Spanish Inflation Cools More Than Expected: ECB Rate Cut Likely

Table of Contents

Unexpected Drop in Spanish Inflation

Inflation Figures and Their Significance

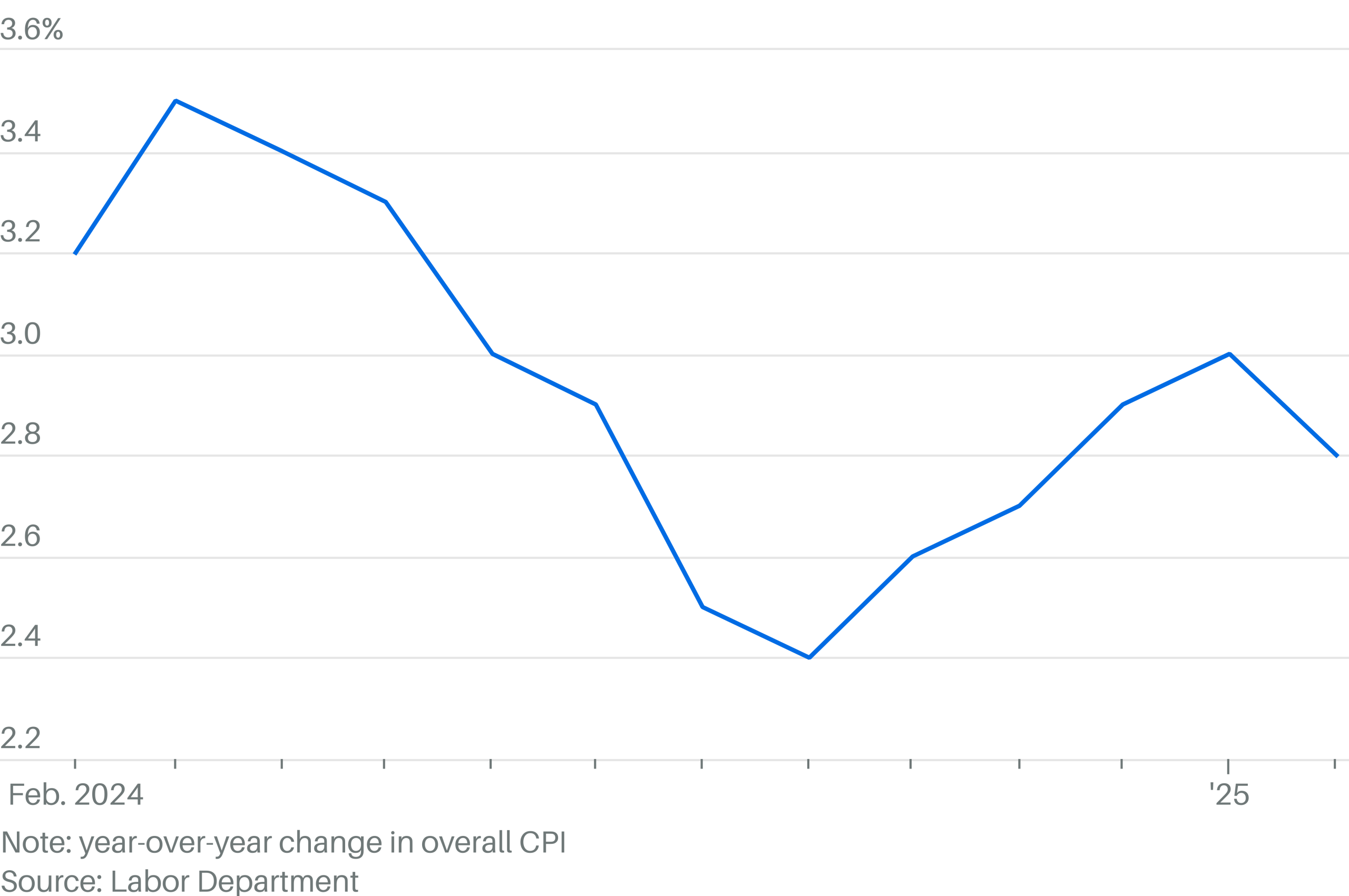

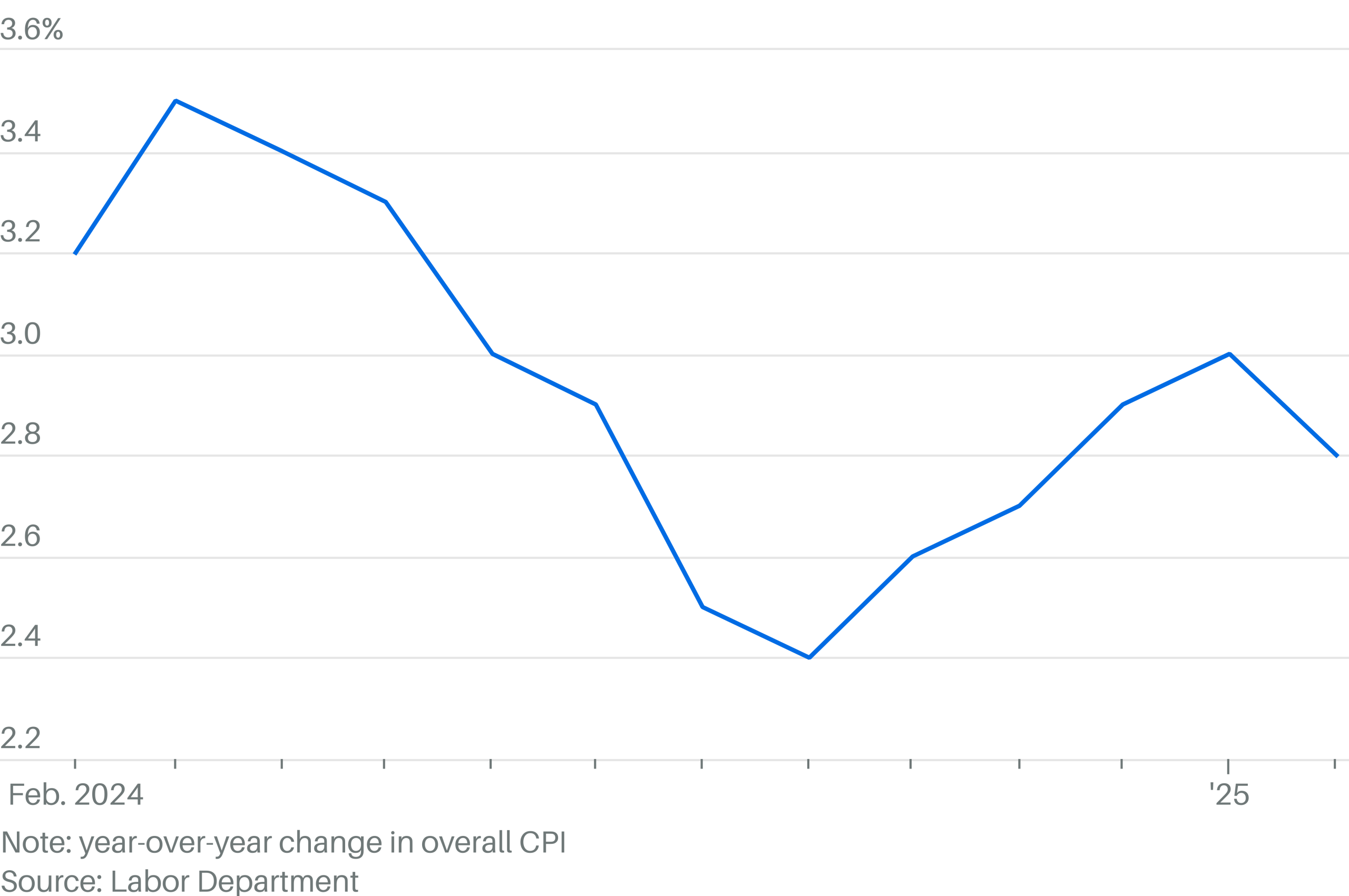

The latest figures released by the Spanish National Statistics Institute (INE) reveal a more-than-expected decrease in the inflation rate. While precise figures will vary slightly depending on the index used, a significant drop from previous months is undeniable. For example, if the previous month's inflation was at 5%, a drop to 4% would be significant, particularly when compared to the European average. This represents a substantial decrease in the cost of living for Spanish citizens.

- Specific Percentage Drop: [Insert the actual percentage drop from a reliable source like INE or Eurostat].

- Key Sectors Showing Slowdown: Significant deflation or slowing inflation is observed in [mention specific sectors e.g., energy, transportation] due to [mention specific reasons, e.g., decreased energy prices, increased supply]. Food prices, while still elevated, also show signs of moderating.

- Data Source: INE (Instituto Nacional de Estadística) and Eurostat are the primary sources for this data.

Factors Contributing to the Inflation Slowdown

Several factors are contributing to this unexpected slowdown in Spanish inflation. A combination of these elements seems to be at play:

- Easing Energy Prices: The recent decline in global energy prices, particularly natural gas, has significantly impacted overall inflation. This is a substantial relief for households and businesses struggling with high energy costs.

- Weakening Demand: A slowdown in consumer spending, possibly reflecting economic uncertainty and higher interest rates, is contributing to lower price pressures.

- Government Interventions: Government policies aimed at mitigating the impact of inflation, such as subsidies or tax cuts, have played a role in easing price increases in certain sectors.

Implications for the Eurozone Economy

ECB Response and Potential Rate Cut

The unexpected drop in Spanish inflation, coupled with similar trends in other Eurozone countries, puts significant pressure on the ECB to reconsider its monetary policy stance. The possibility of an ECB rate cut is gaining traction.

- Pressure on the ECB: The reduced inflationary pressure significantly weakens the argument for continued interest rate hikes. Markets are closely watching the ECB's next move.

- Impact on Borrowing Costs: A rate cut would lower borrowing costs for businesses and consumers across the Eurozone, potentially stimulating economic activity and investment. This would have a knock-on effect on Spain, leading to potentially increased business activity and consumer spending.

- Alternative Responses: The ECB might also explore alternative measures, such as adjustments to quantitative easing programs, to manage inflation effectively.

Impact on Spanish Economic Growth

A lower inflation rate and a potential ECB rate cut could positively impact Spain's economic growth. However, it's crucial to consider both positive and negative consequences:

- Positive Impacts: Lower inflation boosts consumer purchasing power, potentially leading to increased consumer spending and economic growth. Reduced borrowing costs stimulate investment and business expansion.

- Negative Impacts: While a rate cut might spur growth, it also carries the risk of fueling inflation again if implemented too aggressively or if other factors contribute to renewed price increases. It could also potentially weaken the Euro.

Risks and Uncertainties

Persistence of Inflationary Pressures

While the recent drop in inflation is encouraging, it's crucial to acknowledge that inflationary pressures persist in some sectors of the Spanish economy.

- Sectors with High Prices: [Mention sectors where prices remain stubbornly high, e.g., food, housing]. These areas require continued monitoring.

- Resurgence of Inflation: Geopolitical instability or supply chain disruptions could cause a resurgence of inflation in the future, undermining the recent positive trends.

Geopolitical and Global Economic Factors

External factors significantly influence Spain's inflation and the ECB's decision-making process.

- War in Ukraine: The ongoing conflict continues to impact energy prices and supply chains, potentially influencing Spanish inflation unpredictably.

- Global Supply Chain Issues: Disruptions to global supply chains can lead to higher prices for imported goods, impacting inflation even with domestic price moderation.

Conclusion

The unexpected cooling of Spanish inflation provides a temporary respite from persistent price increases and offers a potential path for the ECB to consider a rate cut. While this presents opportunities for economic growth, significant uncertainties remain. The persistence of inflationary pressures in certain sectors and the influence of geopolitical factors necessitate close monitoring. The ultimate impact on Spain's economy will depend on the ECB's response and the evolution of the global economic landscape.

Call to Action: Stay updated on Spanish inflation trends and follow the latest news on the ECB's response to lower inflation to better understand the potential impact on the Spanish economy and its consumers. Learn more about the implications of potential ECB rate cuts and their effects on Spanish businesses and individuals.

Featured Posts

-

Evaluating The Effectiveness Of Veterinary Watchdog Organizations

May 31, 2025

Evaluating The Effectiveness Of Veterinary Watchdog Organizations

May 31, 2025 -

Nyt Mini Crossword May 7 Solutions Full Guide To Todays Puzzle

May 31, 2025

Nyt Mini Crossword May 7 Solutions Full Guide To Todays Puzzle

May 31, 2025 -

Staten Island Nonna Restaurants Authentic Italian Cuisine

May 31, 2025

Staten Island Nonna Restaurants Authentic Italian Cuisine

May 31, 2025 -

Blackout In Spain The Iberdrola Grid Blame Game Intensifies

May 31, 2025

Blackout In Spain The Iberdrola Grid Blame Game Intensifies

May 31, 2025 -

Preparacion De Croque Monsieur Receta Paso A Paso

May 31, 2025

Preparacion De Croque Monsieur Receta Paso A Paso

May 31, 2025