SSE's Revised Spending Plan: £3 Billion Cut Reflects Economic Uncertainty

Table of Contents

The £3 Billion Cut: A Detailed Breakdown

SSE's decision to reduce its capital expenditure by £3 billion represents a substantial shift in its investment strategy. This budget cut, a consequence of several interconnected factors, will inevitably impact various aspects of the company's operations.

-

Specific areas affected: The reduction will affect several key areas, including renewable energy projects (potentially delaying or scaling back new wind and solar farm developments), network upgrades (leading to postponed grid enhancements and potentially impacting energy reliability), and customer service initiatives (possibly resulting in reduced investment in digital infrastructure and customer support programs).

-

Percentage reduction: While the exact percentage reduction across different sectors remains undisclosed, the overall £3 billion cut represents a considerable scaling back of ambitious investment plans.

-

Rationale: The decision stems from a confluence of economic headwinds, including:

- Soaring inflation: Increased costs for materials, labor, and services have significantly impacted project viability.

- Elevated interest rates: Higher borrowing costs make financing large-scale infrastructure projects more expensive and less attractive.

- Supply chain disruptions: Ongoing global supply chain issues have led to delays and increased costs for essential equipment and materials.

-

Impact on job creation and expansion: The reduced spending will likely impact job creation, potentially delaying or scaling back planned expansion efforts within the company. The extent of this impact is yet to be fully determined.

Impact on SSE's Renewable Energy Ambitions

SSE's commitment to renewable energy and its ambitious net-zero targets are directly affected by this £3 billion cut. The company's transition to sustainable energy sources, a crucial element of its long-term strategy, faces a significant challenge.

-

Effect on renewable projects: The budget cut casts doubt over the timeline for several planned renewable energy projects. Wind farm developments, solar farm constructions, and other green energy initiatives may face delays or even cancellation.

-

Net-zero target re-evaluation: SSE will likely need to re-evaluate its net-zero targets in light of the reduced investment capacity. The revised plan may necessitate adjustments to its timeline and overall strategy for achieving carbon neutrality.

-

Alternative financing: To mitigate the impact, SSE might explore alternative financing options, such as partnerships with other investors or government subsidies, to secure funding for its crucial renewable energy projects. However, securing such funding in the current economic climate presents a challenge.

Wider Implications for the Energy Sector

SSE's decision resonates throughout the energy sector, reflecting the broader economic challenges faced by energy companies worldwide. The reduced investment signals a period of heightened uncertainty.

-

Challenges for the energy sector: The move highlights the difficult investment climate within the energy sector, marked by economic uncertainty and volatile energy prices. Many energy companies are grappling with similar pressures.

-

Investor confidence: SSE's revised spending plan could negatively impact investor confidence, potentially deterring future investment in the energy sector. This could have a cascading effect, hindering much-needed investments in energy infrastructure and the transition to cleaner energy sources.

-

Ripple effects: The decision's ripple effect could spread to other energy companies and related industries, impacting supply chains, employment, and overall economic activity.

-

Government policy: Government policies and regulations play a significant role in shaping the investment climate. Supportive policies aimed at incentivizing renewable energy investments could mitigate some of the negative impacts of the current economic downturn.

Analysis of SSE's Financial Outlook

The £3 billion cut significantly impacts SSE's financial outlook, requiring a careful assessment of its long-term implications.

-

Financial health and long-term impact: While SSE remains financially sound, the reduction in capital expenditure will impact profit margins in the short to medium term. The long-term impact depends heavily on the success of cost-cutting measures and the company's ability to secure alternative funding.

-

Share price and credit rating: The announcement likely caused some volatility in SSE's share price and could potentially affect its credit rating. Investor reaction will be a key indicator of the market's perception of the revised plan.

-

Strategies for improvement: To regain investor confidence and improve financial stability, SSE might need to implement further cost-cutting measures, explore diversification strategies, and actively seek out new investment opportunities.

Conclusion

SSE's revised spending plan, involving a significant £3 billion cut, underscores the considerable economic uncertainty impacting the energy sector. The reduction in capital expenditure will undeniably influence SSE's renewable energy ambitions and broader operational strategies. The move also serves as a barometer of the challenges faced by energy companies navigating volatile markets and increased financial pressures. The impact of this significant budget adjustment will be felt across the sector, impacting future investment and the transition to a cleaner energy future.

Call to Action: Stay informed about the evolving situation with SSE and the energy sector by following our updates on the latest developments in SSE's revised spending plan and its implications for the energy transition. Understanding the impact of this £3 billion cut is crucial for anyone invested in or affected by the energy market.

Featured Posts

-

Dexter Resurrection Lithgow Und Smits Kehren Zurueck

May 22, 2025

Dexter Resurrection Lithgow Und Smits Kehren Zurueck

May 22, 2025 -

The Unforgettable Vybz Kartel Concerts In Brooklyn A Sold Out Success

May 22, 2025

The Unforgettable Vybz Kartel Concerts In Brooklyn A Sold Out Success

May 22, 2025 -

Rising Grocery Prices Inflationary Trends For The Third Consecutive Month

May 22, 2025

Rising Grocery Prices Inflationary Trends For The Third Consecutive Month

May 22, 2025 -

British Ultrarunner Attempts Australian Speed Record

May 22, 2025

British Ultrarunner Attempts Australian Speed Record

May 22, 2025 -

Klyuchovi Momenti Peregovoriv Yevrokomisar Pro Perspektivi Chlenstva Ukrayini V Nato

May 22, 2025

Klyuchovi Momenti Peregovoriv Yevrokomisar Pro Perspektivi Chlenstva Ukrayini V Nato

May 22, 2025

Latest Posts

-

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025 -

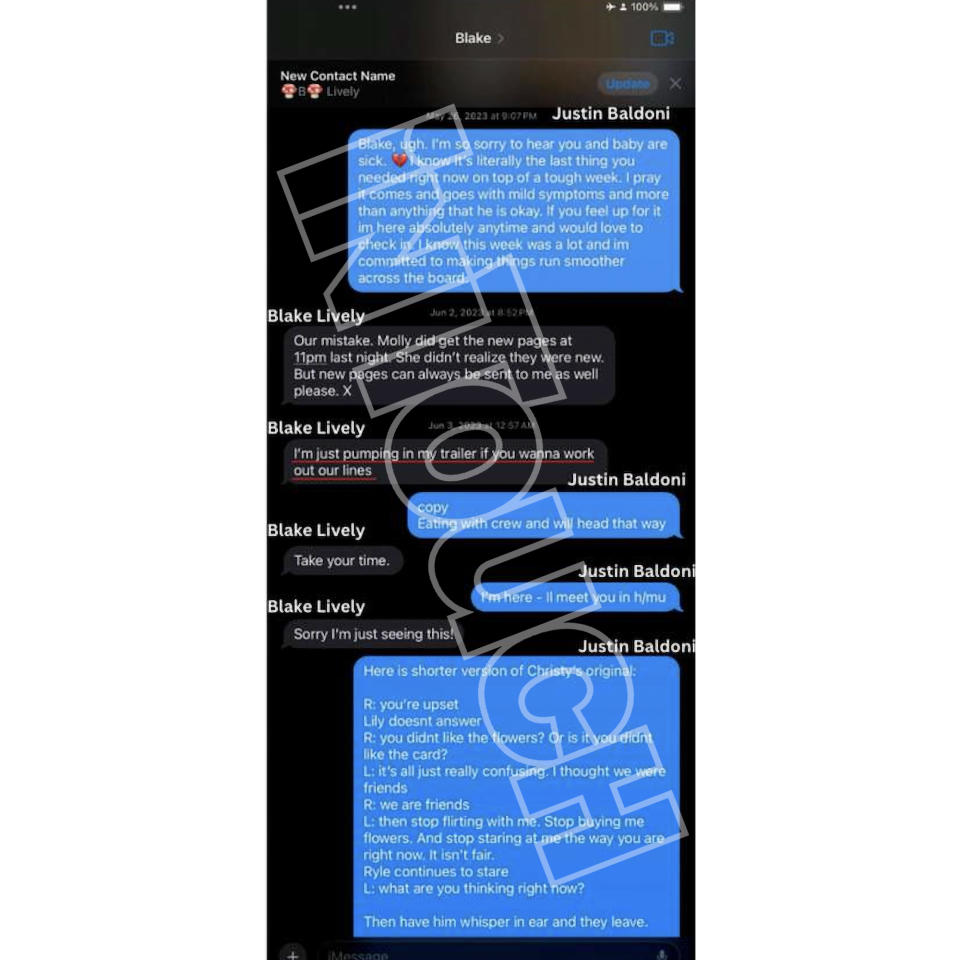

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025 -

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025 -

Ukrayina Poza Nato Analiz Potentsiynikh Zagroz Ta Politichnikh Naslidkiv

May 22, 2025

Ukrayina Poza Nato Analiz Potentsiynikh Zagroz Ta Politichnikh Naslidkiv

May 22, 2025