Stock Market Today: Dow Futures Fall, Dollar Weakens Amid Trade Tensions

Table of Contents

Dow Futures Fall: Analyzing the Market Decline

The Dow futures experienced a sharp decline this morning, signaling a potential downturn in the broader market. This significant drop reflects growing concerns among investors about the escalating trade tensions and their potential impact on global economic growth. The percentage drop, while fluctuating throughout the morning, represents a considerable loss of investor confidence.

- Specific Numbers: At the time of writing, Dow futures are down by [insert percentage and specific number of points here], indicating a significant negative sentiment.

- Market Indicators: The VIX volatility index, a key measure of market fear, has also shown a notable increase, further reflecting the heightened uncertainty.

- Analyst Opinion: [Quote a reputable financial analyst's comment on the short-term outlook for the Dow Jones Industrial Average and the broader market].

Weakening Dollar: Implications for Global Trade

The weakening dollar is another key element shaping the "Stock Market Today." A weaker dollar typically makes US exports more competitive in the global market, potentially boosting sales for US companies. However, it also increases the cost of imports, potentially leading to higher prices for consumers. The relationship between the weakening dollar and ongoing trade disputes is complex.

- Current USD Exchange Rates: The US dollar is currently trading at [insert current exchange rates against major currencies like the Euro, Yen, and Pound].

- Impact on Multinationals: US multinational corporations with significant overseas operations may see their profits affected by fluctuations in currency exchange rates.

- Expert Opinion: [Quote an expert's analysis on the future direction of the dollar and its impact on global trade].

Trade Tensions: The Driving Force Behind Market Volatility

The primary driver behind today's market volatility is undoubtedly the ongoing trade tensions, particularly the US-China trade war. The uncertainty surrounding trade policies and the threat of further tariffs are creating a climate of fear and uncertainty, discouraging investment and slowing economic growth.

- Latest Developments: Recent developments in trade negotiations include [summarize the latest news on trade talks and any new tariffs or trade restrictions].

- Long-Term Consequences: Prolonged trade disputes could have significant long-term consequences for global economic growth, potentially leading to slower expansion and increased prices for consumers.

- Retaliatory Measures: Both the US and China have implemented retaliatory tariffs, impacting various sectors and exacerbating the negative impact on the stock market.

Sectoral Impacts: Which Industries are Most Affected?

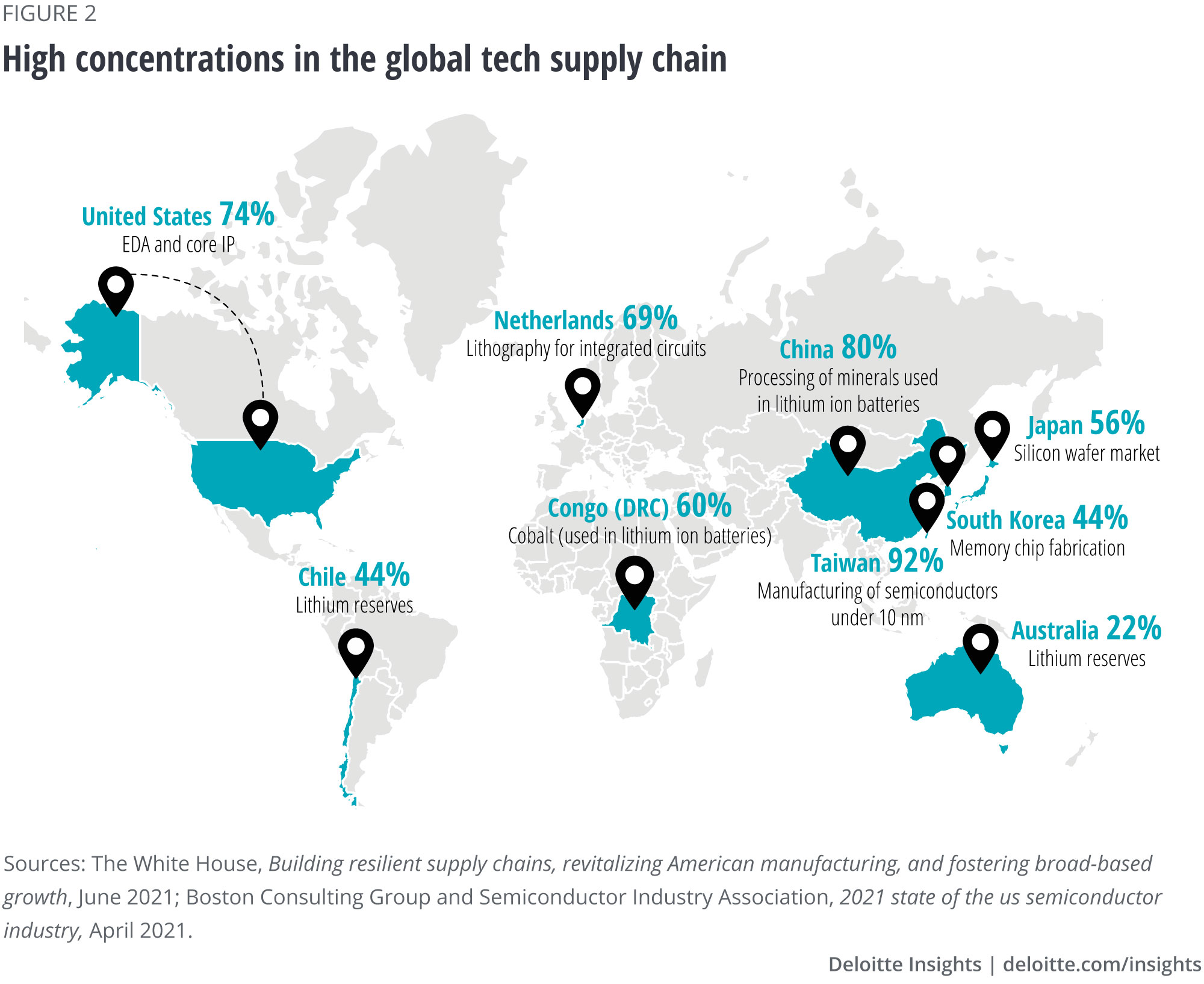

The current market downturn is not affecting all sectors equally. Technology and manufacturing are particularly vulnerable due to their significant reliance on global supply chains and trade.

- Affected Companies: [Give examples of specific companies in these sectors that are experiencing losses as a result of the current situation].

- Mitigation Strategies: Companies are employing various strategies to mitigate the impact, such as diversifying their supply chains, seeking alternative markets, and lobbying for policy changes.

- Sectoral Comparison: A comparison of the impact across different sectors reveals that [explain the varying degrees of impact].

Conclusion: Understanding the Stock Market Today and Planning Your Next Move

In summary, today's stock market reflects a confluence of factors: a significant decline in Dow futures, a weakening dollar, and the overarching influence of escalating trade tensions. These factors are creating substantial market volatility and uncertainty. Monitoring trade developments and their impact on various sectors is crucial for informed investment decisions.

To stay informed about the "Stock Market Today" and navigate these challenging market conditions, subscribe to reliable financial news sources, follow market indices, and consider consulting a financial advisor to create a strategy tailored to your investment goals and risk tolerance. Understanding today's stock market and current market conditions is crucial for making sound investment decisions.

Featured Posts

-

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

Investing In Middle Management A Strategy For Enhanced Company Performance

Apr 22, 2025

Investing In Middle Management A Strategy For Enhanced Company Performance

Apr 22, 2025 -

Analyzing The Impact Of Trumps Trade Offensive On Us Financial Supremacy

Apr 22, 2025

Analyzing The Impact Of Trumps Trade Offensive On Us Financial Supremacy

Apr 22, 2025 -

Brace For More Market Volatility Investors Defy Economic Headwinds

Apr 22, 2025

Brace For More Market Volatility Investors Defy Economic Headwinds

Apr 22, 2025 -

Chinas Economy Assessing The Risks Of Rising Tariffs On Exports

Apr 22, 2025

Chinas Economy Assessing The Risks Of Rising Tariffs On Exports

Apr 22, 2025