Stock Market Today: Dow Futures Rise, Poised For Strong Week Finish

Table of Contents

Dow Futures Surge: A Detailed Look

Dow futures are currently experiencing a significant increase, showcasing a percentage change of [Insert Current Percentage Change Here] as of [Insert Current Time]. This surge is particularly noteworthy considering [mention recent market performance - e.g., recent volatility, previous downturns, etc.]. This positive shift suggests a potential reversal of recent trends and indicates a growing confidence amongst investors.

Several factors are likely contributing to this increase:

- Positive Economic Indicators: Recent employment data, showing [mention specific data, e.g., a drop in unemployment rate, increase in job creation], and a rise in consumer confidence suggest a robust economic recovery.

- Strong Corporate Earnings Reports: Several major corporations have recently released impressive earnings reports, exceeding analysts' expectations and boosting investor sentiment. Examples include [mention specific companies and their positive performance].

- Geopolitical Events: While geopolitical uncertainty remains, recent developments [mention specific positive developments, if any, and their impact on market sentiment] have had a positive impact on investor confidence.

- Federal Reserve Policy Decisions: The Federal Reserve's recent policy decisions [mention specific decisions and their interpreted impact on the market] have been interpreted favorably by the market, contributing to the current uptrend.

These factors, when considered together, paint a picture of a market that is reacting positively to a combination of strong economic fundamentals and positive corporate news. Understanding the interplay of these elements is crucial for effective Dow futures and futures trading. Analyzing Dow Jones Industrial Average movement in conjunction with these broader economic trends provides a more comprehensive market analysis.

Key Sectors Driving the Market Upward

The upward momentum in the stock market isn't uniform across all sectors. Several key sectors are driving this positive trend, significantly contributing to the overall market performance. We see robust growth in:

- Technology Stocks: The technology sector is experiencing a significant surge, with companies like [mention specific tech companies performing well] leading the charge. This growth is driven by [mention specific factors, e.g., increased demand for tech products, advancements in AI, etc.].

- Energy Stocks: The energy sector is also performing exceptionally well due to [mention specific factors, e.g., increased global demand, rising oil prices, etc.]. Companies like [mention specific energy companies performing well] are experiencing significant gains.

- Financial Stocks: The financial sector is showing signs of recovery, with banks and financial institutions benefiting from [mention specific factors, e.g., rising interest rates, increased lending activity, etc.].

The strong performance of these key stock market sectors indicates a broader economic recovery and showcases the diverse opportunities available in the current market. Understanding sector performance is essential for creating a well-diversified investment strategy.

Potential Risks and Cautions

While the current market trend is positive, it's crucial to acknowledge potential risks and exercise caution.

- Inflationary Pressures: Persistent inflationary pressures could dampen economic growth and negatively impact market performance.

- Geopolitical Instability: Uncertainties in the global political landscape remain a potential threat, capable of triggering market volatility.

- Interest Rate Hikes: Further interest rate hikes by central banks could slow down economic activity and affect market sentiment.

Therefore, while the current outlook appears promising, it's imperative to remember that market volatility is inherent. Implementing a robust risk management strategy, including portfolio diversification, is crucial for mitigating potential losses.

Expert Opinions and Predictions

Financial analysts offer varying perspectives on the current market conditions. [Mention specific analysts and their quotes or summaries of their opinions]. Many experts believe that the current positive trend is sustainable in the short term, but caution against excessive optimism. [Mention predictions for the coming week and overall market outlook, citing credible sources]. This blend of positive sentiment and cautious predictions reflects the nuanced nature of the current market outlook. Monitoring the opinions of leading financial analysts and consulting their market forecasts provides valuable insight into potential market movements.

Conclusion: Staying Ahead in the Stock Market

In summary, Dow futures are currently pointing towards a strong week's end, driven by positive economic indicators, strong corporate earnings, and relatively favorable geopolitical developments. However, understanding the inherent market volatility and implementing sound investment advice strategies, like portfolio diversification, remains crucial.

To stay ahead in the dynamic world of the stock market today, continue to monitor market trends closely. Pay attention to key economic indicators, corporate performance, and expert opinions. Consider consulting with a financial advisor to discuss your investment strategy and refine your approach based on the evolving market conditions. Regularly review your portfolio and adjust your holdings as needed to mitigate risks and capitalize on emerging opportunities. Understanding the factors impacting the Dow Jones and other market indicators is essential for effective long-term investment success.

Featured Posts

-

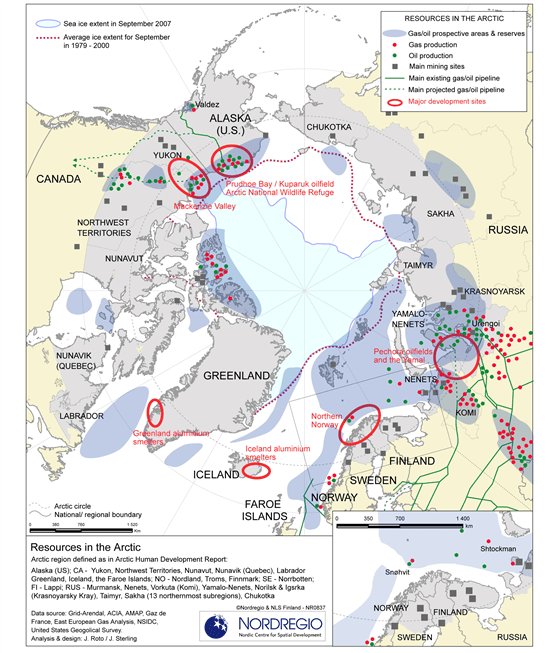

Russias Arctic Gas Exports The Role Of European Shipyards

Apr 26, 2025

Russias Arctic Gas Exports The Role Of European Shipyards

Apr 26, 2025 -

Europa League Ajax Lose Crucial Home Leg To Frankfurt

Apr 26, 2025

Europa League Ajax Lose Crucial Home Leg To Frankfurt

Apr 26, 2025 -

Amanda Seyfrieds Heated Defense Of Nepo Babies

Apr 26, 2025

Amanda Seyfrieds Heated Defense Of Nepo Babies

Apr 26, 2025 -

Wwii Warship Yields Unexpected Discovery An Intact Car

Apr 26, 2025

Wwii Warship Yields Unexpected Discovery An Intact Car

Apr 26, 2025 -

Liev Schreiber Defends Daughters Modeling Career No Nepo Baby

Apr 26, 2025

Liev Schreiber Defends Daughters Modeling Career No Nepo Baby

Apr 26, 2025