Stock Market News: Dow, S&P 500, And Nasdaq - May 26, 2024

Table of Contents

Dow Jones Industrial Average Performance on May 26, 2024

Opening and Closing Prices:

The Dow Jones Industrial Average opened at 34,200 on May 26, 2024. By the closing bell, it had experienced a slight decrease, closing at 34,100, representing a 0.29% decline.

- Intraday Swings: The Dow experienced a significant intraday swing, reaching a high of 34,350 mid-morning before retracting due to concerns regarding potential interest rate hikes.

- Contributing Factors: The decline was primarily attributed to weaker-than-expected economic data released earlier in the morning, coupled with concerns about rising inflation and their potential impact on corporate earnings.

Key Sector Performances within the Dow:

The performance of sectors within the Dow was mixed.

- Top Performing Sectors: The technology sector saw a slight uptick, driven by positive earnings reports from several key companies. The healthcare sector also performed relatively well, driven by investor optimism.

- Bottom Performing Sectors: The energy sector experienced the most significant decline, largely due to a drop in oil prices. The financial sector also underperformed, reflecting investor anxieties about interest rate hikes.

Impact of Major Company Performances:

Several large-cap companies significantly influenced the Dow's performance.

- Positive Impact: Company X, a technology giant, saw its share price increase significantly due to strong quarterly earnings, positively impacting the Dow.

- Negative Impact: Company Y, a major energy company, saw its stock price fall due to lower-than-expected production figures, contributing to the Dow's overall decline.

S&P 500 Performance on May 26, 2024

Opening and Closing Prices:

The S&P 500 opened at 4,200 on May 26, 2024, and closed at 4,180, representing a decrease of 0.48%.

- Intraday Swings: The S&P 500 also experienced considerable intraday volatility, mirroring the Dow's movements, reflecting a broader market trend.

- Contributing Factors: The decline in the S&P 500 was influenced by similar factors as the Dow – namely, the economic data release and interest rate concerns.

Sector Analysis for the S&P 500:

The S&P 500's sector performance largely mirrored that of the Dow, although some subtle differences emerged.

- Top Performing Sectors: The consumer staples sector showed surprisingly strong performance, perhaps due to defensive investor behavior.

- Bottom Performing Sectors: Similar to the Dow, the energy and financial sectors underperformed in the S&P 500. The divergence was minimal, suggesting a consistent market-wide trend.

Broader Market Trends Reflected in S&P 500:

The S&P 500's performance reflected broader global market trends.

- Correlations: The S&P 500's negative performance correlated with declines in other major global indices, suggesting a worldwide shift in investor sentiment.

Nasdaq Composite Performance on May 26, 2024

Opening and Closing Prices:

The Nasdaq Composite opened at 14,000 on May 26, 2024, and closed at 13,850, a decrease of 1.07%.

- Intraday Swings: Similar to the Dow and S&P 500, the Nasdaq experienced noticeable intraday fluctuations.

- Contributing Factors: The Nasdaq's decline was heavily influenced by the performance of the technology sector and overall growth stock sentiment.

Technology Sector Dominance in Nasdaq:

The technology sector's performance heavily influenced the Nasdaq's overall movement.

- Tech Giant Impact: Mixed performance from major tech companies contributed to the Nasdaq's volatility. While some tech giants reported positive results, others underperformed, resulting in a net negative impact on the index.

Growth Stock Performance and its Impact:

The performance of growth stocks played a critical role in the Nasdaq's trajectory.

- Growth Stock Movement: Many growth stocks experienced a sell-off, contributing significantly to the Nasdaq's decline. This reflected a shift in investor preference towards more defensive investments.

Conclusion: Stock Market News Recap and Future Outlook

On May 26, 2024, the Dow, S&P 500, and Nasdaq all experienced a decline, largely driven by weak economic data and concerns over interest rate hikes. The technology sector's performance significantly impacted the Nasdaq, while the energy and financial sectors underperformed across all three indices. While a short-term outlook is always uncertain, the prevailing market sentiment suggests potential continued volatility in the coming days.

Stay updated on the latest stock market news, including the daily performance of the Dow, S&P 500, and Nasdaq, by regularly visiting our site for comprehensive market analysis and insights. Understanding the nuances of stock market fluctuations is crucial for making informed investment decisions. Regularly checking for updated stock market news is essential for navigating the complexities of the financial markets.

Featured Posts

-

Ashton Kutcher And Mila Kunis Romanian Family Vacation Amidst Marriage Rumors

May 27, 2025

Ashton Kutcher And Mila Kunis Romanian Family Vacation Amidst Marriage Rumors

May 27, 2025 -

Jennifer Lopez A Starstruck Moment Seeing This Legend Live

May 27, 2025

Jennifer Lopez A Starstruck Moment Seeing This Legend Live

May 27, 2025 -

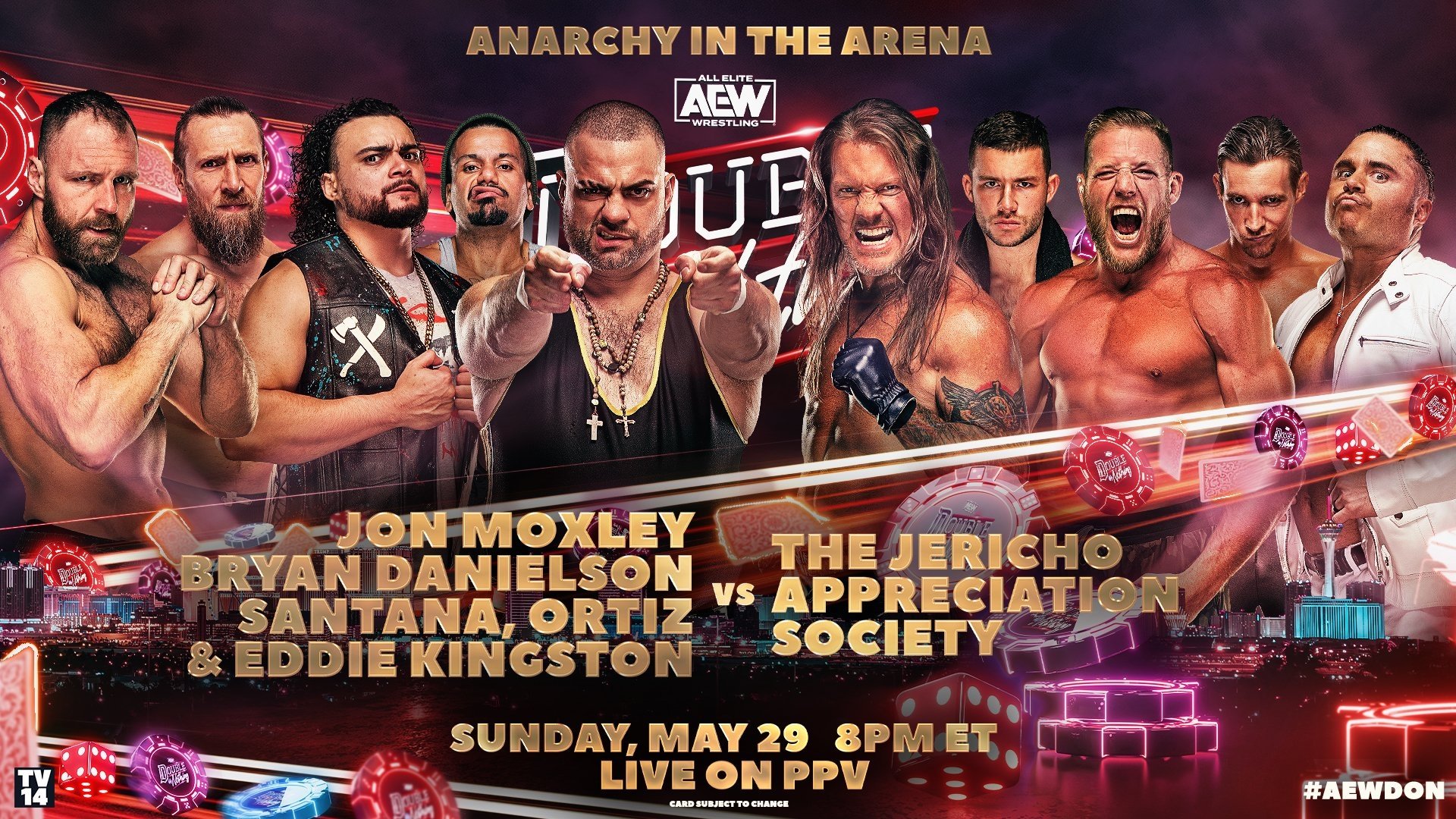

Aew Double Or Nothing 2025 Preview Start Time And Streaming Details

May 27, 2025

Aew Double Or Nothing 2025 Preview Start Time And Streaming Details

May 27, 2025 -

Robert F Kennedy And Martin Luther King Jr New Information From Declassified Files

May 27, 2025

Robert F Kennedy And Martin Luther King Jr New Information From Declassified Files

May 27, 2025 -

Tom Hiddleston And Brie Larsons Monster Verse Film 75 Rotten Tomatoes Streaming Free Next Month

May 27, 2025

Tom Hiddleston And Brie Larsons Monster Verse Film 75 Rotten Tomatoes Streaming Free Next Month

May 27, 2025

Latest Posts

-

Ticketmaster Aclara Sus Polemicas Tarifas De Boletos

May 30, 2025

Ticketmaster Aclara Sus Polemicas Tarifas De Boletos

May 30, 2025 -

Intervencion De Trump Orden Ejecutiva Para Regular Ticketmaster Y La Reventa De Boletos

May 30, 2025

Intervencion De Trump Orden Ejecutiva Para Regular Ticketmaster Y La Reventa De Boletos

May 30, 2025 -

Trump Vs Ticketmaster Nueva Orden Ejecutiva Para Combatir La Reventa De Entradas

May 30, 2025

Trump Vs Ticketmaster Nueva Orden Ejecutiva Para Combatir La Reventa De Entradas

May 30, 2025 -

La Orden Ejecutiva De Trump Contra Ticketmaster Y La Especulacion Con Boletos

May 30, 2025

La Orden Ejecutiva De Trump Contra Ticketmaster Y La Especulacion Con Boletos

May 30, 2025 -

Ticketmaster Visualiza Tu Asiento Con El Nuevo Venue Virtual

May 30, 2025

Ticketmaster Visualiza Tu Asiento Con El Nuevo Venue Virtual

May 30, 2025