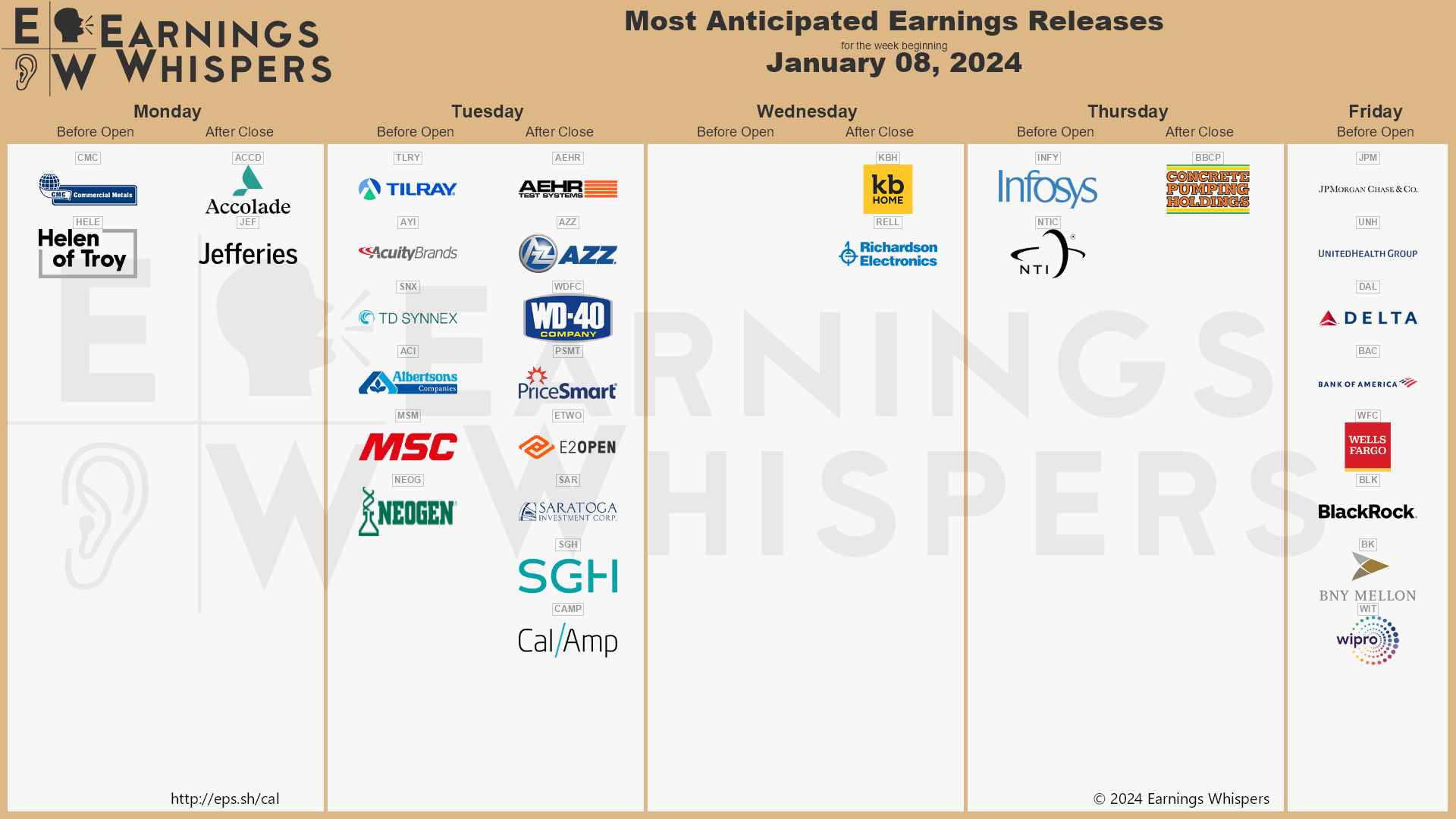

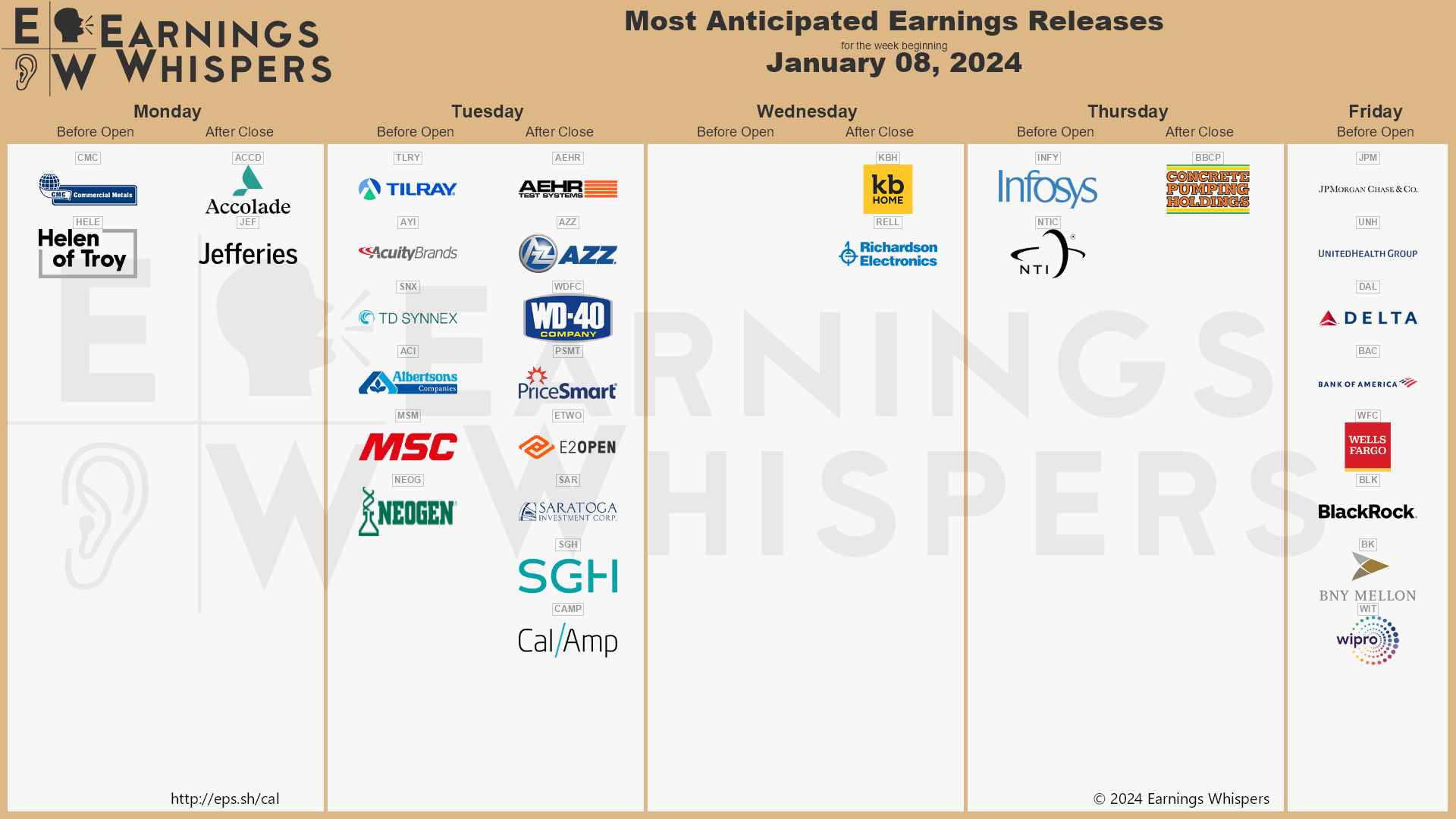

Stock Market Today: Earnings Season Impact On Dow Futures And Market Indices

Table of Contents

Understanding Earnings Season's Influence on Stock Prices

Earnings season is a crucial period for investors, as publicly traded companies release their financial reports detailing their profits and losses over a specific period (usually quarterly). These earnings reports provide a snapshot of a company's financial health, significantly impacting its stock price. A company exceeding expectations (a positive earnings surprise) often leads to a stock price increase, while falling short (a negative earnings surprise) can result in a decrease. This is because earnings reports are a key indicator of future growth potential.

- Increased trading volume during earnings season: The anticipation and release of earnings reports drive significant trading activity, leading to increased market fluctuations.

- Potential for higher market volatility: The uncertainty surrounding earnings announcements can create significant price swings, both upwards and downwards.

- Opportunities for both short-term and long-term gains/losses: Savvy investors can capitalize on these price fluctuations, but it's crucial to understand the risks involved. Short-term traders might aim to profit from quick price movements, while long-term investors focus on the fundamental health of the company.

Dow Futures: A Leading Indicator of Market Sentiment

Dow futures are contracts to buy or sell the Dow Jones Industrial Average at a specific price on a future date. They act as a leading indicator of market sentiment, often reflecting investor expectations before the actual opening of the stock market. During earnings season, Dow futures react swiftly to individual company earnings announcements, providing a preview of how the market is likely to respond. A surge in Dow futures following a positive earnings report suggests broader market optimism. Conversely, a decline indicates potential negative sentiment.

- Dow futures as a predictor of market direction: By monitoring Dow futures, investors can gain insight into potential market movements even before the official opening bell.

- Impact of positive and negative earnings news on futures contracts: Positive earnings often drive futures contracts higher, while negative news leads to a decline, sometimes dramatically.

- Using Dow futures for hedging strategies: Investors can utilize Dow futures to hedge against potential losses in their stock portfolios during the volatile period of earnings season.

Impact on Major Market Indices (S&P 500, Nasdaq, etc.)

Earnings season significantly influences broader market indices like the S&P 500 and Nasdaq. The performance of individual companies within these indices directly impacts their overall value. Sector-specific performance during this period is particularly noteworthy. For example, strong earnings from technology companies might boost the Nasdaq, while robust performance in the financial sector could positively impact the S&P 500.

- Correlation between individual stock performance and overall market indices: A strong performance from large-cap companies heavily weighted in an index will have a greater impact on the index's overall performance.

- The role of market capitalization in influencing index movements: Larger companies have a bigger influence on index movements due to their higher market capitalization.

- Identifying key sectors driving market performance: Monitoring which sectors are driving positive or negative trends is crucial for understanding the overall market direction.

Analyzing Market Volatility During Earnings Season

Earnings season is inherently volatile due to the uncertainty surrounding individual company announcements and their potential impact. Unexpected earnings reports, whether positive or negative, often trigger significant price swings. This increased volatility requires careful risk management strategies.

- Using stop-loss orders to limit potential losses: Stop-loss orders automatically sell a security when it reaches a predetermined price, helping to minimize potential losses during periods of high volatility.

- Diversifying investment portfolio to mitigate risk: A well-diversified portfolio across different sectors and asset classes can reduce the overall impact of negative earnings surprises on your investments.

- Understanding the importance of risk tolerance: Investors should carefully assess their risk tolerance before making any investment decisions, particularly during periods of high volatility like earnings season.

Conclusion: Staying Informed on the Stock Market Today: Earnings Season and Beyond

Earnings season significantly impacts Dow futures and major market indices, creating both opportunities and risks for investors. Understanding the influence of earnings reports on individual stock prices and the subsequent effect on broader market trends is crucial for making informed investment decisions. Monitoring Dow futures, analyzing sector-specific performance, and employing effective risk management strategies are vital during this period.

Stay ahead of the curve by regularly checking for updates on the stock market today and understanding the impact of earnings season on your investments. Continue to monitor Dow futures and market indices to navigate the complexities of earnings season effectively.

Featured Posts

-

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 01, 2025

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 01, 2025 -

Self Built Boat Takes Northumberland Man On Round The World Adventure

May 01, 2025

Self Built Boat Takes Northumberland Man On Round The World Adventure

May 01, 2025 -

Gaslek Roden Melding Blijkt Loos Alarm

May 01, 2025

Gaslek Roden Melding Blijkt Loos Alarm

May 01, 2025 -

Sdr Azad Kshmyr Brtanwy Arkan Parlymnt Ky Kshmyr Ke Msyle Ke Hl Ky Hmayt

May 01, 2025

Sdr Azad Kshmyr Brtanwy Arkan Parlymnt Ky Kshmyr Ke Msyle Ke Hl Ky Hmayt

May 01, 2025 -

How To Make Delicious Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025

How To Make Delicious Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025

Latest Posts

-

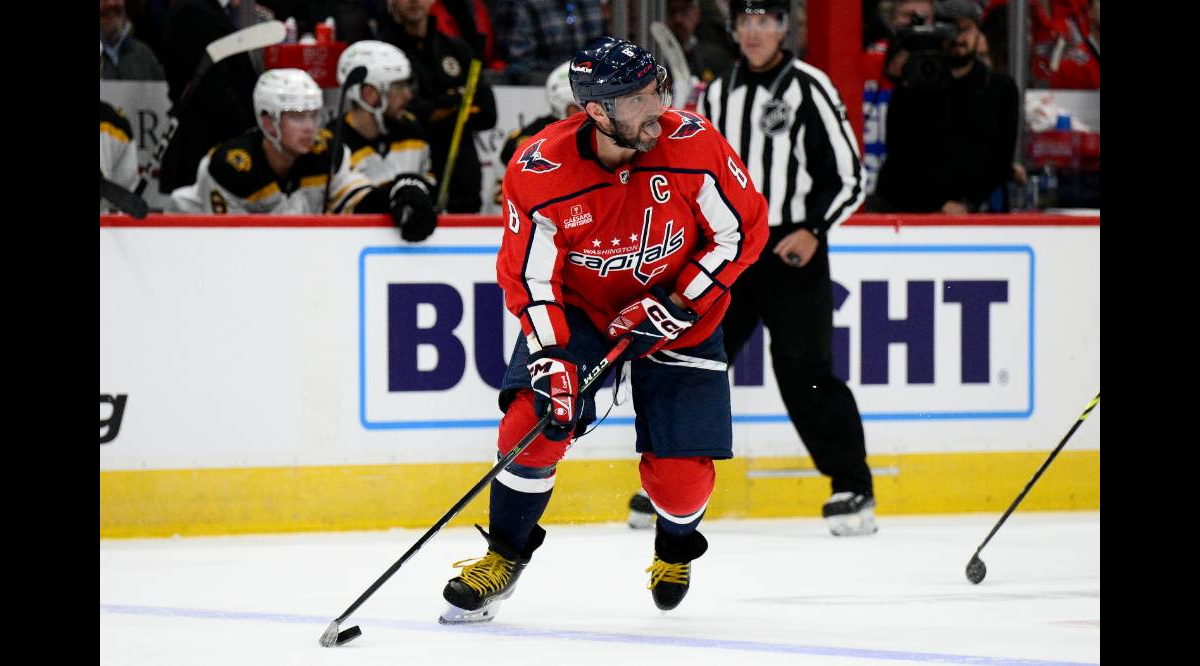

Zakharova O Rekorde Ovechkina V N Kh L

May 01, 2025

Zakharova O Rekorde Ovechkina V N Kh L

May 01, 2025 -

Ovechkin I Ego Rekord V N Kh L Reaktsiya Zakharovoy

May 01, 2025

Ovechkin I Ego Rekord V N Kh L Reaktsiya Zakharovoy

May 01, 2025 -

Zakharova Pozdravila Ovechkina S Rekordom N Kh L

May 01, 2025

Zakharova Pozdravila Ovechkina S Rekordom N Kh L

May 01, 2025 -

Yankees Comeback Victory Judge And Goldschmidts Impact

May 01, 2025

Yankees Comeback Victory Judge And Goldschmidts Impact

May 01, 2025 -

Aaron Judge And Paul Goldschmidt The Yankees Winning Formula

May 01, 2025

Aaron Judge And Paul Goldschmidt The Yankees Winning Formula

May 01, 2025