Stock Market News: Tracking Dow, S&P, And Nasdaq On May 27

Table of Contents

Dow Jones Industrial Average Performance on May 27

The Dow Jones Industrial Average (DJIA), a key indicator of the US stock market, saw a mixed performance on May 27th. Analyzing the Dow Jones performance requires a look at several key factors. Let's examine the specifics:

- Opening Price: [Insert Opening Price - e.g., 33,000]

- Closing Price: [Insert Closing Price - e.g., 33,200]

- High: [Insert High - e.g., 33,300]

- Low: [Insert Low - e.g., 32,900]

- Percentage Change: [Insert Percentage Change from previous day's close - e.g., +0.6%]

The Dow's slight gain was primarily driven by the strong performance of the [Insert Sector - e.g., technology] sector, while the [Insert Sector - e.g., energy] sector experienced a slight downturn. This movement can be partially attributed to [Insert News Event - e.g., positive earnings reports from major tech companies].

- Top Gainers:

- [Company Name] (+X%)

- [Company Name] (+Y%)

- Top Losers:

- [Company Name] (-X%)

- [Company Name] (-Y%)

The Dow Jones Industrial Average's movement on May 27th reflects the complex interplay of various economic factors and company-specific news.

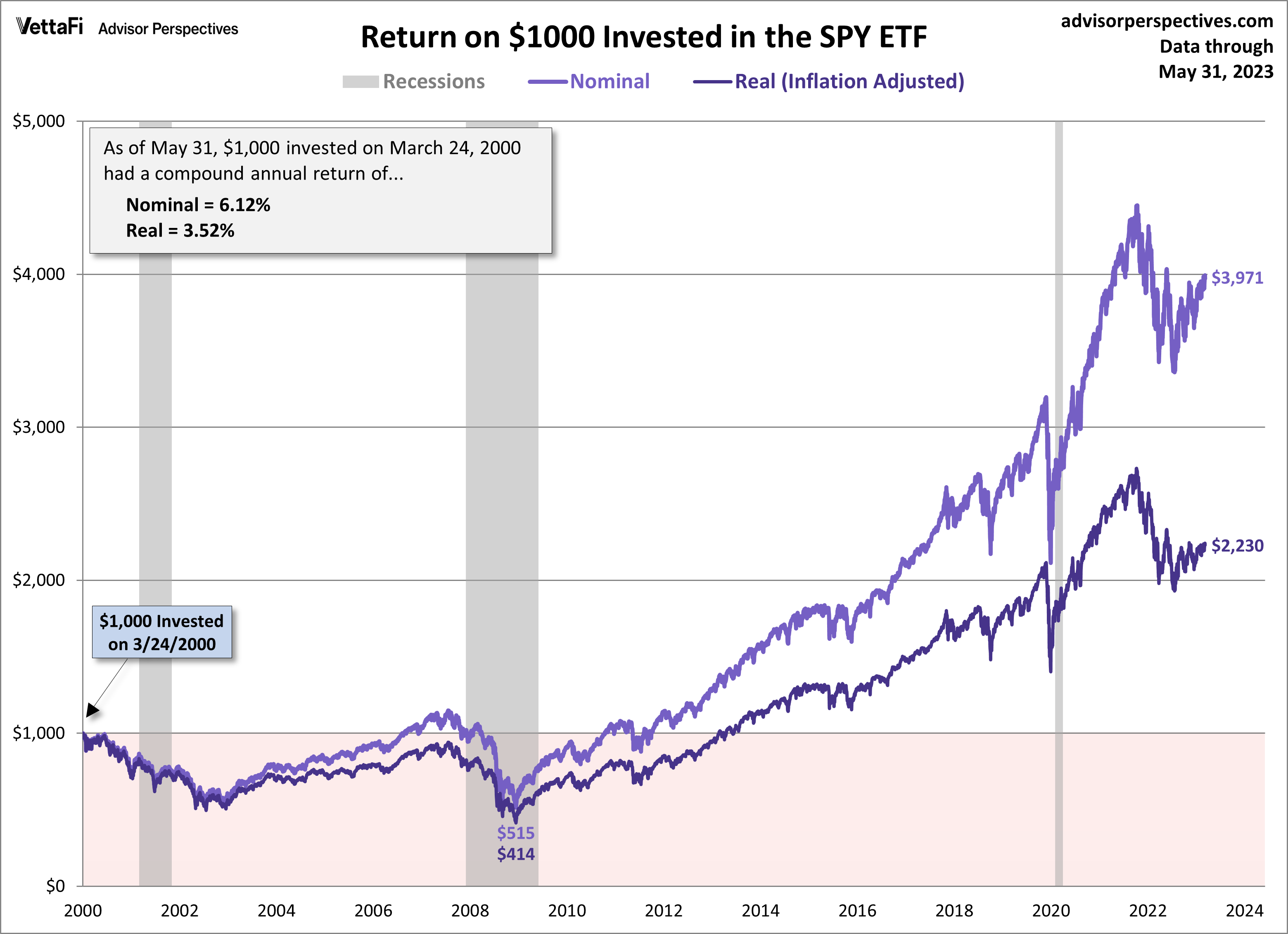

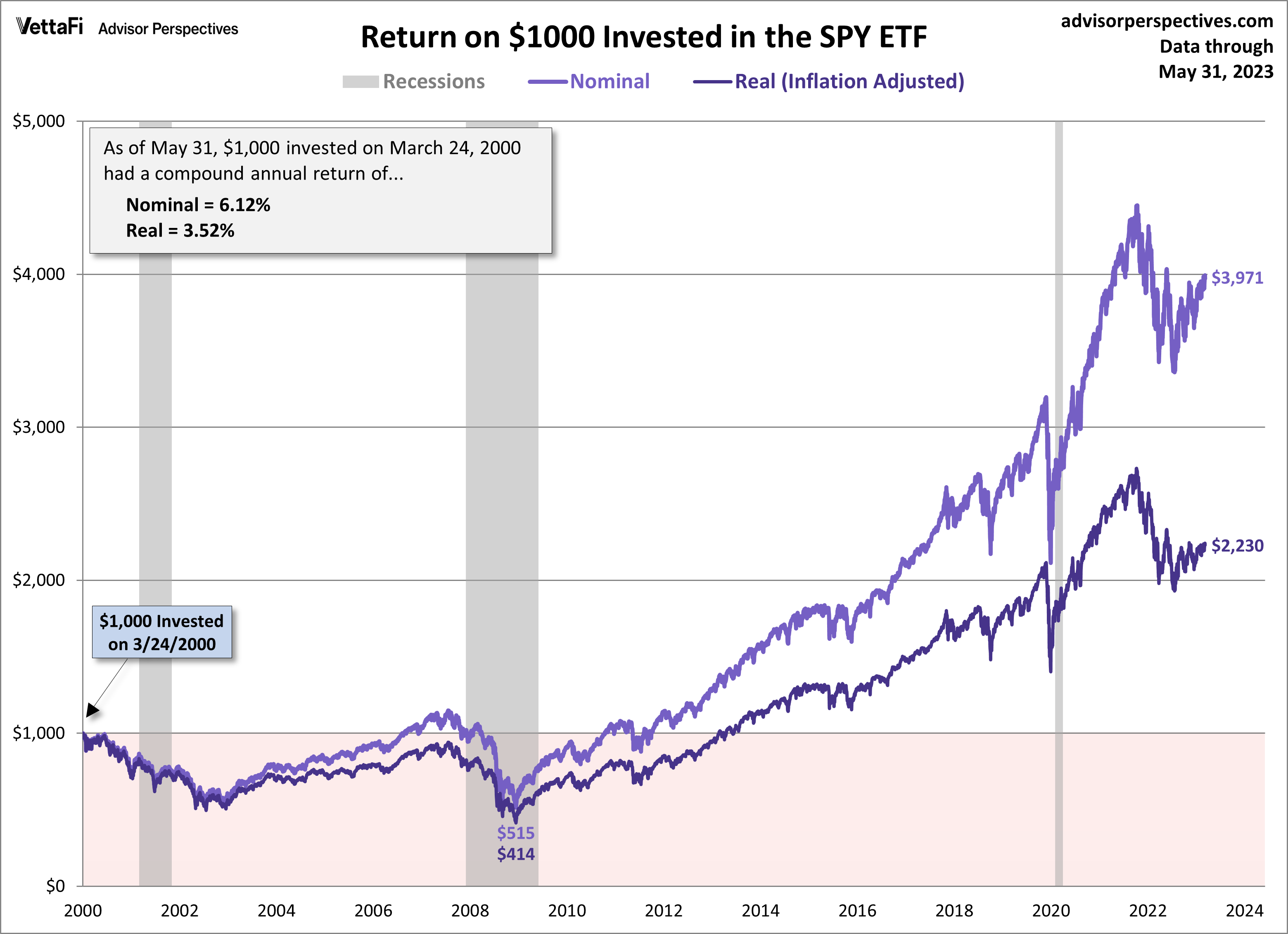

S&P 500 Index Movement on May 27

The S&P 500, a broader representation of the US stock market, mirrored some of the Dow's trends but exhibited its own unique characteristics on May 27th. Understanding the S&P 500's performance requires examination of its key metrics:

- Opening Price: [Insert Opening Price]

- Closing Price: [Insert Closing Price]

- High: [Insert High]

- Low: [Insert Low]

- Percentage Change: [Insert Percentage Change]

The S&P 500's performance was largely influenced by [Insert Sector - e.g., the consumer discretionary sector], which saw significant growth due to [Insert Reason - e.g., positive consumer sentiment]. However, the [Insert Sector - e.g., financial] sector experienced a pullback, potentially due to [Insert Reason - e.g., concerns about rising interest rates].

- Top Performing Sectors:

- [Sector Name]

- [Sector Name]

- Underperforming Sectors:

- [Sector Name]

- [Sector Name]

The S&P 500's movement reflects a more nuanced picture of the overall market health compared to the Dow Jones alone.

Nasdaq Composite Index Analysis for May 27

The Nasdaq Composite, heavily weighted towards technology stocks, experienced [Insert Description - e.g., a volatile day] on May 27th. Let's break down its performance:

- Opening Price: [Insert Opening Price]

- Closing Price: [Insert Closing Price]

- High: [Insert High]

- Low: [Insert Low]

- Percentage Change: [Insert Percentage Change]

The tech sector’s performance directly impacted the Nasdaq's movement. [Insert Company Name], a major tech player, saw a [Insert Movement - e.g., significant jump] in its stock price following [Insert News Event - e.g., the announcement of a new product]. Conversely, [Insert Company Name] experienced a decline due to [Insert News Event - e.g., concerns over slowing growth].

- Top Performing Tech Companies:

- [Company Name]

- [Company Name]

- Underperforming Tech Companies:

- [Company Name]

- [Company Name]

The Nasdaq's performance showcases the dynamism of the technology sector and its significant impact on overall market sentiment.

Overall Market Sentiment and Analysis on May 27

The overall market sentiment on May 27th was characterized by [Insert Description - e.g., cautious optimism]. While the Dow and S&P 500 showed modest gains, the Nasdaq's volatility underscored the uncertainty surrounding the tech sector. Investor behavior was likely influenced by [Insert Factors - e.g., ongoing geopolitical tensions and inflation concerns]. Broader economic factors, such as [Insert Factors - e.g., fluctuating oil prices and interest rate hikes], also played a role in shaping the day's market trends. While predicting short-term market movements is challenging, the current indicators suggest [Insert Prediction - e.g., a period of consolidation] in the coming days.

- Key Takeaways:

- Mixed performance across major indices.

- Tech sector volatility.

- Influence of broader economic factors.

Conclusion:

May 27th presented a mixed bag for investors, with the Dow and S&P 500 showing modest gains while the Nasdaq experienced fluctuations. Understanding the performance of these key market indices—the Dow Jones, S&P 500, and Nasdaq—provides valuable insights into overall market sentiment and potential future trends. Staying abreast of daily stock market news is crucial for informed investment decisions. Stay informed on the latest stock market news by checking back daily for updates on the Dow, S&P 500, and Nasdaq. [Link to relevant page on your site]

Featured Posts

-

Seattles Soggy Weekend What To Expect

May 28, 2025

Seattles Soggy Weekend What To Expect

May 28, 2025 -

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025 -

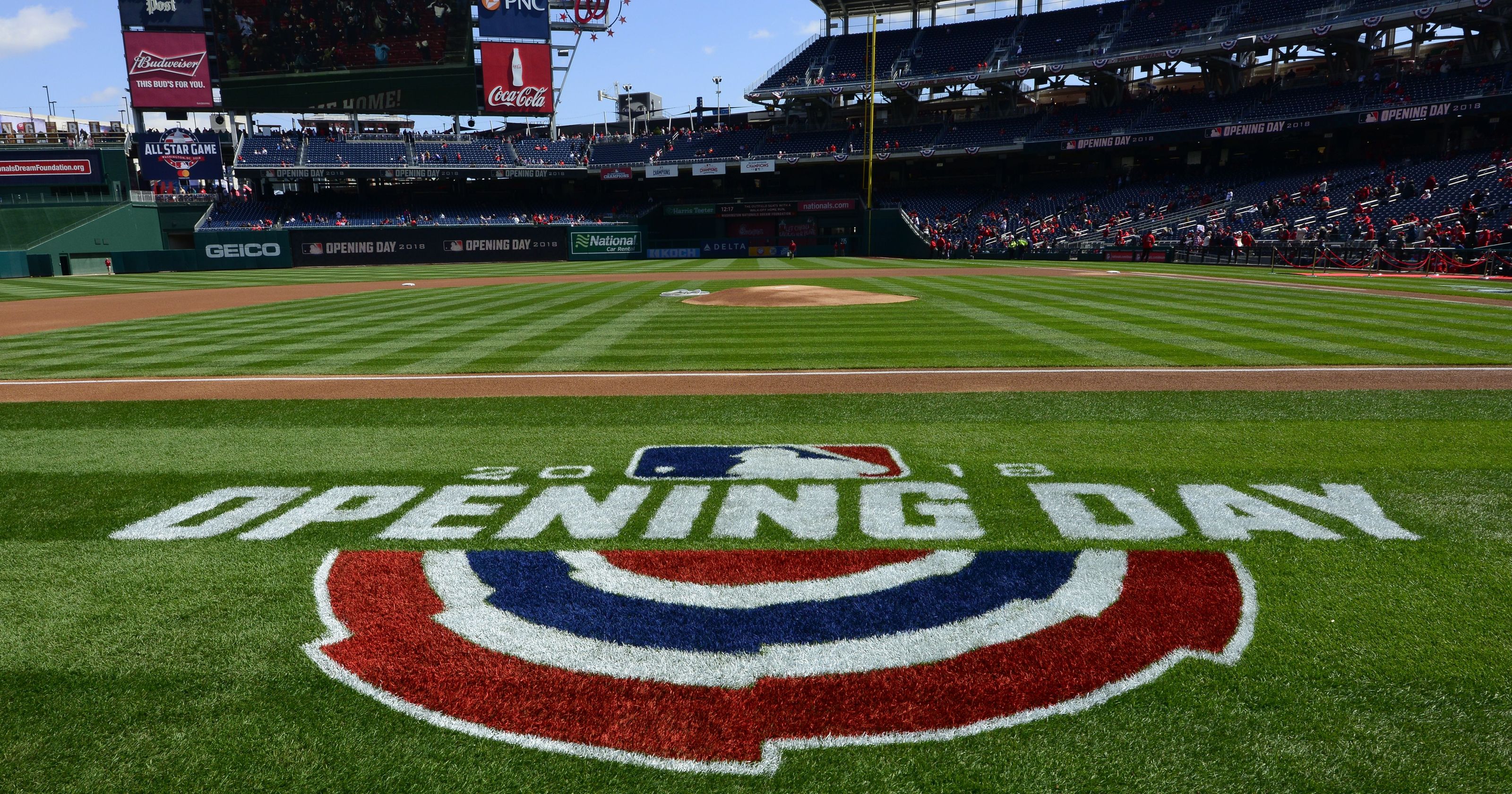

Opening Day Baseball Book Review A New Hit

May 28, 2025

Opening Day Baseball Book Review A New Hit

May 28, 2025 -

American Music Awards 2025 Jennifer Lopez Confirmed As Host

May 28, 2025

American Music Awards 2025 Jennifer Lopez Confirmed As Host

May 28, 2025 -

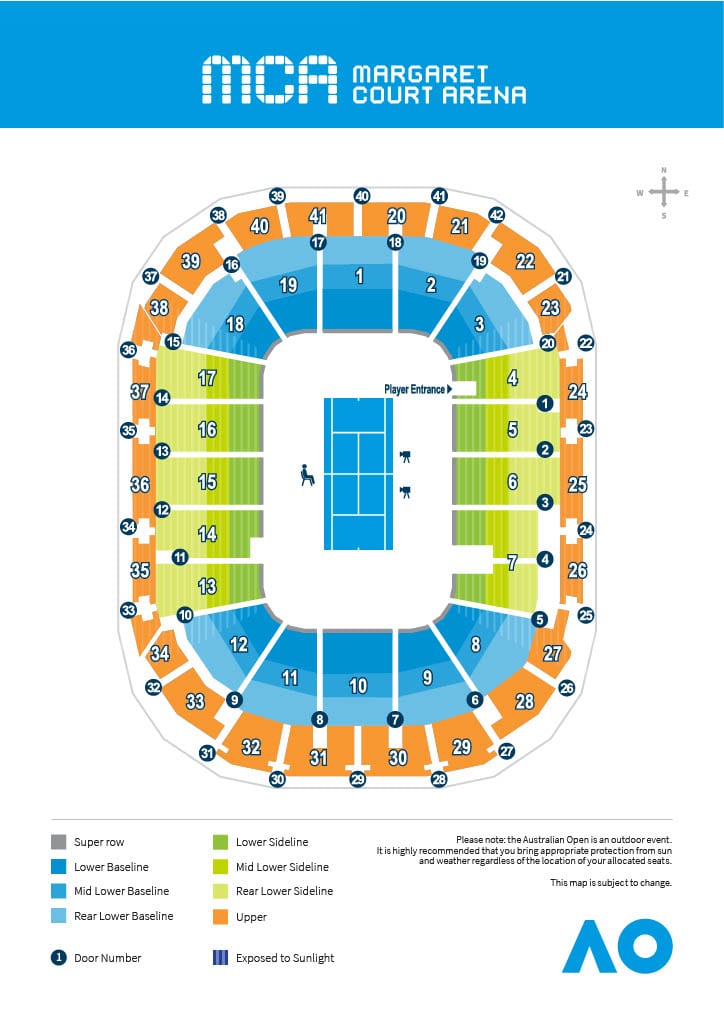

2025 French Open Draw Key Players First Round Matches Unveiled

May 28, 2025

2025 French Open Draw Key Players First Round Matches Unveiled

May 28, 2025

Latest Posts

-

Californias Coastal Crisis The Impact Of Toxic Algae Blooms

May 30, 2025

Californias Coastal Crisis The Impact Of Toxic Algae Blooms

May 30, 2025 -

Cape Cod Faces Emergency Red Tide Situation Public Health Warning

May 30, 2025

Cape Cod Faces Emergency Red Tide Situation Public Health Warning

May 30, 2025 -

Harmful Algal Bloom Crisis Californias Marine Life Under Siege

May 30, 2025

Harmful Algal Bloom Crisis Californias Marine Life Under Siege

May 30, 2025 -

California Coast Algae Bloom Threats To Marine Ecosystems

May 30, 2025

California Coast Algae Bloom Threats To Marine Ecosystems

May 30, 2025 -

Red Tide Warning Issued For Cape Cod Urgent Beach Closures

May 30, 2025

Red Tide Warning Issued For Cape Cod Urgent Beach Closures

May 30, 2025