alsewdyt Wadhrbyjan

May 03, 2025

Itfaqyat Jdydt Ltezyz Alteawn Altjary Byn Alsewdyt Wadhrbyjan

May 03, 2025

Latest Posts

-

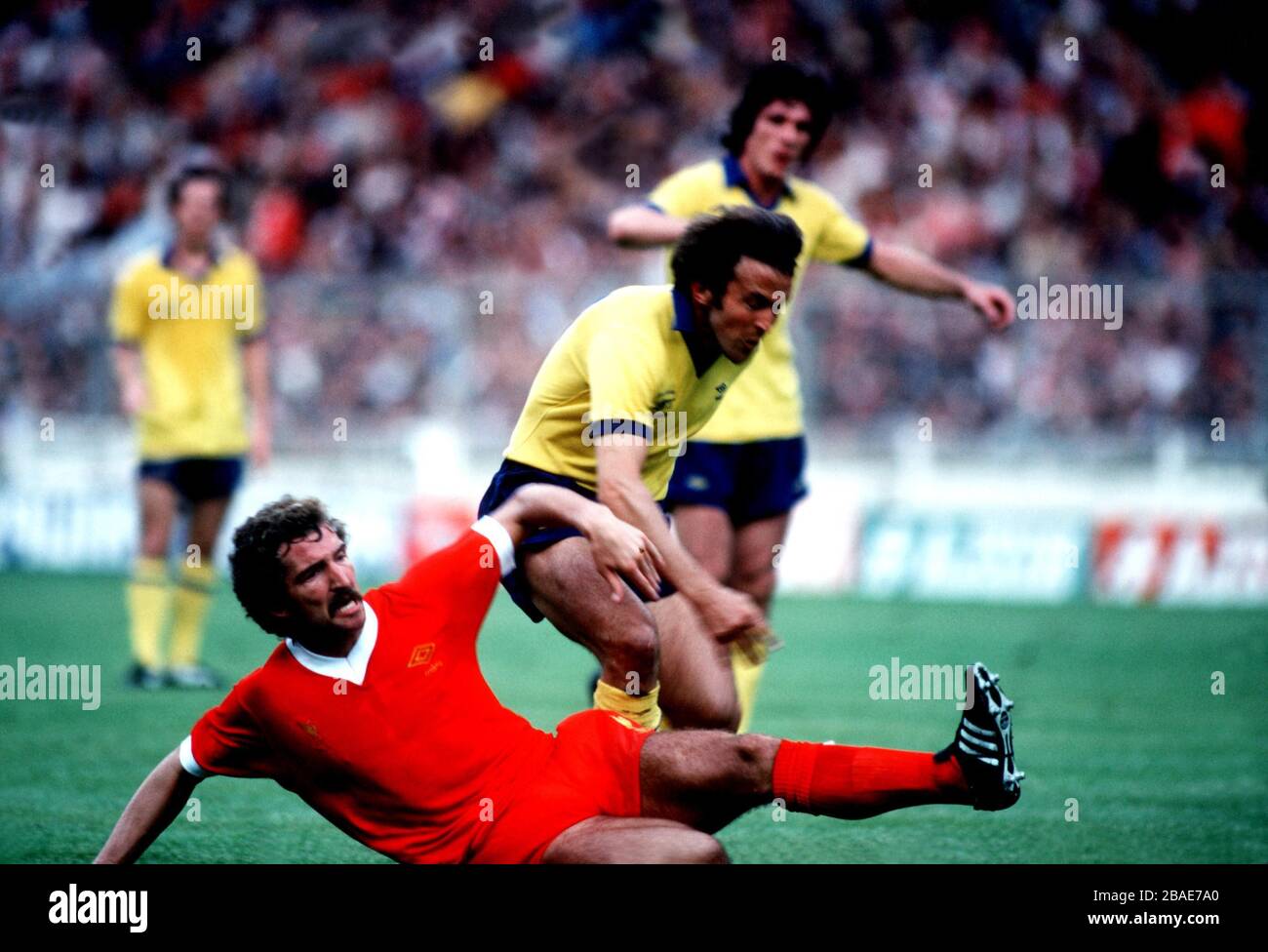

Havertz At Arsenal Souness Questions Improvement Epl Concerns

May 03, 2025

Havertz At Arsenal Souness Questions Improvement Epl Concerns

May 03, 2025 -

Arsenals Rice Graeme Souness Points To Final Third As Area For Development

May 03, 2025

Arsenals Rice Graeme Souness Points To Final Third As Area For Development

May 03, 2025 -

Declan Rice Souness Highlights Key Area For Improvement To Become A Top Player

May 03, 2025

Declan Rice Souness Highlights Key Area For Improvement To Become A Top Player

May 03, 2025 -

Souness Identifies The Position That Cost Arsenal The League

May 03, 2025

Souness Identifies The Position That Cost Arsenal The League

May 03, 2025 -

Souness On Rice Arsenals New Star Needs To Sharpen His Final Third Play

May 03, 2025

Souness On Rice Arsenals New Star Needs To Sharpen His Final Third Play

May 03, 2025