SMFG Eyeing Yes Bank: Analyzing The Potential Acquisition

Table of Contents

SMFG's Strategic Rationale: Why Yes Bank?

SMFG, a leading Japanese financial institution, is reportedly eyeing Yes Bank for several compelling reasons. The potential acquisition aligns perfectly with SMFG’s strategic ambitions.

Why Yes Bank? A Market Entry Opportunity

- Market Expansion: India presents a massive, untapped market for SMFG. Acquiring Yes Bank offers immediate access to a substantial customer base and established infrastructure within a rapidly growing economy. This strategic move allows SMFG to bypass the lengthy and complex process of organically establishing a presence in India.

- Synergies and Growth: Yes Bank's existing network and operations could be synergistically integrated with SMFG's global operations, leading to significant cost savings and revenue generation. This includes potential cross-selling opportunities for both existing customer bases.

- Technological Advantages: SMFG could leverage Yes Bank's existing technology infrastructure and expertise to enhance its own digital banking capabilities and expand its technological footprint in the Asian market.

SMFG's Global Strategy: An Asian Powerhouse

This potential acquisition is not an isolated event but a key component of SMFG's broader international expansion strategy. It reflects a growing trend of Asian financial institutions seeking global dominance and strategic diversification.

- Diversification of Portfolio: Expanding into the Indian market helps SMFG diversify its investment portfolio and reduce its reliance on the Japanese economy.

- Geopolitical Positioning: Investing in India allows SMFG to strategically position itself within a major emerging economy, strengthening its influence in the Asian region.

Financial Benefits and Risk Assessment

While the financial benefits – increased market share, expanded revenue streams, and potential for significant returns – are enticing, potential risks exist:

- Regulatory Hurdles: Securing regulatory approvals in both Japan and India could prove challenging and time-consuming.

- Integration Challenges: Merging two vastly different banking cultures and operational systems requires careful planning and execution to avoid disruptions and potential losses.

- Valuation Disputes: Reaching an acceptable valuation for Yes Bank could be a significant hurdle in negotiations.

Yes Bank's Current Situation & Needs

Yes Bank, once a prominent player in the Indian banking sector, has faced significant financial challenges in recent years. An acquisition by SMFG could be a lifeline.

Financial Health and Restructuring Efforts

- Past Financial Troubles: Yes Bank has undergone significant restructuring efforts following periods of financial instability, impacting its asset quality and profitability.

- Capital Infusion Needs: The bank requires significant capital infusion to strengthen its balance sheet and meet regulatory requirements. SMFG's investment could provide this much-needed capital injection.

- Non-Performing Assets (NPAs): Addressing the bank's NPA portfolio is crucial for long-term stability, and SMFG's expertise in asset recovery could be invaluable.

Regulatory Compliance and Future Outlook

Yes Bank's current regulatory standing is crucial. The acquisition’s success hinges on navigating regulatory scrutiny and ensuring compliance with Indian banking regulations.

Impact on the Indian Banking Sector

The potential SMFG-Yes Bank merger has significant implications for the Indian banking sector.

Increased Competition and Foreign Investment

- Competitive Landscape: The merger could intensify competition within the Indian banking sector, potentially driving innovation and improved services for consumers.

- Foreign Participation: It represents a significant influx of foreign investment into the Indian banking industry, boosting confidence in the market.

Market Consolidation and Consumer Impact

- Consolidation Trends: This acquisition could spur further consolidation within the Indian banking sector as other players seek to enhance their market position.

- Customer Experience: Yes Bank customers might experience changes in services, interest rates, and overall banking experience, potentially positively or negatively depending on SMFG's strategies.

Global Market Implications: An Asian Perspective

The SMFG-Yes Bank acquisition carries broader implications for the global financial landscape.

Increased Asian Influence and Cross-Border M&A

- Shifting Global Power: The deal reinforces the growing influence of Asian financial institutions on the global stage.

- Cross-Border Deals: It sets a precedent for future cross-border mergers and acquisitions in the financial sector, particularly in emerging markets.

Impact on Investor Sentiment

Investor sentiment towards both Indian and Asian banking stocks could be significantly influenced by the success or failure of the SMFG-Yes Bank acquisition.

Conclusion: The Future of the SMFG Eyeing Yes Bank Acquisition

The potential SMFG Yes Bank acquisition presents a complex interplay of opportunities and challenges. While the strategic advantages for SMFG are clear, navigating regulatory hurdles and successfully integrating Yes Bank will be crucial for the deal's success. The impact on the Indian banking sector and the global financial landscape will be significant, potentially leading to increased competition, foreign investment, and further market consolidation. The likelihood of the acquisition's success hinges on the careful execution of due diligence, negotiation, and integration strategies. Stay tuned for updates on this crucial SMFG Yes Bank acquisition. What are your thoughts on this potential SMFG Yes Bank merger?

Featured Posts

-

Lotto 6aus49 Am 19 April 2025 Ueberpruefen Sie Ihre Zahlen

May 07, 2025

Lotto 6aus49 Am 19 April 2025 Ueberpruefen Sie Ihre Zahlen

May 07, 2025 -

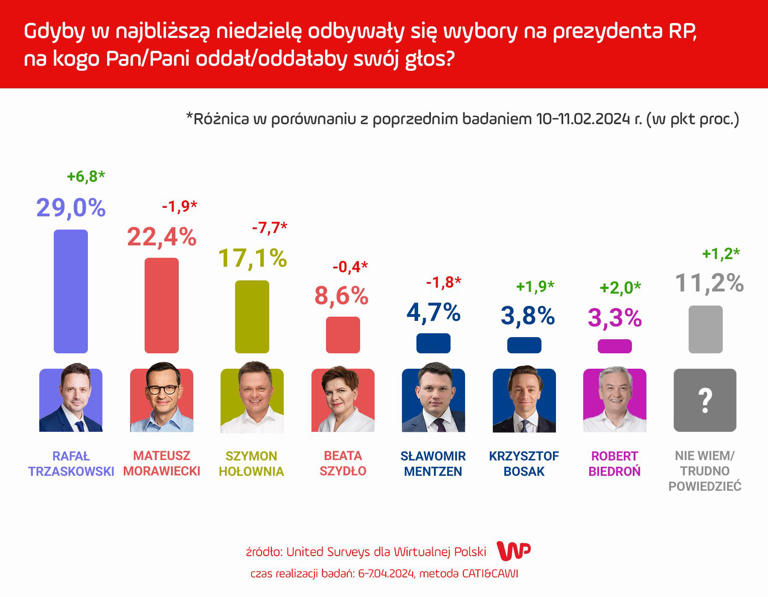

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025

Najnowszy Sondaz Prezydencki Onetu Radosc Dla Trzaskowskiego I Nawrockiego

May 07, 2025 -

Middle Managers Bridging The Gap Between Leadership And Workforce

May 07, 2025

Middle Managers Bridging The Gap Between Leadership And Workforce

May 07, 2025 -

The Last Of Us 10 Filmes Para Conhecer A Isabela Merced Como Dina

May 07, 2025

The Last Of Us 10 Filmes Para Conhecer A Isabela Merced Como Dina

May 07, 2025 -

500 000 Pei Bill For Nhl 4 Nations Face Off Legislative Hearing Details

May 07, 2025

500 000 Pei Bill For Nhl 4 Nations Face Off Legislative Hearing Details

May 07, 2025

Latest Posts

-

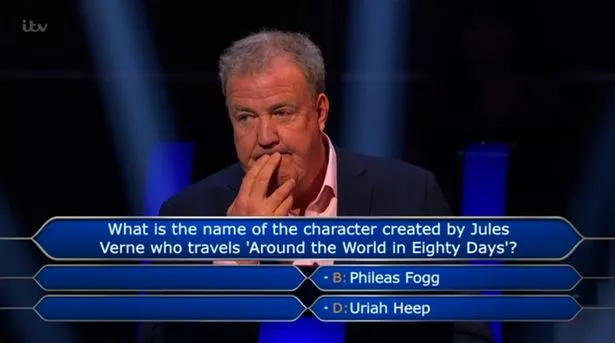

Who Wants To Be A Millionaire Fan Outrage Contestant Wastes Lifelines On Simple Question

May 07, 2025

Who Wants To Be A Millionaire Fan Outrage Contestant Wastes Lifelines On Simple Question

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special Analyzing The Celebrity Editions Success

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special Analyzing The Celebrity Editions Success

May 07, 2025 -

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special A Deep Dive Into The High Stakes Game

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special A Deep Dive Into The High Stakes Game

May 07, 2025 -

British Cycling Stars Laura And Jason Kenny Expand Their Family

May 07, 2025

British Cycling Stars Laura And Jason Kenny Expand Their Family

May 07, 2025