SSE's Revised Spending Plan: £3 Billion Less Amid Economic Uncertainty

Table of Contents

Reasons Behind SSE's Reduced Capital Expenditure

The £3 billion reduction in SSE's capital expenditure is attributed to a confluence of factors, all stemming from the current challenging economic climate. These include:

-

Increased inflation and rising interest rates: Soaring inflation has driven up the cost of materials, labor, and other inputs, making projects significantly more expensive. Simultaneously, rising interest rates increase the cost of borrowing, making financing large-scale infrastructure projects more challenging. This directly impacts SSE's ability to invest in its planned projects, necessitating the spending cuts.

-

Supply chain disruptions impacting project costs: Global supply chain bottlenecks continue to plague various industries, including the energy sector. Delays in procuring essential equipment and materials inflate project timelines and budgets, forcing SSE to re-evaluate its investment strategy. The lack of readily available components has pushed back project completion dates and increased overall costs.

-

Concerns about future energy demand given the economic climate: The current economic downturn has raised concerns about future energy demand. With businesses and households facing cost-of-living pressures, there's uncertainty surrounding future energy consumption levels. This uncertainty necessitates a more cautious approach to investment, leading to the reduction in SSE's spending plan.

-

Government policy changes and their effect on investment decisions: Changes in government policies related to energy subsidies, renewable energy targets, and regulatory frameworks can significantly impact investment decisions within the energy sector. Uncertainties surrounding future policy directions can make long-term investments less attractive, pushing companies like SSE to adopt a more conservative approach to capital expenditure.

These factors combined have forced SSE to reassess its investment priorities, resulting in the substantial reduction outlined in its revised spending plan. The company's financial reports highlight a significant increase in projected costs across multiple projects, underscoring the impact of inflation and supply chain issues on its financial performance.

Impact on SSE's Renewable Energy Projects

The most immediate and visible impact of SSE's revised spending plan will be felt in its renewable energy portfolio. The reduced capital expenditure will likely lead to:

-

Delays in project completion: Several ongoing and planned wind and solar power projects are expected to experience delays due to the reduced funding. This impacts the timeline for the UK's energy transition strategy.

-

Potential project cancellations: In some cases, projects deemed less financially viable in the current climate may face outright cancellation. This means a significant reduction in the planned capacity additions to renewable energy generation.

-

Reduced investment in research and development: The spending cuts could also impact research and development efforts aimed at improving the efficiency and cost-effectiveness of renewable energy technologies. This impacts future innovation within SSE's projects.

This situation has significant implications for the UK's ambitious renewable energy targets. Delayed or cancelled projects will impact the country's ability to meet its climate change commitments and increase its reliance on carbon-intensive energy sources. The reduced investment in green energy projects directly impacts the nation's energy transition goals.

Wider Implications for the UK Energy Sector

SSE's decision to slash its spending plan has significant ramifications for the broader UK energy sector. It could trigger:

-

A domino effect on other energy companies: SSE's move may encourage other energy companies to adopt a similar approach, leading to a wider slowdown in energy investment across the UK.

-

Reduced job creation and economic growth: Cuts in capital expenditure will inevitably lead to fewer jobs created within the sector and a dampening effect on overall economic growth linked to energy infrastructure projects. This also impacts downstream industries.

-

Increased challenges to energy security and climate targets: The reduction in investment in renewable energy could hinder the UK's ability to meet its energy security needs and its ambitious climate change targets, potentially leading to reliance on fossil fuels and greater carbon emissions. A decreased capacity in renewable sources can negatively impact energy security.

The implications are far-reaching and emphasize the need for stable and supportive government policies to attract and sustain investments in the UK energy sector, especially within the renewable energy market.

Analyst Reactions and Market Response

Financial analysts have responded to SSE's revised spending plan with a mix of caution and understanding. Many acknowledge the challenging economic conditions and the need for prudent financial management. However, concerns have been raised regarding the potential impact on the UK's renewable energy ambitions and energy security. The market has reacted with a generally negative sentiment reflected in SSE's share price, signaling investor concerns about the company's future financial outlook. Reports suggest a decline in the company's market capitalization post-announcement. The overall sentiment is one of uncertainty, with analysts closely monitoring the situation and waiting for further updates.

Conclusion: SSE's Revised Spending Plan: Navigating Economic Uncertainty

SSE's £3 billion reduction in its spending plan is a direct response to the prevailing economic uncertainty, driven by inflation, supply chain disruptions, concerns about future energy demand, and evolving government policies. The impact is significant, potentially delaying or canceling renewable energy projects and creating wider challenges for the UK energy sector. This revised spending plan highlights the critical need for a stable and supportive policy environment to foster investment in renewable energy and ensure the UK's energy security and climate goals are met. Stay tuned for updates on SSE's revised spending plan and its ongoing impact on the UK's energy future.

Featured Posts

-

Mamma Mia Review Of The New Ferrari Hot Wheels Car Sets

May 24, 2025

Mamma Mia Review Of The New Ferrari Hot Wheels Car Sets

May 24, 2025 -

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025 -

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025 -

Must Have Gear For Ferrari Enthusiasts

May 24, 2025

Must Have Gear For Ferrari Enthusiasts

May 24, 2025 -

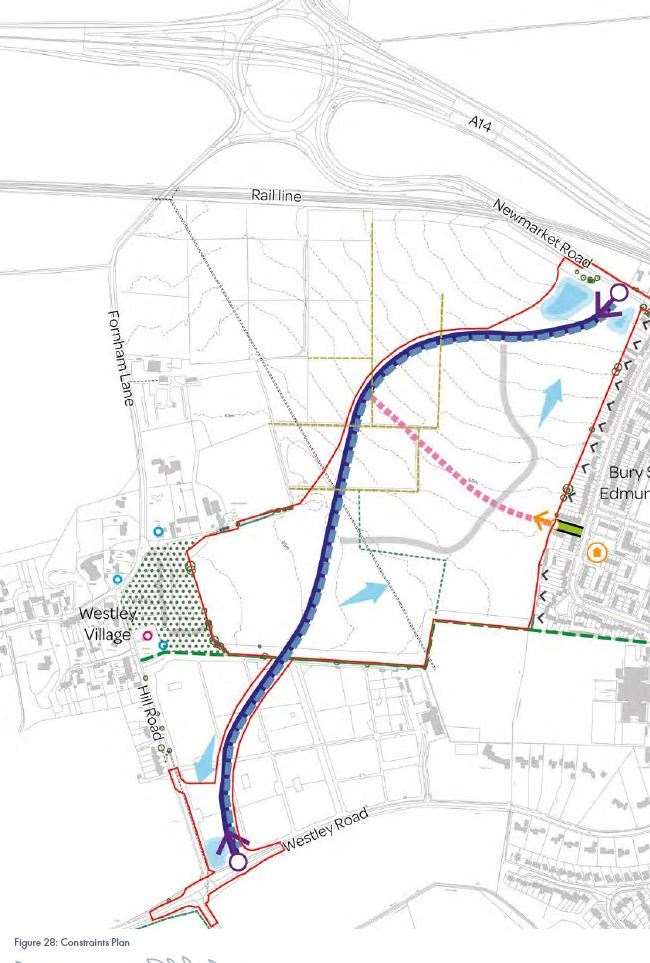

Bury And The M62 Relief Road A Plan That Never Was

May 24, 2025

Bury And The M62 Relief Road A Plan That Never Was

May 24, 2025

Latest Posts

-

Goroskopy I Predskazaniya Razvernutiy Analiz Vashey Sudby

May 24, 2025

Goroskopy I Predskazaniya Razvernutiy Analiz Vashey Sudby

May 24, 2025 -

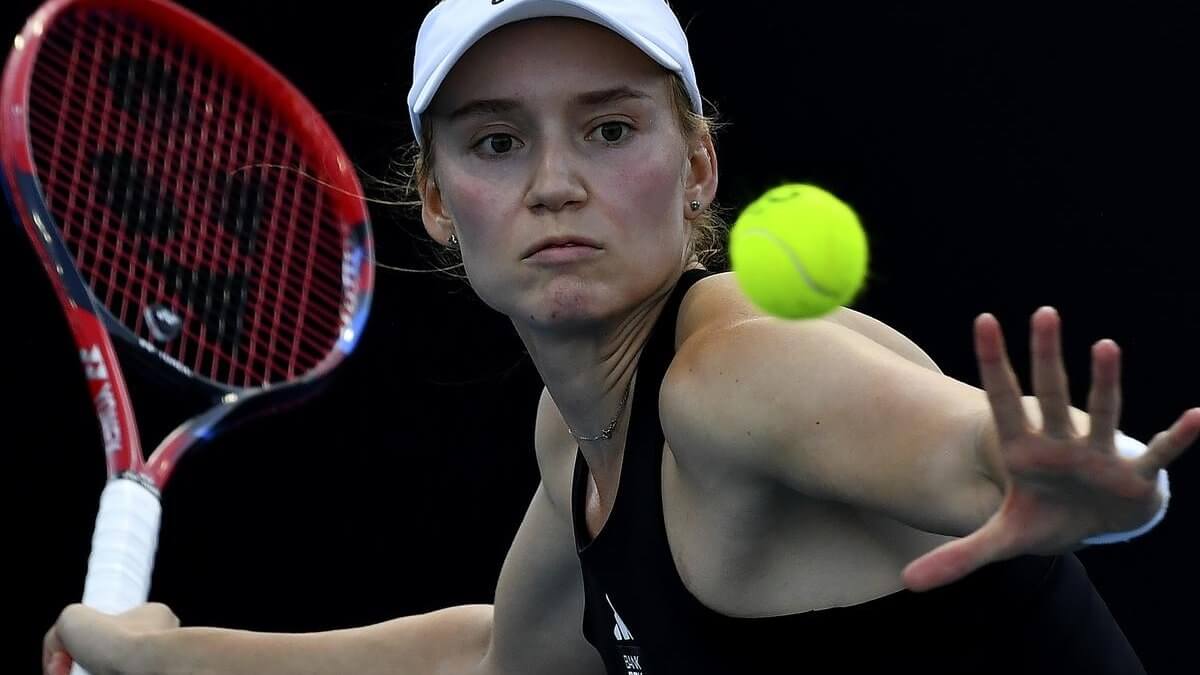

Vklad Eleny Rybakinoy V Razvitie Zhenskogo Tennisa V Kazakhstane

May 24, 2025

Vklad Eleny Rybakinoy V Razvitie Zhenskogo Tennisa V Kazakhstane

May 24, 2025 -

Goroskopy I Predskazaniya 2024 Astrologicheskiy Prognoz Na God

May 24, 2025

Goroskopy I Predskazaniya 2024 Astrologicheskiy Prognoz Na God

May 24, 2025 -

Swiatek And Rybakina Triumph At Indian Wells 2025 Reach Fourth Round

May 24, 2025

Swiatek And Rybakina Triumph At Indian Wells 2025 Reach Fourth Round

May 24, 2025 -

Astrologicheskie Goroskopy I Predskazaniya Prognoz Dlya Vsekh Znakov Zodiaka

May 24, 2025

Astrologicheskie Goroskopy I Predskazaniya Prognoz Dlya Vsekh Znakov Zodiaka

May 24, 2025