Sovereign Bonds And The Current Market: A Swissquote Bank View

Table of Contents

Understanding Sovereign Bonds in the Current Market

Sovereign bonds, also known as government bonds, are debt securities issued by national governments to finance their spending. These bonds are considered relatively low-risk investments compared to corporate bonds or equities, due to the perceived creditworthiness of the issuing government. However, this perception isn't always a guarantee. Several factors significantly impact their performance:

-

Definition and characteristics of sovereign bonds: Sovereign bonds represent a government's promise to repay borrowed funds, typically with fixed interest payments (coupons) at specified intervals and the principal at maturity. They come in various maturities, ranging from short-term (less than a year) to long-term (30 years or more).

-

The role of government creditworthiness and ratings: Agencies like Moody's, S&P, and Fitch rate sovereign debt based on the perceived ability of the government to repay its debts. Higher ratings generally translate to lower yields (interest rates) as investors perceive less risk. A downgrade can lead to increased yields as investors demand higher returns for the increased perceived risk.

-

Impact of inflation on sovereign bond yields: Inflation erodes the purchasing power of future payments. When inflation rises, investors demand higher yields to compensate for this erosion, pushing bond prices down. This is why central bank policies focused on inflation control have a direct impact on sovereign bond markets.

-

Influence of central bank monetary policies: Central banks significantly influence sovereign bond markets through quantitative easing (QE) and interest rate hikes. QE, where central banks purchase government bonds, increases demand and lowers yields. Conversely, interest rate hikes increase yields and can negatively impact the value of existing bonds.

-

Examples of key sovereign bond markets: Major markets include US Treasuries, German Bunds, and UK Gilts. Each market has its own dynamics and is influenced by the specific economic and political situation of the issuing country.

Bullet Points:

- Inverse relationship between bond prices and interest rates: When interest rates rise, the value of existing bonds with lower coupon rates falls, and vice versa.

- Risks associated with sovereign debt default: While rare for developed nations, sovereign debt defaults can occur, resulting in significant losses for bondholders.

- Importance of diversification: Diversifying across different sovereign issuers and maturities reduces overall portfolio risk.

Current Market Conditions and Their Impact on Sovereign Bonds

The current global economic landscape is characterized by several factors impacting sovereign bond markets:

-

Analysis of current global economic outlook: Factors such as global growth rates, potential recessions, and supply chain disruptions influence investor sentiment and demand for sovereign bonds. A pessimistic outlook can drive investors towards the perceived safety of government bonds, increasing demand and lowering yields (a "flight-to-safety").

-

Geopolitical risks and their influence on sovereign bond yields: Geopolitical instability, such as wars or political unrest, can increase market volatility and impact investor confidence, leading to increased demand for "safe haven" assets like sovereign bonds of stable economies.

-

Inflation expectations and their effect on real yields: Real yield represents the return on a bond after adjusting for inflation. High inflation expectations lead investors to demand higher nominal yields, reducing the attractiveness of sovereign bonds with fixed coupon payments.

-

Potential recessionary scenarios and their implications for bond investors: Recessions typically lead to lower interest rates as central banks try to stimulate economic activity. This can benefit bond investors as bond prices rise. However, a severe recession could increase default risk, impacting even sovereign bonds.

Bullet Points:

- Recent market events: The recent surge in inflation and subsequent interest rate hikes by many central banks have significantly impacted sovereign bond markets worldwide.

- Flight-to-safety phenomenon: During times of uncertainty, investors often flock to sovereign bonds, particularly those of developed countries with strong credit ratings, pushing prices up and yields down.

- Impact of rising interest rates: Rising interest rates reduce the value of existing bonds, especially those with longer maturities.

Investment Strategies for Sovereign Bonds with Swissquote Bank

Swissquote Bank offers a range of tools and services to help investors navigate the complexities of the sovereign bond market:

-

Managing interest rate risk: Strategies like laddering (investing in bonds with different maturities) can help mitigate interest rate risk. Hedging techniques can also be employed to protect against interest rate fluctuations.

-

Diversification strategies: Diversifying across different sovereign issuers, maturities, and currencies is crucial for managing risk and optimizing returns. This could involve holding a mix of US Treasuries, German Bunds, and other sovereign bonds.

-

Utilizing Swissquote Bank's trading platform and investment tools: Our user-friendly platform provides access to a wide range of sovereign bonds, real-time market data, and sophisticated trading tools.

-

Accessing market analysis and research: Swissquote Bank offers in-depth market analysis and research reports to help clients make informed investment decisions.

-

Risk management techniques: Our advisors can help clients assess their risk tolerance and develop customized risk management strategies for their sovereign bond portfolios.

Bullet Points:

- Swissquote Bank's specific tools and services: Access to a wide selection of bonds, advanced charting tools, and personalized portfolio analysis.

- Client support in risk assessment and portfolio building: Our experienced financial advisors work with you to build a portfolio tailored to your specific needs and risk tolerance.

- Different investment approaches: We support both active and passive management strategies depending on your investment objectives.

Conclusion

This article has provided an overview of the current state of the sovereign bond market, highlighting the crucial factors impacting their performance and offering strategic investment considerations. Understanding the intricacies of sovereign bonds, particularly in the context of current market volatility, is paramount for informed investment decisions. Swissquote Bank provides the tools and expertise to navigate these complexities.

Call to Action: Learn more about how Swissquote Bank can assist you in building a robust sovereign bond portfolio tailored to your investment goals. Explore our comprehensive range of investment solutions and contact our expert advisors today to discuss your sovereign bond investment strategy. Start investing wisely in sovereign bonds with Swissquote Bank.

Featured Posts

-

Modern Life In Global Art 1850 1950 A Critical Review

May 19, 2025

Modern Life In Global Art 1850 1950 A Critical Review

May 19, 2025 -

Eurovision 2025 Show Length And Finish Time Guide

May 19, 2025

Eurovision 2025 Show Length And Finish Time Guide

May 19, 2025 -

Analyzing Ufc Vegas 106 Burns Vs Morales Odds And Predictions

May 19, 2025

Analyzing Ufc Vegas 106 Burns Vs Morales Odds And Predictions

May 19, 2025 -

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025

Eurovision 2025 Az Rbaycani S Fur T Msil Ed C K

May 19, 2025 -

Chateau Diy Projects Easy Tutorials And Inspiration

May 19, 2025

Chateau Diy Projects Easy Tutorials And Inspiration

May 19, 2025

Latest Posts

-

Revolutionizing Voice Assistant Development Open Ais New Tools

May 19, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 19, 2025 -

Russias Largest Drone Attack On Ukraine Military Reports Massive Assault

May 19, 2025

Russias Largest Drone Attack On Ukraine Military Reports Massive Assault

May 19, 2025 -

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025 -

Epic Games Fights For Fortnites Reinstatement On Us App Store

May 19, 2025

Epic Games Fights For Fortnites Reinstatement On Us App Store

May 19, 2025 -

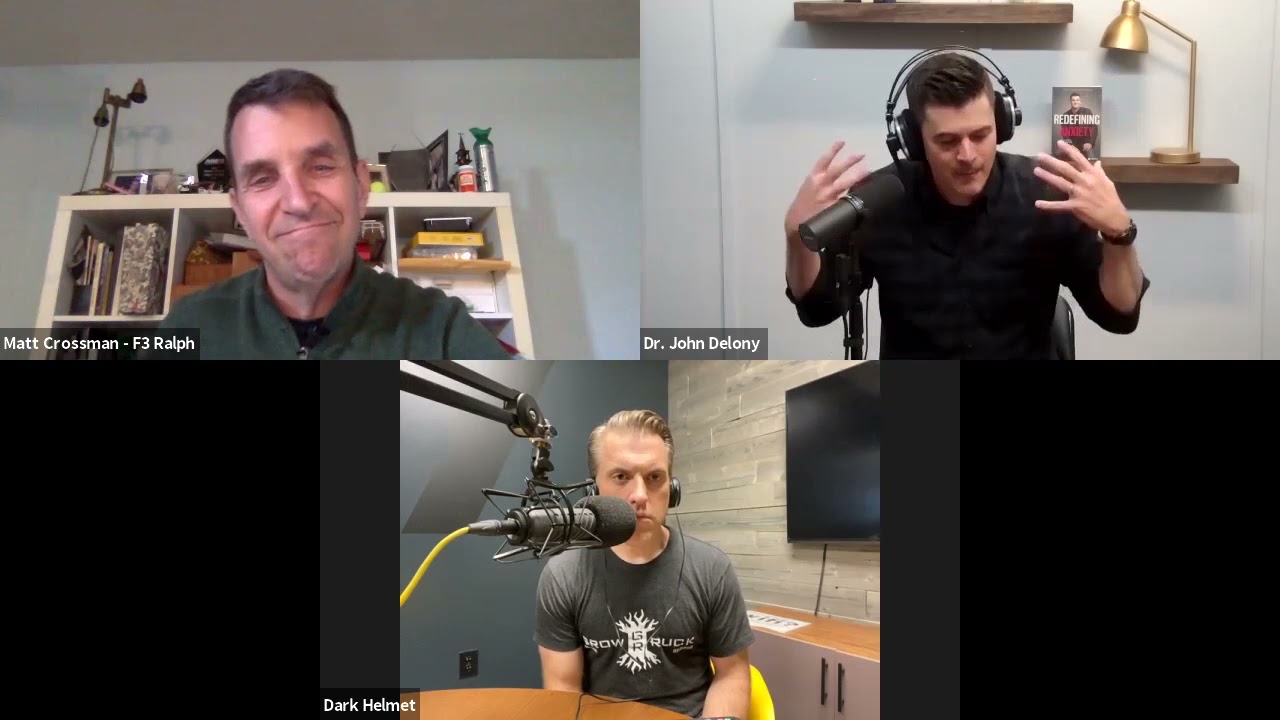

Dr John Delonys Podcast A Formula For Engaging With Sensitive Issues And Building A Large Audience

May 19, 2025

Dr John Delonys Podcast A Formula For Engaging With Sensitive Issues And Building A Large Audience

May 19, 2025