Smith Denies Selling Joshlin: Blames Lombaard And Letoni

Table of Contents

Smith's Official Statement Denying the Joshlin Sale

Smith released an official statement on his company website late yesterday, categorically refuting claims that he has sold his controlling interest in Joshlin. He stated, "These allegations are completely unfounded and malicious. I have not, and will not, sell my stake in Joshlin without a formal public announcement." The statement, released as a formal press release, further emphasizes Smith's commitment to the long-term success of Joshlin and expresses his deep concern about the damage these false rumors have caused.

- Key points from Smith's denial: Complete rejection of sale rumors; Commitment to Joshlin's future; Accusations against Lombaard and Letoni.

- Mention of any legal action: Smith's statement hinted at potential legal action against those responsible for spreading the false information, stating that he is "exploring all available legal avenues to rectify this situation."

- Evidence presented by Smith: While no concrete evidence was directly presented in the initial statement, Smith alluded to internal documents and communications that would refute the claims, suggesting further transparency in the coming days.

The Role of Lombaard and Letoni in the Alleged Smith Joshlin Sale

The statement directly implicated Lombaard and Letoni, long-time business associates of Smith, as the source of the misleading information concerning the Smith Joshlin sale. While the exact nature of their involvement remains unclear, speculation suggests they may have leaked false information for personal gain or to manipulate the stock market. The relationship between Smith, Lombaard, and Letoni has been characterized as complex, with past instances of both collaboration and conflict.

- Lombaard's alleged actions: Rumors suggest Lombaard may have been involved in unauthorized discussions with potential buyers, creating the impression that a sale was imminent.

- Letoni's alleged actions: Letoni is suspected of having spread the rumors through selective leaks to financial analysts and media outlets.

- Potential motives: Financial gain through insider trading or an attempt to undermine Smith's position within the company are the most discussed potential motives.

- Existing conflicts of interest: Past disagreements over business strategy and profit distribution between Smith and his associates have fueled speculation about the underlying motivations.

Public Reaction and Market Impact of the Smith Joshlin Sale Rumor

The rumors surrounding the potential Smith Joshlin sale immediately impacted Joshlin's stock price, causing a significant dip before partially recovering after Smith's denial. The uncertainty surrounding the situation created volatility in the market, highlighting the sensitivity of investor confidence to unsubstantiated reports. Public reaction has been mixed, with some expressing skepticism towards Smith's denial, while others await further evidence.

- Stock market fluctuations: A sharp initial decline followed by a partial recovery, showing market sensitivity to the rumors.

- Public opinion: Social media discussions showed a wide range of opinions, highlighting the uncertainty surrounding the situation.

- Expert opinions: Financial analysts expressed concern about the impact of such unsubstantiated rumors on market stability and investor trust.

Further Investigations and Potential Legal Ramifications

Several regulatory bodies are reportedly looking into the matter to determine whether any illegal activities, such as insider trading or market manipulation, occurred. The potential legal ramifications for Lombaard and Letoni are significant, with potential charges ranging from securities fraud to defamation. Smith’s legal team is actively pursuing all avenues to clear his name and hold those responsible accountable.

- Regulatory bodies involved: The Securities and Exchange Commission (SEC) and potentially other relevant bodies are expected to launch investigations.

- Potential charges: Charges could include securities fraud, market manipulation, and defamation, depending on the evidence gathered.

- Timeline of future developments: The investigation is ongoing and could last several months, with potential legal proceedings expected to follow.

Conclusion

The situation surrounding the alleged Smith Joshlin sale remains highly complex and uncertain. While Smith vehemently denies any involvement in selling his stake, the alleged actions of Lombaard and Letoni cast a shadow over the entire affair. The market reacted strongly to the rumors, highlighting the impact of unsubstantiated reports on investor confidence. Ongoing investigations and potential legal repercussions add another layer of complexity to this unfolding drama. Stay tuned for further updates as this story unfolds. Check back regularly for the latest information on the Smith Joshlin sale!

Featured Posts

-

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 29, 2025

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 29, 2025 -

South African Woman Jailed For Selling Her Six Year Old Child

May 29, 2025

South African Woman Jailed For Selling Her Six Year Old Child

May 29, 2025 -

Ipswich Towns Revival Mc Kennas Role In Phillips Resurgence

May 29, 2025

Ipswich Towns Revival Mc Kennas Role In Phillips Resurgence

May 29, 2025 -

Venlose Man Overleden Na Drievoudige Aanrijding Op A67

May 29, 2025

Venlose Man Overleden Na Drievoudige Aanrijding Op A67

May 29, 2025 -

Hudsons Bay Store Closure And Layoff Details What We Know

May 29, 2025

Hudsons Bay Store Closure And Layoff Details What We Know

May 29, 2025

Latest Posts

-

Sparks Mad Album Review Strengths Weaknesses And Verdict

May 30, 2025

Sparks Mad Album Review Strengths Weaknesses And Verdict

May 30, 2025 -

Sparks Mad Album Review A Critical Look

May 30, 2025

Sparks Mad Album Review A Critical Look

May 30, 2025 -

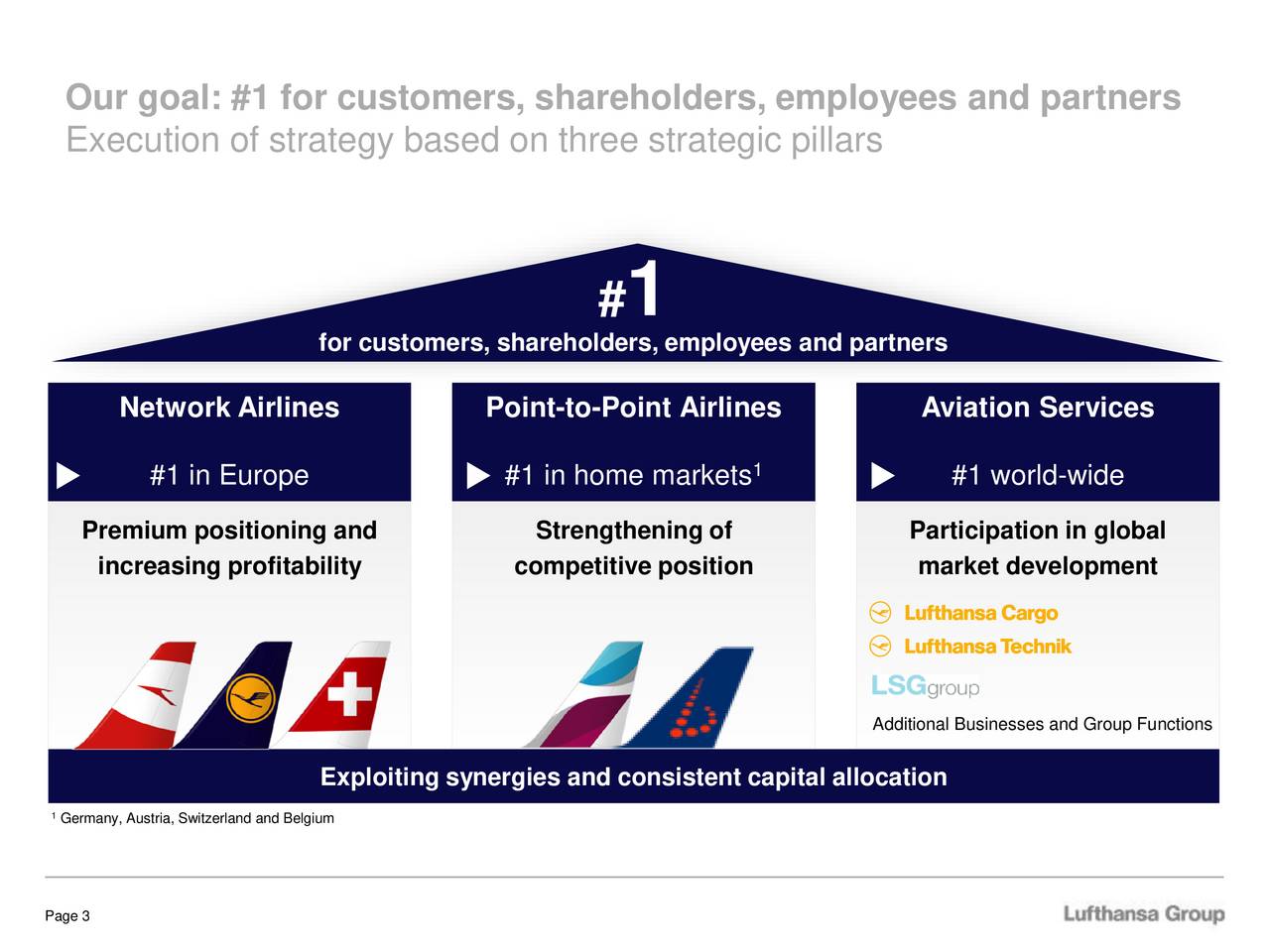

May 15 2025 Virtual Investor Conference Featuring International Companies Deutsche Bank Depositary Receipts

May 30, 2025

May 15 2025 Virtual Investor Conference Featuring International Companies Deutsche Bank Depositary Receipts

May 30, 2025 -

Deutsche Banks Digital Journey The Role Of Ibms Software Portfolio

May 30, 2025

Deutsche Banks Digital Journey The Role Of Ibms Software Portfolio

May 30, 2025 -

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025

Deutsche Bank Appointed Depositary Bank For Epiroc Adr Programs

May 30, 2025