SSE Announces £3 Billion Reduction In Spending Plan

Table of Contents

Reasons Behind the £3 Billion Spending Reduction

The decision to slash £3 billion from its planned spending reflects a confluence of challenging economic factors impacting the energy sector. Several key drivers contributed to this significant cost reduction:

- Increased inflationary pressures: Soaring inflation has dramatically increased the cost of materials, labor, and services needed for energy projects. This has led to significant cost overruns on existing projects and made future investments appear less attractive.

- Rising interest rates: The increase in interest rates has made financing new energy projects considerably more expensive. This higher cost of borrowing directly impacts the financial viability of large-scale renewable energy initiatives.

- Global economic uncertainty: The current global economic climate, marked by uncertainty and potential recession in some major markets, has prompted a more cautious approach to capital expenditure across various sectors, including energy.

- Supply chain issues: Persistent supply chain disruptions continue to delay project timelines and inflate costs. Difficulties in sourcing key components and materials have added considerable pressure on project budgets.

- Internal review and project prioritization: SSE likely conducted a thorough internal review of its investment pipeline, leading to a reassessment of project costs and prioritization based on financial viability and strategic alignment. This process may have resulted in the cancellation or postponement of some less profitable ventures.

Impact on SSE's Renewable Energy Portfolio

The £3 billion spending cut will undoubtedly have a significant impact on SSE's ambitious renewable energy portfolio. While SSE remains committed to the green energy transition, the financial realities necessitate a more strategic and selective approach:

- Potential delays or scaling back of wind farm developments: Large-scale onshore and offshore wind farm projects are particularly capital-intensive. Delays or reductions in the scope of these projects are likely, affecting the overall timeline for renewable energy capacity expansion.

- Review of solar energy investments: Similar to wind projects, solar energy investments will be subject to rigorous scrutiny, leading to potential adjustments in project timelines or even cancellations of less promising ventures.

- Focus shift towards cost-effective projects: SSE will likely prioritize renewable energy projects with lower upfront costs and quicker returns on investment. This may lead to a focus on smaller-scale projects or those with more readily available financing.

- Impact on UK renewable energy targets: The reduction in SSE's investment could potentially hinder the UK's ambitious renewable energy targets. The collective effort of multiple energy providers is crucial for achieving these targets.

- SSE's commitment to the green energy transition: While the spending cut represents a tactical retreat, SSE's overall commitment to the green energy transition remains to be seen. The company's future actions and communications will be crucial in demonstrating its continued dedication to sustainable energy sources.

Financial Implications and Investor Reaction

The announcement of the £3 billion spending cut has significant financial implications for SSE and has elicited a noticeable response from investors:

- Immediate market reaction: The share price of SSE likely experienced volatility following the announcement, reflecting investor sentiment towards the company's revised financial strategy. A deeper analysis of share price fluctuations will provide a better understanding of investor confidence.

- Impact on profitability: The short-term impact on profitability might be positive due to reduced capital expenditure. However, the long-term impact depends on SSE's ability to navigate the energy transition while maintaining a healthy financial position.

- Changes to debt levels and credit ratings: The spending reduction could lead to improved debt levels and potentially a positive impact on SSE's credit rating. This will offer more clarity on the company’s financial health and future investment capabilities.

- Investor sentiment and future funding: Maintaining investor confidence is crucial for SSE's access to future funding. The company's communication strategy and ability to demonstrate a clear path towards long-term growth will be pivotal.

- Comparison with other energy companies: Comparing SSE's financial performance and strategic response to the economic challenges with other major energy companies will help assess the overall impact of this decision on the industry.

Wider Implications for the UK Energy Sector

SSE's decision to cut spending has broader implications for the UK energy sector as a whole:

- Knock-on effects on other energy companies: Other energy companies might adopt similar cost-cutting measures, potentially slowing down the overall pace of investment in renewable energy projects across the UK.

- Implications for UK energy security: Reduced investment in domestic renewable energy sources could increase the UK's reliance on imported energy, potentially impacting energy security and price stability.

- Impact on energy prices for consumers: The long-term effect on energy prices for consumers is uncertain. While reduced investment might lead to some short-term cost savings for SSE, it could also affect future energy supply and potentially increase prices in the long run.

- Government response and policy adjustments: The UK government may need to re-evaluate its energy policies and potentially introduce new incentives to encourage investment in renewable energy and support the energy transition.

- Competitive landscape within the UK energy market: The spending cut will likely reshape the competitive landscape within the UK energy market, with potential shifts in market share and strategic alliances.

Conclusion

SSE's decision to cut its spending plan by £3 billion is a significant development with far-reaching consequences. The reasons behind the cuts, primarily driven by increased costs and economic uncertainty, have implications for the company's renewable energy portfolio and the wider UK energy sector. While the move might improve short-term financial stability, it also raises concerns about the pace of the energy transition and the potential impact on energy prices. The long-term implications for the UK's energy security and the broader energy market remain uncertain and warrant close monitoring.

Call to Action: Stay informed about the evolving situation surrounding SSE's spending cuts and their impact on the energy market. Follow our updates on SSE's £3 billion spending reduction for further analysis and insights into this crucial development in the UK energy sector.

Featured Posts

-

Sheinelle Jones Discussing Her Daily Life Amidst Absence From Today Show

May 23, 2025

Sheinelle Jones Discussing Her Daily Life Amidst Absence From Today Show

May 23, 2025 -

Latest Big Rig Rock Report 3 12 From Rock 106 1

May 23, 2025

Latest Big Rig Rock Report 3 12 From Rock 106 1

May 23, 2025 -

Urgent Action Needed Swiss Mountain Village At High Landslide Risk

May 23, 2025

Urgent Action Needed Swiss Mountain Village At High Landslide Risk

May 23, 2025 -

Alshrtt Thqq Me Ilyas Rwdryjyz Fy Qdyt Mqtl Mwzfyn Balsfart Alisrayylyt Fy Washntn

May 23, 2025

Alshrtt Thqq Me Ilyas Rwdryjyz Fy Qdyt Mqtl Mwzfyn Balsfart Alisrayylyt Fy Washntn

May 23, 2025 -

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025

Latest Posts

-

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025 -

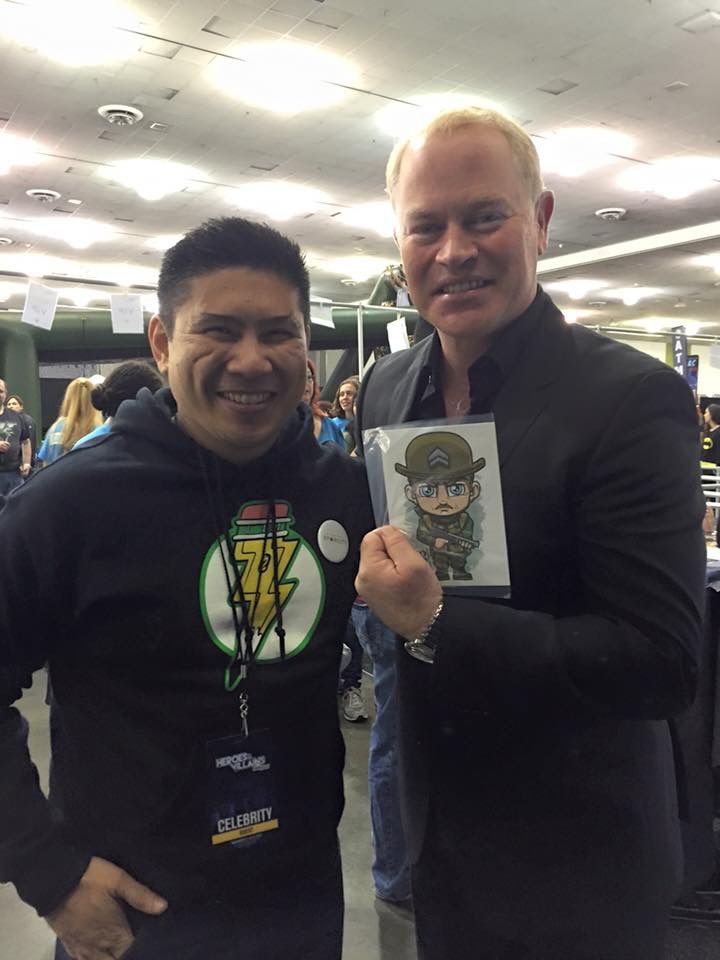

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025 -

Memorial Day Weekend Gas Prices Decades Low Projections

May 23, 2025

Memorial Day Weekend Gas Prices Decades Low Projections

May 23, 2025 -

Neal Mc Donoughs Damien Darhk Could He Beat Superman Exclusive Interview

May 23, 2025

Neal Mc Donoughs Damien Darhk Could He Beat Superman Exclusive Interview

May 23, 2025